Summary:

- Major indexes were crushed last week, down more than 2%, with notable losses in the tech sector. With the Nasdaq pausing from its rapid climb, consider buying the dip.

- Tech companies are advancing, and the AI frenzy offers stocks with competitive advantages and enormous potential for upside appreciation.

- We measure metrics on 89 AI stocks, and I have identified three notable mispriced Mega-Tech Strong Buys stocks focused on AI.

- For many years, all three stocks were fairly valued on a quantitative basis. However, a dip in the stock prices, increased growth estimates by analysts, and attractive valuation frameworks now show these stocks are mispriced.

- If you’re bargain-hunting for top-name companies in AI that can showcase stellar revenue and earnings growth, and strong profitability, with upward analyst revisions, consider 3 top AI stocks with competitive advantages and excellent quant grades.

mesh cube

Mega Cap Stocks Lead the U.S. Market Rally

U.S. stocks have rallied in 2023, with Mega-Tech stocks paving the way, leading the rally as the NASDAQ Composite is up over 30% YTD.

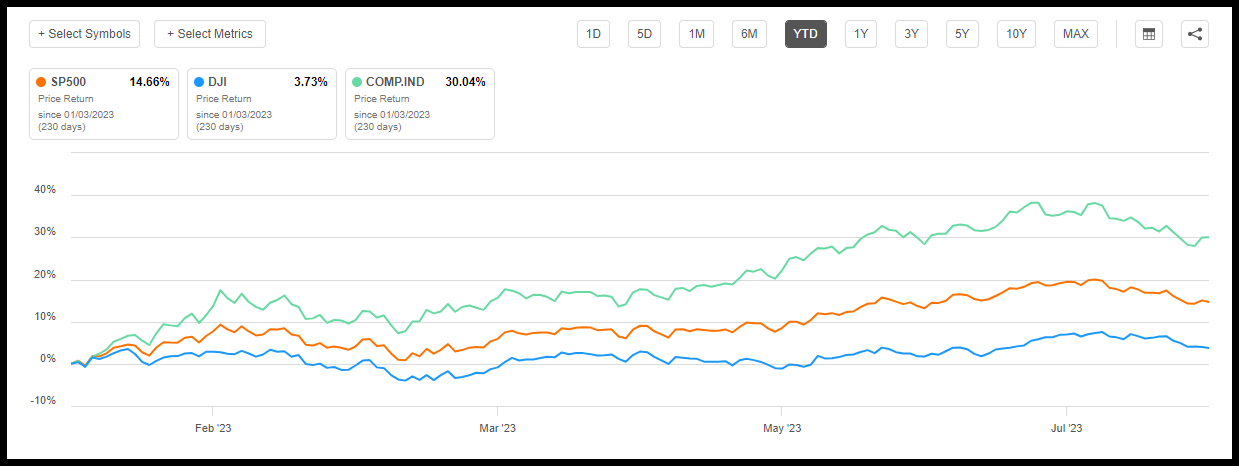

S&P 500 vs. Dow Jones vs. Nasdaq YTD Performance

S&P 500 vs. Dow Jones vs. Nasdaq YTD Performance (Seeking Alpha Premium)

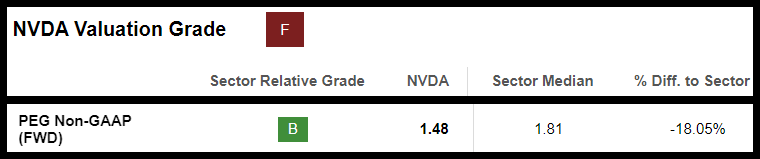

One of the most popular sectors, the tech-heavy Nasdaq, has gained amid the AI frenzy as investors hope to capitalize on the massive return potential of artificial intelligence. Where positive sentiment has created a surge for companies like NVIDIA (NASDAQ:NVDA) deemed the ‘Godfather of AI,’ the global semiconductor leader supplying AI hardware and software, its May earnings report ignited the AI panic that sent the Nasdaq on a bullish trend. Not only did Nvidia’s Q1 earnings report send the stock on a surge, +218% YTD, but the Nasdaq, along with top tech and AI stocks, have fared well. According to analysts, Nvidia is expected to blow past its 52-week high as the world awaits the release of its second-quarter results today. EPS is projected to be $2.09, up from last year’s $0.51 for the same period, expected growth of 309%, and EBIT is forecast at $5.93B, which would be a 348% increase from last year. Despite strong growth, profitability, momentum, and EPS, Nvidia has been severely overvalued since its Q1 stock surge, resulting in an ‘F’ overall valuation grade. This premium valuation is highlighted by a trailing P/E ratio of 153.49x versus the sector median of 19.37x, a 692.28% difference to the sector, and several underlying ‘F’ grades that result in the stock having a Hold rating, overshadowing its other stellar A-rated Factor Grades. That being said, from a quantitative perspective, there is the all-important PEG ratio. From a valuation standpoint, this metric is attractive with a Quant ‘B’ grade as the ratio stands at 1.48x vs. the sector median at 1.81X, showing a 20% discount to the sector on this metric.

Nvidia Stock Valuation Grade (SA Premium)

Hence, an argument could be made that the stock is attractive at this level, despite Nvidia’s Hold rating. Because I look for stocks that are mispriced, I have three of the biggest names that are not only capitalizing on the products provided by Nvidia, but they are some of the biggest names in tech and capitalizing on the AI boom.

Meta, Amazon, and Google: Strong Buy Stocks

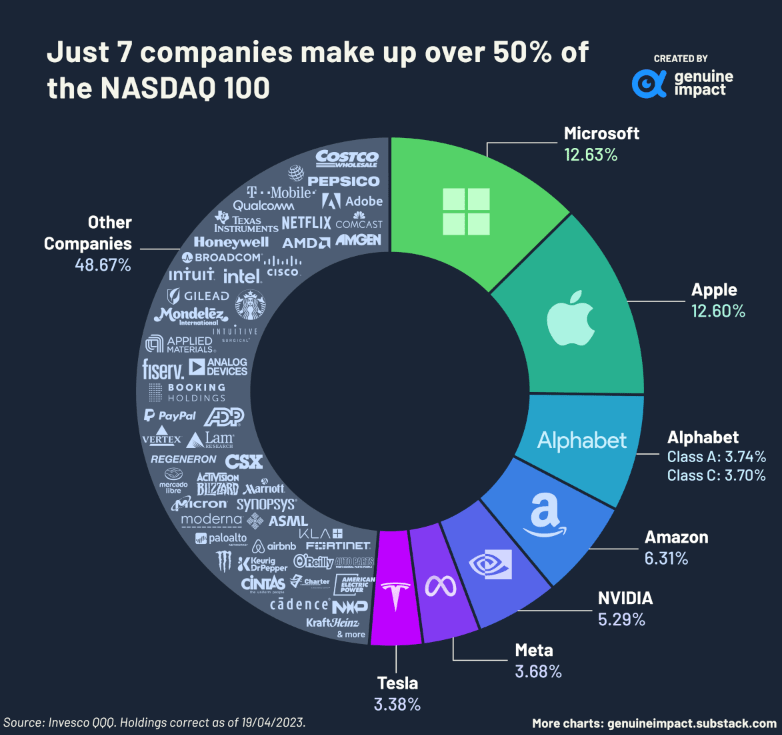

Everyone knows their name: Meta, Amazon, and Alphabet, aka Google. Together, they make up one of the largest weights of the S&P 500 and Nasdaq 100, and while they tend to be extremely overvalued, from a quant perspective, I have identified these AI Mega-Techs as mispriced bangs for their buck!

Top 7 Companies That Make Up the Nasdaq (VisualCapitalist)

One of the most important segments in technology is artificial intelligence, and the popular investment trend on the basis of revolutionary advancements, strong growth stories, and widespread applications has even the biggest names in tech wanting in on the action. Meta recently unveiled its all-in-one AI model for language and speech translation. Amazon has comprehensive services and tools to leverage AI to meet business needs and scale. And Google recently launched AI Chatbot.

Companies want to leverage AI technology for competitive advantages and to benefit from increased efficiency, cost savings, scalability, and improved customer experiences, and each of my picks has excellent ratings despite trading at a relative premium.

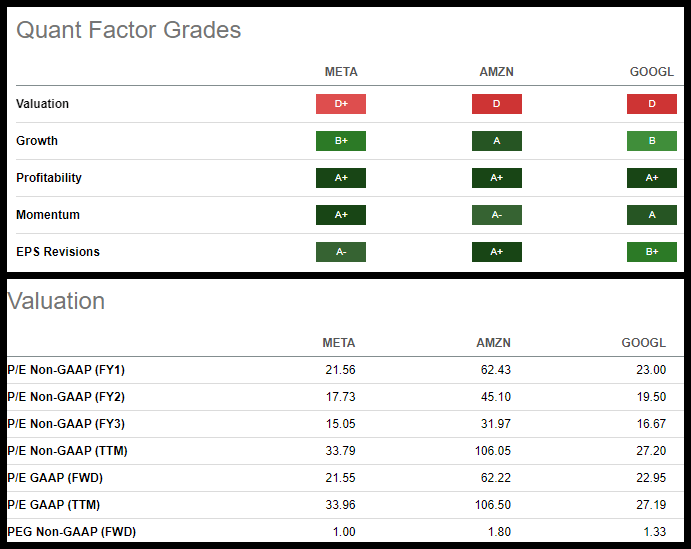

Quant Factor Grades & Valuation (META, AMZN, GOOGL) (SA Premium)

Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. As showcased above, each of my three picks comes at a bit of a valuation premium. Yet, their Growth, Profitability, Momentum, and Revisions Grades indicate that each is fundamentally sound and one of the most profitable companies in their sector and industries. Because each of the stocks’ valuation grade is a D or D+, should their valuations drop slightly, their rating is likely to drop from Strong Buy to Hold, which does not mean sell, as they are still fundamentally strong stocks. Amazon recently became a quant Strong Buy, and Alphabet and Meta have been strong buys. The factor grades could change as soon as they trade higher, with their valuations decreasing. Nonetheless, the stocks are in good shape as you dive into their EPS and growth revisions, even if they drop to Hold. At their current price point and bullish momentum, our quantamental analysis has identified these stocks as a buying-the-dip opportunity. Let’s take a closer look at each stock.

Best AI Stocks to Buy

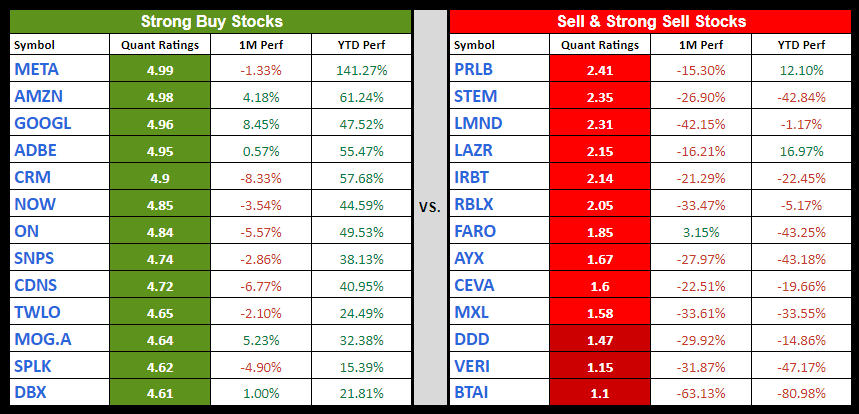

In the race to digitization and advancing industries through AI, the biggest names in tech seek to offer simplified, quicker, and cost-effective solutions by leveraging artificial intelligence. I selected my top three AI stocks by blending four of the largest AI ETFs and narrowing from 89 stocks created in an AI Quant portfolio. Leveraging the power of our portfolio tool, as showcased in the below table, investors can compare stocks from Strong Buy to Strong Sell. The average monthly performance of my 13 Strong Buys is -1.23%, which significantly outperforms the 13 Sell/Strong Sells, whose performance is -27.78%.

AI Quant Strong Buy Stocks vs AI Quant Sell & Strong Sells (SA Premium Portfolio Tool)

While Meta and Alphabet have been on my Strong Buy list in the past, Amazon is a nice addition to the mix as we approach the fourth quarter and holiday spending season.

1. Meta Platforms (NASDAQ:META)

-

Market Capitalization: $728.85B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 8/22/23): 1 out of 249

-

Quant Industry Ranking (as of 8/22/23): 1 out of 61

Formerly known as Facebook, Meta Platforms Inc. is a social media, virtual reality, and AI-driven company developing products for the world to connect and share. Possessing strong fundamentals, growth, and tremendous profitability, Meta’s implementation of AI has enabled it to modernize its applications with its recent breakthroughs, Threads and Reels, the latter, which is expected to contribute a $5B run rate by the end of 2023. According to Meta CEO Mark Zuckerberg,

Threads may add one to two points to the company’s 2024 growth. “Assuming the app is successful, Meta captures 250 [million] average users in 2024, and that Meta chooses to start the revenue ramp next year and reaches 50% of Twitter’s 2021 APRU (which was $23), we estimate a $2-3bn 2024 revenue opportunity.”

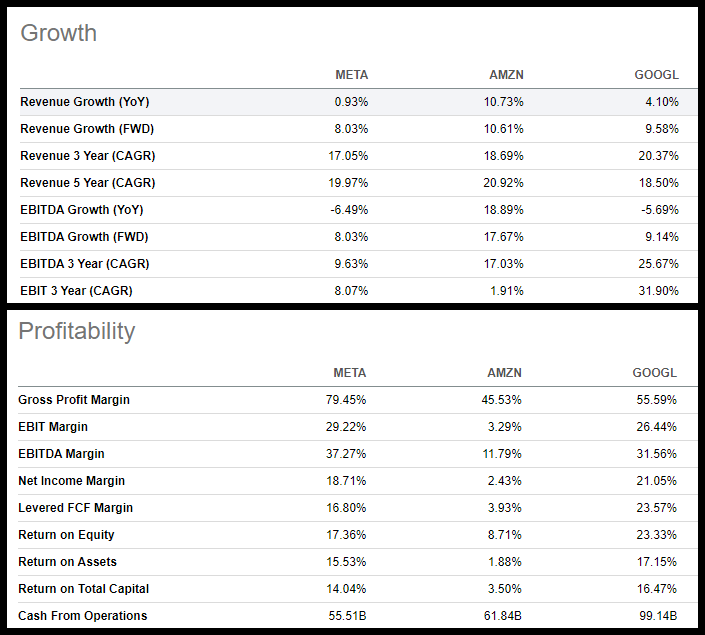

Meta surged past earnings expectations, with Q2 EPS of $2.98 beating by $0.09 and revenue of $32B beat by more than 11% year-over-year. Following last year’s declines, Meta is up 130% YTD, with tremendous momentum, significant gross profit margins, and EBIT Margins, and 44 FY1 Upward analyst revisions. As showcased below, Meta’s growth and profitability figures, along with Amazon and Alphabet, are strong.

Meta, Amazon, and Alphabet Growth & Profitability Metrics (as of 8/22/23)

Meta, Amazon, and Alphabet Growth & Profitability Metrics (as of 8/22/23) (SA Premium)

2. Amazon.com, Inc. (NASDAQ:AMZN)

-

Market Capitalization: $1.37T

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 8/22/23): 3 out of 530

-

Quant Industry Ranking (as of 8/22/23): 1 out of 30

Crushing Q2 earnings with an EPS of $0.65, beating by $0.31, and revenue of $134.38B beating by nearly 11% year-over-year, Amazon, for the first time in nearly three years, has teetered between a Hold rating into Strong-Buy territory, which is why now may be the time to buy the dip. Amazon is progressing in several key areas by lowering costs and improving customer experiences and fulfillment through AI. Exceeding the top-end of its guidance, Amazon, a pioneer in online retail sales, continues to be a clear leader in e-commerce. Investing in growth opportunities, its Amazon Web Services (AWS), which capitalizes on machine learning, has boosted profitability, and an increase in Amazon Prime membership has aided in attracting and retaining customers. Like other tech with a subscriber base, Amazon felt the effects of lower numbers as the subscriber count fell along with ad dollars. But through its innovation, investment in technology, and AI to keep pace in a data-driven industry, Amazon, like Alphabet, is in the business of widening its lead. Consider Amazon as a dip-buying opportunity, along with Alphabet.

3. Alphabet Inc. (NASDAQ:GOOG) and (NASDAQ:GOOGL)

-

Market Capitalization: $1.61T

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 8/22/23): 3 out of 249

-

Quant Industry Ranking (as of 8/22/23): 3 out of 61

Alphabet Inc., formerly known as Google, is the tech giant that has maintained the Quant Strong Buy rating for quite some time. Despite the market volatility of 2022, Google’s technical prowess and strategic focus have enabled it to have nearly double the cash reserves of Meta and Amazon and one of the best balance sheets worldwide. Alphabet’s outlook is very attractive, with a strong market value price-performance +44% YTD. Its Q2 EPS of $1.44 beat by $0.10 and revenue of $74.60B beat by $1.85B. Like my other two picks, although Alphabet is relatively expensive compared to the sector, each of my stock picks experienced significant share price declines in 2022 and is still relatively discounted, which is appealing to some investors looking to buy when the stocks are not trading at their 52-week highs. Coupled with a gradually rising quarterly price performance and bullish momentum, my top three AI stocks look very attractive, so our quant ratings recommend it as a strong buy.

As artificial intelligence continues to change the landscape for tech companies and macro and geopolitical factors pose headwinds, each of my stocks has experienced some deceleration in advertising and revenue growth. But with a focus on innovative use of machine learning to decrease costs and increase customers and retention, Meta, Amazon, and Alphabet are looking to the future, and so should investors wanting to capture these stocks at a time when the stock is at a relative discount – a dip buying opportunity. Although there is opportunity for upside, artificial intelligence is still a fairly new trend, posing some risks.

Risks to Tech and AI Investing

While AI is said to be the wave of the future, creating many growth opportunities for businesses and individuals, too many eggs in one basket can pose problems. We’ve seen in tech before that trends can pick up steam, so much that they become bubbles that may burst. Volatile price swings, interest rates, competition, and geopolitical factors can affect tech stocks, especially those offering products and services globally. The complexities of evolving technology, with the rise of generative AI, can pose dangers, including cybersecurity, tech issues, algorithmic manipulation, data reliance, and more. Fortunately, the stocks I’ve selected are some of the biggest in the industry and have showcased their ability to withstand headwinds better to navigate a path forward.

Conclusion

Some of the top names in tech and growth stocks, Meta, Amazon, and Alphabet, have rocketed back from the 2022 lows, highlighted by bullish momentum giving way to trading volumes above 200-day moving averages. Despite the negative sentiment surrounding Fed uncertainty, the economic outlook, sticky inflation, and recession, the market declines that led to a fall in tech stocks last year have experienced a turnaround in their fortunes that can partially be attributable to some of the enormous potential in Artificial Intelligence.

As artificial intelligence shapes the future, Strong Buy-rated stocks focused on AI that possesses robust fundamentals and, over the long term, offer double-digit growth, profitability, and tremendous cash from operations can benefit from the tailwinds of this revolution. Despite the Fed’s hawkish stance, which has negatively impacted the corporate earnings of many stocks, my three stock picks have crushed recent earnings with significant Fiscal Year upward analyst earnings over the last 90 days, positive demand factors, and strong fundamentals to outweigh headwinds. Consider these strong buy picks as measured by Seeking Alpha’s Quant Ratings and Factor Grades to help ensure investors have the best resources to make informed decisions. Alternatively, if you prefer investing in smaller companies, we have dozens of Top Small Caps, or if you’re seeking a limited number of monthly ideas—curated from a list of Top Quant stocks—consider exploring Alpha Picks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. The author is an employee of Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.