Summary:

- Recent revenue and backlog data pushed out by Transocean has been encouraging, especially during these uncertain times.

- However, the company’s net loss has also increased, primarily due to higher operating and maintenance expenses and interest expenses.

- Despite positive revenue growth and a growing backlog, the company’s high debt levels and expensive stock price warrant caution for investors.

Igors Aleksejevs

Over the years, I have written extensively about the oil and gas industry. This includes pretty much every facet of the industry. One area that I have experience in within this space is the offshore industry. And the company that has been my primary focus in this niche has been none other than Transocean (NYSE:RIG), a major owner of offshore rigs that leases them out under contracts for companies that want to engage in the extraction of these natural resources. For years, the industry has faced significant pressure. This is because a massive decline in pricing years ago resulted in these operators experiencing a significant decline in demand for their services. This makes sense when you consider that the offshore space has largely been considered one of the most costly when it comes to energy extraction. And the long-term nature of many of the projects requires pricing to be elevated for an extended window of time in order for these projects to be profitable.

Right the last article that I wrote about Transocean in was published just over a year ago in early November of 2022. In that article, I lauded the company for its great financial performance leading up to that point. Backlog was growing at a nice rate and that trend looked set to continue so long as energy prices remained high. Add on top of this how cheap shares were at the time, and I ended up rating the company a ‘buy’. This call has gone on to be one of my best over the past year. While the S&P 500 is up 18.9%, shares of the offshore rig operator have returned a profit of 62.8%. Fast forward to today, and the picture does show continued signs of improvement in some respects. But with how shares are priced and the extreme uncertainties regarding the industry moving forward, I am now downgrading the company to a ‘hold’.

Times have been good… sort of

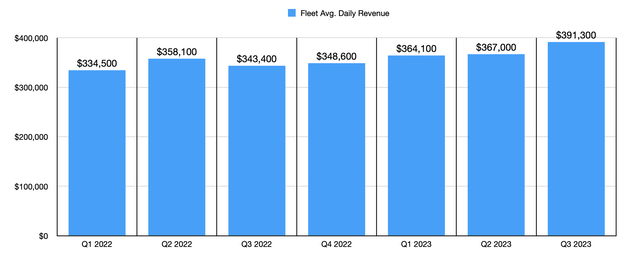

Recently, the management team at Transocean has been able to demonstrate continued growth on the company’s top line. During the first nine months of the 2023 fiscal year, for instance, revenue came in at $2.09 billion. That’s 6.2% above the $1.97 billion the company generated one year earlier. Even though the number of operating days that the enterprise has seen in the first nine months of this year is actually down roughly 6% year over year, the firm has benefited significantly from a rise in the average daily revenue that it generates from its rigs. This number has grown from $344,600 in the first nine months of 2022 to $373,800 the same time this year. As the chart below illustrates, an increase in the average rate per day that the company has been able to capture has been the name of the game since the third quarter of 2022. This clearly shows robust demand for offshore drilling services.

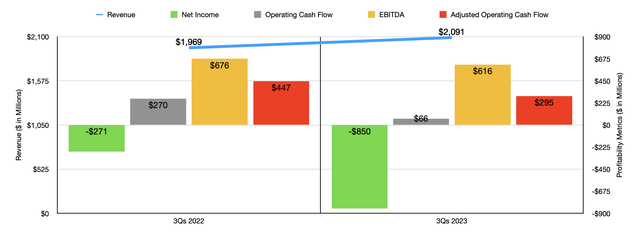

While the top line has been positive, the firm has faced some issues on the bottom line. It went from generating a net loss of $271 million in the first nine months of 2022 to generating a net loss of $850 million during the same window this year. There have been a couple of contributors to this negative change. One of the most significant was an increase in the company’s operating and maintenance expenses from 63.4% of revenue to 67.8%. That increase, according to management, was driven mostly by a $75 million hit that resulted from reactivation and contract preparation activities and a $65 million hit associated with two new build ultra-deepwater floaters that were recently placed into service.

As bad as price increases are to see, it’s actually good that these were the primary drivers because it shows that the company is activating its assets. So you can view this as short term pain for long term gain. Of course, there were some other cost increases that were not quite as positive. $25 million of the increase, for instance, related to inflation on personnel related and maintenance costs, while $20 million was due to higher reimbursable expenses. Outside of the operating and maintenance expense category, there was another contributor. And that one was even larger. Interest expense for the company skyrocketed from $298 million to $649 million.

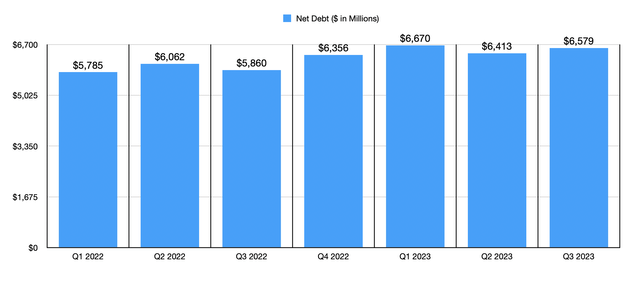

An increase in net debt from an average of $5.90 billion in the first nine months of last year to $6.55 billion this year was partially to blame. However, the company also took a hit in the amount of $272 million that resulted from a fair value adjustment involving one of its indentures. Add on top of this a $167 million swing in losses on disposable assets, and it’s easy to see why prophets took such a beating. Other profitability metrics followed a similar trajectory. Operating cash flow, for instance, went from $270 million to $66 million. If we adjust for changes in working capital, we would get a decline from $447 million to $295 million. And finally, EBITDA for the company fell modestly from $676 million to $616 million.

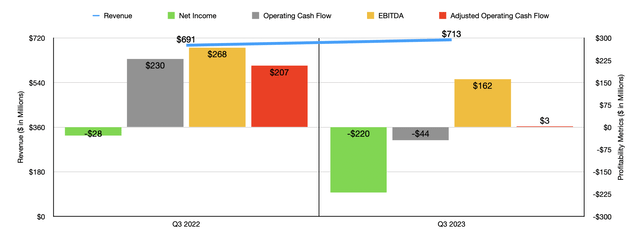

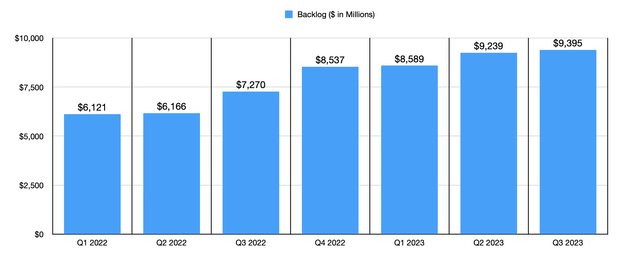

As you can see in the chart above, financial performance for the third quarter on its own was very similar to what the company saw for the first nine months as a whole. Even so, investors seem optimistic. And that’s largely because, in addition to revenue rising, backlog for the business is also growing nicely. The firm continues to win attractive contracts. And that has more than offset the woes that the company has exhibited on its bottom line. As you can see in the chart below, backlog at the end of the first quarter of 2022 came in at only $6.12 billion. That number has increased every single quarter since then and, as of the third quarter of this year, it came in at nearly $9.40 billion. That represents an increase of 29.2% year over year.

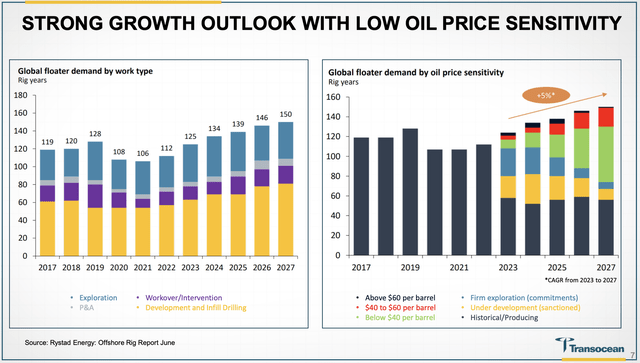

For those who are bullish about the company, there are reasons to believe that this trend will only improve from here. According to estimates provided by management, it’s believed that the global floater demand will be about 125 units this year. So long as energy prices remain elevated, it’s expected that this number will grow to eventually hit 150 by 2027. This is a roughly 5% per annum increase and, according to management, it’s likely to occur so long as oil prices are in excess of $60 per barrel. And when you consider that Transocean already has backlog that’s almost twice as high as the next largest competitor, it stands to reason that the firm is the supplier of choice.

Anybody who has been involved in the energy markets for an extended period of time can definitely say that it is unclear what oil prices are likely to be in the near term. When you add on top of this concerns about the economy more broadly and rising U.S. oil production, there is a rather meaningful degree of uncertainty regarding the longer-term picture. But that’s not enough to cause me to be neutral about the enterprise. What does do the trick, however, are those factors when added to how pricey shares are becoming.

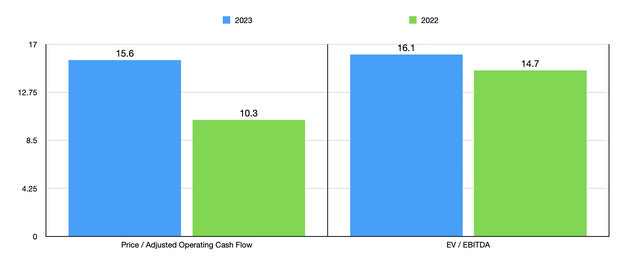

If we annualize results experienced so far for the 2023 fiscal year, we would see that the company is trading at a price to adjusted operating cash flow multiple of 15.6 and at an EV to EBITDA multiple of 16.1. As the chart above illustrates, the picture does look a bit more attractive if we use data from 2022. But even then, the stock looks to be more or less fairly valued. In the table below, meanwhile, I was able to compare the firm to five similar enterprises. On a price to operating cash flow basis, only one of the four companies that had positive results ended up being cheaper than Transocean. But when it comes to the EV to EBITDA approach, three of the five ended up being cheaper.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Transocean | 15.6 | 16.1 |

| Noble Corporation (NE) | 15.5 | 9.7 |

| Valaris (VAL) | 16.3 | 22.5 |

| Seadrill (SDRL) | N/A | 11.7 |

| Diamond Offshore Drilling (DO) | 26.3 | 18.9 |

| Borr Drilling (BORR) | 17.7 | 14.5 |

This does bring me to one concern that I do have about the company. And that is the amount of debt that’s on its books. Even as backlog has grown, net debt for the company has also increased. In fact, net debt as of the end of the most recent quarter came in at $6.58 billion. Although not as high as it was two quarters earlier, it is 12.3% greater than what it was the same time last year. That does do the company some harm from a risk perspective.

Takeaway

Based on the data provided, I would say that the picture for the company is in most respects looking up. The industry seems to be doing fairly well at the moment and revenue generated by the company will likely continue rising from this point on. Profits are an issue and debt continues to increase in a way that makes me uncomfortable. Add on top of this how shares are priced and I would say that there are better prospects that investors can capture right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!