Summary:

- Transocean has seen a rapid recovery in its market capitalization, which has made the company overvalued.

- The company has a massive debt load that will stop cash flow from going toward shareholder returns for the next few years.

- The backlog struggles, and FCF remains lower, making the company a poor investment for shareholder returns.

grandriver

Offshore drilling has seen the share prices of its companies recover substantially recently. Giants such as Transocean (NYSE:RIG) are up nearly 10x from their pandemic lows and have more than doubled in the past year. However, despite investors flocking to the company, as we’ll see throughout this article, its share price is overvalued making it a poor investment.

Offshore Market

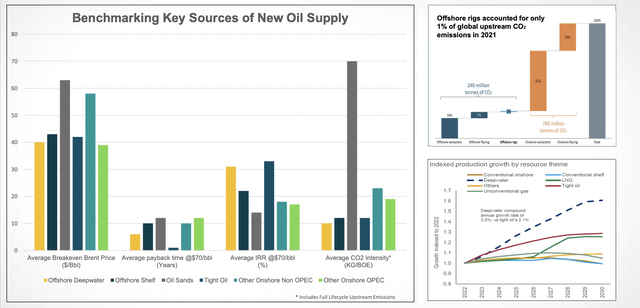

The company touts the strength of the offshore market as new sources of supply are found.

Transocean isn’t wrong that substantial new developments are being found offshore. Additionally, as witnessed through ExxonMobil in Guyana, the logistics of ramping up production are being figured out and with FPSOs offshore oil is becoming uniquely profitable. We do expect this to be a tailwind going into the end of the decade.

However, past that, we expect that plans to ramp down oil production will still impact company exploration and capital expenditures, and offshore drilling companies will be one of the first victims of the move away from fossil fuels.

Transocean Overview

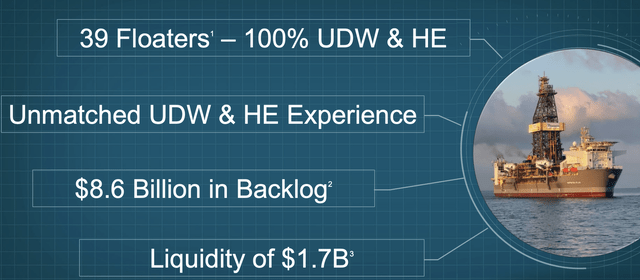

Transocean does have one of the strongest portfolios in the industry, but that’s more of a sign of the difficulty of the industry.

The company has 39 floaters all ultra-deepwater or harsh environments. The company has $8.6 billion in backlog, only 1.6x its market cap, and $1.7 billion in liquidity, enough to handle a downturn. While the company does have much younger ships, it does also have 12 cold-stacked rigs 10 of which are ultra-deepwater, indicating the risks the company faces even in a better market.

Transocean Backlog

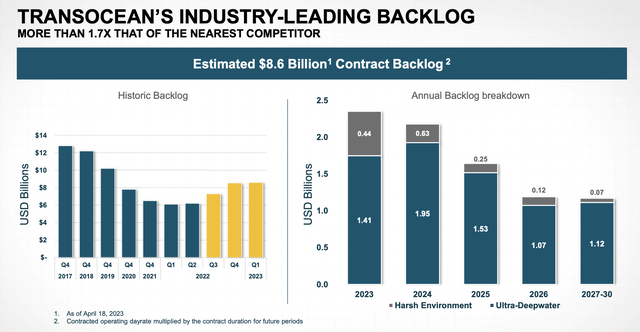

Unfortunately for Transocean, its backlog shows a slow recovery.

The company’s peak 2024 backlog year is roughly $2.5 billion. From there it drops off, especially in the harsh environment sector, but never dips below $1.2 billion or so. The company’s backlog has recovered substantially from 2020-2021 but is still $4-5 billion below its COIVD-19 related peak. It isn’t moving toward that peak.

The company’s struggle is that majors will remain reluctant to invest. Continued slowness in the recovery of oil prices and consistent production cuts by OPEC+ is a sign of this. Brent Crude remains below $75 / barrel as concerns remain about the economy. Continued weakness in that backlog brings us to our next concern, cash flow.

Cash Flow

The company’s problem at the end of the day is cash flow.

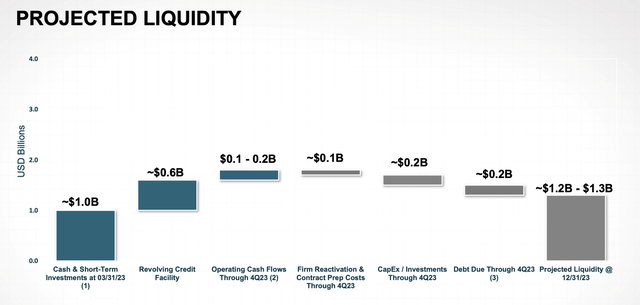

2022 was a strong year, and it’s tough to not argue that the company shouldn’t have already returned to a more steady state environment. In the 1Q, the company earned $650 million of revenue, with high efficiency (97.8%). However, it still had an operating loss and EBITDA at just a hair over $200 million. Net interest payments alone are roughly $100 million.

Through the end of the year, paying the debt due, the company expects to generate net cash / short-term investments by roughly $200 million not counting $600 million utilized (theoretically) from a revolving cash facility. Operating cash flows are below capital expenditures for the company, meaning negative FCF.

Even with continued growth, the company doesn’t appear to have a clear path forward toward being able to resolve that issue.

Thesis Risk

The largest risk to our thesis is capital spending and oil prices. Onshore oil is being depleted. Should oil prices remain higher for longer, perhaps due to an earlier economic recovery in China for example, that could lead to valuable long-term contracts being signed for the company. Given that many expenses are fixed, that could quickly drive up profits.

Transocean Valuation

That cash flow issue ties to Transocean’s valuation. The company no longer has a few hundred million dollar market cap on the verge of failure. It has a market cap of $5+ billion now, in an upswinging market, 3 years post the black swan event. It’s time to indicate to shareholders that there’s a future. The way to do that is to make profits.

The company is focused on reducing debt to a long-term $4-4.5 billion. It plans to do that by paying $1.5 billion in organic debt redemptions over the next 3 years, partially supported by cash on hand. Even when it hits that target, the company will barely be at a double-digit FCF yield. That’s a tough spot to be in a debt-heavy position and a volatile industry.

That’s even riskier when your industry might be half gone in 20-30 years. Because of that, we recommend against investing in the company. Let us know your thoughts in the comments below!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.