Summary:

- Transocean, a leading offshore drilling company, has been awarded a $184 million contract for its semi-submersible, Transocean Equinox, in Australia.

- This deal, along with rising day rates in the offshore oil sector, suggests a positive outlook for the company despite low oil prices and potential recession.

- Transocean’s day rates have significantly increased, reaching close to $500,000 a day from a low of $125,000 during the pandemic.

- Despite the company’s significant debt load of $7 billion, the management has been actively deleveraging its balance sheet since the coronavirus crisis.

- The stock is currently trading at around $7 per share, or around 16 times its projected 2024 earnings, making it a potentially profitable investment in the coming years.

Jeremy Poland

Transocean (NYSE:RIG) has been recently awarded a 380-day contract for Transocean Equinox, its semi-submersible, in Australia. The deal is worth $184 million at a daily rate of more than $484,000. That again confirms the opinion I expressed in my previous articles on Transocean that the day rates in the offshore oil sector are rising substantially. Also, an excellent analysis was published on the largest offshore drillers on Barron’s website. In this article, I would like to discuss the whole situation in the offshore oil sector, Transocean’s rising day rates, and why its stock is a buy.

The current market situation for offshore drillers

Indeed, it does not seem particularly encouraging that the oil prices are quite low right now. The most important reason for that is the fact that the interest rates are going up and everyone expects a recession. However, oil prices can still rise due to the low commodity supplies, the unresolved European energy crisis, and any political turmoil. I wrote a more detailed analysis explaining this.

But even at the current commodity prices, it does make sense for oil majors to invest in more offshore drilling. According to a conference recently conducted by Schlumberger Limited (SLB), one of the leading services companies in the oil industry, 85% of offshore fields are profitable even if oil prices drop to $50 a barrel. Just think about this number. As of the time of writing, WTI is trading at a price of just under $70, Brent crude is trading at $73 per barrel, whilst everyone is expecting more rate hikes and a recession in the near future. For the oil prices to reach $50, there should at least be a mild recession. But bear in mind that offshore oilfields are long-term investments, whilst economic crises come and go. So, the oil prices should average $50 per barrel over a long time period. This is highly unlikely, however. The demand for fossil fuels is not going anywhere in the next several decades. Meanwhile, oil-producing nations, especially OPEC+ members, usually keep production at reasonable levels for them to be able to command higher prices. This is particularly true of Saudi Arabia. This country’s budget needs the oil prices to be at least $80 per barrel for its budget to avoid going into deficit.

You might argue that onshore oil drillers, and most importantly US shale producers are in a better position than offshore oil drillers. Yes, onshore companies are more flexible, indeed. They can quickly increase or decrease production. But they do not extract enough oil. According to Evercore ISI’s analyst James West, on average you can produce 1,000 barrels of oil a day from an onshore well that uses fracking, whilst some offshore oilfields located off the coast of Guyana can produce 20,000 barrels of oil per day. Moreover, the yearly rate of production declines for offshore wells is normally in the single digits. But if you look at onshore shale wells, you will see that in the first year of their utilization, their production decreases by 50% or more.

With that being said, let us have a look at the current day rates in the offshore sector. Just a reminder that Transocean mostly specializes in offshore deepwater drilling. There are now a total of 100 to 150 deepwater rigs operating in the Gulf of Mexico, the North Sea, Guyana, and a few other locations. Day rates on these rigs reached a bottom at about $125,000 a day during the pandemic in May 2020. Now they are close to $500,000 a day. So there was a four-fold increase. It is widely estimated that the rigs’ operating costs are generally below $150,000 a day. All this means that current contracts are highly profitable to invest in.

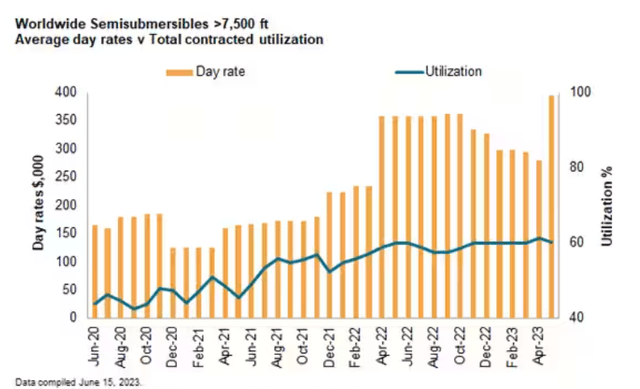

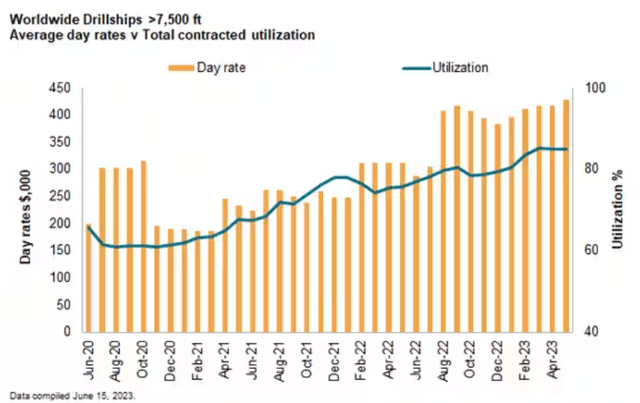

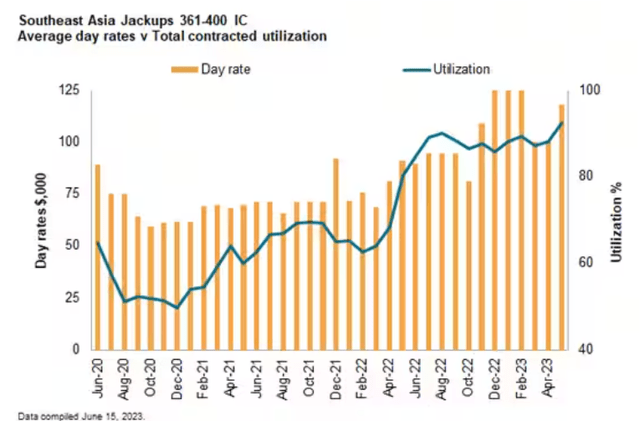

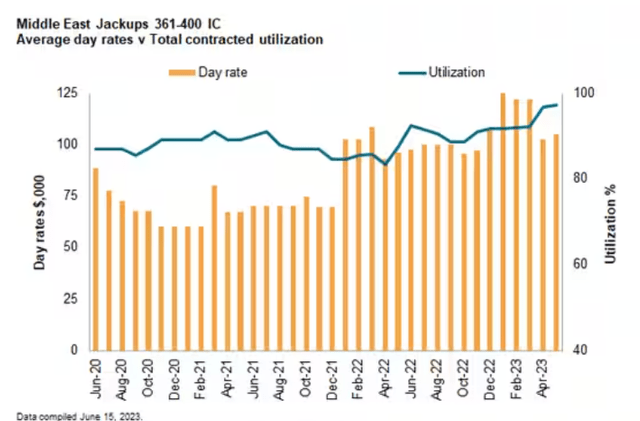

But Transocean is not solely a deepwater equipment company. Below I have presented a few diagrams from S&P Global’s website showing how the day rates for the various types of offshore equipment have changed.

As I have mentioned at the beginning of this article, RIG has quite recently reported a contract for its semi-submersible. The graph above shows how the day rates for this type of equipment have changed in the past three years. A particularly big jump happened in May this year. Now it costs about $400,000 per day to utilize a semi-submersible. This is a lot of money compared to June 2020. The utilization rate for this equipment type has risen dramatically but is still not 100%. So, I see growth potential in that respect, given the fact other types of offshore drilling equipment are almost fully booked.

The drillships able to operate at a depth of more than 7,500 ft are also able to command much higher day rates than they used to three years ago. Not all of them are booked yet. So, the demand for them can still move even higher.

The utilization rates of jack-ups both in Southeast Asia and the Middle East, however, are close to 100%. So, as soon as the oil majors run out of jack-ups, there will likely be a further surge in the day rates.

You might be wondering why then the offshore drillers are not getting high enough earnings. For example, Transocean is not recording positive GAAP net profits. That is only partly due to the high CAPEX. The main explanation for the fact the current earnings are quite low is because of older contracts carrying lower rates. But bear in mind that work on the new contracts recently signed by RIG and other drillers has not started yet. Many industry experts expect the profits to ramp up significantly during the 2024 – 2026 period thanks to higher rates on more recent contracts.

What is next for Transocean?

In my previous article on Transocean’s earnings, I covered RIG’s day rates in a lot of detail.

As I have mentioned many times before, Transocean is a high-risk – high-reward investment. At the same time, it is the industry’s leader, with the most operational deepwater rigs. It also has the largest number of stacked rigs that could be returned to the market.

In my opinion, the recent $184 million contract announcement is really just the beginning. As I have mentioned above, the utilization rates for many drillships and rigs have not reached their peaks just yet. This means that they can rise further because the demand seems to be on the uptrend. Meanwhile, there is not much idle deepwater equipment, meaning the day rates for many types of Transocean’s equipment can rise even further as well.

So, more contract announcements at higher day rates can push the company’s stock price upwards in the near future.

Risks

First of all, the company has a significant debt load of $7 billion, whilst its market value is just below $5 billion. The debt load means higher risks for Transocean, of course. But bear in mind that of all the largest rig operators only Transocean avoided bankruptcy during the coronavirus crisis, quite an achievement for its management.

But as I have mentioned in my other pieces on Transocean, the management has been actively deleveraging its balance sheet since the coronavirus crisis. Obviously, completely getting rid of the debt could push the equity prices higher as ownership truly passes from bondholders to stockholders.

Valuations

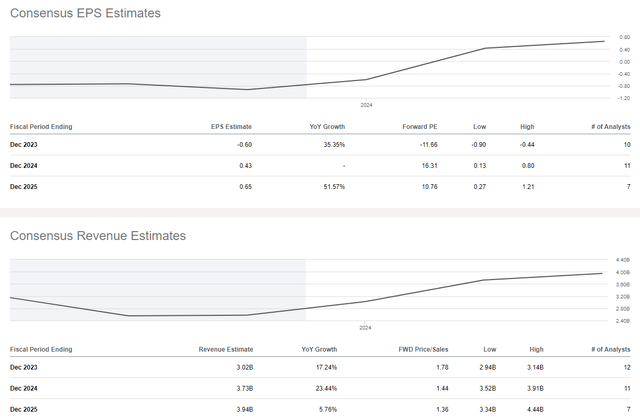

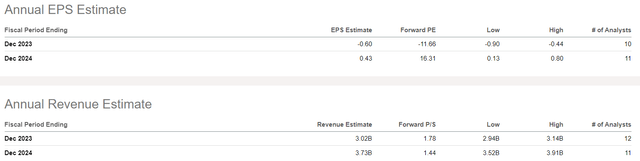

Now let us talk about the valuations. As I am writing this, the stock is trading at around $7 per share, or around 16 times its projected 2024 earnings.

The company’s forward P/S ratio for 2024, meanwhile, is 1.44, quite reasonable, given the company’s current stock price and the fact the company will be profitable enough in 2024.

The company could be one of the greatest stories in the energy sector in the next several years. According to Anderson, one of the industry’s experts, RIG’s potential annual free cash flow would total $1 billion from 2024 through 2026. If that turns out to be correct, then RIG is still trading quite low at a market cap of $5 billion.

Conclusion

Although I admit the fact Transocean is still quite indebted, the recent contract announcement is most likely not the last one because the industry is getting revived. And Transocean is here to benefit thanks to its largest fleet and higher day rates for the deep water equipment. RIG shares are also quite cheap relative to the company’s high 2024 projected EPS and sales.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.