Summary:

- Transocean is announcing new contracts and reporting record high dayrates.

- RIG stock is near 52-week lows, and insiders are actively buying the shares.

- Much of the stock price plunge was due to the non-cash charge due to the sale of two drillships.

Abstract Aerial Art

A lot has happened since my last coverage of Transocean (NYSE:RIG) stock. The oil prices have plunged. Transocean announced $645 million in non-cash impairment charge, which made the company’s stock plunge in value. But the company also received a new contract award, which is largely ignored by the market. Many market players and analysts expect an imminent recession. But bear in mind that Transocean’s top managers believe in the company they manage. So, why should we not take the hint and do the like? But let me dig in some more depth.

My previous work on Transocean

In my previous article about Transocean’s stock, I wrote about the company’s fleet status report, where a $531 million contract with record high day rates was announced. I also wrote about the company’s earnings release. Transocean reported a net loss but increasing revenues and positive cash flow. During the press-conference, the company’s management was also optimistic about the future and expected the fleet to be fully booked into 2026, improving balance sheet and liquidity projections.

Recent news and their consequences for Transocean

One of the main reasons for RIG’s stock price decrease was the surprise sale of two warm-stacked 6th generation floaters, resulting in aggregate proceeds of $342 million. However, this will also require an up to $645 million in non-cash impairment charge, which means there will not be any real consequences for Transocean’s financial position or business operations.

As my fellow Seeking Alpha analyst Henrik Alex mentioned in his article, the sale can be due to challenging market conditions for lower-specification units. However, if the conditions for the entire offshore market were indeed rocky, the recent fleet status report would have been so rosy. Offshore drillers tend to be long-term investments. By this, I mean that oil majors signing contract agreements with them tend to plan their drilling programs for the long term, unlike they do for more flexible and easy-to-cut oil production.

However, the market substantially overreacted to the news announcement as well as the recent fall in oil prices. I will write some more about the recent commodity price crash later in this article. In turn, the positive developments, like the new contract announcements, were largely ignored amid the market panic.

The first announcement was a $123 million ultra-deepwater drillship contract. Reliance Industries Limited signed a contract with Transocean for the Dhirubhai Deepwater KG1 for six wells offshore India. The estimated 300-day program will commence in the second quarter of 2026 and will contribute about $123 million in backlog, excluding additional services and a mobilization fee. This averages a dayrate of about $410,000. Some of Transocean’s contracts have higher dayrates. But a rate of $410,000 per day is very good for India because in India there have traditionally been relatively low rates. The award includes various options. If all options are exercised, the rig would remain in India until the end of 2029.

Also, a 365-day contract was announced for the Deepwater Atlas ultra-deepwater drillship with BP (BP) in the US Gulf of Mexico, as well as a 365-day option. Transocean expects the drilling program to begin in Q2 2028 and contribute approximately $232 million in backlog. The drillship is now working for Beacon Offshore in the Gulf of Mexico for $455,000 per day, with two extensions—one for four wells from July 2025 to February 2026 for a $505,000 per day, and another for two wells at a $580,000 dayrate. These figures are very sound, indeed. In fact, the dayrates hit record highs.

Even though these contracts will not start in the next several days to boost Transocean’s liquidity position, the fact these conditions were announced means the offshore industry is not struggling.

Oil market and its implications for Transocean

The oil prices have tumbled in the recent months. The most significant reason is falling oil demand in China, the largest oil importer. Neither OPEC+’s extension of voluntary cuts nor Libya’s supply outages have helped to support the prices. The biggest question for oil prices remains if most central banks, including the Fed, ease their monetary policies fast enough. If they manage the soft landing, the oil market would benefit. Also, much ignored is the conflict between Israel and Gaza. This is mostly due to the fact that Iran and the Gulf countries have not been directly involved in the military conflict. So, the impact on the oil prices has been limited. But there is still a probability the situation will get out of control, thus pushing the prices upward. Obviously, higher oil prices mean a higher RIG’s stock price. However, offshore drilling is a sector where oil majors invest for the long term. So, oil prices should stay higher for longer in order to have a materially high impact on Transocean and its peers.

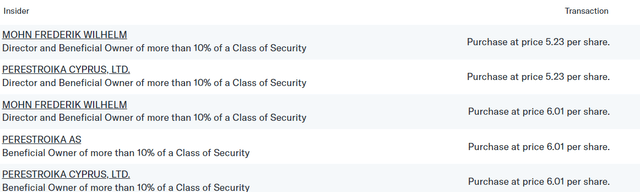

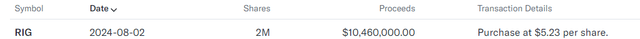

Management buying Transocean’s shares

It is reasonable to suggest that the company’s insiders know about Transocean much more than we do. Such insiders are obviously the company’s top managers and funds with a direct involvement in the company’s activities. The recent purchases of Transocean’s stock were made by Frederik Wilhelm Mohn, member of the finance committee and the governance, safety, and environment committee, and Perestroika Ltd., a Norwegian investment company owned and managed by Mr. Mohn. These purchases were made at a price of between $5 and $6. The latest time when Mr. Mohn bought the stock was on 2 August 2024. Overall, 2 million shares were bought at a price of $5.23 for a total sum of $10.46 million.

This suggests that one of the directors considers Transocean’s shares to be worth substantially more than they are trading now at around $4 per share as I am writing this.

Transocean’s fundamentals

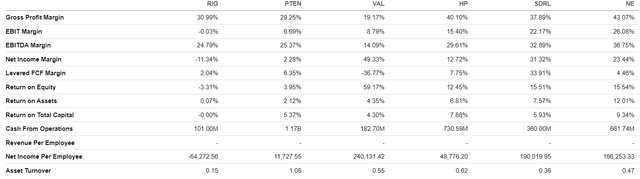

The truth is that Transocean does not make a positive net profit. However, this does not affect the company’s financial position because most of the loss is due to amortization and depreciation. In fact, Transocean has a sound gross profit margin, much better than Valaris (VAL) and better than Patterson-UTI Energy (PTEN). RIG’s EBITDA margin is also much better than VAL’s, albeit worse than Helmerich & Payne’s (HP), Seadrill’s (SDRL), and Noble’s (NE). Even though Transocean’s profitability is not brilliant but not as catastrophic as some of the analysts bearish on the stock are trying to show.

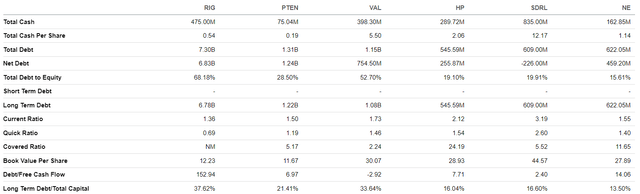

However, Transocean’s debt is much higher than all of its peers’. It also has substantial net debt and total debt-to-equity indicators.

This is probably the only factor that poses risks to Transocean.

RIG stock valuations

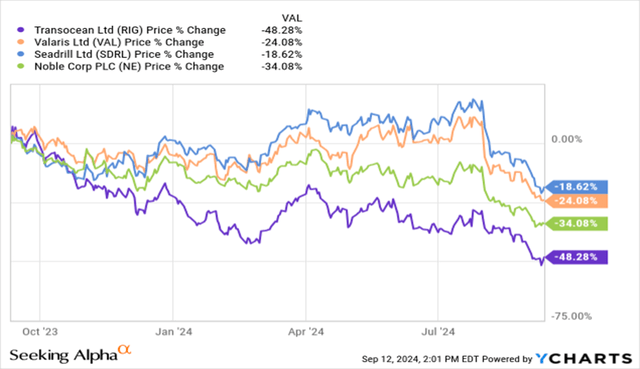

From the graph below, we can clearly see that Transocean’s shares have decreased substantially more than other companies’ shares over the past year. This is true of Seadrill, Valaris and even Noble, even though Transocean is the largest offshore driller. This greater volatility is mostly due to Transocean’s higher debt load, in my opinion. But it also shows two positive things. First, Transocean’s stock is more oversold. Then, it also means that if the market picture gets for favorable for oil, then Transocean’s stock is more likely to jump higher than its competitors’.

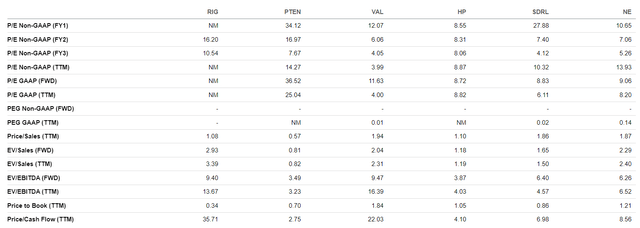

However, if we take the company’s valuation ratios, we will see that most of Transocean’s peers have lower valuation ratios than RIG. Only Transocean’s P/B and forward EV/EBITDA ratios are lower than its peers’. However, we should not forget that Transocean is the offshore industry’s largest player with the most considerable backlog. So, it deserves to trade at a premium, in my view.

Risks

Transocean is not a cash cow and has some debt to pay back. But thanks to the non-cash impairment, which was seen as a piece of bad news, leading to aggregate proceeds of $342 million, Transocean’s cash reserves have risen. So, the reaction to Transocean’s sale of two drillships was rather exaggerated, in my opinion.

As an oil company and not a highly profitable firm Transocean is a bigger risk if there is a recession. Many analysts are saying an economic crisis is imminent. However, most central banks and most importantly the Fed are getting dovish. So, a rate cut might mean the oil industry’s and the offshore drillers’ revival. This should obviously affect Transocean as well.

RIG’s stock price has been volatile for a while. And some investors may find this to be a substantial risk. However, the fact the stock is trading near its 52-week lows suggests that it may be overvalued. I have mentioned this in my previous section.

Conclusion

Despite some risks, investors’ concerns, lack of Transocean’s profitability and a likely recession ahead, Transocean may be a sound buy now when it is trading near its 52-week lows. Although there is a risk the oil prices may crash further due to their cyclicality, Transocean is recording excellent dayrates and may therefore be a sound buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.