Summary:

- Transocean’s stock is struggling to break through the $9 resistance line, but could reach double digits this year.

- New drilling contracts and rising oil prices are positive indicators for offshore drillers.

- The current conditions for offshore drillers suggest an upcycle.

grandriver

Transocean (NYSE:RIG)’s stock is struggling to get past the $9 resistance line. But if everything goes the way it is going now, then the stock may trade well in the double digits as soon as this year. In fact, some analysts expect the stock price to triple in the next 36 months. I think this is far too optimistic, albeit not impossible. New drilling contracts are announced, and the oil prices are high and seem to be growing.

New contracts

Here are a few quotes from the company’s earnings conference where Jeremy Thigpen, Transocean’s CEO, summarizes the contract awards of the past quarter.

“First in the Gulf of Mexico, we signed an agreement with a major operator for two years on the Deepwater Conqueror and direct continuation of the current program at a leading edge rate of $440,000 per day,… adding approximately $321 million in firm backlog…”

“In Norway, Equinor exercised two one-well options on the Spitsbergen at a rate of $305,000 per day, extending the current firm term through June 2023.” With Equinor another contract was signed “at a rate of $335,000 per day commencing October 2023”.

In the UK a contract was signed at a rate of $175,000 per day, adding approximately $17.5 million to the company’s backlog. “If all options are exercised, this will keep the rig busy through April 2024.”

So far, Brazil’s day rates seem to be the best. “Down in Brazil, the Deepwater Mykonos was awarded a 435-day contract at a rate of approximately $364,000 per day… Also in Brazil…, the Petrobras 10,000 received a 5.8-year contract at $399,000 per day escalating annually to $462,000 per day…” This “adds an estimated $915 million to our backlog”.

“In India, Reliance Industries awarded an estimated 86 day contract extension plus up to four option wells for the KG1 at a local market-leading rate of $330,000 per day… And if all options are exercised, the campaign will extend through April 2024…”

In total, approximately $1.3 billion in backlog was added since the release of RIG’s fleet status report.

So, from this release, we can clearly see that the contracts were concluded at reasonably high rates and in different regions of operation. But most importantly in the past quarter alone $1.3 billion in new backlog was added, which is really substantial. Soon after the earnings conference call, two more contracts were announced. The first one was the $222M ultra-deepwater drillship contract awarded by Oil and Natural Gas Corporation Ltd. for the Dhirubhai Deepwater KG1 for work offshore India. The second one was a $486M contract for the Deepwater Aquila drillship. All this signals a clear improvement in Transocean’s business activity.

In addition to the new contracts announced, the company also issued some debt. Transocean Aquila Limited, Transocean’s wholly owned indirect subsidiary, commenced a private offering of $300M of senior secured notes due 2028. In other words, RIG had to borrow money to afford Aquila, the new build. But I do not think the debt load increase will be that significant.

Debt history

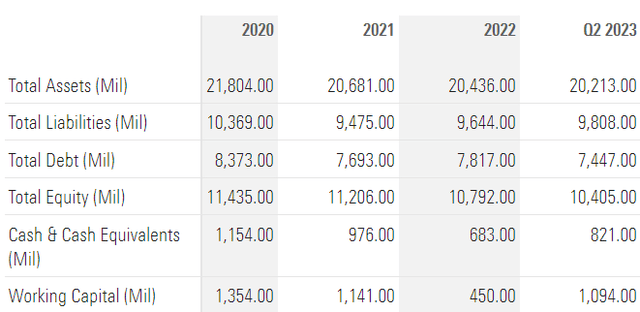

In order to have a better idea of Transocean’s debt situation, let us have a look at the company’s debt history. The data were obtained from Morning Star’s website.

If we have a look at Transocean’s total liabilities, these were substantially lower in 2Q 2023 compared to the year 2020. As concerns the company’s total debt, it has been falling since 2020. So, the general picture seems to be improving. Even if the debt load rises by $300 million, nothing horrible will happen, it seems. Not to mention that Aquila, the new asset, will generate cash flows and revenues.

Growth potential

Transocean has been criticized for having too many cold-stacked rigs. But it does not mean these cold-stacked rigs will have to be recycled. Rather the opposite is true. The company is deploying its cold-stacked rigs by bidding them on open tenders or through direct negotiations. Transocean has 10 cold-stacked ultra-deepwater rigs and 1 harsh environment semisubmersible. Interestingly, 8 of these vessels are highly demanded sixth- and seventh-generation drillships. Globally, there are just 12 of these cold-stacked vessels and 4 stranded new builds that are now owned by anyone.

The market for offshore drilling equipment is currently far too tight, whilst it takes years to construct an ultra-deepwater ship and also plenty of money investments. Even if we assume the budget to reactivate a deepwater or an ultra-deepwater drillship is above $75-125 million, it will still be substantially lower compared to the amount of money used to construct say the new 7th generation drillship Deepwater Aquila. So, apart from the warm-stacked or active rigs, cold-stacked drillships can still potentially be reactivated and used to generate cash flows and revenues. According to one of the recent Transocean presentations, buying and activating a stranded shipyard asset could result in an investment of $300 – $500 million, substantially more than any reactivation of any cold-stacked ship.

Oil prices

In my recent article, I wrote quite a bullish prediction for the oil prices this coming winter. The fossil fuel markets in Europe and the Northern Hemisphere in general are very tight and more is yet to come, it seems. I absolutely agree that offshore drillers invest for the long term. Seasonal oil price fluctuations are not a very good reason to invest in costly offshore exploration, of course. However, if the oil markets remain tight, the supply stays low, and green energy sources do not manage to become a perfect alternative to fossil fuels in the next several years, then oil majors will keep investing in offshore drilling, whilst signing new contracts with Transocean.

The latest data out of Cushing, Oklahoma, the US major oil storage hub once again showed a steep drop in inventories. Once again investors were reminded of the tight global supply. In fact, crude has soared by about 40% over the past three months. This summer was really bullish for oil. Not only are Saudi Arabia and Russia willing to cut the supply. Inventory levels in Cushing have decreased by almost 50% since June. So, they are now at less than 23 million barrels. This is close to the operational minimum. But if the storage levels fall below 20 million barrels, the oil can become difficult to remove, which will again add to oil market deficits. According to Investing Group Leader HFI Research, “U.S. crude storage will not build during refinery maintenance season in October”. So, the only bearish factor is demand destruction, which is not happening right now.

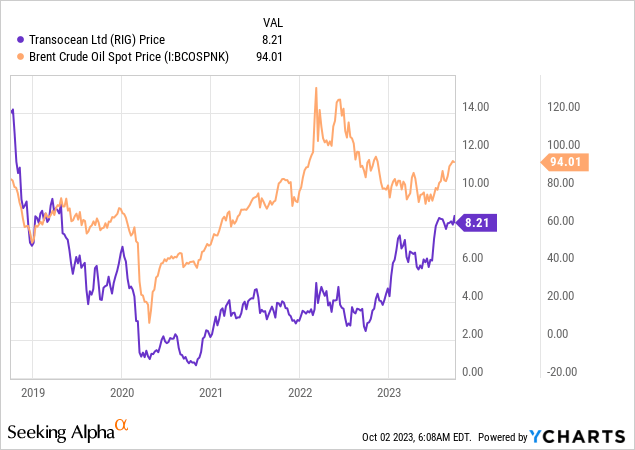

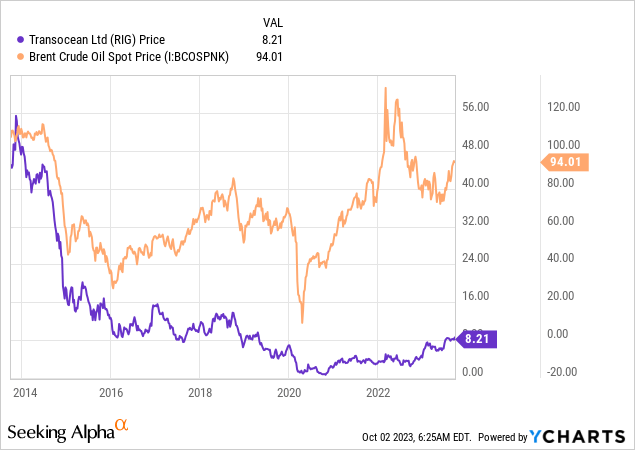

I agree that “this too shall pass“. After all, higher inflation readings can lead to further rate hikes by the Fed and other central banks. Moreover, as I have mentioned before, Transocean’s business benefits from long-term demand. However, there is a correlation between RIG’s stock price and the oil prices.

At the same time, in my opinion, the company’s stock price is currently trading quite low compared to the oil prices.

This is explainable, of course. After all, before the 2014-2015 crisis, RIG used to have a larger fleet, higher revenues, and cash flows. But still, there could be some growth potential, given the current situation.

Technical analysis

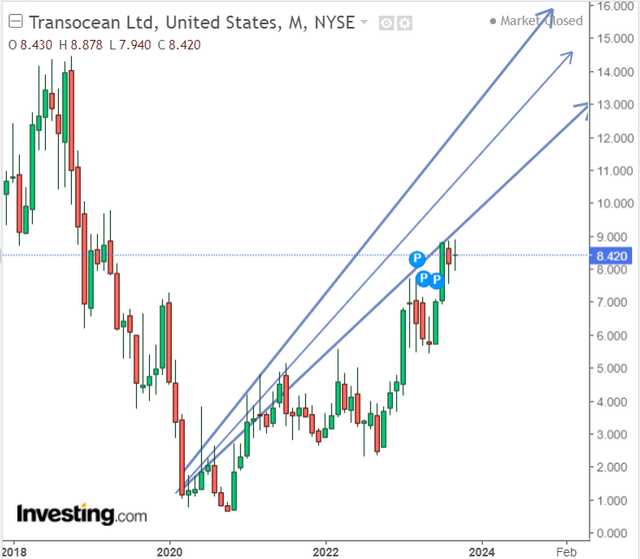

Transocean’s stock has been on the rise in the last several years. You can say that all rallies eventually pass. But it seems that the momentum is really strong for this stock. If you just draw the trend line assuming that the wider recovery of the offshore drilling sector continues, you will see that the stock price will be well in the double digits by 2024 or at the beginning of 2024 at the latest.

Fundamental analysis is much more superior to any trend following. Anything can happen. For example, no one knew back in 2019 that the coronavirus pandemic and the resulting lockdowns would drive the oil prices to negative values. But if everything goes the way it is currently going, then we can see RIG in the double digits by 2024.

Valuations

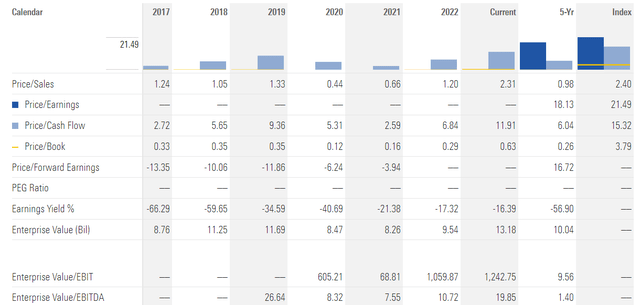

If we see Transocean’s current valuation multiples, we will see that they are at multi-year highs.

However, they are still not extremely high if we compare these to the S&P 500’s averages. For example, the S&P 500’s average P/S (price-to-sales) ratio is currently standing at 2.39, whilst RIG’s P/S is 2.31. S&P 500’s price-to-cash flow ratio is 15.32, whilst Transocean’s is less than 12. Yes, most S&P 500 companies are currently profitable but RIG is expected to report a sound net profit next year.

Risks

The risks are clear. First, as I have mentioned many times before, this is the likelihood the Fed and other central banks would raise the interest rates, thus provoking a full-scale recession. Then, the oil supply situation may change. The OPEC+ may start extracting more oil, whilst US oil majors may also do the same. After all, all rallies end.

You might also say that Transocean is not free of debt and is overvalued. But paradoxically in an upcycle, this is the company’s big advantage. In other words, RIG’s stock is more sensitive to any good announcements because it is more speculative than its peers – Valaris (VAL), Noble (NE) – that have emerged from bankruptcy and are now almost free of debt.

So, the most important thing now for Transocean is the continuation of an upcycle, I think.

Conclusion

Transocean is in a very good situation, it seems. The oil market is tight and is highly likely to stay so in the near future. New contracts get announced, and the debt load is not as high as it was in 2020. RIG is expected to report a sound net profit in 2024. The stock has a very strong momentum too. In my view, the biggest risks are that of a prolonged recession and a supply glut. In my view, however, the increase of 200% in the next 36 months may not be too farfetched. RIG stock may trade in the double digits as early as 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.