Summary:

- Transocean discloses new 20k PSI work for the 8th generation drillship “Deepwater Atlas” at record-high rates.

- However, additional contract commencement delays are likely to negatively impact second quarter results.

- Over the past three months, the company added $656 million in backlog. However, with a quarterly revenue run rate of well above $800 million, total backlog was down again.

- Valuation-wise, the company remains expensive relative to peers. With the stock trading close to my $5.50 price target, I am reiterating my “Hold” rating on the shares.

pabst_ell

Note:

I have covered Transocean Ltd. or “Transocean” (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Wednesday’s regular session, leading offshore driller Transocean released a new fleet status report highlighted by new contract awards at record-high rates for the 8th generation drillship Deepwater Atlas in the U.S. Gulf of Mexico.

After a number of delays, the Deepwater Atlas finally transitioned to a new higher-margin contract this month with the dayrate increasing from $268,000 to $455,000. However, an additional two-month delay experienced in Q2 is likely to negatively impact second quarter revenues.

Following the end of its current contract in July 2025, the rig will continue to work for Beacon Offshore Energy at a dayrate of $505,000 until February 2026 with contingencies to perform three completions at the same dayrate in subsequent months.

Between June 2026 and November 2026, the rig will perform 20K PSI work at a dayrate of $580,000 with contingencies to perform two completions at a rate of $650,000 (!).

These are, by far, the highest rates awarded over the past decade. However, it is important to note the short-term and contingent nature of this particular 20K PSI contract.

I would estimate the backlog value of the firm parts of the new Deepwater Atlas contracts at approximately $190 million.

Contract extensions for the drillship Deepwater Asgard as well as the harsh environment rigs Transocean Norge, Transocean Spitsbergen and Transocean Endurance had been previously reported by the company.

In addition, the drillship Deepwater Invictus secured a 40-day contract extension in the U.S. Gulf of Mexico.

Lastly, customer Petrobras (PBR) exercised a 279-day option for the drillship Deepwater Mykonos in Brazil at a dayrate of $366,000.

In aggregate, these fixtures added $656 million in backlog. As of July 24, Transocean’s total backlog amounted to approximately $8.8 billion, down from the $8.9 billion number reported in the company’s last fleet status report in April.

However, the company’s second quarter results will likely be negatively impacted by additional contract commencement delays for the drillships Deepwater Atlas (as discussed above already) and Dhirubhai Deepwater KG1. In aggregate, I would expect the revenue impact to be approximately $20 million.

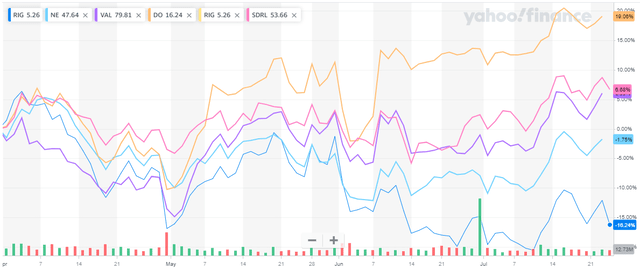

Since the end of Q1, Transocean’s stock has underperformed peers by a wide margin:

Yahoo Finance

While shares of companies like Seadrill (SDRL) or Valaris (VAL) recently marked new 52-week highs, Transocean’s stock has been trading closer to its 52-week lows as of late.

I would attribute the material underperformance to a number of issues:

- The company’s still elevated valuation relative to peers.

- A recent slew of disappointing quarterly results and resulting full-year guidance reductions.

- A weak fleet status report in April.

- Renewed dilution resulting from the recent decision to acquire the semi-submersible rig Transocean Norge from funds associated with Hayfin Capital Management (“Hayfin”).

In total, Transocean issued $130 million in 8% 2027 Senior Notes and 55.5 million new common shares to Hayfin in exchange for the remaining 67% stake in the rig.

Assuming the shares having been valued at $5 in the transaction, Transocean paid slightly above $400 million to Hayfin, very much in line with my expectation. Under this scenario, the value assigned to the rig was around $600 million, which looks expensive at first glance, but investors should note that Transocean Norge has been awarded almost $600 million in profitable backlog in recent quarters.

Compared to the previous bareboat charter agreement with the rig-owning entity, the transaction should result in an estimated $5 million to $10 million in annual cash savings for Transocean.

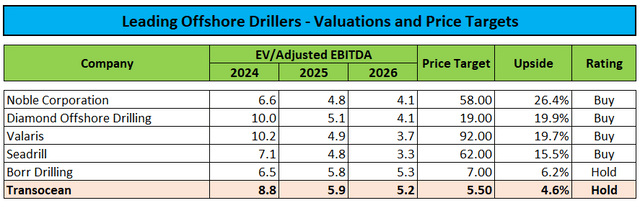

On a forward-basis, the stock remains expensive relative to competitors in the floater space thus limiting potential upside:

Value Investor’s Edge

Investors looking for exposure to the industry, should rather consider peers like Seadrill, Valaris and Noble Corporation (NE) which are all trading at substantially lower forward valuations while at the same time commanding vastly superior balance sheets.

With shares trading close to my $5.50 price target, I am reiterating my “Hold” rating on the stock ahead of the company’s second quarter earnings report next week.

Bottom Line

Some of the follow-on work secured for the 8th generation drillship Deepwater Atlas was awarded at dayrates not seen for more than a decade.

However, it is important to note the short-term and contingent nature of this particular 20K PSI contract.

In aggregate, Transocean added $656 million in backlog, but with the company’s quarterly revenue run rate being well above $800 million, total backlog was down for the third consecutive quarter.

In addition, the company experienced additional contract commencement delays, which are likely to negatively impact Transocean’s upcoming second quarter results.

Valuation-wise, the company remains expensive relative to peers. With the stock trading close to my $5.50 price target, I am reiterating my “Hold” rating on the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.