Summary:

- Transocean’s quarterly earnings announcement caused the stock to drop by over 10%, but the market’s reaction was exaggerated.

- The company’s results have improved compared to previous quarters, with increased demand for harsh-environment floaters.

- Transocean’s management is optimistic about improving day rates, longer contracts, and potential reactivation of cold-stacked rigs.

- In April, the company also did a very successful debt exchange, and the company’s credit rating improved.

Abstract Aerial Art

Transocean (NYSE:RIG) reported its quarterly earnings on April 29, 2024, and the management held its press conference on April 30. The stock plunged by more than 10% on the day of the earnings announcement. But in my view, the stock market’s reaction was far too exaggerated. In this article, I will discuss the results, the press conference, Transocean’s outlook, and why I think RIG seems to have a bright future.

My previous coverage on Transocean

When I wrote my last article on Transocean at the beginning of February this year, the stock traded near 52-week lows. The shares started trading quite low in the fourth quarter of 2023 after the company’s fleet status report and the quarterly earnings results were published at the time. These disappointed investors, although there were some clear positive developments. The Middle East crisis did not escalate as fast as many investors expected. So, the oil prices did not exceed the $100 mark, something that disappointed investors and affected RIG’s stock price as well. At the time, the market also ignored the company’s positive deleveraging news, something that is also happening now. Transocean reduced its debt load in April this year, so apart from publishing sound earnings results, the company also managed to improve its balance sheet. So, even Moody’s, the credit rating agency, lifted the company’s credit rating. I will give more details of Transocean’s April deleveraging later in this article.

Transocean’s results

Overall, we can safely say that Transocean’s results have substantially improved compared to the previous quarters.

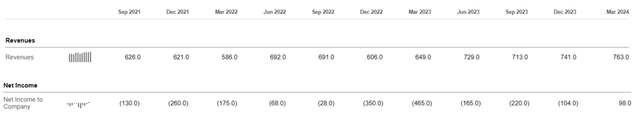

The revenues have improved both compared to the previous quarter and to the same period a year ago. Also, since September 2021, the March 2024 quarter was the first time Transocean’s net income was positive. It totaled $98 million, a sound number given Transocean’s rather poor profit track record.

A lot of analysts here on Seeking Alpha have very correctly mentioned that many rigs owned by Transocean are cold-stacked. But the demand for the company’s harsh-environment floaters has risen substantially compared to the same period a year ago.

Utilization

|

Three months ended March 31, 2024 |

Three months ended December 31, 2023 |

Three months ended March 31, 2023 |

|

|

Ultra-deepwater floaters |

51.2% |

46.8% |

52.5% |

|

Harsh-environment floaters |

62.0% |

66.7% |

50.1% |

|

Total fleet average rig utilization |

53.7% |

51.6% |

51.9% |

Source: Transocean

The average daily and contract drilling revenues have shown very sound progress. This is particularly true of ultra-deepwater floaters.

Average daily revenue

|

Three months ended March 31, 2024 |

Three months ended December 31, 2023 |

Three months ended March 31, 2023 |

|

|

Ultra-deepwater floaters |

$422,900 |

$432,100 |

$360,000 |

|

Harsh-environment floaters |

$367,900 |

$354,700 |

$376,000 |

|

Total fleet average daily revenue |

$408,200 |

$407,800 |

$364,100 |

Source: Transocean

Contract drilling revenues (in millions)

|

Three months ended March 31, 2024 |

Three months ended December 31, 2023 |

Three months ended March 31, 2023 |

|

|

Ultra-deepwater floaters |

$569 |

$536 |

$484 |

|

Harsh-environment floaters |

$194 |

$205 |

$165 |

|

Total contract drilling revenues |

$763 |

$741 |

$649 |

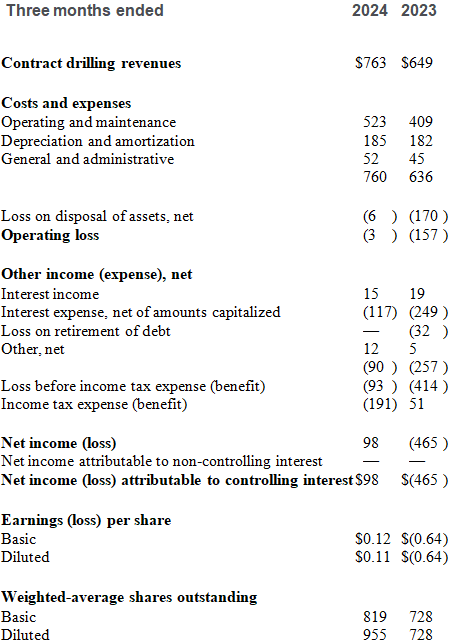

If we compare Transocean’s accounting results to the same period a year ago, we will also see some good progress. I will not go into too many details about RIG’s EPS because the company occasionally issues new shares. But even if we look at the total net income, we will see that Transocean’s performance improved.

Transocean

As explained by the management, the quarterly results were negatively affected by delays to rig start-ups in Australia and Brazil because of longer-than-expected mobilizations, extensive customer acceptance, processes, and operational start-up problems, rather long contract preparation for the KG1 in India, extreme adverse weather impacting the company’s operations in Norway, and finally, downtime on the Deepwater Titan. Most of these factors seem to be one-offs. And it is likely the results for the second quarter will be unaffected by most of these factors. So, there will be an improvement.

Transocean’s press conference

Now I would like to give my take on the key points of the management’s press conference.

The company’s day rates and contract durations have increased compared to earlier periods. For example, a contract for an additional four wells of 15K work on the Deepwater Atlas at a day rate of $505,000 per day was signed for a period between 240 and 360 days. The company was compared to more successful competitors and was often criticized for not being able to charge a day rate of $500,000. Well, it has managed to even exceed the $500,000 day rate. But the $505,000 contract might just be the beginning, and higher day rates might follow soon if the offshore sector keeps growing.

Also, important is the fact that contracts got longer. In 2022, the average contract length totaled 302 days, while in the first quarter of 2024, the length was 511, quite in line with 2023’s average of 526 days. You might argue that there was no improvement compared to 2023. But the results were only announced for the first quarter. So, even longer contracts can be announced in the following quarters.

The fact that the pace of the contract awards is not as fast as some analysts and investors would prefer can be explained by the fact that the financial commitment from Transocean’s customers is becoming far more substantial. In other words, higher day rates and longer contracts require more approvals within the customers’ companies. Moreover, Transocean’s active fleet is largely contracted through the end of the year. As I have mentioned above, a large portion of Transocean’s rigs are cold-stacked and not utilized by the company. So, the key challenge here is for Transocean to reactivate its cold-stacked rigs.

Another interesting idea mentioned during the conference was the fact that Transocean’s clients are willing to invest in new technologies like K-BOS, HaloGuard, Robotic Riser Systems Intelli-Wealth together with Transocean. This is a sign that the downturn in offshore drilling is finally over. Eventually, Transocean’s customers might start investing in the unstacking of cold rigs, since they now seem to be willing to commit more cash to offshore drilling.

But although the unstacking process might be costly, Rystad expects deepwater greenfield CapEx in 2025 to be the highest in 12 years. By 2027, total deepwater investment is said to reach almost $130 billion, a rise of about 40% from 2023.

Also, according to the management, there is a run on the active fleet. So, there are many oil majors trying to secure the rigs that are already active.

So, in 2024, almost the entire active fleet in the offshore industry will be sold out for two to three years. According to the management, towards the end of 2024, the demand for the stacked rigs will likely rise. So, before the end of the decade, several of those rigs would be put back to work. I know it might sound far-fetched and uncertain, but it seems that the management is open to reactivating the old rigs, which will probably be substantially cheaper than building new ones from scratch. This is very important because Transocean has been criticized for not being able to acquire much more backlog due to its limited active fleet. But with rig reactivations, this problem will be solved.

Another important bullish factor for Transocean is its deleveraging. In April, RIG did a tremendous $1.8 billion debt exchange to amend the company’s revolving credit facility. The proceeds from the bond offering were used to redeem the 7.25% senior notes due in 2025 and the 7.5% senior notes due in 2026. The company also managed to partially redeem the 8% senior notes due in 2027. Given the fact that Transocean also extended its revolving credit facility through mid-2028, the company’s financial stability greatly improved. According to the management, the company can even afford to make restricted payments, including dividends to shareholders, and also buy back its stock. This is a great achievement for a company that has been often criticized for its lack of profitability and heavy debt load. But many analysts here on Seeking Alpha ignore this, while the stock price plunged after the company’s earnings results. But Moody’s, the credit rating agency, upgraded Transocean’s rating to B3 from Caa1 thanks to these financial measures.

It also seems likely to me that more contracts will be announced very soon. It was mentioned during the conference that the Inspiration, repositioned in the Las Palmas area, is currently idle. Also, the idle DD3 in Aruba can easily be contracted. The management is also saying that there are plenty of contract opportunities in the Africa and Asia regions.

Risks

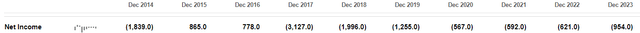

The risks are clear. To start with, RIG is not a blue-chip stock. In other words, it has some debt, and it does not have a sound profitability track record. The last positive annual income was recorded in 2016.

Also, the company dilutes its stock, which is bad for its price.

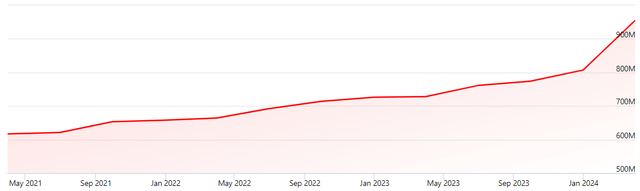

Right now, the total share count is 955 million, quite an increase from about 600 million in 2021.

Moreover, there are general downside risks, including those of a general oil price plunge and a recession.

However, high risks typically mean high returns. In other words, if the offshore sector keeps doing well and the company further reduces its debt load and announces even more contracts at even higher day rates, RIG stock will substantially rise in value, much higher than its debt-free peers Noble (NE) and Valaris (VAL).

Valuations

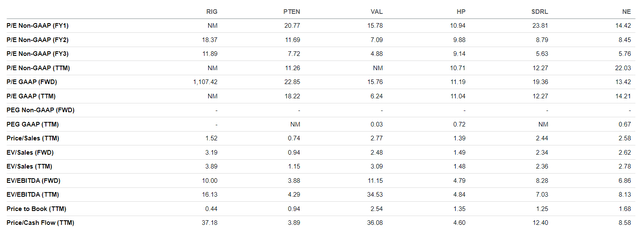

It is often argued that Transocean’s stock is overvalued compared to that of its peers. This is only partly so.

Valaris, Noble, and the rest of the companies mentioned in the table below are much more profitable than Transocean.

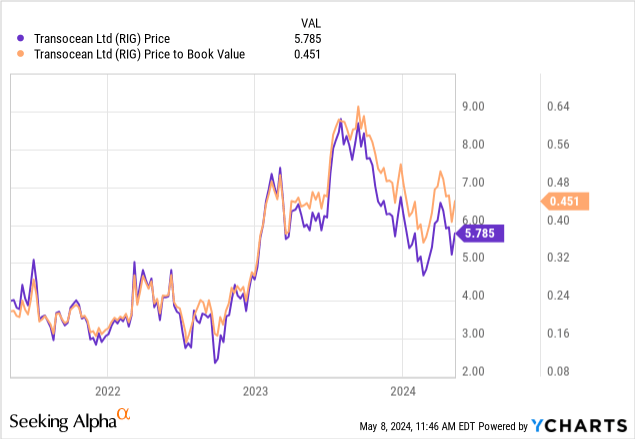

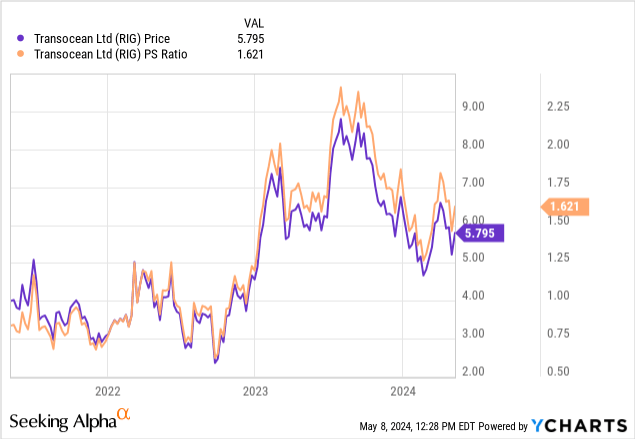

That is why its profitability ratios look much higher compared to its peers’. RIG’s GAAP P/E does not even exist. However, RIG’s price-to-book (P/B) and price-to-sales (P/S) ratios are almost the lowest in the industry.

Even if we look at Transocean’s P/S and P/B ratios, we will see that they are about average for this company and not at their all-time highs.

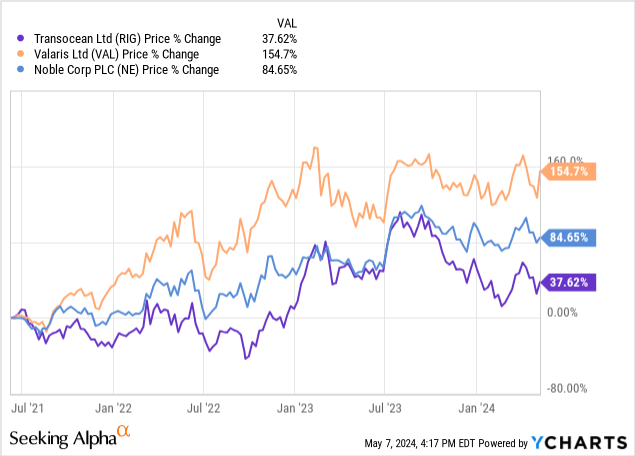

I would also like to compare Transocean’s stock price gains to those of its peers for the last three years.

Compared to its peers, namely Noble and Valaris, Transocean’s stock has gained substantially less in the past three years. This might suggest its undervaluation compared to peers. In other words, the stock market paid more attention to Transocean’s rivals because their shares rallied much more than RIG’s.

Conclusion

Transocean has reported a sound set of results. But even more brilliant was the company’s other news, especially its bond exchange and credit rating upgrade. More contract announcements are likely to follow soon. However, the company has room for improvement; it might substantially increase its backlog if it reactivates its cold-stacked rigs and the offshore drilling industry continues to expand. The outlook is highly positive for Transocean overall. The only key risks I see are those of a recession and a fall in oil prices. Otherwise, if the offshore sector does well, Transocean will likely keep doing well. Its stock is not expensive because many investors seem to ignore the good news.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.