Summary:

- Transocean’s CEO is optimistic about the company’s future, with a fully contracted fleet for 2024-2026 and high day rates indicating strong market conditions.

- A potential merger with Seadrill could significantly boost Transocean’s backlog and fleet, enhancing its competitive position among offshore drillers.

- Despite strong fundamentals, Transocean’s stock remains undervalued due to market skepticism and low oil prices, presenting a potential investment opportunity.

- Deleveraging efforts and potential shareholder distributions by 2026, along with rising demand for deepwater drilling, support a positive outlook for Transocean.

MarkusBeck

Some time ago, Transocean’s (NYSE:RIG) management commented on the company’s quarterly results. Some research has already been published about this earnings report here on Seeking Alpha. But I would like to focus on the management’s outlook and comments. Jeremy Thigpen, the company’s CEO, was highly optimistic during the press conference. The deepwater drillers’ future seems bright. But the market still does not appreciate that.

Previous analysis of Transocean

Last month, I posted some research on Seeking Alpha about RIG. So, I wrote that recent contracts added $1.3 billion to its backlog. The company’s backlog totals $9.3 billion. The high day rates suggest strong market conditions.

Some time ago, there were rumors of a potential merger with Seadrill Limited (SDRL). If this merger takes place, it could significantly boost Transocean’s backlog and fleet, improving its competitive position among offshore drillers.

Transocean’s stock is still trading near 52-week lows as I am writing this despite rising day rates and strong fundamentals, partly due to low oil prices and market skepticism.

Transocean’s earnings results and the management’s comments

In this section, I will focus on some highlights of the earnings release, but most importantly, Transocean’s management’s press conference.

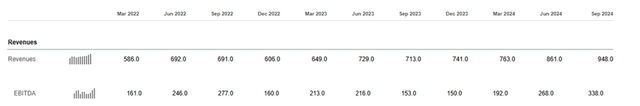

For the third quarter of 2024, Transocean recorded an EBITDA of $338 million on $948 million of contract drilling revenues. This is very high compared to the previously reported periods since the March 2022 quarter. The EBITDA and the sales recorded for the past quarter were record-high compared to the periods mentioned in the table below.

Also, the management mentioned Transocean’s active fleet is now fully contracted for the rest of 2024 and also for most of 2025 and 2026. Based on today’s backlog, the company’s active fleet utilization for 2025 is over 97% and is lingering at almost 86% through the first half of 2026.

Some day rates are extremely high as well. In the US Gulf of Mexico, BP awarded the Deepwater Atlas a one-year contract at a rate of $635,000 per day. Even though the contract will only start work in the second quarter of 2028, this is still very high for offshore drillers, including Transocean. Moreover, 75% of new projects of the major operators are profitable even below $60 a barrel. That is why many customers discuss offshore projects beginning in 2026 and later.

The management also sees some potential for Transocean to be awarded new contracts in Mozambique, Namibia, and especially Brazil. In the North Sea, the demand for offshore equipment even exceeds supply. As concerns Transocean’s balance sheet and liquidity position, most of the newbuild CapEx is largely behind the company. So, according to the management, they can use more free cash flows to de-leverage the balance sheet. The management even believes Transocean will approach a debt level sufficient to consider shareholder distributions by the end of 2026. This is significant for a company that has been criticized for its high debt load and lack of net profitability. According to the company’s debt maturity schedule, Transocean will decrease its debt by at least $715 million in 2025. So, by the end of 2025, its gross debt is expected to be about $6.2 billion. Thanks to extra cash, RIG aims to decrease its net debt-to-EBITDA ratio to less than 3.5 times, which will enable the management to consider making distributions to stockholders. A net debt-to-EBITDA ratio of 3.5 has room for improvement, however. A favorable ratio should ideally be below 3 for the company to enjoy higher credit ratings. However, a high ratio is usually between 4 and above 6, which signals potential financial troubles for investors and creditors.

Even though Transocean does not want to reactivate any cold-stacked rigs, Transocean’s CEO, Jeremy Thigpen, accepts the possibility of doing so in 2025 thanks to rising demand for its fleet.

Also, during the analysts’ question and answer session, a question was asked about Transocean’s possible merger with Seadrill. Transocean’s CEO says that there is room for more consolidation because there is value to be created through merging with another company. According to Mr. Thigpen, Transocean could take on 10 or 15 additional rigs. But asset quality is the main priority, and a merger should be good value for money. But there is still some uncertainty. So, the management may have to wait for the next several months before announcing the merger. But if we analyze Thigpen’s answer, it seems that the deal is inevitable, but the details and the exact date of the transaction are uncertain.

Deepwater drillers are undervalued compared to the rest of the oil companies

As I have mentioned in the previous analysis, deepwater oil and gas production is expected to rise by 60% by 2030, according to Wood Mackenzie’s report. There will be a particularly large increase in deepwater and ultra-deepwater drilling. Ultra-deepwater production will keep growing very fast. So, it will account for half of all deepwater production by 2030. But now I would like to mention offshore drillers’ extreme undervaluation.

Many offshore drillers have been impacted by the bearish sentiment in the oil market. But some deepwater drilling firms, including TechnipFMC Plc. (FTI) and Oceaneering International Inc. (OII) outperformed the market. Their year-to-date gains totaled 41.56% and 29.04%, respectively, as of the time of writing. However, the sector’s other big players are deeply in the red. Among them are Transocean Ltd. (RIG) -32.28%, Seadrill -14.68%, Noble Corporation Plc (NE) -30.32%, and Valaris Ltd. (VAL) -29.56% as of the time of writing. However, the energy sector’s favorite benchmark, the Energy Select Sector SPDR Fund (XLE), has risen by 17.27% YTD versus the S&P 500’s return of 24.91%. So, despite the strong fundamentals, the market is far too skeptical, which suggests undervaluation.

Valuation

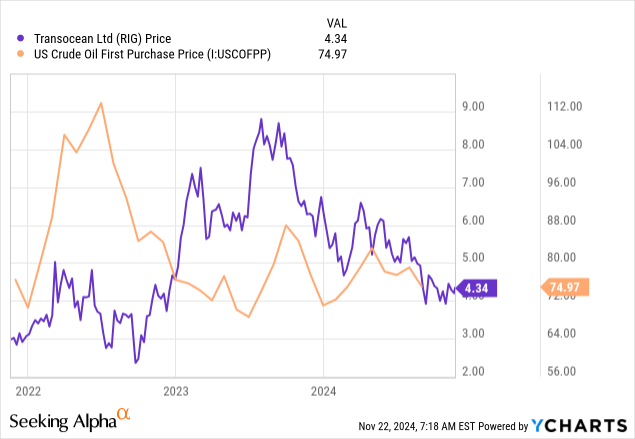

There are indeed plenty of valuation metrics for stocks. Many analysts compare Transocean’s EV/EBITDA, revenue indicators, and profitability metrics to those of its close peers, namely Valaris, Seadrill, and Noble. I would personally like to compare and contrast RIG stock prices to oil prices.

So, if we see the diagram above, we will see that RIG stock price moves in strong correlation with oil prices and even sometimes underperforms oil. It therefore seems clear that recent stock fluctuations have not been due to Transocean’s fundamentals. Instead, they have been due to the oil market.

Downside risks

The downside risks are very clear, in my opinion. It has been mentioned many times by analysts that Transocean has to service more debt than its peers.

Then, due to its current lack of a sound profitability track record, Transocean is more vulnerable to market downturns. However, if we see other profitability metrics, not just the net profit margin, we will see that RIG is currently generating profit and positive net cash flows. As I have mentioned before, the company still has some cash reserves to keep it afloat if a major downturn occurs.

The other risks, in my opinion, are very general, namely that of a general oil price crash and that of an economic downturn.

Upside factors

One of the upside factors is that of deepwater drillers’ revival. I have already discussed this possibility in some more detail above. This would lead to more contracts at higher day rates. Also, Transocean might even have to reactivate its cold-stacked rigs.

Then, deleveraging would be another great plus for Transocean’s activities and shareholders’ returns.

Moreover, a possible merger with Seadrill would generate Transocean more assets and more contract backlog, thus raising Transocean’s revenues.

Finally, another factor would be an oil price surge. But the question is how sustainable it would be. Offshore oil usually means long-term investments. However, the correlation between RIG stock price and oil prices seems to be positive.

Conclusion

In conclusion, I would say that Transocean’s future looks bright if no unforeseen things happen. The merger with Seadrill is likely to eventually take place. But downside factors, in my view, are mostly external, namely a possible recession and oil price crash.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.