Summary:

- Company releases its latest fleet status report with backlog up just slightly on a sequential basis and most contract awards having already been announced in recent months.

- Lack of progress on the drillship front disappoints, particularly with several rigs scheduled to roll off contract over the next six months.

- Discussing reports of near-term contract opportunities and awards.

- Guidance of negative free cash flow in 2023 provided in the company’s most recent presentation disappoints but next year should be a very different story with lower idle time and higher average dayrates expected to result in substantially positive free cash flow.

- While I wouldn’t chase the shares at current levels, investors should consider adding on any major weakness as industry fundamentals continue to be strong.

Ion-Creations

Note: I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

After Tuesday’s market close, leading offshore driller Transocean released its latest fleet status report with basically all recent contract awards having already been announced and backlog of approximately $8.6 billion up just slightly from the $8.5 billion number reported in February.

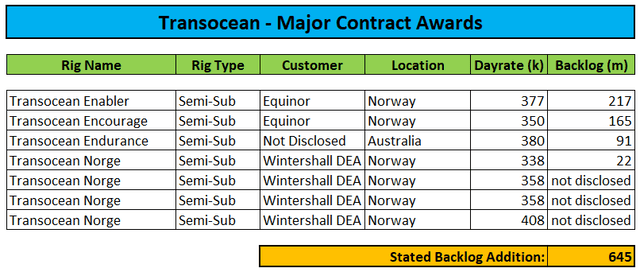

- The CAT-D rig Transocean Enabler was awarded a 19-well contract offshore Norway by Equinor (EQNR) at a dayrate of $377,000. Moreover, the customer has been granted options for up to eight additional wells. The 570-day contract is expected to commence in April 2024 and contribute approximately $217 million in backlog, excluding additional services and potential performance bonuses.

- The CAT-D rig Transocean Encourage secured a 9-well contract offshore Norway with Equinor at a dayrate of $350,000. The 460-day contract is expected to contribute approximately $165 million in backlog, excluding additional services and potential performance bonuses.

- The CAT-D rig Transocean Endurance will leave Norway for a multi-well plug and abandonment campaign offshore Australia at a rate of $380,000 per day. The undisclosed customer has been granted additional options. The 240-day contract is expected to commence in January 2024 and contribute approximately $91 million in backlog, excluding fees for mobilization.

- Customers exercised four one-well options for the harsh environment rig Transocean Norge offshore Norway at dayrates between $338,000 and $408,000 per day.

According to Transocean, total backlog addition associated with these fixtures is approximately $645 million.

Fleet Status Report / Company Press Releases

That said, I am having some trouble reconciling the numbers based on the company’s previous disclosures.

On March 28, Transocean issued a press release discussing the contract awards for the Transocean Enabler and Transocean Encourage with an aggregate $382 million in firm contract backlog.

On March 29, the company announced the contract award for the Transocean Endurance offshore Australia which contributed $91 million in backlog excluding mobilization fees.

In addition, Transocean announced a one-well option exercise for the Transocean Norge with work expected to commence in May 2023 ahead of the rig’s existing firm term for 60 days and contribute approximately $22 million in backlog.

Coupled with the awards for the Transocean Enabler and Transocean Encourage that were recently announced, we have added an incremental $494 million in backlog from our high-specification harsh environment fleet.

Based on these disclosures, one would have to assume that incremental backlog associated with the previously undisclosed three additional one-well option exercises for the Transocean Norge would exceed $150 million which, based on the changes to the rig’s employment schedule in the new fleet status report, looks virtually impossible.

A potential explanation for the rather large discrepancy would be Transocean having included mobilization fees and additional services in the backlog number.

Please note also that Transocean Endurance will apparently be released by Equinor two months ahead of its scheduled contract end only to face several months of idle time before relocating to Australia.

In addition, investors should note the total absence of new drillship contract awards or material extensions despite the ultra-deepwater drillships Deepwater Inspiration and Deepwater Invictus currently scheduled to roll off contract in the U.S. Gulf of Mexico this month and in July respectively.

Moreover, the drillship Dhirubhai Deepwater KG1 and the semi-submersible rig GSF Development Driller III are expected to conclude their respective contracts in October.

Furthermore, the harsh environment rig Transocean Barents is expected to roll off contract in June.

Lastly, the company still needs to find work for the warm-stacked CAT-D rig Transocean Equinox following its early termination by Equinor last year.

That said, there have been reports of Transocean having offered the Dhirubhai Deepwater KG1 and the Discoverer Inspiration in a recent tender by India’s ONGC. Unfortunately, the company will have to compete against Vantage Drilling (OTCPK:VTDRF) which has been offering two rigs that are already working for ONGC offshore India. Given this issue, I would be surprised to see Transocean emerging as the winner here.

At least the Transocean Barents seems to have secured new work offshore Lebanon but the rig will likely be facing an up to six-month contract gap:

Total Energies has informed the Energy Ministry and the Petroleum Sector Administration that it has contracted Transocean to bring a drilling rig to Lebanon to drill the first well in Block 9.

The drilling rig, which is expected to arrive in Lebanon and begin drilling between September and December of this year, is a self-propelled platform currently operating in the North Sea with Total Energies as well.

The contract estimates that the drilling rig will operate for 67 days at a cost of $365,000 per day, making the total cost of the contract for working days $25.58 million.

The contract also includes the cost of sailing the rig to the drilling site, including fuel costs of $6.24 million, as well as the cost of departing Lebanon and returning to the North Sea at $6.24 million.

In addition, 10 percent of these amounts will be allocated for emergencies, bringing the total value of the contract to $41.29 million, to be paid by Total Energies.

On a different note, there have been some news on the debt front recently as the company’s largest shareholders Perestroika AB agreed to exercise its conversion rights for $213.4 million of the company’s 2.5% Senior Guaranteed Exchangeable Bonds due 2027:

As part of the Company’s ongoing efforts to reduce debt, one of the Company’s wholly-owned subsidiaries entered into an agreement with a holder of U.S. $213,367,000 principal amount of Transocean Inc. 2.5% senior guaranteed exchangeable bonds due 2027 (…), pursuant to which the holder agreed to exercise its rights to exchange all of its 2.5% Exchangeable Bonds for shares of the Company (…). Upon the holder’s exercise of its rights to exchange its 2.5% Exchangeable Bonds, the Company expects to issue 34,600,147 shares to the holder, which is consistent with the number of Company shares issuable to the holder in accordance with the applicable exchange rate reflected in the Indenture.

As a result, outstanding shares will increase by almost 5% to approximately 761 million while total debt should be reduced to $6.7 billion.

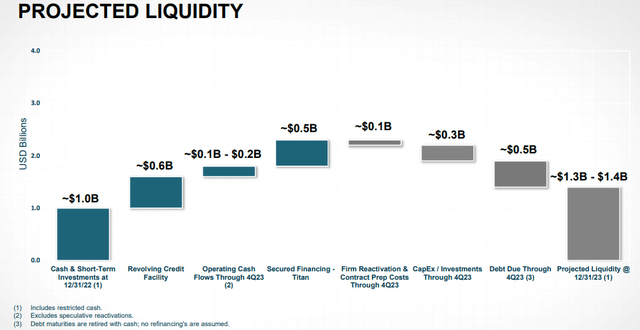

Finally, I have to admit being disappointed by guidance for negative free cash this year provided in the company’s most recent presentation:

Quite frankly, operating cash flow of only between $100 million and $200 million in 2023 would be a far cry from last year’s $448 million. Based on projected capital expenditures, reactivation and contract preparation costs, free cash flow could be negative by up to $300 million this year despite substantially reduced capex requirements following the recent delivery of the newbuild drillships Deepwater Atlas and Deepwater Titan.

Please note that these numbers do not include any speculative rig activations.

That said, 2024 should be a very different story for Transocean with substantially less idle time and higher average dayrates materially benefiting cash flows.

Bottom Line

Transocean’s latest fleet status report is unlikely to act as a catalyst for the company’s shares given the lack of positive surprises and progress on the drillship front.

In addition, I am disappointed by the company’s less-than-stellar cash flow guidance for this year but 2024 should see substantial improvement on that front.

Since the beginning of the year, Transocean has made great progress as the company replenished liquidity and extended near-term debt maturities at reasonable terms while bagging a number of high-margin drillship contracts offshore Brazil.

While I wouldn’t chase the shares at current levels, investors should consider adding on any major weakness.

Despite recent volatility in oil prices and related stocks, I remain positive on the entire industry, including leading U.S. exchange-listed players Seadrill (SDRL), Valaris (VAL), Noble Corp. (NE), Diamond Offshore Drilling (DO), Borr Drilling (BORR), Helix Energy Solutions (HLX) and offshore drilling support providers like Tidewater (TDW) and SEACOR Marine Holdings (SMHI).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.