Summary:

- Transocean reported weaker than expected Q2/2024 results with revenues again impacted by contract commencement delays and profitability hit by non-cash tax accounting requirements.

- However, adjusted for $156 million in GAAP income tax expense, the company would have reported a profitable quarter.

- On the conference call, management reiterated full-year expectations and remained enthusiastic about the company’s prospects going forward.

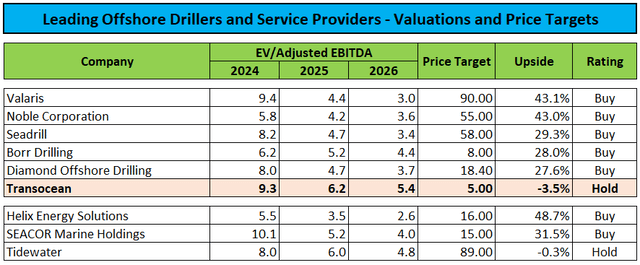

- While profitability and cash generation should increase very substantially going into 2025, these expectations appear very much reflected in the company’s premium valuation relative to peers.

- With shares trading close to my $5.00 target, I am reiterating my “Hold” rating on the stock.

pabst_ell

Note:

I have covered Transocean Ltd. or “Transocean” (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

Three weeks ago, leading offshore driller Transocean reported weaker than expected Q2/2024 results with revenues again impacted by contract commencement delays and profitability hit by non-cash tax accounting requirements.

However, adjusted for $156 million in GAAP income tax expense, the company would have reported a profitable quarter.

Company Press Releases/Regulatory Filings

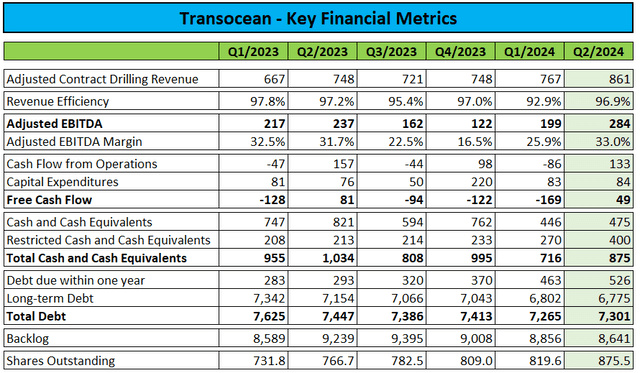

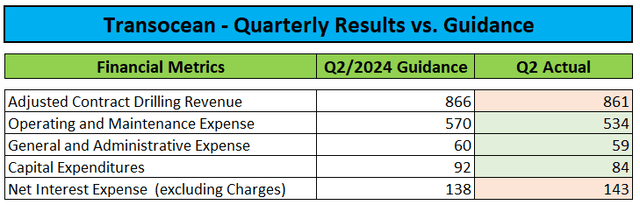

Adjusted EBITDA of $284 million came in substantially ahead of expectations provided by management on the Q1/2024 conference call as slight revenue underperformance was more than offset by lower operating and maintenance expense. On the conference call, management attributed this to “the delay of in-service maintenance in the active fleet and the favorable resolution of old contingencies“.

Q1 Conference Call Transcript / Company Press Release

Adjusted EBITDA margin of 33% represented the highest level in recent quarters and Transocean generated $133 million of cash flow from operations. Capital expenditures amounted to $84 million thus resulting in free cash flow of $49 million.

The company finished the quarter with unrestricted cash and cash equivalents of $475 million, restricted cash of $400 million and approximately $7.3 billion in debt. Transocean retains access to its undrawn $576 million secured credit facility for a total liquidity of $1.05 billion.

Please note that Transocean includes restricted cash in its liquidity calculations and projections:

Our projected liquidity at year-end 2024 is unchanged from last quarter at approximately $1.4 billion which includes the full $576 million capacity of our undrawn revolving credit facility as well as restricted cash of approximately $390 million, most of which is reserved for debt service. This liquidity forecast includes 2024 CapEx expectations of $250 million of which approximately $115 million is related to the Deepwater Aquila, about $15 million of CapEx associated with the Aquila remains.

Backlog of $8.64 billion as of July 24 was down 2.4% on a sequential basis, but on July 31, the company announced a new $531 million contract for the high-specification drillship Deepwater Invictus in the U.S. Gulf of Mexico.

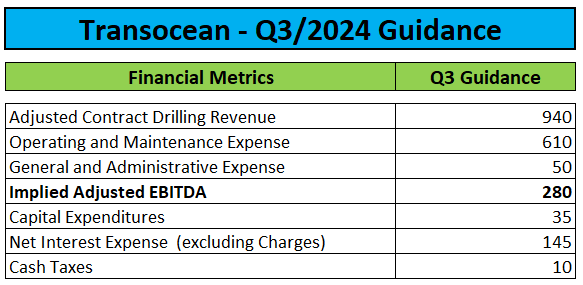

On the conference call, management guided Q3/2024 largely in line with expectations:

Q2/2024 Conference Call Transcript

With both revenues and operating expenses expected to be up substantially, Adjusted EBITDA is likely to be roughly unchanged from Q2.

However, with capital expenditures projected to be down approximately $50 million quarter-over-quarter, free cash flow should get a boost, albeit the timing of interest payments remains an important factor.

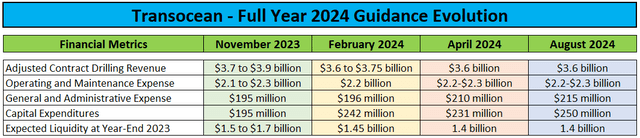

Following two consecutive downward revisions, the company reiterated its full-year outlook:

On the conference call, management was enthusiastic about the company’s prospects:

In closing, we continue to believe the underlying fundamentals support a multiyear growth cycle for our assets and services.

Given our backlog and the visibility it provides to future cash flows, along with a future reduction in CapEx requirements as our newbuilds are now all out of yards and on contract, we expect our unlevered free cash flow to continue incrementally increasing each quarter for the next several quarters, which can enable us to delever our balance sheet and ultimately position us to design, communicate and implement a sustainable strategy to make distributions or otherwise return value to our shareholders.

CEO Jeremy Thigpen even mentioned the potential need for customers to finance the reactivation of Transocean’s cold-stacked rigs:

(…) our working fleet is more than 90% committed through the end of 2025. And based upon advanced discussions with our customers and reflecting LOIs and strong verbal commitments, we believe that aside from some small activity gaps, which could arise in our customer drilling programs, our fleet that is currently working could soon be completely booked well into 2026. As such, our customers may soon need to consider financing the reactivation of cold-stacked assets to meet their future program requirements.

Please note that Transocean management’s views are somewhat in contrast to its main competitors Noble Corporation plc (NE), Valaris Limited (VAL), and Seadrill Limited (SDRL) which all pointed to the current period of subdued floater contracting activity likely extending well into 2025 with demand for lower-specification assets being particularly weak.

This is also evidenced by Transocean’s most recent fleet status report which shows two 6th generation floaters (Deepwater Inspiration and Development Driller III) sitting idle for more than a year already.

On the conference call, management stated that these rigs are not expected to be awarded new work in the near future and as a result, the company has started to reduce operating expenses for these assets.

While the outlook for high-specification assets is better, there’s no need for customers to pay for the reactivation of Transocean’s cold-stacked assets, particularly not given the fact that these drillships have been sitting idle for almost a decade now.

Please note that there are no examples of rigs being reactivated after having been mothballed for such a long period of time which adds considerable uncertainty regarding the company’s ability to successfully complete reactivations in time and on budget. In contrast to competitor Valaris, Transocean has never reactivated a cold-stacked drillship so far.

In addition, there are plenty of high-specification assets available in the market today with a number of newbuild drillships currently marketed for employment by competitors.

Right now, Noble Corporation has a hot (ready to work) 7th generation drillship (Noble Voyager) sitting idle in Curacao while Seadrill will have to find work for three high-specification drillships scheduled to roll off contract by mid-2025.

Consequently, I would be surprised to see any near- or even medium-term reactivations of Transocean’s cold-stacked rigs.

However, even with the currently active fleet, the company should see a decent jump in profitability next year with free cash flow likely to exceed $700 million with additional rigs transitioning to higher-margin contracts and recently transitioned units contributing for a full year.

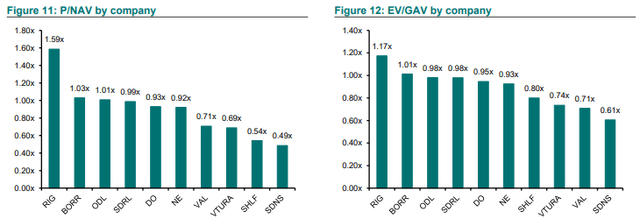

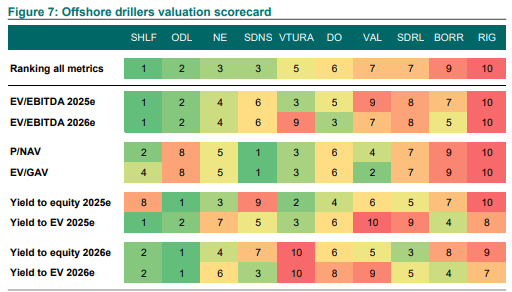

Unfortunately, Transocean’s share price already reflects expectations for much higher profitability and cash generation going forward as the stock continues to trade at a large premium to peers based on basically all key financial metrics tracked by analysts:

DNB Markets

From a net asset value perspective, the company is valued at a more than 100% premium to competitor Valaris:

In addition, Transocean’s recent decision to acquire the remaining 67% stake in the harsh environment floater Transocean Norge in exchange for 55.5 million newly issued shares and $130 million in 8% senior notes has resulted in further dilution for common equity holders and higher overall debt levels.

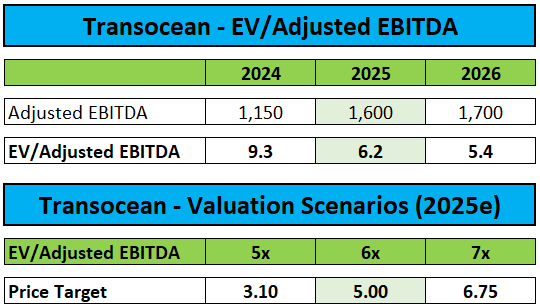

While full ownership of Transocean Norge will positively impact cash flow and Adjusted EBITDA, the increased contribution is fully offset by lower expectations for the Deepwater Inspiration and Development Driller III which I now assume to remain idle until at least H2/2025. As a result, my forward Adjusted EBITDA estimates remain unchanged:

Author’s Estimates

With an additional 55.5 million shares now included in the model, I am lowering my price target from $5.50 to $5.00 while reiterating my “Hold” rating on the shares.

Investors looking for exposure to the industry should rather consider peers like Noble Corporation, Valaris, and Seadrill which are all trading at substantially lower forward valuations despite vastly superior balance sheets and strong commitments to shareholder capital returns.

Bottom Line

Adjusted for a large non-cash tax charge, Transocean reported profitable second quarter results and reiterated full-year expectations.

While profitability and cash generation should increase very substantially going into 2025, these expectations appear very much reflected in the company’s premium valuation relative to peers.

With the stock price close to my revised $5.00 target, I am reiterating my “Hold” rating on the shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SDRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.