Summary:

- Leading offshore driller Transocean reported better than expected Q3/2024 results with both revenues and profitability exceeding consensus expectations.

- Backlog of $9.3 billion was up 7.6% on a sequential basis mostly due to a new $531 million contract for the high-specification drillship, Deepwater Invictus.

- Strong contract coverage will effectively shield the company from anticipated near-term weakness in deepwater activity.

- An acquisition of Seadrill at reasonable terms would be highly accretive and transform the company’s balance sheet thus providing a potential path to near-term shareholder capital returns.

- Transocean continues to trade at a large premium to peers. While deserved to some extent, Thursday’s rally in the shares has reduced the upside quite meaningfully. Consequently, I am downgrading my rating from “Buy” to “Hold”.

leskas

Note:

I have covered Transocean Ltd. or “Transocean” (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

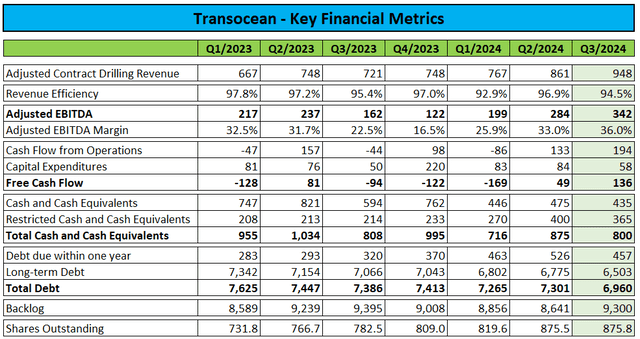

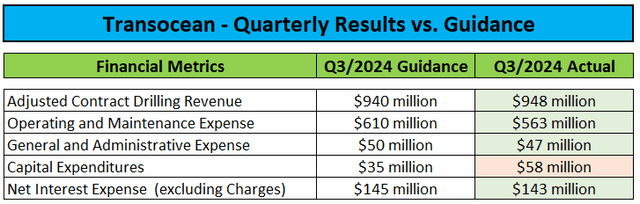

After the close of Wednesday’s regular session, leading offshore driller Transocean reported better-than-expected Q3/2024 results with both revenues and profitability exceeding consensus expectations:

Adjusted for one-time items, earnings per share were $0.07, comfortably ahead of analyst expectations with the outperformance being mostly a function of much lower than projected operating and maintenance expenses:

Company Press Releases and Conference Call Transcripts

On the conference call, management attributed the lower expenses to the “delay of non-critical in-service maintenance activities in the active fleet and the favorable resolution of old contingencies“.

Without persistent reliability issues related to the company’s new 20k PSI Blowout Preventers (“BOPs”), revenue outperformance would have been even higher.

Adjusted EBITDA of $342 million came in well ahead of the implied number provided by management on the Q2/2024 conference call. Adjusted EBITDA margin of 36.0% increased to multi-year highs and Transocean generated $136 million of free cash flow. The company finished the quarter with $435 million in unrestricted cash, restricted cash of $365 million as well as approximately $7 billion in debt.

Please note that Transocean includes restricted cash in its liquidity calculations and projections:

We ended the third quarter with total liquidity of approximately $1.4 billion. This includes unrestricted cash and cash equivalents of $435 million about $365 million of restricted cash, the majority of which is reserved for debt service and $576 million of capacity from our undrawn revolving credit facility.

A backlog of $9.3 billion as of October 24 was up 7.6% on a sequential basis mostly due to a new $531 million contract for the high-specification drillship Deepwater Invictus in the U.S. Gulf of Mexico.

Transocean has secured strong contract coverage for next year (97%) and the first half of 2026 (86%) thus effectively shielding the company from the current weakness in deepwater contracting activity.

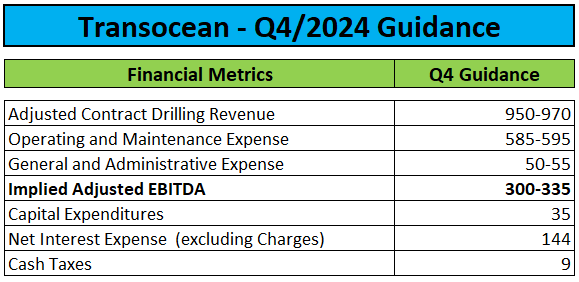

On the conference call, management guided Q4/2024 slightly below consensus expectations:

Conference Call Transcript

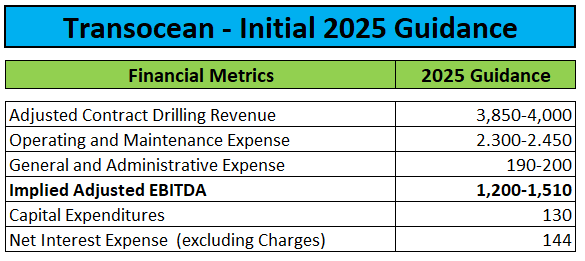

Initial 2025 guidance was also slightly below expectations:

Conference Call Transcript

However, with very limited capital expenditures, free cash flow should increase significantly next year. Consequently, management expects to reduce debt by a minimum of $715 million until the end of 2025.

Going forward, Transocean will aggressively pursue debt repayments in order to reduce the company’s Net Debt/EBITDA ratio to below 3.5x as required by debt covenants in order to start returning capital to shareholders.

As we have discussed previously, we will deploy all excess cash to debt repayment in pursuit of reducing our net debt to EBITDA metric to less than 3.5 times, a prerequisite for us to contemplate distributions to shareholders.

Based upon our existing backlog and our visibility to future demand, we currently expect this threshold to be met in late 2026, as Jeremy highlighted in his remarks.

During the question-and-answer session of the call, management wasn’t really concerned about the persistent weakness in deepwater contracting activity and projected dayrates for high-specification floaters to remain at decent levels with activity expected to reaccelerate in 2026:

If you think about that specifically in Deepwater, the current levels of sanctioning are around about $50 billion per year at the moment. But, in ’26 and ’27, that’s actually expected to double according to the latest Rystad projection.

While management abstained from directly commenting on the recent Seadrill Limited (SDRL) acquisition rumor, a number of statements could be viewed as in favor of a potential transaction:

We still think there’s room for a bit more consolidation in the space and think that would be healthy. There are all kinds of incremental benefit, all kinds of value that can be created through a transaction and a combination. I mean, we could take on 10, 15 additional rigs with very little increase to our shore base support for those rigs. A lot of synergies that can be realized.

(…)

For us, there’s value obviously, you can immediately grow into your balance sheet and solve some issues there. You can acquire some very good marketable assets that are currently hot and some rolling off contract and ready to be repriced and what we think is favorable.

Please note that Seadrill is the only offshore driller with an active fleet that matches the fleet size stated by management.

In addition, Seadrill has a pristine balance sheet and a quartet of 7th-generation drillships working at low-margin legacy contracts offshore Brazil with a high probability of securing follow-on work at substantially higher dayrates, very much as outlined by management above.

On the flip side, management tried to caution expectations for a near-term transaction:

So, we’re still always looking, but for us it’s going to be around asset quality. It’s going to have to be the right value. And so, I think it’s tough to match everything up and get deals done in the current environment where everybody thinks that we’re up into the right for the foreseeable future. It may have a little bit of a pause here over the next several months.

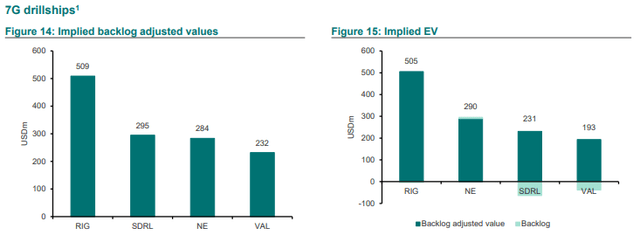

Similar to most sell-side analysts, I am in strong support of a Seadrill acquisition due to major accretion, the addition of several high-specification floaters and particularly the substantial strengthening of Transocean’s balance sheet which would also provide a path to near-term shareholder capital returns.

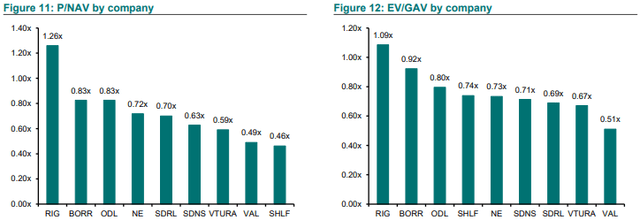

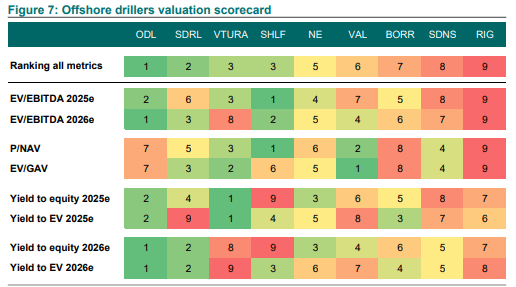

Valuation-wise, the company continues to trade at a large premium to its U.S. exchange-listed peers on basically all key financial metrics tracked by analysts:

DNB Markets

From a net asset value (“NAV”) perspective, the company is valued at a more than 150% premium to competitor Valaris Limited (VAL):

Even when adjusted for Transocean’s market-leading backlog, things don’t look much different:

However, at least in my opinion, the company deserves to trade at a premium to peers due to its superior contract coverage which will effectively shield Transocean from anticipated near-term market weakness.

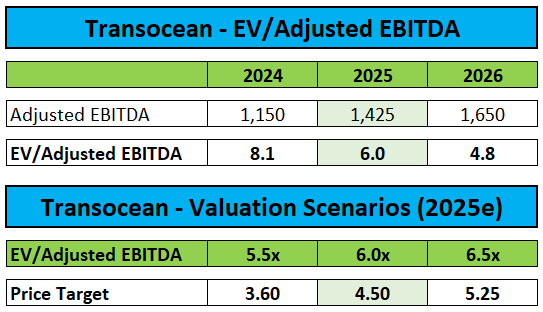

As a result, I continue to assign an EV/EBITDA multiple of 6.0x as compared to a reduced 5.5x for peers with lower near-term contract coverage.

On the flip side, I have reduced my Adjusted EBITDA expectations based on management’s guidance for 2025:

Author’s Estimates

Following Thursday’s rally, the stock is trading very close to my new $4.50 price target. Consequently, I am downgrading my rating from “Buy” to “Hold“.

That said, should Transocean indeed manage to acquire Seadrill at reasonable terms, I would become more constructive on the shares again.

Bottom Line

Transocean reported better-than-expected third quarter results with strong profitability and decent cash generation.

While the fourth quarter and initial FY2025 guidance were slightly below expectations, the company’s strong near-term contract coverage effectively shields Transocean from anticipated near-term weakness in deepwater activity.

Moreover, reading between the lines, management appears to be in favor of a rumored acquisition of smaller competitor Seadrill. A deal at reasonable terms would be highly accretive and immediately transform Transocean’s weak balance sheet thus accelerating the path to shareholder capital returns.

Unfortunately, the company continues to trade at a large premium to U.S. exchange-listed competitors. While deserved to some extent, Thursday’s rally in the shares has reduced the remaining upside quite meaningfully.

Consequently, I am downgrading my rating from “Buy” to “Hold” with a slightly reduced price target of $4.50.

However, should Transocean indeed manage to acquire Seadrill at reasonable terms, I would become more constructive on the shares again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SDRL, BORR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.