Summary:

- RIG stock surged by 10% after fleet status report, announcing $531 million contract with record high dayrates.

- Transocean reported a net loss but increasing revenues, positive cash flow, and high dayrates in fleet status report.

- Management is optimistic about the future, expects the fleet to be fully booked into 2026, improving balance sheet and liquidity projections.

MarkusBeck

A lot has happened since my last coverage of Transocean (NYSE:RIG). RIG stock surged by about 10% following the publication of the fleet status report. Later on July 31st, a contract worth $531 million at a daily rate of about $485,000 was announced. The company’s dayrates surged to record highs, much like the management predicted. The company has just reported its earnings, and more positive announcements are yet to come, it seems. Offshore drillers’ earnings are among the most predictable ones. So, I am personally more interested in the management’s comments than in Transocean’s earnings and sales figures.

Earnings

As I have mentioned in the introduction part of this article, offshore drillers generally have very predictable earnings and revenues. So, I would not be extra attentive towards the actual EPS and sales figures. Instead, I would pay particular attention towards the management’s press-conference. Traditionally, Jeremy Thigpen, Transocean’s CEO, gives a lot of information about the company’s activity levels in different regions and its possible contract announcements. Moreover, I generally take note of any possible financial updates, namely Transocean’s debt exchanges, balance sheet improvements and any possible rig reactivations. Despite higher dayrates, Transoсean also needs to increase its fleet to be able to raise its backlog, thus contributing to higher revenue numbers.

RIG’s earnings (The data are given in $millions.)

|

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Sep 2023 |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

|

Revenues |

692 |

691 |

606 |

649 |

729 |

713 |

741 |

763 |

861 |

|

EBITDA |

246 |

277 |

160 |

213 |

216 |

153 |

150 |

192 |

268 |

|

Net income |

(68) |

(28) |

(350) |

(465) |

(165) |

(220) |

(104) |

98 |

(123) |

Source: Prepared by the author based on Seeking Alpha’s data

The company reported a net loss for the past quarter due to more retired rigs and higher interest rates. The revenues, however, increased. In fact, we can safely say that quarterly revenues have been rising since the June 2022 quarter.

Cash provided by operating activities was $133 million during the second quarter of 2024, a rise of $219 million versus the $86 million cash used in operating activities in the previous quarter. The increase happened thanks to the timing of interest payments, decreased payments for payroll-related expenses and raised cash received from clients. According to the management, the positive free cash flow of $49 million in the 2Q reflects $133 million of operating cash flow, net of $84 million in capital expenditures. Capital expenditures for the reported period included $53 million related to the newly built deepwater drillship, with the balance associated with various other projects across the fleet. Let me discuss some details related to the company’s fleet status report and the associated backlog.

Transocean’s dayrates

In my view, the most important part of the fleet status report was the fact Transocean reported exceptionally high dayrates. According to Transocean’s recent fleet status report, the offshore drilling giant reported six contract updates and two exercised options in 2Q 2024. Several of these included dayrates above $500,000 in the US Gulf of Mexico.

The most remarkable announcement was a $580,000 dayrate for a two-well contract for the Deepwater Atlas ultra-deepwater drillship in the US Gulf of Mexico signed with Beacon Offshore Energy. That contract comes with contingencies to perform two completions for work at 20,000 pounds per square inch – also known as 20k – at an amazing $650,000 dayrate.

I have been writing about Transocean for a long time. For several years, Transocean has been struggling to reach the $500,000 dayrate, even for its most expensive rigs. Now several of its rigs cost substantially more than $500,000 per day.

- Deepwater Atlas awarded a four-well contract in the U.S. Gulf of Mexico at a dayrate of $505,000, with contingencies to perform three completions at the same dayrate.

- Deepwater Atlas: Awarded a two-well contract for drilling operations in the U.S. Gulf of Mexico at a dayrate of $580,000 with contingencies to perform two 20K completions at a dayrate of $650,000.

- Deepwater Asgard was Awarded a 365-day contract extension in the U.S. Gulf of Mexico at a rate of $515,000.

- Transocean Norge: Awarded a three-well contract extension in Norway at a current dayrate of $517,000.

Not only is the Gulf of Mexico experiencing high dayrates, Norway’s offshore equipment market seems to be in a deficit. Transocean Norge got an extension worth $517,000 per day.

Offshore drillers’ dayrate history

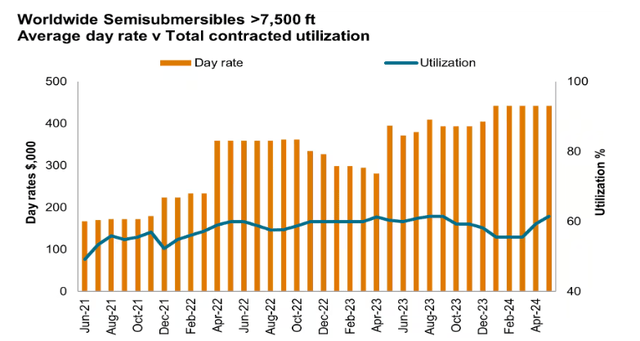

The offshore drilling dayrates are generally on a rising trajectory. The only exception is probably the worldwide semisubmersibles. Its utilization rate is just over 60% and does not seem to be increasing.

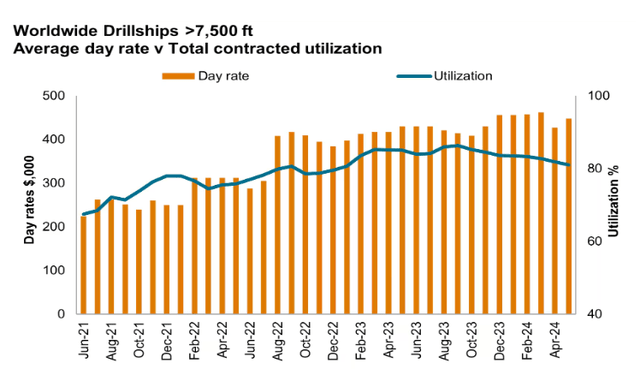

The worldwide drillships’ utilization is over 80% and has been rising since 2021.

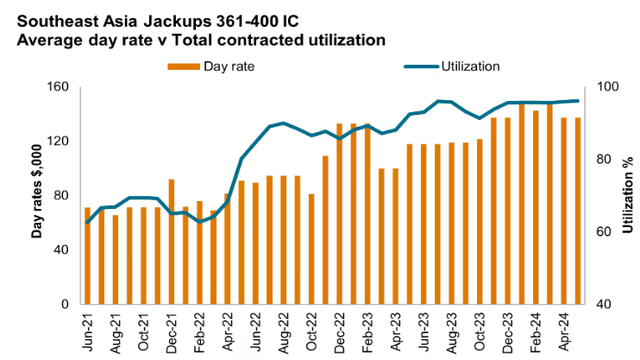

The same is true of jackups in the Southeast Asia region. The utilization and the dayrates have been rising for a while. Right now, they are near 100%.

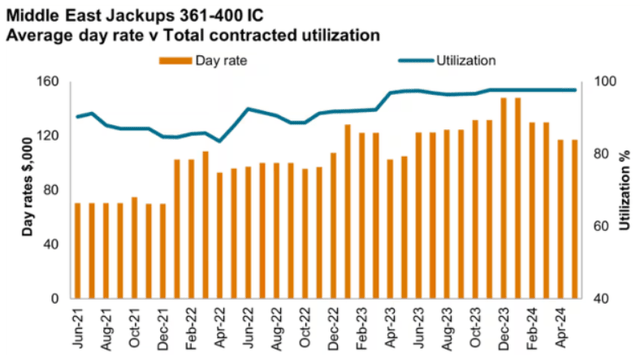

The jackups’ dayrates in the Middle East have also been rising, as has the utilization percentage.

Semi-submersibles are probably the weakest in the offshore drilling industry.

Yet, Transocean Spitsbergen, a harsh-environment ultra-deepwater dual-activity semi-submersible, was awarded a three-well contract extension in Norway at a rate of $483,000. So, it seems that most of the company’s equipment is doing well in terms of dayrates.

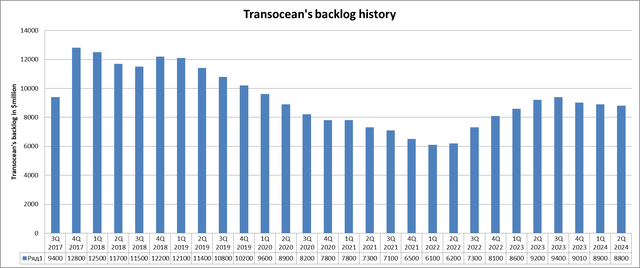

Transocean’s backlog history

Prepared by the author based on Transocean’s data

From the diagram above, we can clearly see that Transocean’s backlog touched its multi-year lows at the beginning of 2022. Although the current backlog of $8.8 billion is below the high of $9.4 billion reached in 3Q 2023, it seems the upward trend is not over.

Other news

It was mentioned here on Seeking Alpha and also in the fleet status report that Transocean suffered a number of contract delays. Obviously, the quarterly earnings and revenue figures have been affected as a result. However, given the extremely high dayrates, it does not seem that Transocean’s clients are less willing to cooperate with the offshore giant. Moreover, as the graph above showing the offshore industry’s dayrates suggests, the demand for the industry’s equipment is generally high and rising, while most of the rigs are already contracted out. I agree with my fellow analysts and investors that it is disappointing, and I think that Transocean deserves to have higher EPS and sales, given its fleet and the rising demand for offshore drilling. However, the delays do not seem to suggest fundamental or cyclical weakness.

The management’s comments

Let me also briefly discuss some of the management’s comments.

First of all, Jeremy Thigpen is very optimistic about the future of offshore generally. According to Rystad Energy, global offshore exploration and production capex is forecast to increase to $110 billion in 2027. That’s a rise from $48 billion in 2024, with about half of this rise is expected to be driven by activity in South America and Africa. But the future seems to be bright in the Gulf of Mexico as well. He expects Transocean to add additional wells to one of the rigs in the Gulf of Mexico that has availability “in the very near future”.

As I have mentioned in the fleet status report section of the article above, there is very strong demand for Transocean’s fleet. According to the management, aside from some small activity gaps which could arise in the company’s customer drilling programs, Transocean’s fleet could soon be completely booked well into 2026. That is why, according to the press conference, Transocean’s customers may soon need to consider financing the reactivation of cold stacked assets to meet their future program requirements. For example, the management says it is likely the entire West Africa region will require at least four additional deepwater rigs from 2026 onwards, which could possibly require the reactivation of some currently cold-stacked assets.

The management also expects its CapEx requirements to decrease as the company’s new builds are now all out of yards and on contract.

Now, a few words, about the management’s financial remarks. Transocean ended the second quarter with total liquidity of approximately $1.5 billion. The company is not burning cash, indeed. I have mentioned Transocean’s cash flows in the earnings section above.

For the third quarter, the management expects contract drilling revenues to total about $940 million, based upon an average fleet-wide revenue efficiency of 96.5%. This is quite a rise from the June 2024 quarter’s result of $861 million in sales.

The projected liquidity at year-end 2024 is expected to total $1.4 billion, not a big change from the recently reported $1.5 billion in cash holdings.

The management believes the rising cash flow will improve the balance sheet. It is anticipated that by the end of 2026, the debt load will approximate $4.7 billion. This will be quite an improvement, given that Transocean’s total long-term liabilities are $8.043 billion, while its long-term debt is $6.775

Valuations

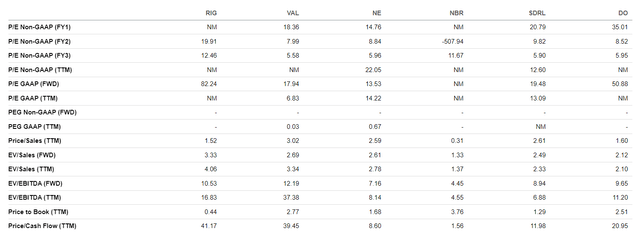

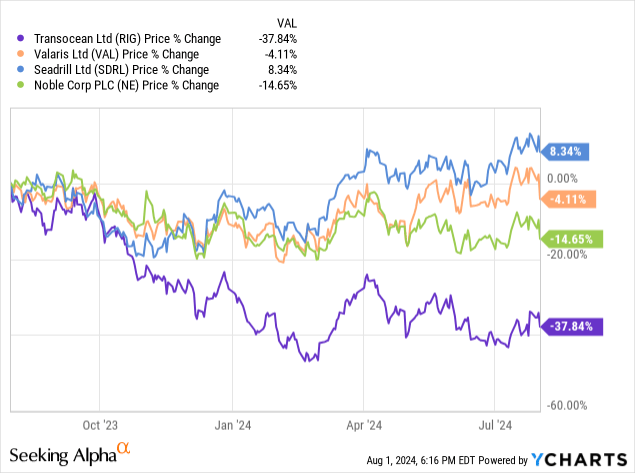

It was mentioned by my fellow Seeking Alpha analyst Henrik that Transocean was still overvalued compared to its peers, namely Noble (NE), Valaris (VAL), and Seadrill (SDRL). However, RIG stock is trading near its 52-week lows, unlike its major competitors.

It is true that most of RIG’s valuation ratios are higher than its peers’. The only exceptions are the P/S and P/B ratios. Transocean’s P/B and P/S are quite low compared to its fellow offshore drillers.

At the same time, the fact that Transocean’s ratios are higher than their peers’ is due to the fact that Transocean is the industry’s leader. In other words, it has the largest fleet and the highest backlog. In other words, it is a much bigger company than its fellow offshore drillers I have mentioned above.

Risks

The risks facing Transocean are both general and company-specific.

- First, the Fed’s higher interest rates for longer may eventually provoke a recession. This, ceteris paribus, will make oil prices crash. Although the offshore sector relies on long-term investments, if commodity prices stay low for longer, this will negatively impact offshore drillers, including Transocean.

- Unlike its peers’, Transocean’s balance sheet is not impeccable. However, following the offshore drillers’ post-Covid recovery, major agencies raised Transocean’s credit rating. For example, Moody’s increased Transocean’s rating to B3 from Caa1. Moreover, the fact that Transocean is not as profitable and has some debt makes it an even better bet on broader offshore recovery. More stable and debt-free companies’ market caps do not increase as dramatically as do less stable companies’ if there is a broad oil market recovery.

- Any major capital investment may force Transocean to issue more shares, thus diluting its existing shareholders. But it seems that the management is very conservative and does all it can to strengthen its balance sheet and raise its cash levels.

Conclusion

Overall, Transocean published a sound set of results, but I was more impressed with the company’s fleet status report. The dayrates paint a very optimistic picture for the offshore drilling market. It is possible that eventually the company will reactivate its cold-stacked rigs. But a lot depends on the broader economic environment and oil prices. A recession can delay offshore oil’s brilliant recovery.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.