Summary:

- Transocean’s recent contracts added $1.3 billion to its backlog, now totaling $9.3 billion, with high day rates indicating strong market conditions.

- Rumors of a potential merger with Seadrill Limited could significantly boost Transocean’s backlog and fleet, enhancing its competitive position in the offshore drilling market.

- Transocean’s stock remains undervalued despite rising day rates and strong fundamentals, partly due to low oil prices and market skepticism.

- The upcoming earnings report and management’s press conference will be crucial, especially regarding the potential merger and its financial implications.

Abstract Aerial Art

Transocean Ltd. (NYSE:RIG) has recently published a quarterly fleet status report. The incremental backlog of the new contracts totaled about $1.3 billion. As of October 24, 2024, the company’s total backlog was $9.3 billion. All the fixtures were at extremely high day rates. Furthermore, rumors are circulating that Transocean is discussing a merger agreement with its competitor Seadrill Limited (SDRL). Neither Seadrill nor Transocean has confirmed that yet.

RIG is set to report its quarterly earnings results post-market on 30 October 2024. The management’s press conference is expected to occur soon after the earnings announcement, during which significant recent developments, including the possible merger, will be discussed. Let me go into some detail about the recent news.

My previous analysis of Transocean

In my previous article about Transocean, I wrote that the company was announcing new contracts and reporting very high day rates.

RIG stock was lingering near its 52-week lows. At the same time, insiders were actively buying the shares. I also wrote that its stock price plunge was due to the non-cash charge resulting from the sale of two drillships.

The stock is still trading very low, while the contracts announced in the recent fleet status report are at excellent daily rates. The reason I am updating my analysis is because of the discussions of a possible merger between Seadrill and Transocean.

Quarterly fleet status report

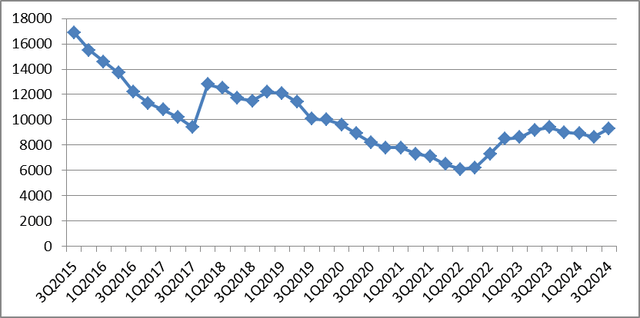

As mentioned at the beginning of this article, Transocean’s reported backlog totaled $9.3 billion. But let us see how high or low that really is. After all, to judge if the recent reported backlog was good, it is necessary to compare it to the previous periods, which I have done below.

Transocean’s quarterly backlog history (in $millions)

|

Period |

$ million |

|

3Q2015 |

16900 |

|

4Q2015 |

15500 |

|

1Q2016 |

14600 |

|

2Q2016 |

13700 |

|

3Q2016 |

12200 |

|

4Q2016 |

11300 |

|

1Q2017 |

10800 |

|

2Q2017 |

10200 |

|

3Q2017 |

9400 |

|

4Q2017 |

12800 |

|

1Q2018 |

12500 |

|

2Q2018 |

11700 |

|

3Q2018 |

11500 |

|

4Q2018 |

12200 |

|

1Q2019 |

12100 |

|

2Q2019 |

11400 |

|

3Q2019 |

10080 |

|

4Q2019 |

10020 |

|

1Q2020 |

9600 |

|

2Q2020 |

8900 |

|

3Q2020 |

8200 |

|

4Q2020 |

7800 |

|

1Q2021 |

7800 |

|

2Q2021 |

7300 |

|

3Q2021 |

7100 |

|

4Q2021 |

6500 |

|

1Q2022 |

6100 |

|

2Q2022 |

6200 |

|

3Q2022 |

7300 |

|

4Q2022 |

8500 |

|

1Q2023 |

8600 |

|

2Q2023 |

9200 |

|

3Q2023 |

9400 |

|

4Q2023 |

9000 |

|

1Q2024 |

8900 |

|

2Q2024 |

8640 |

|

3Q2024 |

9300 |

Source: Prepared by the author.

As can be seen from the diagram and the table above, the backlog reached its multi-year lows in 2022 but is now recovering at a fast enough pace. It is now near the levels seen in 2017 and 2019. But the most important part of the recent quarterly fleet status report story is the fact the day rates have greatly improved compared to the previously reported periods. That is not only true of Transocean. This is also true of the entire offshore drilling sector.

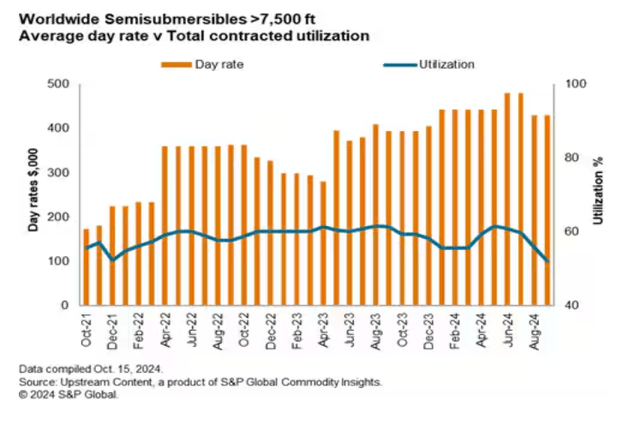

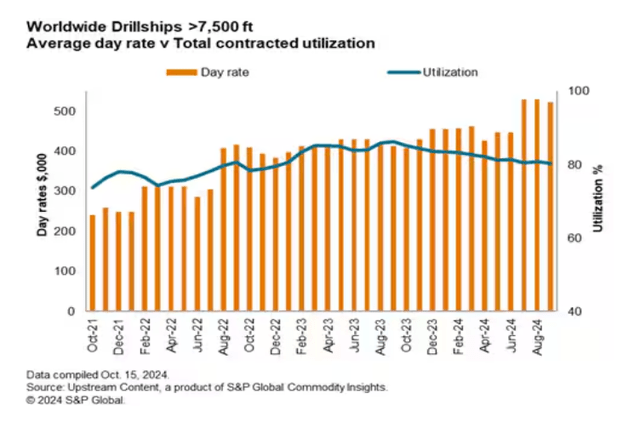

The diagrams below show the day rates and total contracted utilization for semisubmersibles and worldwide drillships. These types of equipment are ultra-deepwater. Transocean’s equipment, meanwhile, mostly consists of deepwater and ultra-deepwater equipment. So, the company is directly benefiting from rising day rates and reasonably high utilization ratios.

Offshore drillers’ progress is praised by leading experts and consulting firms. For example, according to Evercore ISI, the “Big 3” offshore drillers—namely Transocean, Noble Corp. (NE), and Valaris (VAL)—are all reporting “strong offshore fundamentals and a robust outlook” that will likely continue into 2030.

According to Evercore, this multi-year growth is due to years of underinvestment and the rising importance of energy security and reliability. The agency also notes that leading-edge day rates are lingering around the $500,000 mark. Meanwhile, a rising number of contracts is being awarded at the low- to mid-$500,000 day rates. The utilization for both floaters and jack-ups has substantially improved to the high 80s and low 90s percentage points, respectively.

So, we can easily see that the company’s backlog and its day rates are doing fine. But how about the rumors of a merger with Seadrill?

Transocean-Seadrill merger

According to a recent report from Bloomberg citing “people familiar with the matter,” Transocean is discussing a merger with its rival offshore driller Seadrill. The potential structure of a combination is still uncertain. Moreover, according to the sources, a final decision on whether the deal will be pursued has not been made and the companies could still choose to remain independent. The companies’ representatives have not commented on the widely expected deal.

The rumors come as there has been plenty of consolidation in the offshore drilling industry in the past few years. Recently, Noble became the world’s most expensive offshore driller by market cap after buying rivals Diamond Offshore (DO) this year and Maersk Drilling in 2022.

According to Bloomberg, merging with Seadrill would let Transocean achieve its aim of increasing its backlog of work while getting the most advanced rigs capable of drilling in water at a depth of more than two miles. Some analysts also say that the Noble-Diamond Offshore merger would also put pressure on Transocean, Seadrill, and Valaris to do the same to seize growth opportunities in the dynamic offshore market. If the merger takes place, this would create a fleet of 49 rigs. Transocean operates a fleet of 34 mobile offshore drilling units (MODUs), including 26 ultra-deepwater floaters and eight harsh environment floaters. Seadrill operates 15 MODUs, including 12 drillships, one niche semi-sub, and two harsh environment units.

According to Reuters’ reports, Seadrill’s CEO, Simon Johnson, said Seadrill was interested in buying distressed assets or players with “distressed” balance sheets. Merger plays could also be in the cards. The Reuters report also quoted Transocean’s President and COO, Keelan Adamson, saying that the company believed there was an opportunity for “one big consolidation, especially given that our customers are also consolidating.” Furthermore, Seadrill’s Johnson said his company was open to increasing its fleet by “20-25 units” and becoming “a junior partner” as long as the acquisition offer was a good one and reflected its fleet’s quality.

I believe there are many details to be discussed, and it is uncertain whether the merger deal would indeed take place. However, I still think that it would be a wonderful opportunity for Transocean to raise its backlog, further improve its fleet, and also take advantage of the excellent market situation where there are offshore equipment shortages. At the same time, I wonder how it would financially be for Transocean in the short-to-medium term. It will likely not be a takeover but a merger, but questions remain on how it would be done. Nevertheless, I believe that the management would indeed take the balance sheet and cash concerns into account and sign the deal only if the company can afford to.

Quarterly earnings release

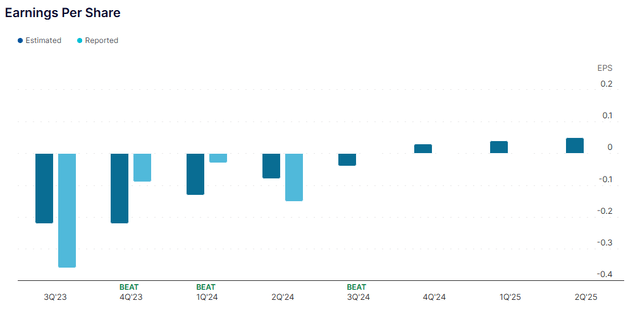

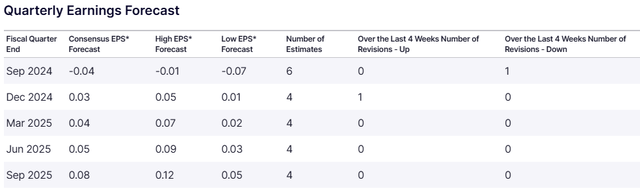

Transocean is set to report its earnings on 30 October 2024. Analysts expect that RIG will report EPS of -$0.04. As can be seen from the diagram below, Transocean’s quarterly earnings have been improving for a while, and so have the market’s earnings expectations.

The September 2024 quarter is expected to be the last time Transocean reports negative EPS.

However, I believe that earnings and revenues will not be the most important part of this quarterly report. Instead, I would be more interested to hear the management’s information about the widely expected merger deal with Seadrill. They might confirm or deny the upcoming deal. If it is to take place, then the management would give more financial details and also explain what the expanded company’s outlook would be.

Valuations

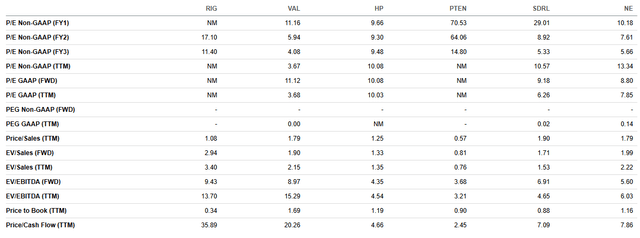

Many analysts consider Transocean to be highly overvalued compared to its peers.

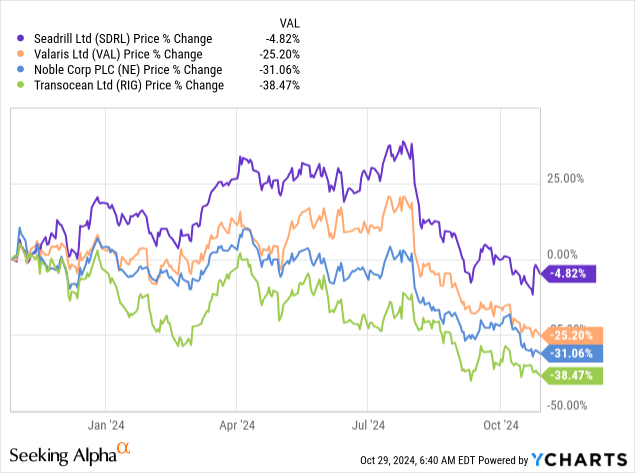

The price-to-free cash flow ratio is indeed substantially higher than its competitors. Moreover, given the fact Transocean does not currently have a positive net profit margin, its P/E ratios are negative. So, in this respect, we cannot really compare RIG to its peers. The EV/EBITDA ratio is lower than that of Valaris but higher than most other offshore drillers. Then, the P/B and P/S ratios are lower than Transocean’s peers’. This is explainable because Transocean is not particularly profitable and has some debt load. However, if we take a look at how the company’s stock did compared to its peers over the past year, we will see that Transocean’s stock is much more oversold than its close rivals’.

Y-Charts

At the same time, we should not forget that Transocean has been the industry’s leader for a long time. It has the largest fleet and the largest amount of backlog.

Upside factors

As I have mentioned above, according to many experts, offshore drillers’ growth has just started, it seems. We all know that Transocean is primarily a deepwater or even an ultra-deepwater offshore driller. So, it seems the company will be one of the first to gain here.

Most importantly, Transocean’s day rates are rising at a considerable speed. Who could have imagined a day rate of almost $700,000 for any of Transocean’s equipment a couple of years ago? At the same time, the market seems to ignore the good news that keeps on coming. RIG stock price does not rise when new contracts are announced. In my view, this is due to rather low oil prices.

Moreover, we should not forget Transocean’s leadership position, its fleet, and very capable management when criticizing RIG stock’s overvaluation. It is one of the few offshore oil companies that managed to avoid bankruptcy in 2020 during the pandemic. I do not agree that the company’s shares are overvalued compared to its peers, given Transocean’s fundamentals and how low the stock price has been in the past couple of months.

Downside risks

There are risks to my rather bullish position on Transocean’s stock. To start with, the company has a considerable amount of debt compared to its close peers, namely Valaris and Noble. Transocean has a negative net profit margin. However, it is not negative because of the negative cash flows from operations. It is negative due to the company’s equipment depreciating.

Then, there is a general risk of a recession and the glut of oil supply coming from either OPEC+ countries or US shale producers. The Chinese economy, oil’s largest consumer, is slowing down. At the same time, as I have mentioned in my recent article about the oil market, investors are underestimating the Middle East threat, namely the conflict between Israel and Iran. Moreover, oil is still trading at quite low prices, as if the market only takes downside risks into account.

Conclusion

Although the likely merger ahead may not happen, it seems to pose plenty of opportunities for Transocean if it does indeed take place. RIG would increase its backlog and be able to compete with Noble, which has recently expanded. As the offshore industry is growing and more opportunities emerge, it would be a good idea for Transocean to have an even larger fleet and an even larger backlog. But key questions remain, including the probability of the deal as well as any details. Anyway, it would be interesting for me to hear the management’s press conference, which would soon follow the quarterly results announcement.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.