Summary:

- Transocean’s Q4 results showed an increase in average day rates and revenue, but also higher operating & maintenance costs and negative FCF.

- Lowered guidance for 2024 was not the right way for the highly leveraged company to kick off the year.

- Transocean’s debt remains a major concern, and its ability to generate free cash flow and reduce debt will be crucial for its future prospects.

grandriver

Last April, I started coverage of Transocean (NYSE:RIG) stock with a “Hold” rating, saying that while the day rates were improving that its debt load was an issue. The stock is down over -20% since then versus an over 20% gain in the S&P. More recently, in September, I said its deleveraging story has becoming clearer, but its valuation and indebtedness compared to peers made it a high risk/reward stock. The stock is down -40% since that write-up. With the company recently reporting its Q4 results, let’s catch up on the name.

Company Profile

As a reminder, RIG owns a fleet of drillships and semisubmersibles that offshore drillers contract out. Drillships are deployed in calmer seas, while semisubmersibles are use in harsh sea conditions.

The company owned 37 vessels at the end of 2023 with an average age of about 11 years. It had 29 ultra-deep water vessels and 8 harsh environment vessels in its fleet. 25 of its vessels are operating, 11 are cold-stacked, and one is under construction.

Q4 Results and 2024 Outlook

One of the most important things for RIG continues to be day rates. The industry and RIG came under extreme pressure between 2014 through the pandemic when day rates stayed low. However, rates have been recovering since 2021.

For its Q4 reported in late February, RIG saw its average day rate climb 24% year over year to $432,000 per day, up from $349,000 per day a year ago. In Q1, its average day rate was $391,000.

More importantly, RIG said that based on its current backlog, it expects its average day rates for Q1 2024 to be $433,000 per day. That would be a 19% increase compared to current levels.

Overall, RIG saw its contract revenue climb 22% year over year, and 4% sequentially, to $741 million. Analysts were looking for revenue of $741.2 million.

Operating and maintenance costs climbed 35% to $569 million from $423 million, and were up 9% quarter over quarter.

Adjusted EBITDA fell -13% to $122 million, and was down -25% sequentially.

Adjusted EPS was a loss of -9 cents compared to -48 cents a year ago and -36 cents in Q3.

The company generated $98 million in operating cash flow in the quarter. Free cash flow was -$122 million. It generated $164 million in operating cash flow for the year, with free cash flow of -$263 million.

Turning to its balance sheet, RIG ended 2023 with $7.41 billion in debt and cash of $762 million. That would equate to leverage of about 9x on the $738 million in adjusted EBITDA it produced in 2023

RIG noted that it continues to see contract durations increase. It recently contracted out a vessel in the Romanian Black Sea for a minimum duration of 540 days, with a day rate of $465,000 per day, which will go up to $480,000 per day after the initial term.

The company also noted that the U.S. Gulf market, which has historically seen short lead times and short duration contracts is starting to move to longer lead times and longer duration contracts.

Looking ahead, the company guided for Q1 revenue of about $780 million. It expects operating and maintenance expense to be approximately $545 million and G&A expenses of $47 million.

For the full year, the company is projecting revenue of between $3.60-$3.75 billion. This is down from an earlier forecast calling for 2024 revenue of between $3.7-3.9 billion projected in October. The company said the reduced guidance was due to delayed contract commencements for three vessels caused by prolonged mobilization and contract preparation activities.

On the expense side, it is expecting O&M expenses to be around $2.2 billion, G&A to approximately $196 million, and interest expense to be $513 million. CapEx is projected to be $242 million.

On its Q4 earnings call, CEO Jeremy Thigpen said:

“Our fleet is largely contracted through 2024, and we will continue to actively seek work to fill any gaps in utilization. Having said that, our $9 billion backlog and superior assets provide us with the competence and flexibility we need to be selective in the opportunities we pursue as we constantly endeavor to strike the right balance between utilization and day rate optimization. As previously mentioned, we’re encouraged by the longer-term programs we see materialize with start dates well into the future. As we move into 2024 and further into what appears to be a sustained upcycle, our priorities remain, first, converting our industry-leading backlog to cash. We’ll do this by maintaining acute focus on safety and the uptime performance across our fleet, which directly impacts our overall revenue efficiency. Second, deleveraging the balance sheet. Assuming the market materializes, as we expect, we will generate significant free cash flow over the next few years. And while we recognize that operating a growing fleet is a competing priority with deleveraging, we will be sure to balance the two in a manner that best serves our shareholders Third, and finally manage the business with the ultimate goal of returning more value to our shareholders, either through share repurchases or dividends.”

RIG continues to benefit from the rebound in day rates, while longer contract durations should begin to give it more visibility. However, operating and maintenance costs have also been skyrocketing, and its operating cash flow has been relatively modest.

With nearly $7 billion in net debt and 9x leverage, the company needs to generate substantial cash to pay down its debt and start to deleverage. With the capex spent on building a new vessel, the company disappointingly wasn’t able to make any dent in its debt load last year, despite a much improved environment and higher day rates.

Lowering revenue guidance, with no change is expense guidance, also isn’t great for a company in its debt position.

Valuation

RIG stock currently trades at nearly 9x the 2024 consensus EBITDA of $1.24 billion and 6.7x the 2025 consensus of $1.63 billion.

It trades at a forward P/E of 12.3x the 2025 consensus of 42 cents. Adjusted EPS is expected to 1 cent in 2024.

It’s projected to grow revenue by nearly 29% this year and about 12% in 2024.

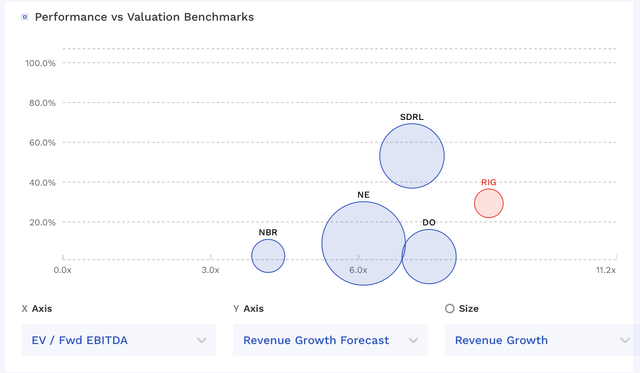

RIG is one of the more expensive stocks among its peers, and has a higher debt/equity level than most of its peers.

RIG Valuation Vs Peers (FinBox)

For RIG shares to increase in value, the company really needs to reduce debt through generating free cash flow. Right now, for 2024 it looks like it will be able to generate free cash flow of between $450-500 million. That can move leverage down to close to 5x at the end of 2024, and then a stronger year in 2025 could see debt reduced by possibly $1 billion in 2025 based on higher EBITDA estimates (helped by stronger day rates and a full year of a new ship) and less capex. That would bring leverage down to a more reasonable 3.3x. Keep a 7x multiple on 2025 EBITDA estimates, and you have an $8 stock.

Conclusion

The path for deleveraging for RIG remains over the next two years. However, the company has shown that the journey may not be a smooth one. It will also need to continue to see day rates remain strong and for it to get its O&M expenses in check.

2024 is a big year for RIG, and so far, it’s not off to a good start. However, if it can start to reactivate its cold-stack rigs at some point this year and get them into service, that could shift the narrative on the company.

RIG remains a high risk-reward stock. I see nice upside potential if things go as planned, but at the same nice, if the market turns it could be a zero given its debt load. I lean more towards the deleveraging story working at this time, but recognize the large risk associated with the name. As such, I continue to rate the stock a “Hold.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.