Transocean: Lowering Estimates After Disappointing 2024 Outlook – Hold

Summary:

- Leading offshore driller Transocean Ltd. reported slightly weaker-than-expected Q4 2023 results and issued disappointing Q1 2024 and full-year guidance.

- The company continues to deal with an elevated number of contract startup delays. In addition, customer TotalEnergies abstained from exercising options after suspending its drilling campaign offshore Lebanon.

- Moreover, the 8th generation ultra-deepwater drillship Deepwater Atlas will remain on a low-margin dayrate in Q1 as the customer does not yet require the rig’s 20,000 Psi drilling capability.

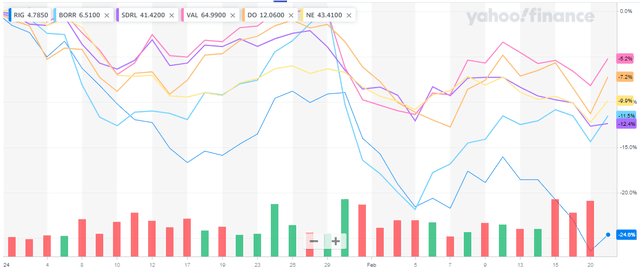

- Lowering estimates and price target on Transocean but reiterating “Hold” rating following the 25% decline year-to-date.

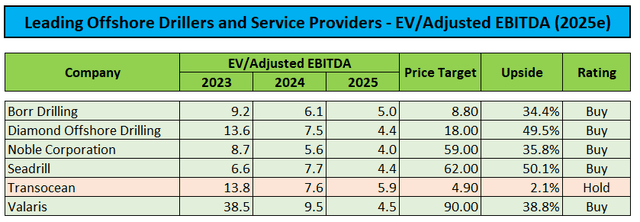

- Transocean stock remains expensive relative to peers. Investors looking for industry exposure should rather consider competitors Seadrill, Noble Corporation, Valaris and Diamond Offshore Drilling.

Ion-Creations

Note:

I have covered Transocean Ltd. (NYSE:NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

Last week, leading offshore driller Transocean Ltd. or “Transocean” released a disappointing new fleet status report which reflected the recent slowdown in contracting activity. Operators are increasingly looking to secure rig capacity for the long term, thus resulting in higher lead times.

Over the past four months, Transocean signed just three new contracts, with the most significant already having been announced by the company in December.

- Semi-submersible rig Transocean Barents has been awarded a minimum 540-day contract in the Romanian Black Sea at a rate of $465,000.

- Ultra-deepwater drillship Deepwater Skyros has secured a three-well extension with customer TotalEnergies (TTE) offshore Angola at a rate of $400,000.

- Ultra-deepwater drillship Deepwater Invictus has been awarded a 40-day contract in the U.S. Gulf of Mexico at undisclosed terms.

In aggregate, these fixtures added approximately $326 million in backlog, well below the company’s current quarterly revenue run rate.

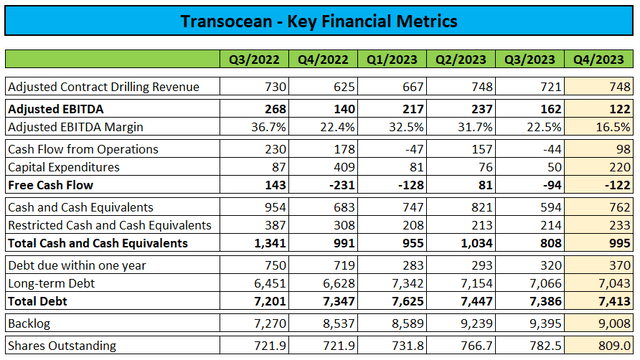

Consequently, backlog was down by more than 4% sequentially to $9.0 billion, the first decrease in two years.

Adding insult to injury, Transocean experienced additional contract startup delays which will negatively impact the company’s financial performance in 2024.

Moreover, TotalEnergies abstained from exercising options for the Transocean Barents after the first exploration well in Lebanon came up dry in October. As a result, the unit is now likely to sit idle until the rig will commence complex preparations for its Bosporus passage towards the end of this year.

Furthermore, the 8th generation ultra-deepwater drillship Deepwater Atlas will remain on a low-margin dayrate in Q1 as the customer does not yet require the rig’s 20,000 Psi drilling capability.

Lastly, the announced sale of the 4th generation moored semi-submersible rigs Paul B Loyd Jr. and Transocean Leader to Dolphin Drilling closed on February 15. Consequently, the company will not recognize further revenues from the rig, thus resulting in an approximately $11 million headwind in Q1.

Quite frankly, I am still struggling with the decision to sell the active Paul B. Loyd Jr. in combination with the cold-stacked Transocean Leader, particularly after acquirer Dolphin Drilling has disclosed that the estimated EBITDA from the rig’s firm contract backlog is going to cover “more than three times the net acquisition price” of $50 million.

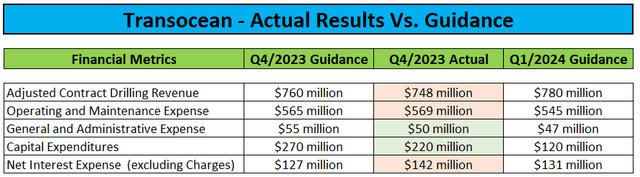

Earlier this week, Transocean reported Q4 2023 results just shy of expectations (after adjusting for a $145 million accounting gain related to the fair value measurement of the company’s exchangeable notes):

Company Press Releases / Regulatory Filings

However, on the conference call, management guided first quarter revenues well below consensus estimates:

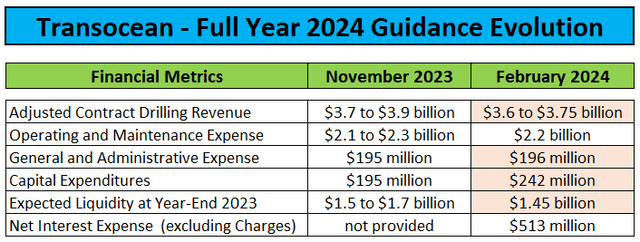

In addition, Transocean lowered full-year ranges for revenue and liquidity while increasing capex projections by almost 25%. Some of the budgeted contract preparation investment for the newbuild ultra-deepwater drillship Deepwater Aquila has moved into this year:

On the conference call, management tried to alleviate concerns regarding the robustness of the recent industry recovery:

Despite the strong year of contracting, we recognize that some investors have been concerned by the pace of contract awards over the past few months. In an effort to ease that concern, it’s important to note that our customers are increasingly focused on extended duration opportunity with longer lead times to contract commencement. While this tends to result in prolonged contract negotiations, it also demonstrates our customers’ confidence in the longevity of this up-cycle and their commitment to the offshore market.

During the questions-and-answers session, analysts asked for additional color on last week’s contract extension for the Deepwater Skyros at a seemingly mediocre dayrate of $400,000:

Fredrik Stene

So, with that, I wanted to touch a bit on the first, Skyros rate of $400,000 per day that was announced, have a couple of discussions with investors around the $400,000 mark and that potentially being in the low end of what to expect when we do get the specs of the rig. So, can you just clarify if that was anything particular on that? Was there any sort of price elements? And is it where I am sorry to miss that, or was it are there considerations that made their day rate for that rig – for that work?

Roddie Mackenzie

Yes. Hey, Fredrik, this is Roddie. I will take that one. Yes, so, the $400,000 day rate, I mean that was something that’s, it’s been in the works for a while. So, it’s kind of an older rate. But the truth of matter for us is, a reasonably short-term extension on that rig staying in the jurisdiction that it’s in, it doesn’t have any changes, doesn’t have any upgrades to do. So, that was just a bridge to other opportunities, shall we say. So, I mean stay tuned on that one. But certainly a decent fixture in terms of just continue to produce the EBITDA that that rig produces and hang on to that steady state operation, which is obviously our preferred choice at this stage.

Jeremy Thigpen

Yes. And I would add to that, we have fairly clear line of sight to the next opportunity. And so keep hot and generating significant cash flow was very important to us.

For my part, I consider this a very reasonable explanation. With follow-on work apparently close at hand, the decision makes plenty of sense.

In addition, the company hinted to a new contract announcement for the Deepwater Atlas “very very soon” and remained very positive on the outlook for the 20,000 Psi market.

Furthermore, management commented positively on TotalEnergies’ recent decision to acquire 75% of Vantage Drilling’s ultra-deepwater drillship Tungsten Explorer and essentially awarding a 10-year contract to the rig.

Jeremy Thigpen

I think the key messages that we get out of that is, clearly this is like underscores the view to the long-term long – prosperity of this up-cycle. If you see operators looking at 3-year and 4-year, 5-year contracts, we are very excited by that. To be making fixtures for 10 years, this early in the cycle, I think is a super positive indicator. (…)

There even is perhaps another one or two of the 10-year variety to happen. But I think you will see kind of a flurry of fixtures for 3 years, 4 years and 5 years over the next kind of six months selling, the first half of this year.

However, commentary on the company’s idle 6th generation ultra-deepwater rigs Development Driller III and Deepwater Inspiration was more guarded:

Roddie Mackenzie

(…) It just so happens that the Inspiration and the DD3 are amongst our lower specification, sixth generation assets. So, we continue to look all of that stuff, there are several opportunities for it. So, again, I can’t really give you the details of the things that we are working on. But we think there are some good things coming that way. And even if there is some additional idle time on those rigs, we have been very disciplined about that. We are certainly not going to go and chase something for the sake of it. And if we needed to, we would even take them off the market.

While it’s hard to get excited about Transocean’s near-term outlook, more long-term contract awards would be a very positive development for the industry as an increasing number of rigs won’t be available on the market for an extended period of time thus likely resulting in higher pricing power for offshore drillers.

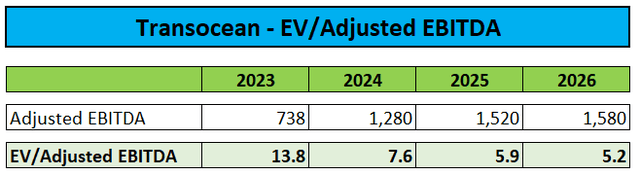

Following the company’s lowered guidance, I have reduced my adjusted EBITDA estimates for both 2024 and 2025 by approximately 8% on average:

Company Press Releases / Author’s Estimates

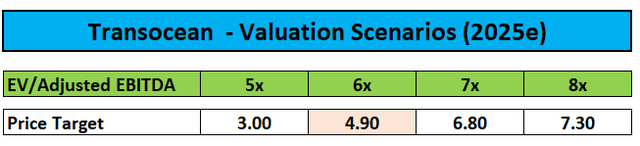

Consequently, I have lowered my price target for the shares to $4.90 which remains based on an assigned 2025 EV/Adjusted EBITDA multiple of 6x:

Author’s Estimates / Calculations

With the bad news now behind the company and considering the recent underperformance relative to peers, I reiterate my “Hold” rating on the stock.

Following the most recent correction, a number of U.S.-exchange listed peers seems to offer decent upside from current price levels:

Author’s Estimates / Calculation

However, Borr Drilling (BORR), Diamond Offshore Drilling (DO), Noble Corporation (NE), Seadrill (SDRL) and Valaris (VAL) have yet to report Q4 earnings and provide initial or updated projections for 2024, so investors would be well-served to wait for these companies to offer more color on their near-term outlook before initiating or adding to existing positions.

Bottom Line

Transocean Ltd. reported fourth quarter results just shy of expectations and issued disappointing Q1 and full-year 2024 guidance as the company continues to deal with an elevated number of contract startup delays.

Consequently I have reduced my Transocean Ltd. estimates for both 2024 and 2025 and lowered my price target for the shares to $4.90 while reiterating my “Hold” rating.

However, management projected the company to turn profitable by the third quarter at the latest point. Even when considering the lowered guidance, I would expect Transocean to generate approximately $500 million in free cash flow this year which should help the company’s stated deleveraging efforts.

Despite some recent hiccups, I remain positive on the medium- to long-term outlook for the industry and expect 2025 to be the year of earnings inflection for most players. This should result in sizeable capital returns to RIG shareholders over time.

Unfortunately, it will likely take more time for a heavily indebted company like Transocean to reward shareholders with dividends and buybacks, as the focus will be on debt reduction for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SDRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.