Summary:

- Day rates continue to rise, which bodes well for RIG and the industry.

- RIG’s debt burden remains an issue, and the company has yet to turn FCF positive.

- While the journey won’t be easy, there is a path for RIG to repair its balance sheet.

Lichtwolke

Back in April, I said Transocean (NYSE:RIG) was benefiting from a nice increase in day rates, but that its debt burden remains an issue. Let’s check in on the name, with the stock down over -5% since my initial neutral write-up on the name.

Company Profile

As a quick reminder, RIG is an offshore contract driller that owns a fleet of drillships and semisubmersibles. Drillships are suited for operations in calmer seas, while semisubmersibles are used in rough sea conditions.

The company had 37 vessels at the end of Q1 and was in the process of building an ultra-deepwater drillship. It also had a non-controlling interest in a company building a new vessel as well. Of its vessels, 24 were ultra-deep drillships and 13 are semisubmersibles. Ten of the semisubmersibles are for harsh environments.

Offshore Drilling Recovery Continues

As I noted in my initial write-up, a recovery in the offshore drilling market and higher day rates is the biggest potential driver for RIG. The offshore drilling market can be highly cyclical, and the industry experienced a very tumultuous period for the past decade. Many offshore drillers filed for bankruptcy during this time, although RIG was not one of them.

However, the market has been shifting and day rates have been on the rise. Last year, day rates were about $359,852, increasing from $232,555 in 2021. They have averaged $420,000 in the first half of 2023, and are up 40% over the past 12 months. Analysts at both Wood Mackenzie and Westwood Global have predicted that rates could end the year at $500,000 or above.

In a recent report, Wood Mackenzie analyst Leslie Cook said:

“Are we at the tipping point of the deep-water rig market?” active floater utilisation has rebounded from a low of 65% in 2018 to more than 85% in 2023, the number of contracted ultra-deepwater benign rigs has returned to pre-Covid levels and dayrates for best-in-class floaters have doubled in the past two years. Higher oil prices, the focus on energy security and deep-water’s emissions advantages have supported deep-water development and, to some extent, boosted exploration. Active supply is now more in line with demand and rig cash flows are positive. We expect demand to continue to rise.”

For its part, RIG echoed a similar sentiment on its Q1 earnings call, with CEO Jeremy Thigpen saying:

“Sixth and seventh-gen drillship utilization remains at nearly 100%. We expect these utilization levels will be sustained as drillship demand is anticipated to rise throughout 2023. And we believe that as a result, day rates will continue to trend upward, especially for the higher specification ultradeep fleet. In fact, by the end of the year, we expect leading-edge rates to exceed $500,000 per day.”

Now, RIG should continue to see a benefit from this, as ships come off contracts and get put back to work at higher day rates. The company also said it is starting to see customers looking for longer-term contracts, in some cases for over three years.

Higher oil prices are playing a role in high dayrates but a lack of drillships is also playing a role. During the tumultuous past decade, many contract drillers reduced the number of vessels through scrapping them or cold-stacking them. While cold-stacked vessels are still around, it is expensive to prepare them to get back into service. Thus, most companies aren’t going to reactivate these ships unless they have solid contracts in hand.

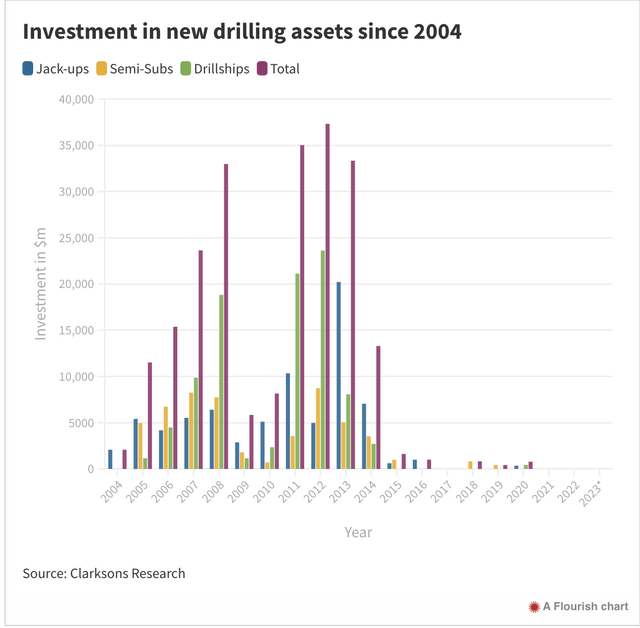

At the same time, not surprisingly, there haven’t been a whole lot of new drilling assets built in the last several years. There has been only one drillship newbuild since 2014, and that was completed in 2020. Meanwhile, the last semisubmersible order was completed in early 2019. But there has been hardly any investment in drilling assets since 2014.

Now, if drillship demand continues and cold-stacked vessels start to be re-activated, RIG is in a good place. It currently has 12 cold-stack assets, of which three are 7th generation cold-stacked drillships and five are sixth generation cold-stacked drillships. There are only 13 of these “newer” drillships that are cold-stacked in the industry, with RIG owning eight of them.

RIG estimates that it would cost between $75-125 million to reactivate one of its cold-stacked vessels. That compares to a cost of $200-250 million to acquire a newbuild ship that was stranded.

Now, debt remains an issue, and RIG ended Q1 with nearly $6.9 billion in net debt. Adjusted EBITDA in Q1 was only $217 million, and the analyst consensus for this year is for adjusted EBITDA of $960.8 million. That’s a lot of leverage. In addition, the company is still not generating cash flow. Operating cash flow was an outflow of -$47 million in the quarter, while free cash flow was -$128 million for the quarter.

RIG is projected to have net interest expense this year of $479 million, which eats into half its EBITDA. On the positive front, the company said after the quarter that a holder of its exchangeable bonds agreed to convert its exchangeable bond to equity, which will reduce its debt by $213 million. It has $618 million of these exchangeable bonds still outstanding.

Valuation

RIG stock currently trades at nearly 12x the 2023 consensus EBITDA of $960.8 million and 7.5x the 2024 consensus of $1.51 billion.

It trades at a forward P/E of 14.4x the 2024 consensus of 43 cents. Adjusted EPS is expected to be negative in 2023.

It’s projected to grow revenue by nearly 17% this year and over 23% in 2024.

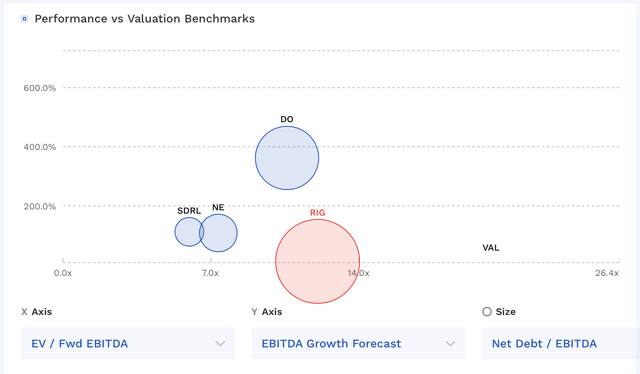

RIG is one of the more expensive stocks among its peers, and has a higher debt/equity level than most of its peers.

RIG Valuation Vs Peers (FinBox)

Conclusion

While there is a path for RIG to right-size the ship and get its balance sheet in shape, it’s not an easy journey. If rates get to and stay in the $475,000-$500,000+ range and contracts get fixed at these higher rates, then you can project the company generating a lot of EBITDA and free cash flow. Break evens are around $300,000 a day, so $73 million in profit per ship and 37 vessels equals $2.7 billion in EBITDA, minus corporate costs ($180 million) and for cash flow interest expense ($480 million), and you can see how the math generally works.

Of course, not all of its ships are going to command that rate, so it would be less in reality, but there is still a path to where the company has paid off a decent chunk of debt in a few years and its leverage is down significantly due to a combination of debt reductions and higher EBITDA.

So can RIG work from here? Yes, most certainly. But it’s a higher risk-reward play on the space compared to some other contract drillers that previously went down the bankruptcy path, and thus have better balance sheets. Thus, I continue to rate RIG a “Hold” at this time, but see its merits for more aggressive investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.