Summary:

- News of OPEC+ phasing out voluntary production cuts later this year caused crude oil prices to tumble to new four-month lows.

- Not surprisingly, offshore drilling stocks have sold off alongside the commodity, with highly leveraged market leader Transocean underperforming peers.

- The company announced an aggregate $161 million in contract extensions and option exercises for a number of harsh environment floaters, but overall contracting activity remains disappointing.

- Transocean also disclosed its intent to acquire the remaining 67% in the 6th generation harsh environment rig Transocean Norge against a combination of new common shares and senior notes.

- Valuation-wise , the company remains expensive relative to peers. With the stock price close to my $5.50 price target, I am reiterating my “Hold” rating on the shares.

pabst_ell

Note:

I have covered Transocean Ltd. or “Transocean” (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

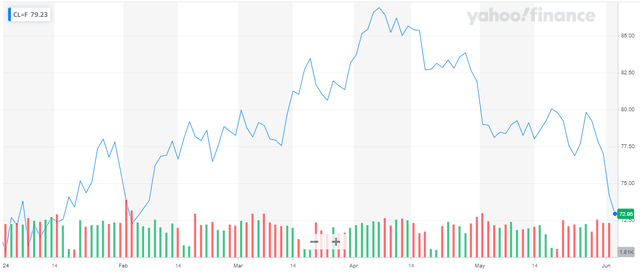

News of OPEC+ starting to phase out voluntary production cuts later this year caused crude oil prices to tumble to new four-month lows at the beginning of this week:

Yahoo Finance

Cautious commentary from Goldman Sachs (GS) and a surprise build in U.S. oil inventories certainly didn’t help sentiment.

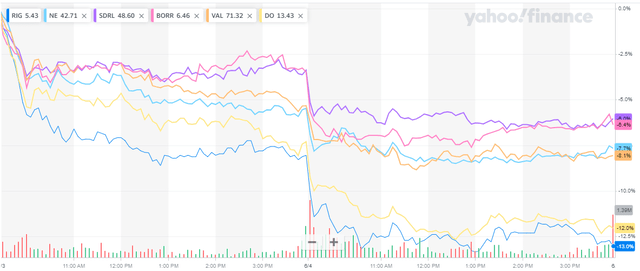

Not surprisingly, offshore drilling stocks have sold off alongside the commodity with highly-leveraged market leader Transocean underperforming peers:

Yahoo Finance

On Tuesday, the company issued a press release celebrating an aggregate $161 million in contract extensions and exercised options for three of its harsh environment semi-submersible rigs:

- Transocean Spitsbergen was awarded a three-well contract extension with Equinor (EQNR) offshore Norway. Work is expected to commence in Q4/2025 in direct continuation of the rig’s current program. The extension also includes options for up to six additional wells. Fixed backlog addition amounts to $72 million.

- Transocean Norge secured a three-well contract extension with Wintershall Dea offshore Norway at a calculated dayrate of $507,000 with backlog addition of $71 million. That said, work is not going to start before Q1/2028.

- In Australia, customer Woodside Energy Group (OTC:WOPEF) exercised a priced one-well option for the Transocean Endurance which will keep the rig working through May 2025. Total backlog addition amounts to $18 million.

However, considering the company’s $850+ million quarterly revenue run rate, contracting activity remains disappointing.

Please note also that the Transocean Spitsbergen contract had already been discussed on the recent Q1/2024 conference call.

Without material new contract awards, Transocean’s backlog is likely to decline for the third consecutive quarter.

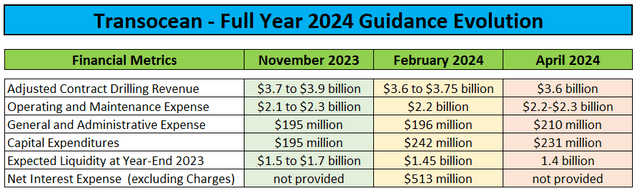

The company’s financial performance has been disappointing in recent quarters with results falling short of expectations and full-year 2024 guidance lowered twice already:

Conference Call Transcripts

Management attributed the shortfall to a plethora of issues including delayed contract commencements, adverse weather conditions and operational problems with the latter resulting in Q1/2024 revenue efficiency dropping to new multi-year lows.

In addition, Transocean’s persistent debt issues have resulted in substantial dilution for common shareholders in recent years. Since the beginning of the decade, outstanding shares have increased by approximately 35%. Assuming conversion of in-the-money exchangeable notes, dilution would exceed 50%.

Unfortunately, equity holders are likely to experience additional dilution in the not-too-distant future as Transocean has disclosed its intent to acquire the remaining 67% in the Transocean Norge, a 6th generation harsh-environment semi-submersible rig originally ordered by competitor Seadrill (SDRL) and acquired in 2018 by Transocean and funds affiliated with Hayfin Capital Management LLP (“Hayfin”) for $500 million (emphasis added by author):

On June 3, 2024, a subsidiary of Transocean entered into a non-binding letter of intent with certain funds managed (…) by Hayfin (…) for the acquisition by Transocean of the outstanding equity interests in the joint venture that owns the Transocean Norge.

Presently, Transocean owns a 33.0% interest in the joint venture and Hayfin owns the remaining 67.0% ownership interest.

The consideration in the proposed transaction is anticipated to be a combination of ordinary shares of Transocean and senior notes issued by a subsidiary of Transocean.

The proposed acquisition is subject to regulatory approval in Norway, and Transocean submitted on June 3, 2024 a merger control filing in respect of such approval. Transocean would expect to consummate the acquisition as soon as practicable after obtaining the required regulatory approval.

Strangely, the company abstained from disclosing the agreed purchase price.

However, with the rig working on a profitable multi-year contract and Hayfin likely to demand a reasonable return on its $335 million investment, I would expect a payment of at least $400 million.

Even worse, if the value of the common stock component hasn’t been fixed, Hayfin would be incentivized to short Transocean’s shares ahead of closing in order to hedge gains and maximize its share allocation.

Assuming the purchase price consisting of 40 million new common shares valued at $5 per share and $200 million in new 8.25% senior notes, dilution would approximate 5% while annual interest expense would increase by $16.5 million.

Based on disclosures made in Transocean’s annual report on form 10-K, I would estimate the bareboat charter rate for the Transocean Norge to be between $70,000 and $80,000 per day.

However, with the company owning 33% of the joint venture, net daily bareboat charter expense is likely to be closer to $50,000 or $18.25 million on an annualized basis.

Under this scenario, there would be no material benefits to Transocean from the proposed transaction, particularly when considering the additional dilution for common shareholders.

Hopefully, the final deal structure will be more beneficial to the company as otherwise there would be no sense in pursuing a transaction (assuming Hayfin doesn’t hold a put option for its stake in the joint venture).

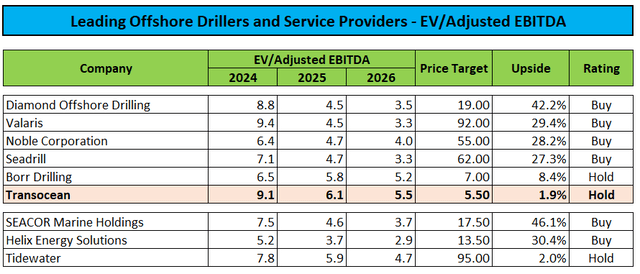

Valuation-wise, the company remains expensive relative to peers:

Value Investor’s Edge

Investors looking for exposure to the industry, should rather consider peers like Seadrill, Noble Corporation (NE), Valaris (VAL) and Diamond Offshore Drilling (DO) which are all trading at substantially lower forward valuations while commanding vastly superior balance sheets.

With shares trading close to my $5.50 price target, I am reiterating my “Hold” rating on Transocean.

Bottom Line

Transocean secured additional work for some of its harsh environment floaters, but contracting activity remains disappointing. Without material new contract awards, the company’s backlog is likely to decline for a third consecutive quarter.

In addition, the company’s intent to acquire the remaining 67% in the harsh environment rig Transocean Norge is likely to result in further dilution for common shareholders as well as higher debt levels.

Valuation-wise , the company remains expensive relative to peers. With the stock price close to my $5.50 price target, I am reiterating my “Hold” rating on the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.