Summary:

- Tesla stock slides after Morgan Stanley and Barclays downgrade the EV giant, citing overvaluation.

- Price momentum on Tesla may be history, as Tesla is +140% YTD, presenting stock price performance doubts for many analysts as they revise their FY earnings estimates down.

- Forward growth estimates show Toyota trumping Tesla on GAAP EPS growth, P/E and PEG Ratios, P/S, EV/EBITDA, P/CF, CAPEX/Sales, Cash, and Dividend Yield.

- At the forefront of manufacturing vehicles and related parts and accessories since 1933, Toyota is now rolling out next-gen batteries and an EV strategy to rival its rivals.

- With strong fundamentals to highlight it as a top auto manufacturing stock, Toyota is trumping its biggest competitors and benefitting from demand tailwinds and a strong global network.

Justin Sullivan

Tesla Downgraded

No bull. Competition is heating up in the electric vehicle space as Tesla (NASDAQ:TSLA) is no longer Morgan Stanley’s top U.S. automaker. The Elon Musk-led company has fallen from an Overweight to an Equal Weight rating, despite momentum and a recent 60% rally charged by the AI frenzy. Although Morgan Stanley analyst Adam Jonas believes Tesla is still a ‘must own’ stock, the broader market’s AI push that began with Nvidia’s (NVDA) runup may have hyped up Tesla as an AI company.

“Following Nvidia’s blowout quarter, AI-exposed stocks have outperformed broadly, and investors are constructing portfolios with exposure to the theme. While we understand why Tesla gets a serious mention in an AI conversation, we believe a re-rating on this theme is in the realm of the non-disprovable bull case. Autonomous driving and generative AI still remain, in our view, two very different technological disciplines. While the market may want to dream on the AI theme, we’d prepare to wake up to the sound of a blaring car horn.”

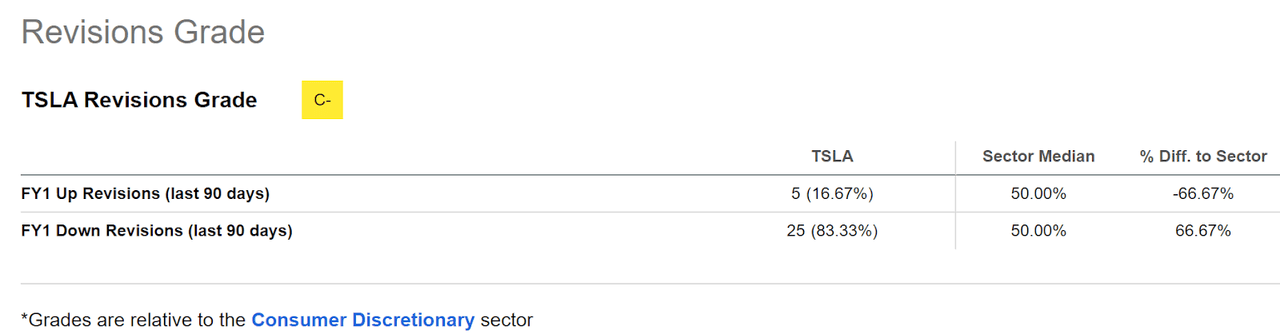

Where Seeking Alpha offers a list of many top-rated auto manufacturers, Tesla, the most well-known and advanced, has had a rough year on the basis of fundamentals and analysts’ guidance, despite its YTD price performance, up 140%, one of the few positive differentiators compared to my pick, Toyota (NYSE:TM). However, the price run-up for Tesla may be history. Rated a Hold by Seeking Alpha’s quant ratings, Tesla has a premium valuation and 25 downward analyst revisions over the last 90 days.

TSLA Stock Revisions Grades (SA Premium)

Inflation and rising interest rates have weakened the demand for many EVs, a consumer discretionary item. When you factor in Musk’s Twitter Inc. takeover, which brought on less than popular press for an already polarizing CEO, this disruptive stock could experience more headwinds.

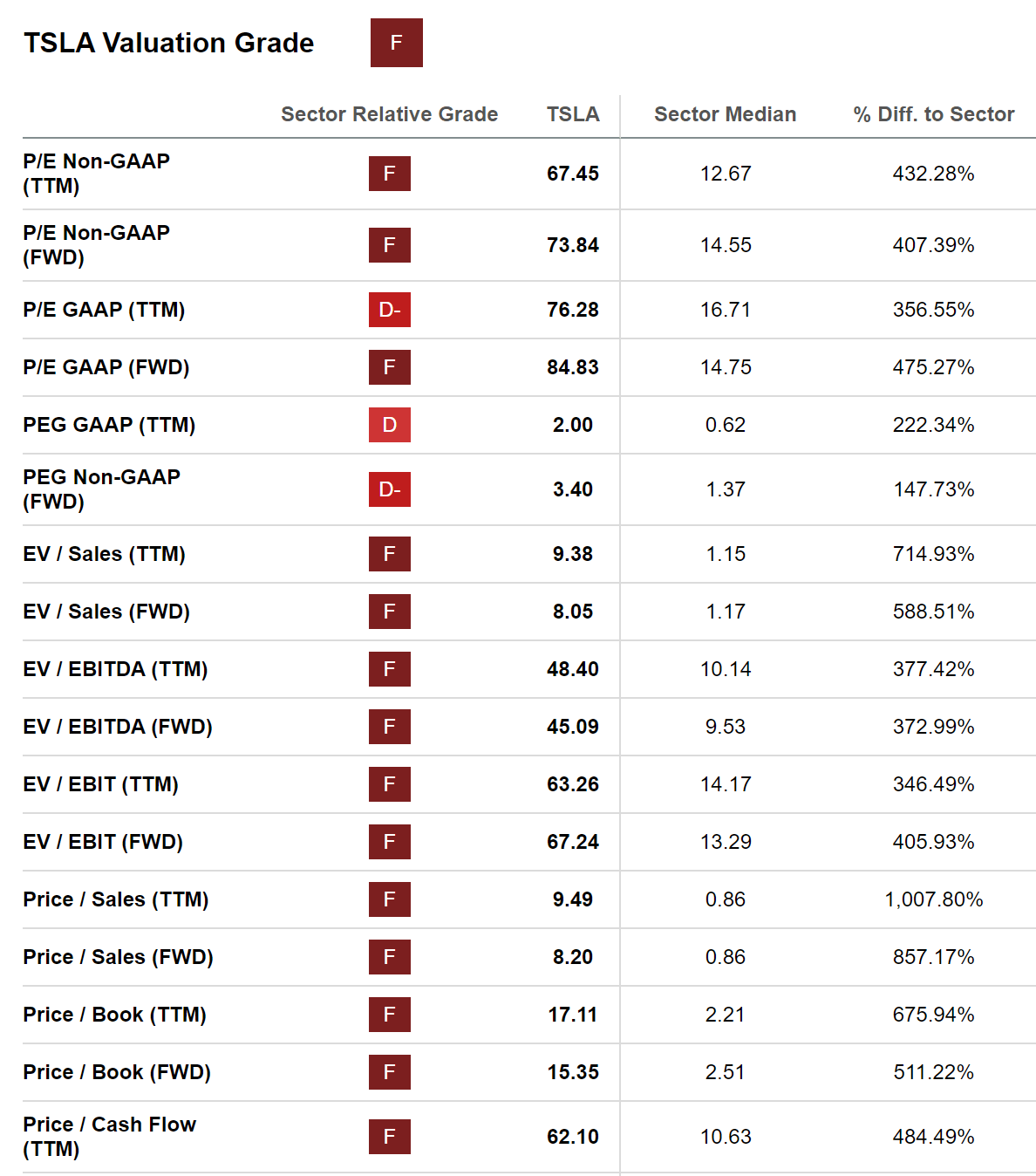

Severely overvalued, as showcased by the ‘F’ valuation grade below, Tesla, whose market capitalization is $822.36B (as of 6/22/23), has some uphill battles to fight, and the CEO wants to duke it out!

TSLA Stock Valuation Grade (SA Premium)

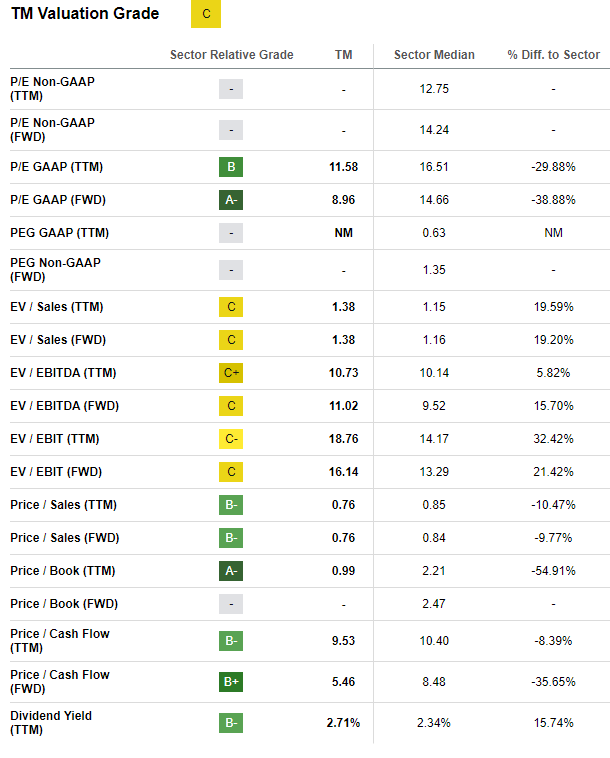

Comparing each company’s valuation grades and underlying metrics, it’s obvious that TM comes at a better price. But when it comes to a comparison of fundamentals, not only is Elon Musk ready to cage-match Mark Zuckerberg in a battle of the techs, but Toyota Motor Company is ready to go toe-to-toe with Tesla in terms of fundamentals, and specifically, its long-range Model Y, the world’s best-selling EV that can drive for about 530 km.

TM Stock Valuation Grade (SA Premium)

With a focus on creating an electric vehicle that can drive 1,000 km, shares of Toyota climbed after announcing plans for an all-solid-state battery, which will cut charging times, and plans to deliver more than 1.5M EVs by 2026 and 3.5M by 2030. In a statement, Toyota said, “With the evolution of the vehicle’s operating system, the next-generation battery EV will also enable customization of the ‘driving feel,’ with a focus on acceleration, turning, and stopping.”

Toyota’s newly established Battery EV (BEV) Factory “aim[s] to change the future with BEVs… the next-generation battery EVs will adopt new batteries, through which we are determined to become a world leader in battery EV energy consumption,” said Takero Kato, BEV Factory President. Adding insult to injury, Barclays piped in Wednesday, also downgrading Tesla, citing that shares of the stock will likely cool. As competition intensifies and economies work through geopolitical and macroeconomic issues, move over Tesla! There’s a seasoned Japanese carmaker ready to give a run for investors’ money.

Best EV Stock to Buy

Ranking as one of Seeking Alpha’s Top Auto Manufacturers, Toyota Motor Company is not only a Top Growth Stock, +11% YTD with 78% forward EPS growth, it continues to have strong financials, despite pandemic, natural disaster, semiconductor, and supply chain headwinds, that constrained production. Toyota’s enviable position on fundamentals compared to Tesla and other auto manufacturers is why this stock is so attractive, especially as it looks to outperform and outproduce competitors in the vehicle race to electrification.

Toyota Motor Company (TM)

-

Market Capitalization: $212.06B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/22/23): 10 out of 534

-

Quant Industry Ranking (as of 6/22/23): 2 out of 31

The largest automaker in the world, Toyota Motor Company is a Japanese auto manufacturing behemoth that is the gold standard in Hybrids, moving full force into the EV world. Specializing in the design and sale of passenger and commercial vehicles, parts, and accessories, the company has entered the EV world with an opportunity to preserve its already impressive financial position and hedge against risk and competition.

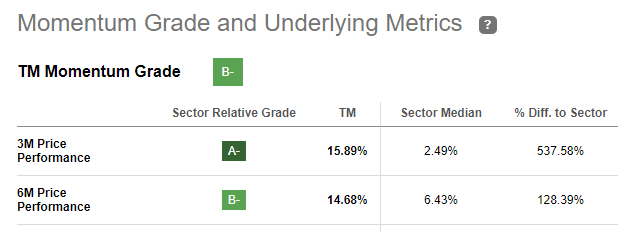

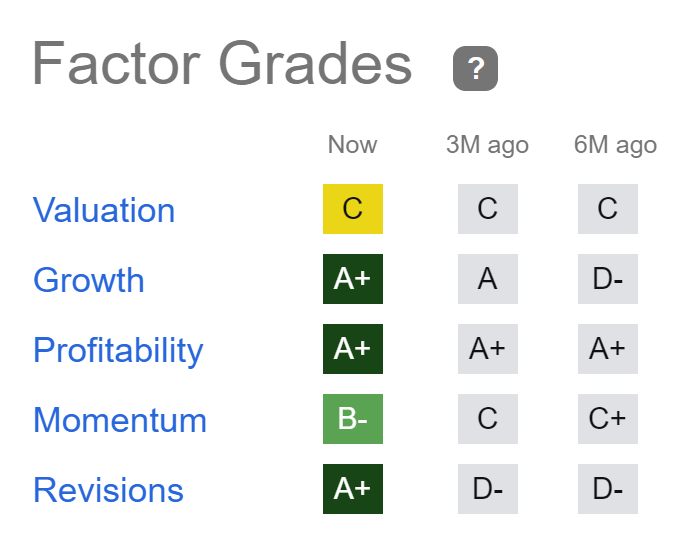

Toyota has experienced significant ups and downs in its price performance over the last two years. Despite economic challenges, Toyota’s growth and profitability have maintained its A-rating for extended periods. Its bullish momentum and discounted valuation make it an even more attractive consideration for upside potential.

Toyota Stock Valuation & Momentum

Undervalued, Toyota is one of the few large-cap stocks trading at a discount. Toyota’s forward P/E ratio is 8.93x vs. the sector’s 14.75x, which is nearly a 40% discount. Its Price/Book (TTM) is more than a 54% discount. Rallying 10% over the last month, the stock continues outperforming the overall sector over the last 3 months, showcased in quarterly price performance.

TM Stock Momentum Grade (SA Premium)

Toyota Stock Growth & Profitability

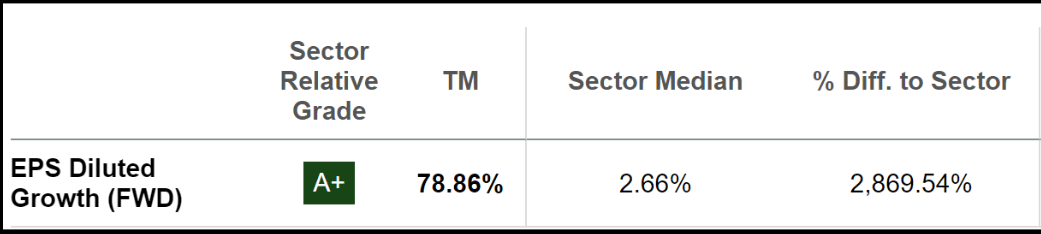

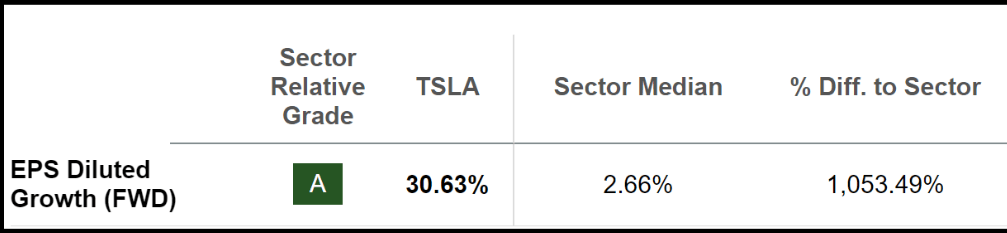

Factor Grades rate investment characteristics on a collective basis. As showcased above, not only is Toyota very strong on Growth, Profitability, and Revisions grades, an indication that TM is one of the most profitable companies in its sector. When assessing growth going forward, Toyota is showcasing a tremendous jump in GAAP in EPS growth based on analysts’ estimates compared to Tesla. Clearly, ranging from Toyota’s Parade of 5 New Batteries to New Tacoma Dominates Mid-Size Truck Segment, Toyota has a lot more products than Tesla that will contribute to their earnings growth.

Toyota

Toyota EPS Diluted Growth (FWD) (SA Premium)

Vs.

Tesla

Tesla EPS Diluted Growth (FWD) (SA Premium)

Seeking Alpha Factor Grades For Toyota

Toyota Stock Factor Grades (SA Premium)

Adding to a cash hoard of $22.26B, Toyota increased fourth-quarter revenue by 19.4% year-over-year, increased operating income by 35.2%, and its margin by 80 basis points to 6.5%. Given the inflationary environment, costs have increased around the globe, but FOREX benefits have been profit and growth drivers for TM. The weak Yen against the U.S. dollar helped offset raw material costs, contributing to its operating income growth.

Thinking about the future, Toyota is focused on creating common parts for vehicles and moving aggressively on EVs. With the introduction of next-gen minivans and 5 new batteries, as SA Author Doron Levin writes, “Lithium ion phosphate chemistry will arrive first, followed eventually by two solid-state batteries in the second half of the decade, the first with a range of about 745 miles between charges. ‘New manufacturing methods and designs should help reduce battery cost and battery-electric vehicle (BEV) pricing,’ Toyota executives said at Tokyo briefing.”

These key aspects should aid in increasing sales, and while recalls have posed some risks, as the company looks to more sustainable options and electrification in the push for a greener environment, coupled with its healthy balance sheet and investment choices, Toyota’s future could see greater shareholder distributions and upside. Consider Toyota Stock versus Tesla. The Quant ratings highlight the Strong Buy pick.

Risks

In addition to challenges posed by the macroeconomic environment and supply chain constraints that have affected both companies, the Seeking Alpha Dividend Grades for Toyota do not score well. This is because the company reports semi-annually, and the dividend rate fluctuates. With this in mind, there have been 13 years of consecutive dividend payments. This is highlighted on the Seeking Alpha stock page with a giant red banner, Toyota is at high risk of cutting its dividend. Notably, during TMs Q4 Earnings Call, its CFO highlighted plans for a new dividend policy to increase dividend stability and reward long-term shareholders. When selecting stocks, I focus on the quant ratings versus dividend safety, particularly when evaluating a foreign – ADR stock. Quant ratings focus on fundamentally strong companies, which trumps dividend safety, and is the primary method I use to determine that not only is Toyota a Strong Buy pick versus Tesla, but also the merits of TMs underlying metrics are evidenced in its below Factor Grades.

Conclusion

Automotive manufacturing stocks focusing on electrification are linked to semiconductors, which have been resilient in the face of recent downturns. As competition in the EV space increases, companies that are innovative, especially if you can identify those with fair valuations and excellent fundamentals while capitalizing on their growth and momentum, can prove to be great investments.

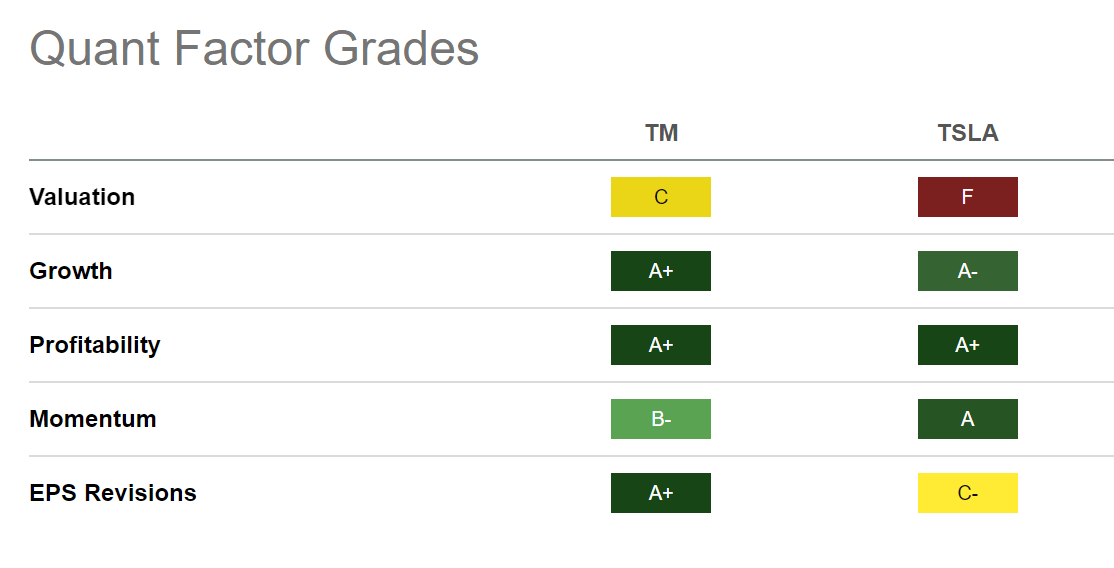

When comparing both stock’s factor grades, Toyota outperforms significantly on valuation and the all-important metrics of growth, EPS revisions, and profitability.

Toyota Stock Quant Grades vs. Tesla Stock

Toyota Stock Quant Grades vs. Tesla Stock (SA Premium)

Unlike Tesla, which only became profitable over the last few years, Toyota Motor Company has been profitable for decades. Although Tesla’s price performance has significantly improved compared to Toyota’s, each company innovates.

Toyota has become a leader in sustainability, offering a good balance of growth and value. With just as noteworthy of a name, Toyota is making headway in the electrification of vehicles, it is a great play to diversify your portfolio, and you don’t have to pay a Tesla premium. I believe Toyota is the most opportune of the auto manufacturing EV stock picks, offering a better valuation and continued advancements and momentum than Tesla. Regarding discretionary spending, we have many Top Consumer Discretionary stocks to choose from, or perhaps simply a look at the dozens of Top Rated Stocks. Our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.