Summary:

- Transocean LTD. has a strong balance sheet, with net property and equipment assets that far exceed its total debt.

- Transocean LTD. has so many assets that even in a bankruptcy scenario shareholders could still expect to see gains from a cash payout from liquidation proceeds.

- The company’s contract backlog of $9.4 billion and its new drillships recently placed into production suggest healthy profits in the coming years.

landbysea/E+ via Getty Images

I believe that Transocean Ltd. (NYSE:RIG) is a strong buy for three reasons. The first is that RIG’s $16.9 billion in net property and equipment assets alone dwarfs its $7.39 billion in total debt. This means that even if RIG ran out of liquidity and had to file for bankruptcy where it then liquidated all of its property and equipment to pay off all of its outstanding debt, shareholders would still theoretically have $11.75 in cash to be paid out per share, a 92.3% upside from the current price of $6.11.

The second reason why I am so strongly suggesting RIG is its impressive contract backlog worth $9.4 billion. If this backlog is fulfilled RIG should see healthy profits over the next couple of years as the company begins to put their new drillships currently being built to work and as old drilling contracts expire and get replaced with new contracts that have significantly higher day rates.

The third reason is more of a broad general outlook in the oil market that suggests demand for offshore drilling stays high for the foreseeable future. These market forces are mainly comprised of oil production cuts from OPEC+, new developments in the Red Sea, and continued conflict between Russia and Ukraine which should keep oil prices elevated giving RIG the chance to cash on its newly built offshore drilling units and lucrative new contracts.

About Transocean Ltd.

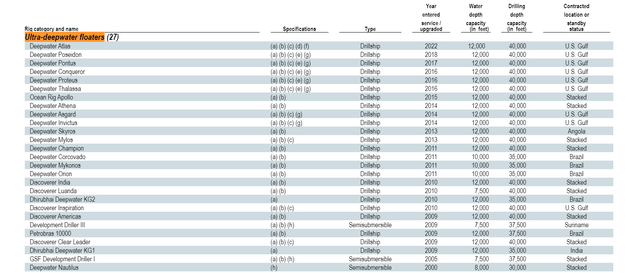

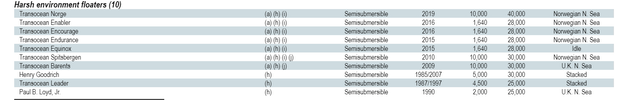

Transocean Ltd. provides offshore drilling services for oil and natural gas. Based out of Steinhausen, Switzerland and listed on the New York Stock Exchange, RIG conducts its offshore drilling operations worldwide using both harsh environment semi-submersible floating rigs and deep sea drillships. As of September 30th, 2023 RIG had over 5,000 employees and a total of 37 mobile offshore drilling units comprised of 28 ultra deep water floaters and nine harsh environment floaters. As of October 2023 RIG has one new ultra deep-water drillship under construction and two new drillships that had just been recently completed in September.

Drilling Units (ultra-deepwater floaters) as of December 31st, 2022 (RIG 2022 10-K) Drilling Units (harsh environment floaters) as of December 31st, 2022 (RIG 2022 10-K)

Business Operations

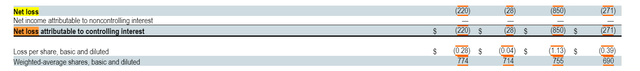

While Rig’s revenue continued to rise in the first nine months of 2023 from $1.97 billion to $2.09 billion they have actually banked a net operating loss of $850 million so far this year compared to a $271 million loss in the first nine months of 2022.

Revenue for the First Nine Months of 2023 (RIG 2023 3rd Quarter 10-Q ) Net Loss Figures for the First Nine Months of 2023 (RIG 2023 3rd Quarter 10-Q )

Many factors played a role in RIG’s increased costs and expenses in 2023. They recognized a $169 million dollar loss to trade one of their ultra-deepwater drillships for a noncontrolling interest in a company called Global Sea Mineral Resources who is a leading developer in deep-sea polymetallic nodules mining which is an exciting new way of extracting precious metals needed to fuel the growth of the renewable energy markets.

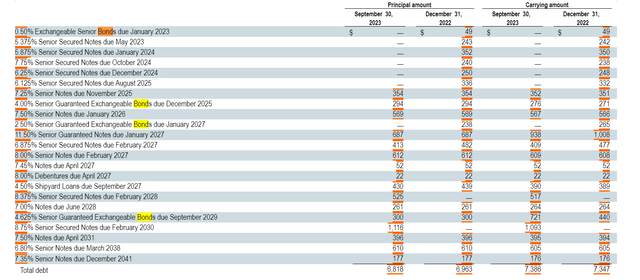

RIG also had an interest expense increase of $272 million in the first nine months of 2023 compared to the first nine months of 2022 stemming from recognized changes to the estimated fair value of the bifurcated compound exchange feature of their 4.625% senior guaranteed exchangeable bonds due September 2029 and another $169 million in payments related to their debt issued since September of 2022. RIG also recognized a $58 million loss for impairments on one of their assets held for sale.

General and administrative expenses increased $18 million in the first nine months of 2023. RIG saw an increase in depreciation and amortization expenses of $62 million which stemmed from new ship builds placed into service, drilling rigs that had reached the end of their useful life, and from Transocean Ltd. selling off some of their older rigs. Another $210 million worth of cost increases came from placing two new ultra-deepwater floaters into service, reactivation and contract preparation expenses, reduced activity as some of their contracts had ended, and inflationary costs of personnel and maintenance expenses among other things.

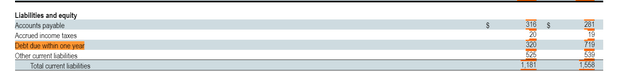

Upcoming Debt and Future Profits Ahead

All in all the debt that RIG had to pay within one year as of December 31st, 2022 was $719 million. As of September 30th, 2023 Rig only has $320 million worth of debt due within the next year. It really does look like RIG really went to work incurring a lot of expenses in 2023 so that the company has a much cleaner slate to work with in 2024. From the look of things it looks like RIG has a nice launch pad to profitability in 2024 as more and more of their old contracts are completed and RIG is able to renew contracts with much higher day rates.

Debt Due Within One Year (RIG 2023 3rd Quarter 10-Q)

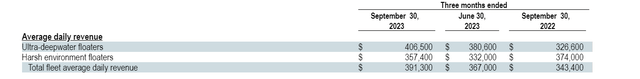

As of September 30th, 2023 Rig was able to charge an average day rate of $391,000 for their ultra-deepwater harsh environment floaters and $357,000 a day for their regular harsh environment floaters. Day rates are only expected to increase further and on December 12th, 2023 RIG announced a 540 day contract to drill in the Romanian Black Sea for a day rate of $465,000 a day and $480,000 a day for each additional day past their initial contract end date. Over the next three years 79% of their ultra-deepwater floaters will be able to take on more contracts and 94% of their harsh environment floaters will be available for new contracts. As this happens it should give RIG a straightaway to future growth and future free cash flow. It should also give RIG the ability to pay down its bond debts.

Average Daily Revenue from RIG’s Assets (RIG 2023 3rd Quarter 10-Q)

Contract Backlog And Discounted Cash Flow

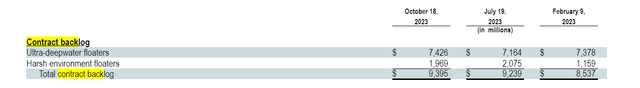

One of the key determining factors when purchasing stock is how you can expect that company to perform in the future and most importantly how much free cash flow that business can generate to either grow their business or return funds back to their shareholders. With RIG we are afforded an opportunity to more accurately gauge their future revenue and therefore get an estimate of their future free cash flows by glancing into their extremely impressive $9.4 billion backlog of drilling contracts it plans to service over the course of the next few years.

Contract Backlog Value (RIG 2023 3rd Quarter 10-Q)

As previously mentioned lot of money was spent this year on completing construction on new drill rigs as well as contract preparation and expenses related to reactivating oil and gas rigs to fulfill contracts. The more business expenses RIG incurs in 2023 that is directly related to generating future cash flow in 2024 the better RIG’s operating income will look come next year.

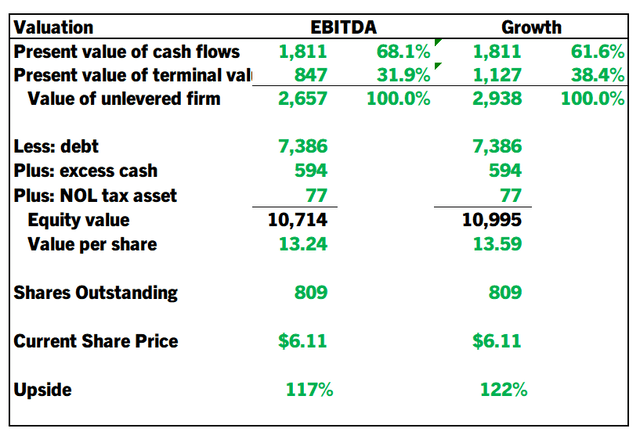

RIG should become greatly profitable from its contract backlog through 2027. I ran the company through a discounted cash flow model with a rather conservative 12.5% weighted average cost of capital while I kept all other figures modest and easily attainable with a 1.8% perpetual revenue growth rate, in addition to the $9.4 billion contract backlog with an EBIT rate of 5.0% through 2026 and a 7.3% EBIT rate afterwards and this stock still has a growth DCF model upside of 122% on a stock price of $6.11.

Discounted Cash Flow Model Results for RIG (Leland Roach)

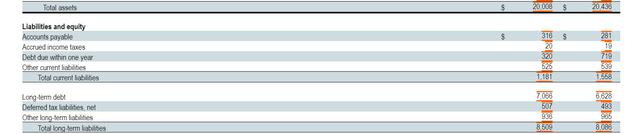

Net Asset Valuation Versus Liabilities

A large part of my conviction towards Transocean Ltd. is its large pile of assets in comparison to its debts. Currently RIG has $8.51 billion in total liabilities vs $20 billion in total assets. This debt to asset relationship per share should itself be enough to provide investors with an ample margin of safety. If RIG had to liquidate its business right now to pay off all of its debts investors would still have $14.21 a share in cash left over after all of RIG’s liabilities had been taken care of. Even if RIG only liquidated all of its property and equipment to pay off all of its outstanding $7.39 billion in total debt, shareholders would still be left with $11.75 in cash per share, a 92.3% upside from the stock’s current price.

RIG’s Assets Versus Liabilities Relationship (RIG 2023 3rd Quarter 10-Q )

Risks

The biggest risk RIG faces is an inability to generate cash flow sufficient enough to meet their credit agreement which obligates RIG to keep at least $500 million in cash on hand as well as have a minimum guarantee coverage ratio of 3.0 to 1.0, a minimum collateral coverage ratio of 2.1 to 1.0, and a maximum debt to capitalization ratio of 0.60 to 1.00. If RIG was unable keep above these ratios limits it may be forced to sell off some of its assets or incur fees and higher borrowing costs. RIG could also fail to make an interest or principal payment which would again likely trigger a liquidation of RIG’s assets.

Total Bond Debt (RIG 2023 3rd Quarter 10-Q)

This scenario plays directly into RIG’s margin of safety (its asset vs. liabilities). RIG could sell off half of its assets, become debt free, and the stock would still be fairly valued between $6.00 and $7.00 a share. Is also unlikely that RIG wouldn’t be able to pay its debts in 2024 because RIG only has $320 million worth of debt due within the next 12 months as of September 30th, 2023. This is under half of the $719 million worth of debt RIG had due over the next 12 months back in September of 2022.

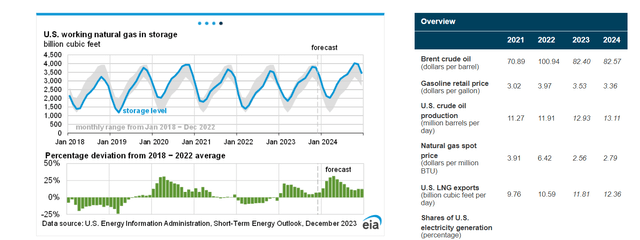

A collapse in oil prices would be the most likely scenario that would push Transocean Ltd. into a default however oil and gas prices are forecasted to remain relatively steady with 2024 oil price forecasts being priced at an average of $84 to $85 a barrel compared to the December average of $78 a barrel.

Short Term Oil and Natural Gas Outlook (U.S. Energy Information Administration)

Current developments in the Middle East and more specifically the Red Sea may also put upward pressure on the price of oil over the next 12 months. Spikes in the price of oil will lead directly to better earnings figures for RIG due to the immense pricing power they have on their offshore drilling rigs.

As previously mentioned RIG is going into 2024 with the highest day rates I have ever seen at $465,000 a day for a drilling contract in the Romanian Black Sea. If tensions in both the Ukrainian-Russian conflict and in the Red Sea stick around well into 2024 keeping oil prices elevated I can only imagine the day rates will only further increase which sets RIG up to profit handsomely.

Conclusion

I believe an interesting trifecta of events are currently converging that gives RIG an ideal launch pad to have a tremendous 2024. Oil production cuts from OPEC+ combined with continued conflict in eastern Europe combined with more recent tensions in the Red Sea should keep oil prices high through the next 12 months and give RIG leverage to continue increasing their rig day rates. RIG had also began operating two new Ultra-deepwater floaters as well as placed various other drilling rigs into service under new contracts as it begins to work on its large $9.4 billion contract backlog. Global conflict and OPEC+ production cuts combined with the ability to generate new revenues from brand new drilling rigs should lead RIG to profitability over the next 12 months. The third factor that should ensure a successful 2024 for Transocean Ltd. is the fact that it has so much less debt due over the course of the next 12 months compared to what it had due in September of 2022. This should speed up RIG’s growth story and give the company the flexibility to pay down debt or look for future growth opportunities within the offshore drilling and mining business sectors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.