Summary:

- Tower REITs have been set ablaze by the REIT selloff.

- Investors have themselves to blame as they bid these to insane levels in 2021.

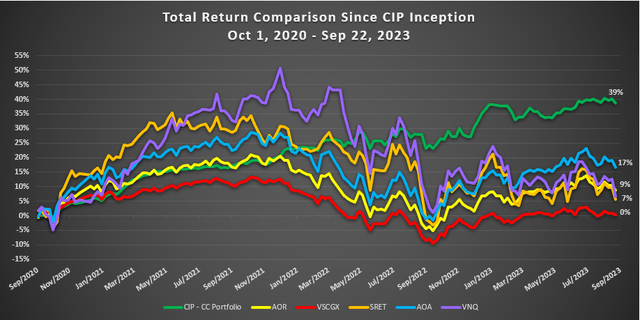

- Things are looking good for the patient investor and we give you three reasons why 8% annual returns from here are very likely.

imagoRB/iStock via Getty Images

Extrapolation. We all do it. After all, we have been taught history does rhyme. That extrapolation has been painful in the transition out of the ZIRP (Zero Interest Rate Policy) Era. The REIT investor has gone down kicking and screaming here and met every bear argument with “but when the Fed cuts…”. With the latest Fed meeting, the last hopes for interest rate cuts are being dashed, and the highest duration securities are being taken to the cleaners. We look at two tower REITs that have been taken down in the conflagration and tell you why you can now make money in both of them. We also tell you why you probably will decide not to buy.

The Contenders

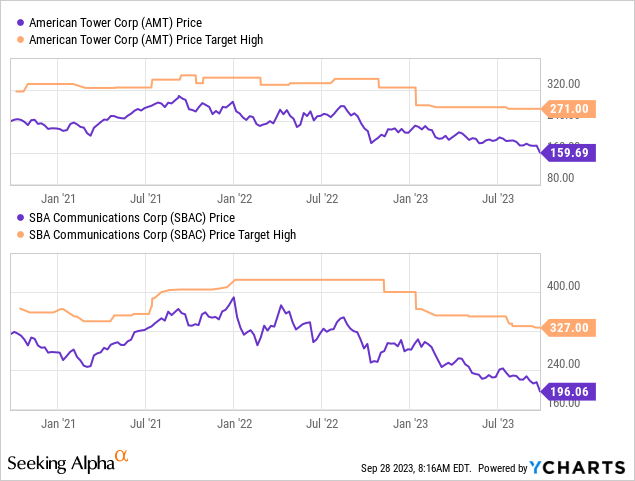

American Tower Corporation (NYSE:AMT) and SBA Communications (NASDAQ:SBAC) are two darlings of the REIT growth era. It is rare that you can grow revenues and funds from operations (FFO) rapidly in REIT space, as the high distributions tend to limit internal capital for growth and force equity issuance. That in turn dilutes out the FFO per share. The two REITs delivered the impossible for investors and that of course meant that common sense went straight out the window with some analysts finding ways to justify more than twice the current price for both two years back.

On our last coverage of AMT we wrote that the REIT was overvalued for the no-growth era. Adjusted FFO (AFFO) would be flat between 2021 and 2023, and we would look for a minimum of $150 on the downside. For SBAC, we said that we would look for a 12X to 14X AFFO multiple and only get involved near the $180 region. Staying out has worked well, and we give you three reasons why we think you can make money in both now.

The Data Age Is Still Going Strong

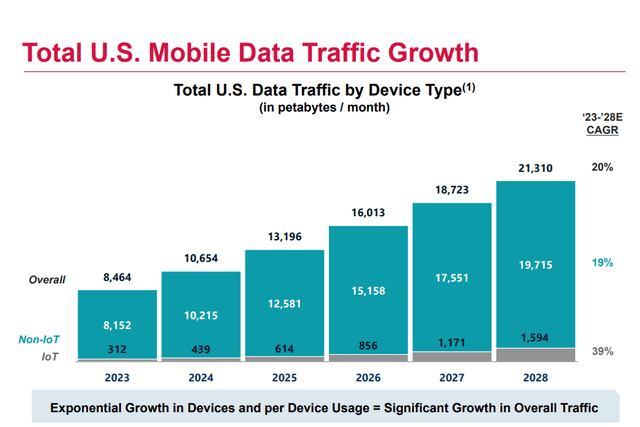

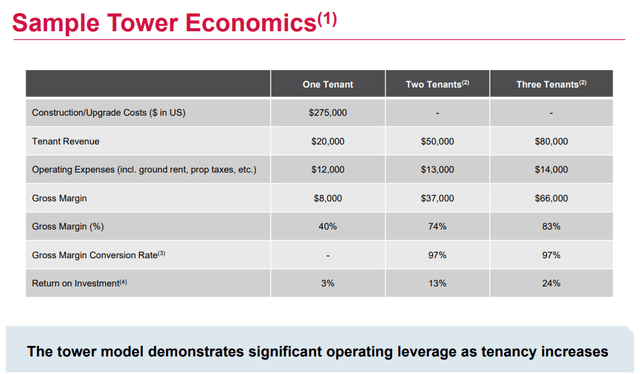

The growth in data usage has been staggering and is expected to continue. Even if you don’t buy the extremely optimistic projections like the one shown below, you can safely assume that these towers will be in extremely high demand decades out.

While the AI revolution might not play out as glamorously as some envision, it will at a minimum amplify any secular growth trajectory in data consumption. In this environment, the tower REITs are indispensable pieces of the puzzle. Their low capex model will prove to be resilient, even if data growth turns out to be half of what is being projected.

They should make up some part of our portfolio, and the only question is valuation.

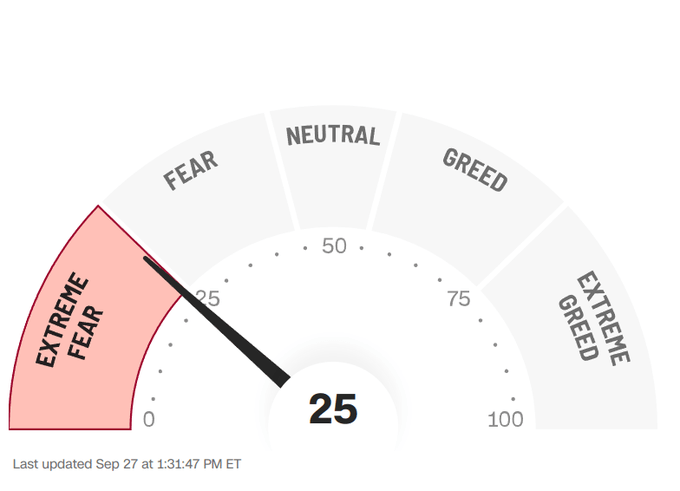

Fear Nothing But A Lack Of Fear Itself

You generally want to buy any growth sector when the fear is palpable. For SBAC and AMT, we can see that from a few different angles. The first being the generalized fear in the market and that looks good. At an “extreme fear” level, you can safely assume that there is only “hand over fist” selling, regardless of what billionaires say.

CNBC Fear & Greed Index

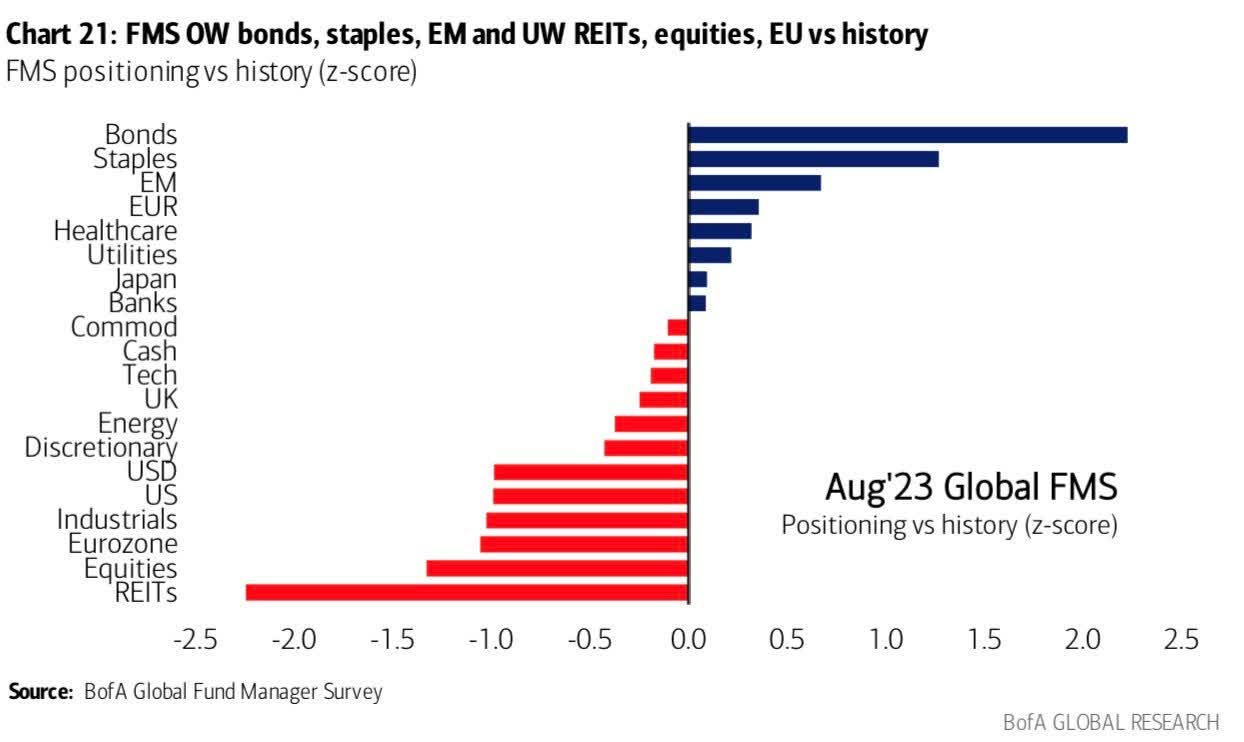

To get more sector specific, REITs, as an asset class, are hated. The collective investment big-dawgs are now finally underweight. This survey was done in August, and of course September has proven far more brutal.

BAC August FMS Survey

By the time the next positioning level comes out it will be worse, no doubt augmented by the absolute lunacy carried out by dividend darling W. P. Carey Inc. (WPC).

Multiples Mean That You Can Get 7%-8% Returns, Even Without Interest Rate Cuts

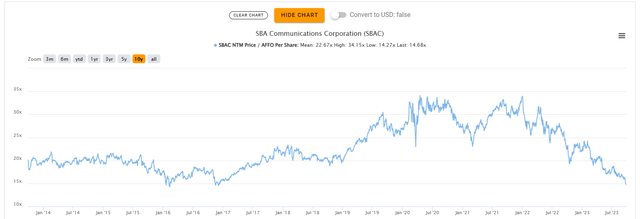

SBAC just broke under 15X forward AFFO and that is pretty rare.

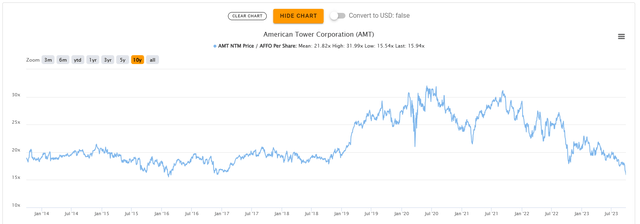

AMT is on a similar path, and it will take 1-2 big down days to go past that.

So you can safely say that at least you are buying with a modicum of discretion. Of course, the key point to recognize here is that we may go lower, far lower. Extreme overvaluation, like we saw with AMT above $300 and SBAC nearing $400, is always followed by extreme undervaluation. That can occur with sideways movement for multiple years as FFO moves up, or it can occur with a sudden, sharp decline. It is hard to know in advance, but generally when risk-free rates rise rapidly, the latter is a far stronger possibility. So what is our worst case here? We think both can trade at 12X AFFO, which would be an incredible opportunity. It would also mean that those that bought near the top would be puking uncontrollably. That is the kind of first trimester nausea that forms generational opportunities. 12X AFFO would be around $130 for AMT and $160 for SBAC.

Verdict

Whether or not they reach those 12X AFFO levels, on a 10-year horizon, you will make decent returns from today’s buy point. We estimate about 8% annual total returns and if correct, that would mean that top-buyers would break even in 10 years. The investor who has never been involved with these REITs will rightfully ask whether they want the gut-wrenching volatility for those returns when you can get 7.5% yield to maturity for some ultra-quality 8-year REIT bonds. That is a fair point, and hence we are still not in the ultra-bull camp. One way to enhance returns here is to add covered calls to your investment. Especially today, where implied volatilities are high, you can add a lot of extra juice to those expected returns. That is the way to go, and we think you can ratchet that return up to 10% a year with that approach.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.