Summary:

- Transocean’s credit spreads have significantly narrowed over the past weeks.

- If the massive debt is no longer viewed as distressed, the leverage effect should continue providing a tailwind for Transocean’s equity.

- Transocean’s equity is likely to keep outperforming Noble and Valaris even if the latter two do better in terms of overall enterprise value.

nikkytok

Why invest in offshore stocks now?

The investment thesis for offshore drillers such as Transocean (NYSE:RIG), Noble (NE), Valaris (VAL), Seadrill (SDRL) or Diamond Offshore (DO) is well-known:

- “Renaissance” in offshore oil and gas capex after a long-period of underinvestment;

- U.S. shale growth reaching its limits, which further increases the confidence in long-cycle offshore plays;

- Limited supply of drilling rigs due to fleet attrition, high cost of newbuilds and shipyard bottlenecks.

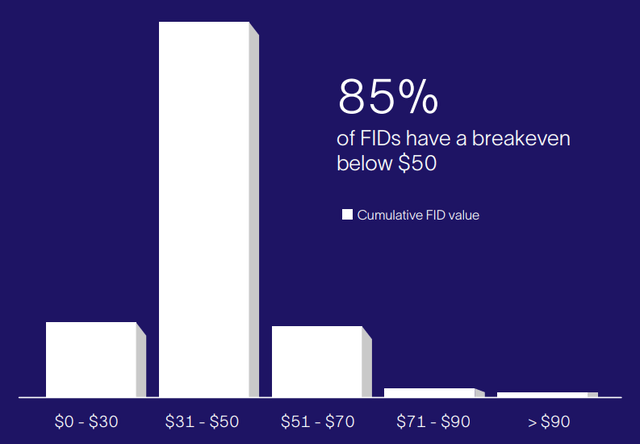

While U.S. shale doesn’t see an incentive to increase production at $70 oil, oilfield services bellwether Schlumberger (SLB) believes 85% of the offshore FIDs now have a breakeven below $50:

This means that the offshore capex cycle will continue despite cyclical headwinds. In Schlumberger’s view:

We see also the emergence of the second leg of FID and future offshore expansion driven by exploration appraisal. Exploration appraisal is happening in many countries. There are many rounds of licensing rounds happening, a lot of exploration and appraisal is happening to find this next reserve and develop it. So offshore is there to stay and not only in 2024 or 2025, but beyond as we can see, and with the second leg materializing.

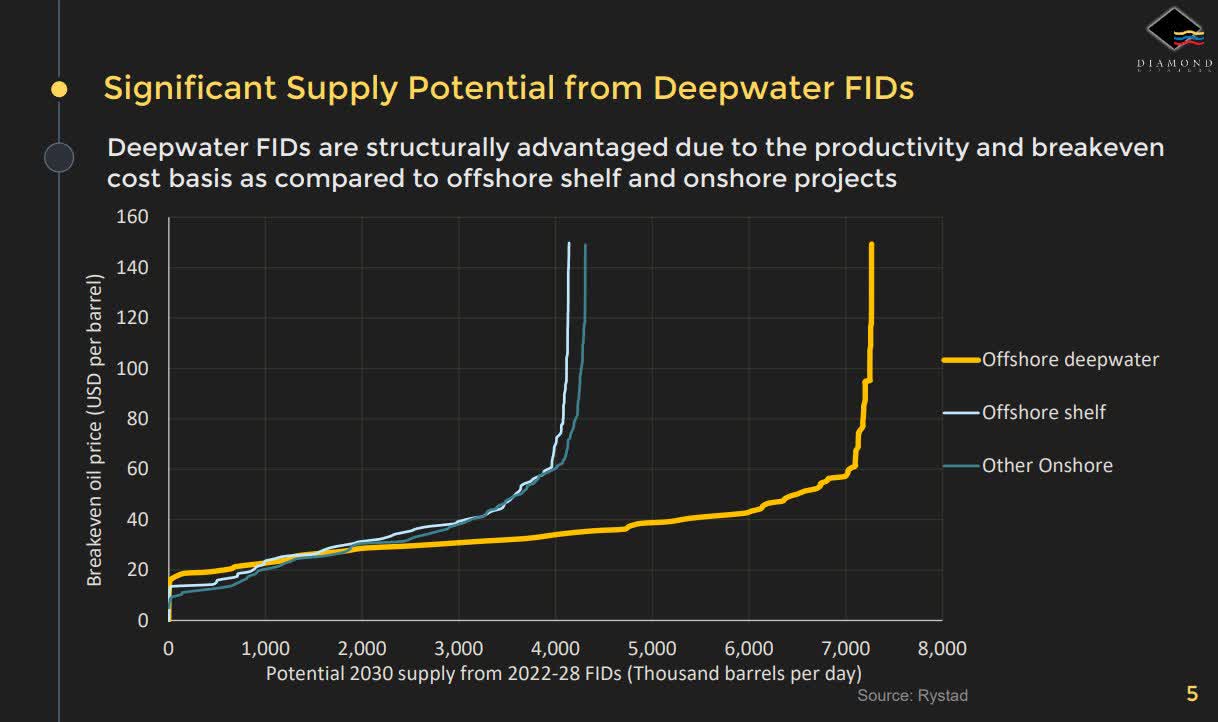

Consultancy Rystad also thinks that deepwater has the greatest potential to add low-cost production:

Diamond Offshore Presentation

Therefore, the incentive to develop offshore resources is strong. Greater demand for rigs while the supply remains limited means higher utilization and dayrates for Transocean and its peers. By the way, similar logic also extends to offshore support vessels (TDW) and subsea equipment (OTCPK:SUBCY). Further down the road, even providers of production chemicals (CHX) expect to benefit from the offshore boom.

I explain my views on the macro setup in a couple recent articles:

Oilfield Services Update: Offshore And International Make Up For North America Weakness

3 Things To Consider Before Buying Oil Stocks

However, here I want to focus on Transocean.

Why is RIG different from other drillers?

In one word, leverage. We can debate the technical aspects of different drillers’ fleets but the main reason why RIG stock behaves differently is because of the massive loads of debt. In contrast, Transocean’s competitors wiped out their shareholders and emerged out of bankruptcy with clean balance sheets.

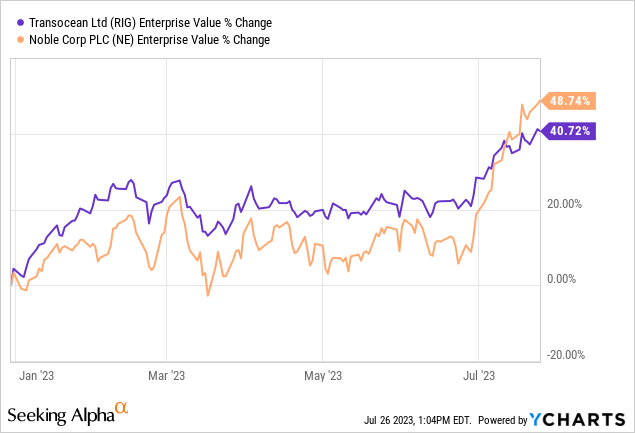

Year to date, Noble saw a higher increase in its enterprise value (equity plus debt minus cash) than RIG:

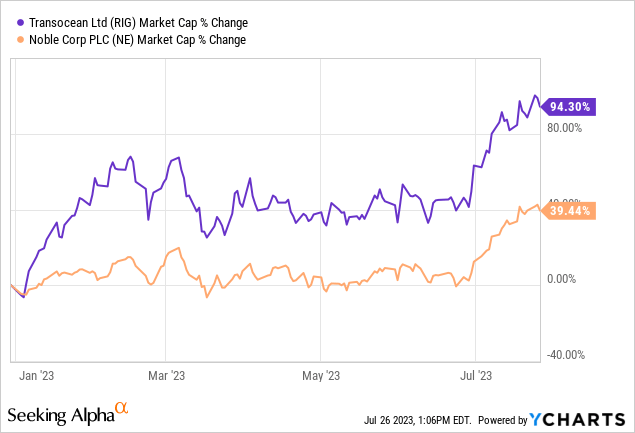

But if we look at market cap (the market value of the equity only), RIG has almost doubled while NE is only up 40%:

There is no “magic” here. In an upcycle, the more levered equity will outperform. The downside is that if things again turn south for the industry, RIG will underperform its less levered peers.

The market also knows that offshore drilling is a cyclical industry, so it may be willing to reward less levered companies with higher valuation multiples, especially if the future appears less certain. That is why it is important to monitor how perceptions of Transocean’s debt are evolving.

Transocean’s credit spreads are narrowing

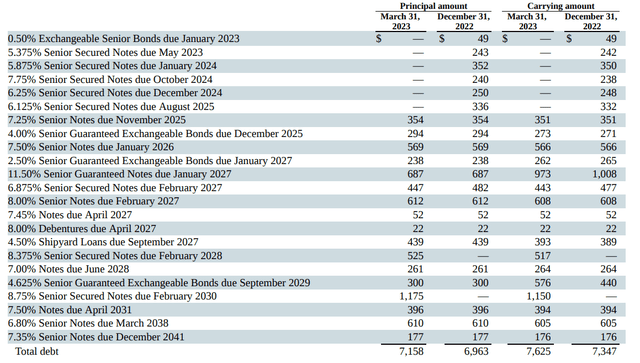

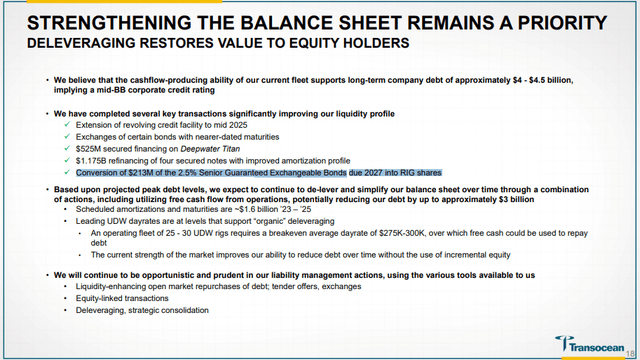

Over the last few weeks, the debt market action has been quite bullish. Transocean indeed has a lot of outstanding debt:

I focus though on the senior unsecured notes, which aren’t tied to specific rigs as collateral. This provides a better view of the overall credit risk. I also look at notes which aren’t convertible. The yield on corporate debt has two components: the matching risk-free rate plus a “credit spread” that compensates the bondholders for the risk they may not get repaid. Distressed companies, such as Carvana (CVNA), for example, can have very wide credit spreads; companies in good financial health have narrower spreads.

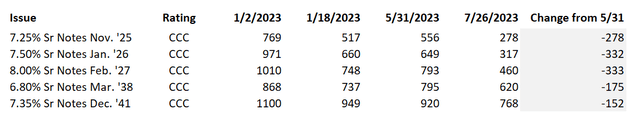

The Fed is still raising the risk-free rates, so the yield can increase even if the credit spread doesn’t. This is why tracking the spreads provides a better picture of the credit perception. Furthermore, many corporate bonds have call options (they can be redeemed early), so it is common to run comparisons based on the “option adjusted spread.” I show below how RIG’s option-adjusted spreads evolved from May 31 to July 26; for reference, I also show the start of the year and January 18, which is a day after the extension of key near-term maturities was announced:

The spreads on the shorter term notes narrowed by 300 bps from May 31, which is a big move for less than two months. For reference, the spread on Noble’s recently issued April 2030 notes, rated BB-, narrowed from 350 to 262 bps over the same period.

Spreads depend too on other factors such as the size and liquidity of a debt issue, so I’m not saying it’s all about the credit risk. However, all 5 senior unsecured issues seem to tell a similar story. First, an initial de-risking happened in mid-January after RIG announced a solution to the troubling near-term maturities. Spreads ended up in a similar place in May, when a further reduction in credit risk perceptions seems to have started.

Even though Transocean’s unsecured notes are rated CCC, the narrowed spreads are now more consistent with where B rated issues trade. The bond market usually front runs credit rating agencies, so this could be a sign that a credit rating upgrade may come at some point. Needless to say, it is very positive for the equity too. If the debt isn’t perceived as distressed, the “leverage effect” will continue to dominate.

What about the convertible debt?

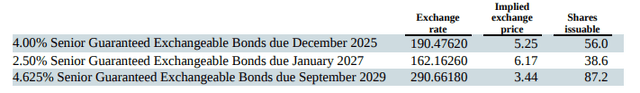

Transocean’s restructuring efforts resulted in a few convertible issues:

For all three issues, the conversion options are now in the money, which implies dilution. In fact, insider Perestroika already converted most of the 2027 issue into shares:

Transocean Investor Presentation

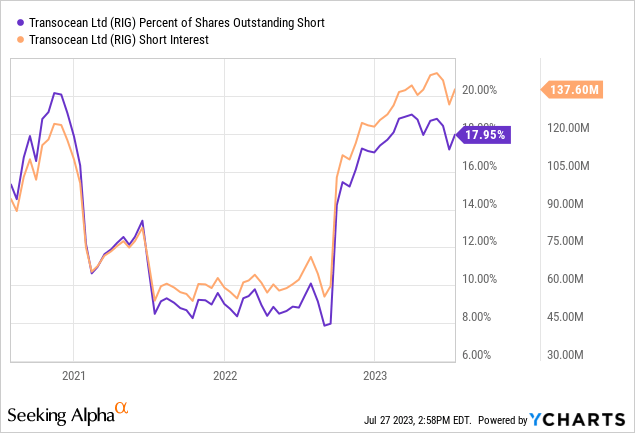

So 20% of the dilution may have already happened and the updated issue balance should be included in the forthcoming Q2 filings. As for the remaining convertible balances, much seems to have been hedged against the equity which accounts for some of the still high short interest:

I of course don’t know the hedging ratios involved, but I would think some of the newly issued shares would be used towards covering these short positions.

Bottom line

The credit spreads on Transocean’s unsecured notes have significantly narrowed over the past few weeks. While the spread narrowing in January can be explained by specific refinancing actions, the latest de-risking round appears perhaps driven by the improved business perceptions on the back of several strong new contract announcements, from both RIG and others.

As the $7 billion debt load is looking more manageable by the day, the “leverage effect” should continue. The “multiple effect” (less leveraged peers being rewarded with higher multiples) will be less relevant in a prolonged offshore cycle. I expect RIG’s equity to continue outperforming NE and VAL even if these less levered competitors have more favorable EV multiples or even outperform RIG on EV basis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.