Summary:

- Transocean reported its year end earnings and shares have sold off in recent weeks.

- I talk about the sector outlook from Transocean as well as a piece from Noble Corporation’s earnings call.

- Transocean does have a lot of debt on the balance sheet, but I think that means the upside could be huge as the company deleverages over the next couple years.

- I’m looking at 2025 LEAPS, which could provide huge returns on a small investment, especially if shares fall further in coming weeks.

Jeremy Poland

Markets had an interesting week last week as Silicon Valley Bank (SIVB) quickly folded like a house of cards. I wrote up my thoughts on SIVB in a piece published yesterday, but it will likely take weeks or months to figure out what kind of impact it will have on markets and the financial system. It looks like Signature Bank (SBNY) wasn’t far behind. My first reaction is that it will not lead to financial contagion, but it is certainly something to keep an eye on. Today I will be back to the regularly scheduled programming on one of my favorite companies for 2023, Transocean (NYSE:RIG).

Investment Thesis

I’m very bullish on the offshore sector and I think we are going to see a cyclical upswing across the industry. I talked about Tidewater (TDW) last week, which pulled off another acquisition to add to their already impressive OSV assets. Transocean operates a portfolio of 27 ultra-deepwater floaters and 10 harsh environment floaters. While Transocean avoided the bankruptcies that swept through the sector after the last downturn, that left them with a very leveraged balance sheet. In my opinion, I think that creates a lot of juice on the upside for shares of Transocean. I have talked in my last article about the debt refinancing in the last couple months that improved their maturity schedule, but I think shares are still very attractive due to Transocean’s asset base. I will talk about some material from Noble Corporation’s (NE) earnings call, as well as a piece of a recent proxy statement from Transocean. I added shares after the post earnings call, and I will wrap up with an options chain I have been watching for a while.

What Companies In The Sector Are Saying

I have been bullish on companies across the sector, but I’m not the only one. I don’t own Noble Corporation, but they are one of Transocean’s competitors. I came across a piece from their earnings call where the CEO outlines his bullish take on the industry for coming years. Feel free to take this with a grain of salt because most CEO’s will have a positive outlook on their industry and company, but I tend to agree with his take as far as the macro picture and supply and demand.

Now on to the market outlook. In short, the fundamental setup for our industry is arguably the best that it has looked in the past 20 years based on a confluence of macro supply and demand factors. Leading indicators on offshore project sanctioning uniformly point to a sustained multi-year upturn in offshore investment and rig demand. And our near term commercial pipeline for 2023 and 2024 confirms as much.

– Noble Corporation CEO, Robert Eifler

I think that we are going to see the whole offshore industry benefit over the next couple years as we see the continuation of a cyclical upswing across the sector. The other thing I saw recently was a paragraph from Transocean’s recent proxy statement. They talk about dayrates and the backlog growth (which was actually $8.5B as of 2/9/2023).

Across the global fleet on a year-over-year basis, the dayrate on the average drillship fixture in the fourth quarter of 2022 was 63% higher. In addition to leading the industry in dayrates, Transocean was also awarded approximately 31% of the 81 floater rig years contracted during the year, adding approximately $4 billion in incremental backlog. This is additional evidence that our customers recognize and appreciate the value that Transocean creates and validates our strategy of operating the most desirable, high-specification fleet in the industry with highly trained crews and exceptional and experienced shore-based support. As such, we ended 2022 with a total backlog of approximately $8.3 billion – more than twice that of our nearest competitor. Our momentum has carried into 2023 with another multi-year, high dayrate contract in Brazil signed in January.

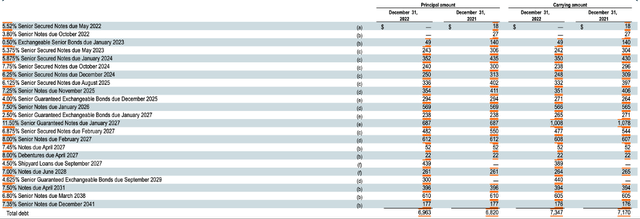

Any investor considering Transocean should be comfortable with the company’s debt load. They had $7.35B of debt at year end, but I think that they will be able to deleverage their balance sheet significantly over the next couple years.

RIG Total Debt ((RIG 10-K) sec.gov)

If you can read the tiny font above from the 10-K, it shows their entire debt ladder. I talked about the two debt issues that Transocean did in my last article, which extended their maturities. If you compare things to where they were before the new debt offerings, it looks a lot better for investors.

Transocean has been busy in January, with two separate debt offerings. The first offering was priced in early January for $525M at an interest rate of 8.375%, due in 2028. The debt is a secured offering, with the proceeds going towards the operations of Deepwater Titan. The second offering was even bigger, at $1.175B. It carries an interest rate of 8.75%, and the proceeds will be used to pay off four notes secured by rigs. The interest rate is higher than the existing debt, but it extends the maturity significantly to 2030. Three of the current bond issues are due in 2024, with the last due in 2025.

I’ll be the first to admit that the debt level creates more risk than some of the other companies in the sector, but I think that the reward could be huge for investors with a one-to-three-year time frame. That is why I’m looking at using another options chain to add to my position in Transocean stock.

2025 LEAPS

I started with Transocean with a small purchase of $5 calls expiring in January 2024, but I recently have been adding shares as well. Shares have been very volatile lately (shares down more than 10% in the last week), but if we see a further decline, I will be looking to add a small chunk of 2025 call options. I think it’s highly likely that shares head above $10 (and potentially much higher) in the next couple years, which is why I think a small position in the call options could give investors a lot of bang for their buck. I would probably look at the $10 or $15 strike prices, which trade at $1.50 and $0.75 as I write this Sunday night. I would probably prefer the $10 strike, but if those prices come down a bit in coming weeks, I will probably take advantage to add to my position.

Conclusion

Like I mentioned in my article on Tidewater, I don’t view Transocean and other companies in the offshore sector as buy and hold forever investments. I think that we are going into a cyclical upswing that will provide near ideal operating conditions for the sector, and I think investors looking at it with a one-to-three-year time frame will have attractive returns. Transocean is my personal favorite because I think the upside is huge, but I own Tidewater as well, along with a tiny position in Valaris (VAL) warrants. I’m looking to add to my Transocean position again if shares sell off further, because I think Transocean represents an asymmetric investment in an overvalued stock market.

Disclosure: I/we have a beneficial long position in the shares of RIG, TDW, VAL-WT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.