Summary:

- President Trump has proposed up to 10% universal tariffs on US imports.

- The EU has also implemented new tariffs of up to 45% on electric vehicles imported from China and other non-Chinese-made EVs.

- U.S. worker strikes and layoffs, lower demand for EVs, coupled with cheaper alternatives from China, could impact automakers.

- Tesla’s Q3 earnings showed improvement, but the company has struggled to bring down costs-per-car, and the current macroeconomic environment has challenged its sales.

- GM is now the #2 EV seller in America, capturing ~10% of the total EV market. Solid Quant ratings and factor grades suggest GM might be more resilient should the automotive industry suffer from trade disruptions caused by tariffs.

Wengen Ling

Trump Tariffs and Trade Policies

The US Presidential Election has brought tariffs back into the spotlight, with President Trump proposing a 10% universal tariff on all U.S. imports and potentially raising duties on Chinese products to as high as 60%. If implemented, the proposed tariffs could impact several sectors and their corresponding stocks. Trump has notably called out the automobile sector, suggesting that cars that are imported through Mexico could be subject to tariffs in excess of 100%. In September, Trump called out the agricultural and farm machinery giant Deere & Company (DE), threatening DE with a 200% tariff if the company were to follow through with plans to move some of its manufacturing to Mexico.

EU Slaps Tariffs on Chinese EVs

Increasing protectionism is not only on the rise in the United States. Last week, the European Union implemented new tariffs on electric vehicles imported from China. These tariffs range from 7.8% – 35.3% in addition to the existing 10% import duty on all vehicles. Tariffs also target non-Chinese made EVs, including Tesla (NASDAQ:TSLA), Renault SA (OTCPK:RNSDF), and BMW (OTCPK:BMWYY). These tariffs are the result of a year-long anti-subsidy investigation by the European Commission and intended to “level the playing field” for European-based EV producers. China has lodged a formal complaint with the World Trade Organization (WTO) in response, on the merits that the EU’s tariffs lack “legal and factual” foundation. The economic policy impact of restricting imports and imposing higher tariffs are crucial decisions that the new president will have to tackle.

More Tariffs, but More Manufacturing Jobs?

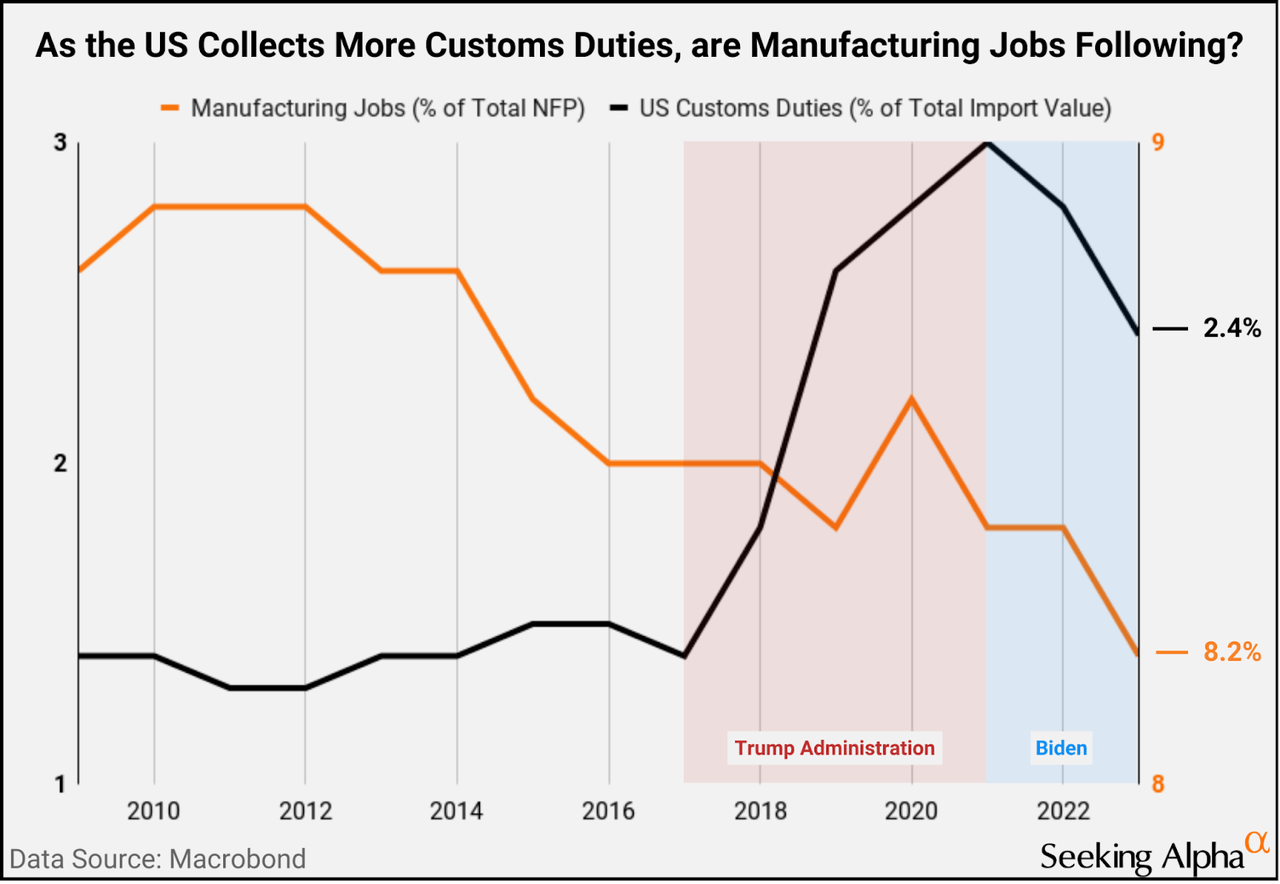

Before the start of the first Trump Administration, U.S. customs duties (as a percentage of total import values) hovered around 1.5% in 2016, just above a record-low 1.2% in 2008. In the coming years, this surged to a peak of 3% – the highest since 1994. This has decreased slightly during the Biden Administration but remains at historically elevated levels.

As the latter continued the legacy of tariffs, manufacturing as a percentage of total non-farm payrolls remained on its long-term downward trajectory since the 1940s, deteriorating to a record low of 8.2% at the end of 2023. The auto industry experienced some supply chain disruptions following Section 232’s steel and aluminum tariffs, which raised the cost of production for manufacturers, negatively impacting exports. This trend could be exacerbated following more tariffs, and reductions in production and profitability, but consider keeping an eye on two key players in auto manufacturing.

Auto Stocks to Watch

The global nature of automotive supply chains makes the industry vulnerable to trade disruptions that might arise from increasing tensions. Many vehicles are assembled using specialized, component parts from multiple countries. Tariffs on imports can quickly increase production costs, even for domestic vehicles manufactured in the US.

While Tesla (TSLA) might benefit from Elon Musk’s potential connections in a Trump administration, General Motors (NYSE:GM) is the #1 Quant-rated automobile manufacturer stock, and it made huge movements in October, gaining over 13% in the month. Below, I will compare Tesla, one of the largest and most well-known auto manufacturers to GM, another storied US automaker based on Seeking Alpha’s Quant ratings and factor grades, and contextualize their current EV strategies and how new tariffs may impact their prospects.

1. Tesla, Inc. (TSLA)

-

Sector: Automobile Manufacturers

-

Market Capitalization: $799.24B

-

Quant Rating: Hold

-

Quant Sector Ranking (as of 11/4/2024): 90 out of 496

-

Quant Industry Ranking (as of 11/4/2024): 4 out of 29

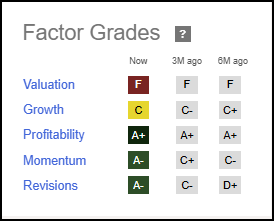

Tesla is among the most well-known auto manufacturers and the largest by market capitalization. The company, currently rated a ‘Hold’ by Seeking Alpha’s Quant Ratings, has had a rough year based on its fundamentals and analysts’ guidance. Tesla’s conditions appear to be improving, the company’s EPS Revisions and Momentum factor grades have improved throughout the course of 2024.

TSLA Stock Factor Grades

SA Premium

In Q3, Tesla achieved record deliveries and beat EPS estimates by $0.12. The company’s revenue of $25.18B was up 7.85% Y/Y, but missed estimates by $259.6M. The current macro environment, characterized by inflation and economic uncertainty, has weakened the demand for automobiles and EVs in particular, which are, on balance a more expensive consumer discretionary item relative to their gas-powered counterparts. Tesla is working hard to implement cost-reduction measures for its cars and achieved its lowest quarterly cost-per-car and is hopeful a reduced interest rate environment will have an impact on sales growth

“[For] The vast majority of people…the demand is driven by the monthly payment. Can they [afford the] monthly payment? So, like, most likely, we’ll see continued decline [in] interest rates, which helps with affordability [of] vehicles,” said Elon Musk, Tesla CEO.

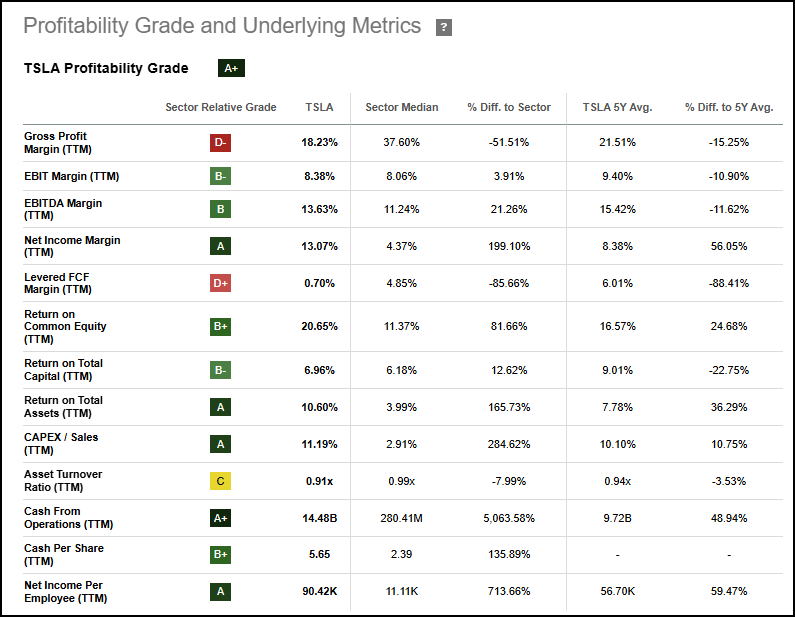

Tesla is severely overvalued, as showcased by the ‘F’ valuation grade. It trades at massive premiums relative to the sector with a FWD PEG Non-GAAP of 6.8x (+334% vs. the sector). However, the stock boasts excellent profitability with $14.48B in cash from operations and an EBITDA margin of 13.6% vs. the sector’s 11.2%.

TSLA Stock Profitability Grade

SA Premium

Tesla’s mixed Q3 results show a company balancing growth and profitability in a challenging macro environment, while heavily investing in future technologies like autonomous driving and robotics. There is increasing optimism around the company, reflected in its 29 FY1 up revisions in the last 90 days, and there are multiple scenarios where the company could benefit from either administration. However, until the company can bring down costs-per-car, the current iteration of Tesla will be challenged.

2. General Motors Company (GM)

-

Sector: Automobile Manufacturers

-

Market Capitalization: $56.04B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/4/2024): 7 out of 496

-

Quant Industry Ranking (as of 11/4/2024): 1 out of 29

GM still stands as the top Quant-rated automaker since its addition to the Top 10 Stocks for H2 2024 back in June. In addition to designing and manufacturing, GM offers after-sale services through its dealership, including vehicle maintenance, collision repairs, and parts, and has experienced rapid growth through its affordable auto segments like SUVs, crossovers, and increasingly electric vehicles. Solid revenue and earnings growth have benefitted from GM’s winning product portfolio and enormous competitive advantage that has stemmed from being one of few EV manufacturers vertically integrated to own its battery supplier, which is located in both Tennessee and Ohio.

“If you attended Investor Day, I hope you have a deeper appreciation for the role our battery manufacturing capabilities and overall cell strategy are playing in our drive to EV profitability. The scale and vertical integration we have achieved with LGES in Ohio and Tennessee is a major competitive advantage that’s driving down cell costs, so are the world-class yield rates we are seeing. Because we jointly produce ourselves, we reap the benefits of lower commodity prices, and we are generating significant manufacturing credits at both the cell and module level. It will be years before some of our competitors approach this level of performance,” said Mary Barra, Chairman and Chief Executive Officer of GM.

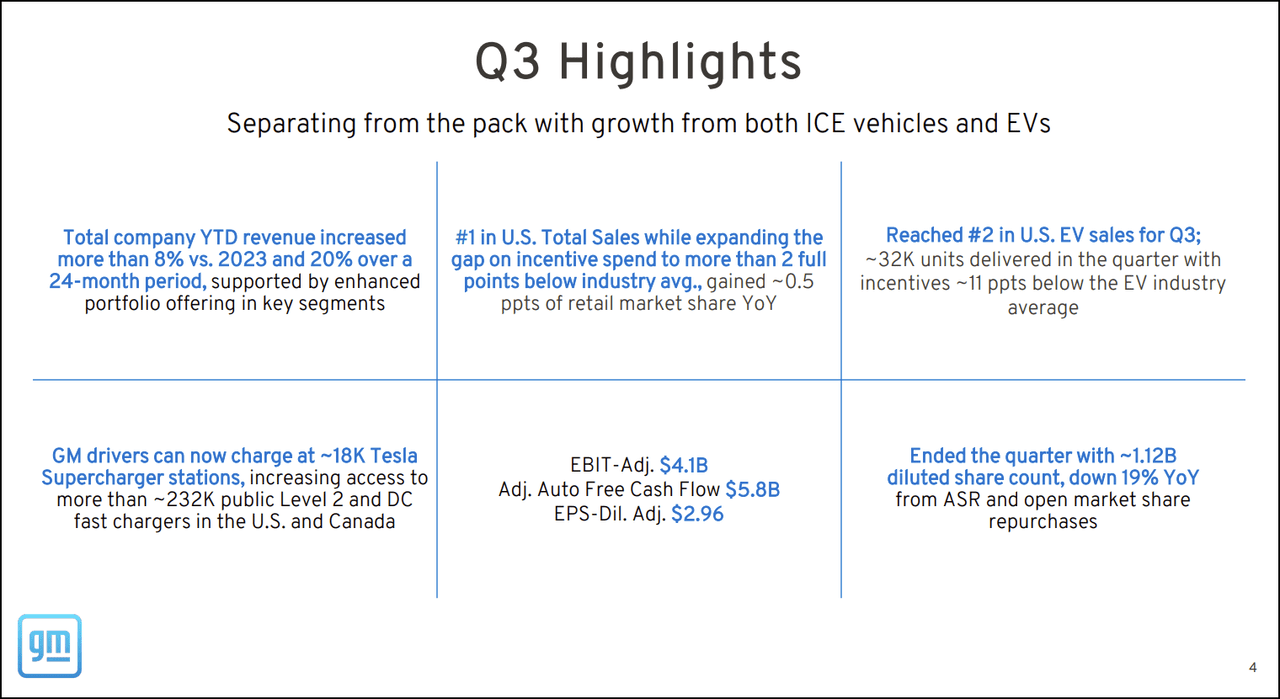

GM has become the #2 EV seller in America, capturing about 10% of the EV market. Nearly 60% of General Motors’ EV buyers are new to the brand, and GM is expected to become profitable on each individual EV sold by the end of 2024.

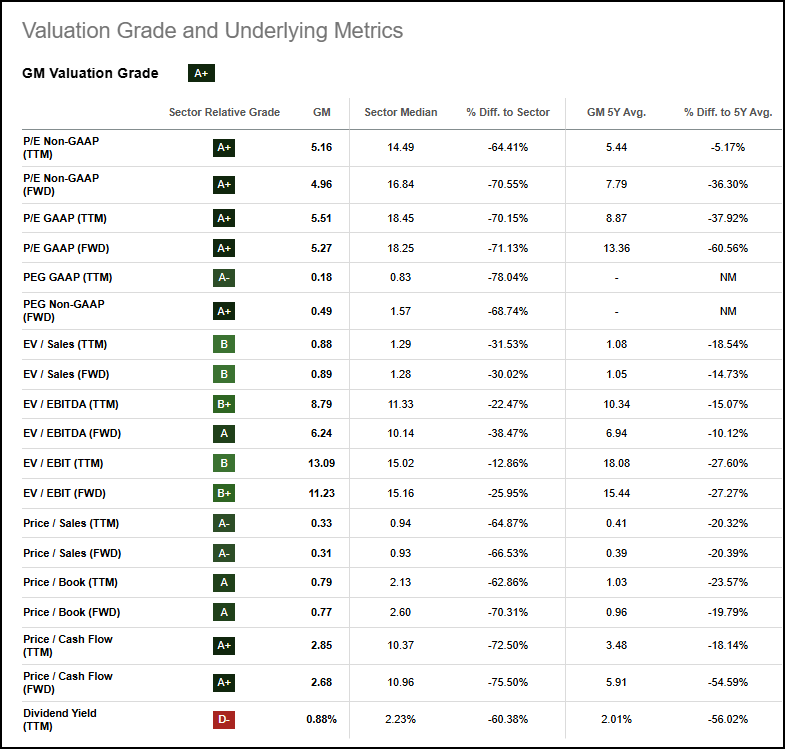

GM’s profitability and growth characteristics stand out. The company’s TTM net income margin and forward revenue growth are 6.0% and 4.5% respectively, both exceeding the sector median by 39%. Despite the significant gains, having returned over 46% YTD, the stock is still graded an ‘A+’ in terms of valuation, trading at 0.49 FWD PEG Non-GAAP, which is nearly a 70% reduction versus the sector.

GM Stock Valuation Grade

SA Premium

GM has received a whopping 17 positive EPS revisions, with only three downward revisions in the last 90 days. GM is a great example of a company harnessing its century of mass-manufacturing experience to bring down costs, convert new customers and compete with technological pioneers like Tesla on EVs.

Concluding Summary

The rising popularity of tariffs, as evidenced by US Presidential Election rhetoric and the EU’s recent actions against the Chinese EV industry, suggests a broader trend toward trade protectionism. This trend could result in trade disruptions, which could have an impact on multiple sectors, including the automotive sector. This article examines two auto giants: Tesla and GM, exploring their current strategic positioning, stock fundamentals, and outlook.

Tesla maintains its strong culture of innovation, investing heavily in future technologies, while struggling to bring down current costs to manufacture its existing fleet. High interest rates and economic uncertainty have also acted as additional headwinds for TSLA, pushing down sales in Q3. Despite these challenges, Tesla displays strong profitability, as well as EPS revisions and momentum grades. At the same time, GM has emerged as a compelling competitor in the EV space, by leveraging its traditional manufacturing expertise and scale. GM is trading at an attractive valuation relative to the sector, alongside excellent growth, profitability, momentum, and EPS revisions. GM’s strong Quant ratings and solid factor grades suggest that it might be more resilient to weather protectionist policies should those policies go into effect.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Consider using Seeking Alpha’s ‘Ratings Screener’ tool to help find stocks that achieve diversification into desired sectors you like. Or, if you’re seeking a limited number of monthly ideas, consider exploring Alpha Picks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. Steven Cress is the Head of Quantitative Strategy at Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.

I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.