Summary:

- Transocean missed analyst expectations in Q2 2024 earnings, leading to a share price decline of 4.86%.

- The company’s revenue, operating income, and adjusted EBITDA improved year-over-year, but net losses persisted.

- RIG should be able to generate positive levered cash flow going forward now that the Deepwater Aquila is completed and working.

- The company continues to have significant amounts of debt, and it is likely that a significant portion of its free cash flow will go to paying that down.

- RIG stock looks fairly valued at best.

Jeremy Poland

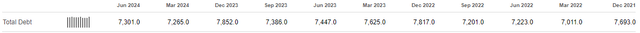

On Wednesday, July 31, 2024, offshore drilling rig owner Transocean Ltd. (NYSE:RIG) announced its second-quarter 2024 earnings results. At first glance, these results were very disappointing, as the company missed the expectations of its analysts on both a top-line revenue and a bottom-line earnings basis:

Seeking Alpha

The company’s revenues did come in stronger than last year, though, which makes this look a bit better. The company’s adjusted EBITDA was likewise stronger than what was seen in the prior year quarter. As I have pointed out in a few previous articles, for a capital-intensive business like Transocean’s, adjusted EBITDA can sometimes be a better metric to use than revenue or net income because it is less affected by certain accounting items that do not actually result in cash leaving the business. It is effectively akin to a company’s pre-tax cash flow, so it gives us a good starting point for an analysis of a company’s cash generation ability.

It is not an understatement to say that the market was not impressed with the company’s earnings report. Over the past five days, Transocean’s share price has fallen by 4.86%. This was much worse than what the S&P 500 Index (SP500) delivered over the period, even in the wake of Thursday’s substantial decline:

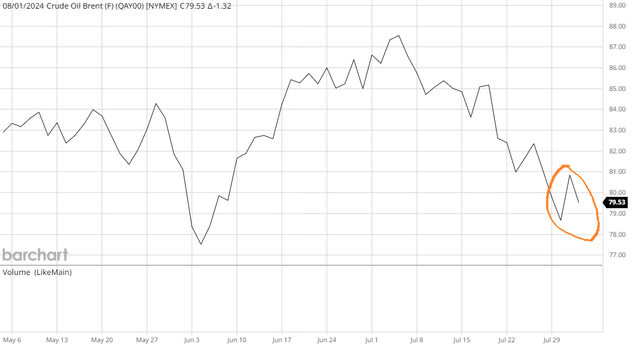

The company’s stock price was doing pretty well until August 1, which suggests that the earnings report was the big driver of the stock price decline. The spot price of Brent Crude Oil was also down a bit on August 1:

It is possible that this was also a contributor to Transocean’s poor stock price performance on August 1, but oil prices alone cannot fully explain the company’s share price performance. After all, the spot price of Brent Crude Oil fell on July 30, but Transocean’s share price was up, so we can see that the company does not perfectly correlate to crude oil prices.

Let us take a look at Transocean’s earnings results and see if we can explain anything about the market’s reaction to the earnings, and possibly see if we can derive an investment thesis from it.

Transocean Q2 Earnings Results Analysis

As I stated in a recent article:

It is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis.

Here are the highlights from Transocean’s second-quarter 2024 earnings report:

- Transocean brought in total contract drilling revenues of $861 million during the second quarter of 2024. This represents an 18.11% increase over the $729 million that the company brought in during the prior-year quarter.

- The company reported an operating income of $84.0 million during the reporting period. This compares very favorably to the $11.0 million that the company reported in the year-ago quarter.

- Transocean’s revenue efficiency came in at 96.9% for the reporting quarter. This compares unfavorably to the 97.2% revenue efficiency that the company reported a year ago.

- The company reported an adjusted EBITDA of $284 million during the most recent quarter. This represents a substantial 19.83% increase over the $237 million that it earned during the corresponding quarter of last year.

- Transocean reported a net loss of $123.0 million during the second quarter of 2024. This was a significant improvement over the $165.0 million net loss that the company reported in the second quarter of 2023.

Anyone looking at these highlights will likely experience mixed emotions. The company’s year-over-year revenue, operating income, and adjusted EBITDA were all very nice to see. The net loss came in smaller than last year, which was nice, but it was still a loss. The weakness in revenue efficiency was rather disappointing, though. However, the 96.9% revenue efficiency from the most recent quarter was a lot better than the 92.9% revenue efficiency that the company had in the first quarter. With the exception of revenue efficiency, these results were better than the company achieved in the first quarter of 2024 or the second quarter of 2023, which are the two most comparable quarters. As such, we probably should not be too disappointed here, even though things were not exactly perfect.

Transocean’s chief executive officer, Jeremy Thigpen, seemed generally pleased with the company’s results. He stated in the earnings press release:

The entire Transocean team executed well in the second quarter, delivering strong uptime performance for our customers, which drove revenue efficiency to 97% and produced 33% Adjusted EBITDA margins. In addition, the team recently secured a number of meaningful contracts, which are illustrative of current industry dynamics and reinforce our view that we are in an increasingly tightening market. Of these contracts, we are especially excited to continue 20K operations with Beacon in the U.S. Gulf of Mexico.

As we continue to secure work for our fleet, our focus remains on optimizing our portfolio of assets to maximize EBITDA and generate free cash flows, which we can use to de-lever the balance sheet.

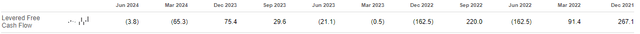

Mr. Thigpen specifically mentions the company’s ambitions to generate positive free cash flow, but this is an area in which Transocean has been struggling for a while. In the second quarter of 2024, the company had a negative levered free cash flow of $3.8 million. In fact, the company has only had a positive levered free cash flow in five of the last eleven quarters:

(all figures in millions of U.S. dollars)

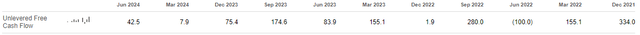

The company has done better with free cash flow generation on an unlevered basis, however:

(all figures in millions of U.S. dollars)

We can see that it had $42.5 million of free cash flow in the second quarter of 2024 when looking at the unlevered numbers. However, in most cases, the levered free cash flow is the more important figure when analyzing a company’s finances. The levered free cash flow is the amount of money left after the company has satisfied all of its financial obligations, particularly interest payments. Thus, if the company actually wants to de-lever its balance sheet, as Mr. Thigpen claims, then it needs to consistently generate a positive free cash flow. It has been failing to do that, as the above numbers show.

One of the big culprits that prevented the company from generating a positive levered free cash flow in the second quarter is its capital spending. From the earnings press release:

Second quarter 2024 capital expenditures of $84 million were primarily associated with the newbuild ultra-deepwater drillship Deepwater Aquila. This compares with $83 million in the prior quarter.

The Deepwater Aquila is listed on the fleet status report as scheduled to begin work on a contract in June 2024. If it actually started up as scheduled, then Transocean should no longer have any rigs under construction. This should result in capital expenditures in the third quarter of 2024 being lower than they were in the second quarter, and given the fact that the levered free cash flow was only negative by $3.8 million, the reduction of the capital expenditures associated with the construction of Deepwater Aquila should be sufficient to swing the company’s levered free cash flow to positive. Of course, that largely depends on its third-quarter 2024 revenue coming in around the same level.

According to the fleet status report, the only rig that comes off of its current contract without having a new contract to start work on during the third quarter of 2024 is the Deepwater Invictus. This rig’s current contract was scheduled to end in July 2024, and it does not have any work until the new contract starts in November 2025. Thus, it appears that this rig ceased generating revenue for the company sometime last month and will not earn any more revenue this quarter. Obviously, that will have an adverse impact on Transocean’s revenue during the third quarter. However, the Deepwater Aquila started its contract in June, so the $447,000 per day that this rig is earning might offset the lost incremental revenue from the Deepwater Invictus. The latter rig’s contract dayrate was undisclosed, though, so it is uncertain whether or not the Deepwater Aquila will be able to fully offset the loss.

Overall, though, it does look like Transocean should be able to achieve positive levered free cash flow in the third quarter. This is exactly what the company needs in order to begin to reduce its debt, as Mr. Thigpen stated. Naturally, though, it would be quite surprising to see a dividend from this company in the near future given the importance of strengthening the balance sheet.

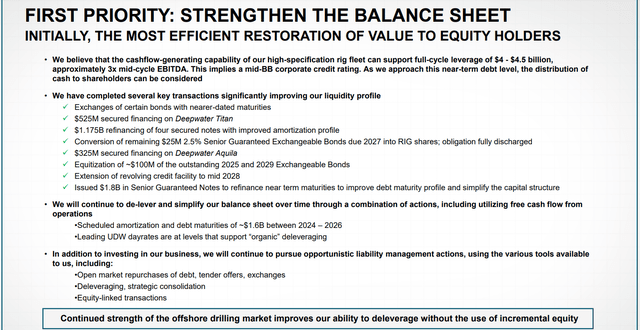

In a presentation, that Transocean gave to its investors in May 2024, it also stated its desire to reduce its leverage and strengthen the balance sheet:

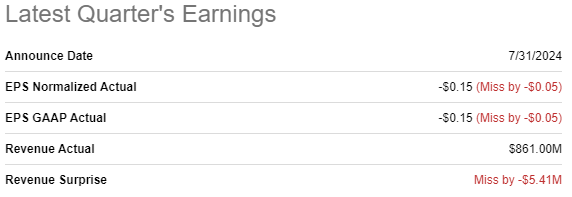

If the company can indeed switch over to positive levered free cash flow generation, as the above analysis suggests, then it should be able to make some headway on paying down its debt. The company is in a reasonably strong position right now with its contract backlog, as the current level is hovering near multi-year highs:

Transocean

As of July 2024, Transocean’s contract backlog stood at $8.64 billion. This is lower than it was in the third quarter of 2023 through the first quarter of 2024, but it is still very close to its post-pandemic high. This is being partially driven by the increasing demand for ultra-deepwater rigs around the world, as high oil prices have supported the development of offshore wells in a way that we have not seen since the 2010 to 2013 industry upcycle. Admittedly, oil companies are not yet being quite as aggressive about their commitments as they were during the last upcycle, but we are once again seeing signs of life in this industry.

In any case, the large backlog should support fairly sustainable revenue generation for Transocean for quite a while. The backlog is defined as the total amount of revenue that will be generated by all of its existing contracts, assuming 100% revenue efficiency. As already stated, the current backlog stands at $8.64 billion. That represents about ten quarters of revenue at the second quarter 2024 run rate. That is two-and-a-half years, which is reasonable. Basically, this means that Transocean’s revenues should be at least reasonably stable for a while, which should support free cash flow generation if it can keep its capital expenditure under control. The company seems likely to do that, as the memories of the overbuilding of rigs that took place prior to 2015 are still fresh in the minds of anyone connected to the offshore drilling industry.

Financial Considerations

As I stated in various previous articles (such as this one):

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the money to repay the existing debt. This can cause a company’s interest expenses to increase following the rollover, depending on the conditions in the market.

As we are all very well aware, interest rates are currently at the highest levels that most developed nations have seen in more than fifteen years. Thus, any company needing to issue debt today will almost certainly experience an increase in its interest expenses.

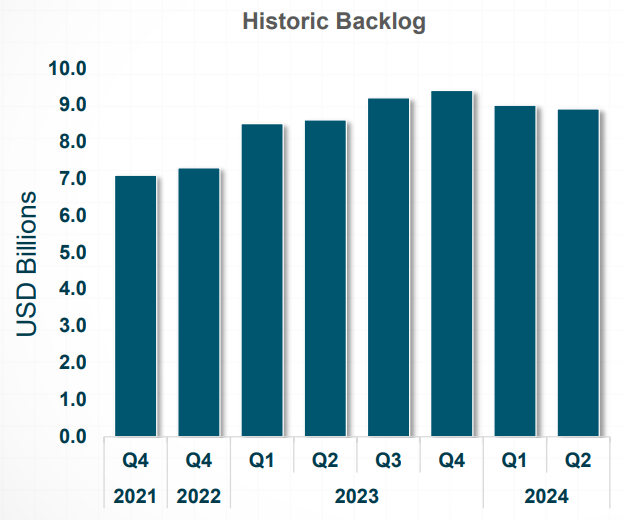

Transocean is not as insulated as many upstream or midstream companies from the need to issue debt. In the second quarter, the company issued $1.7670 billion in new debt but used some of the proceeds to pay off $1.6640 billion of existing debt. The total debt outstanding only increased by $36.0 million, going from $7.265 billion to $7.301 billion. That is not really too bad, and the impact on interest expenses was not really as bad as would be expected. In fact, Transocean’s net interest expenses have been falling, with the company only paying $60 million in the current quarter compared to $157 million in the year-ago quarter. The company’s year-to-date interest expenses look even better, as its net interest expenses came in at $162 million for the first half of 2024 compared to $387 million in the first half of 2023.

Thus, it very much appears as though the company is strengthening its balance sheet, although it is making slow progress. The slight increase in total debt this quarter, for example, seems to contradict that claim. However, the company’s total debt is still down quite a bit from 2023 levels:

We can see that the total debt load was frequently above $7.4 billion from the fourth quarter of 2022 until the fourth quarter of 2023, so we do see a slight improvement. It will take the company being consistently free cash flow positive to make any real improvements here, so let us hope that the completion of Deepwater Aquila results in it achieving that.

RIG Stock Valuation

As of the time of writing, Transocean is trading at an enterprise value-to-trailing twelve-month EBITDA ratio of 16.98. Here is how that compares to some of the company’s peers:

|

Company |

EV/TTM EBITDA |

|

Transocean |

16.98 |

|

Valaris (VAL) |

37.94 |

|

Noble Corporation (NE) |

8.43 |

|

Diamond Offshore Drilling (DO) |

11.35 |

|

Seadrill (SDRL) |

7.13 |

Based on this, Transocean looks rather expensive. After all, the company’s enterprise value-to-trailing twelve-month EBITDA is well above the peer median of 11.35.

However, it might be better to look at the enterprise value-to-forward EBITDA ratio. While this figure will admittedly only be an estimate since we do not know for sure if the company will manage to meet analysts’ EBITDA expectations, it might give us a good idea of how Transocean compares to its peers in terms of how well the company will do tomorrow. Here is the comparison chart:

|

Company |

EV/Forward EBITDA |

|

Transocean |

10.63 |

|

Valaris |

12.37 |

|

Noble Corporation |

7.42 |

|

Diamond Offshore Drilling |

21.33 |

|

Seadrill |

9.28 |

One thing that we see here is that analysts clearly expect Transocean, Valaris, and Noble Corporation to all generate much better EBITDA over the next year than they had during the previous period. This reinforces the statements that have been made throughout this article that the company’s overall situation seems to be improving. We can also see that Transocean does not look particularly expensive compared to its peers. Transocean’s valuation is only the median here, so it is not especially cheap but neither does it look expensive.

The takeaway here is that Transocean is at best fairly valued right now. The company does not appear to be particularly cheap, but it is certainly not expensive. There are some risks involved here, as the company might fail to meet analysts’ expectations for its EBITDA and of course, there is always the risk of a disaster that prevents the levered free cash flow from swinging positive. It does not appear to be unattractive right now either, though.

Conclusion

In conclusion, Transocean missed the expectations of its analysts and that seems to have contributed to a fairly steep share price sell-off. However, all is not bad here, as the company’s results were generally better than in the prior-year quarter. More importantly, we are seeing signs that Transocean could be on the verge of swinging to a positive free cash flow on a sustainable basis. That should help it begin to pay down the mountain of debt that has been hanging over the company for quite some time now. It is still very much in the early stages, but we are seeing signs of a recovery here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!