Summary:

- On Tuesday, shares of leading offshore driller Transocean Ltd. marked new 52-week lows, likely due to a combination of perceived negative company-specific news and a selloff in crude oil.

- The surprise sale of two warm-stacked 6th generation floaters will result in aggregate proceeds of $342 million but also require an up to $645 million non-cash impairment charge.

- Essentially, the sale can be viewed as an admission to rocky market conditions for lower-specification units, as already stated by several competitors recently.

- Please note also that even with the industry currently undergoing a period of lower contracting activity, 2025 should be a much better year in terms of profitability and cash generation.

- With net debt coming down by more than 5% and only minor estimate revisions, I consider the selloff as overdone. With almost 20% upside to my unchanged price target of $5, I am upgrading Transocean shares from “Hold” to “Buy.”.

pabst_ell

Note:

I have covered Transocean Ltd. or “Transocean” (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

On Tuesday, shares of leading offshore driller Transocean dropped to new 52-week lows on heavy trading volume. This was likely due to a combination of crude oil selling off by more than 4% and perceived negative company-specific news:

On September 3, 2024, as part of our ongoing efforts to dispose of non-strategic assets, Transocean Ltd. (the “Company”) announced that a subsidiary of the Company entered into agreements (the “agreements”) with a third party to sell the Development Driller III and associated assets for $195 million and the Discoverer Inspiration and associated assets for $147 million. The Company expects the sale of these assets, for an aggregate $342 million, will result in an estimated non-cash charge for the third quarter 2024 ranging between $630 million and $645 million associated with the impairment of such assets.

The transactions contemplated by the agreements are subject to customary closing conditions and are expected to close in the third quarter of 2024. The Company intends to use substantially all of the proceeds from these transactions to repay existing indebtedness.

At least in my opinion, market participants are rightfully scrutinizing the surprise sale of the 6th generation drillship “Deepwater Inspiration” and the 6th generation semi-submersible rig “Development Driller III” for a handful of reasons:

- An up to $645 million impairment charge resulting from the sale of just two warm-stacked floaters doesn’t bode well for the market value of the company’s idle fleet.

- If these rigs are indeed considered non-strategic, there would have been no need to keep the idle units in the fleet for more than a year already. In addition, why hasn’t the company disposed of comparable cold-stacked units long ago?

- On the recent Q2 conference call, management stated that Transocean was just waiting for the right long-term contract opportunity for these assets.

- The sale results in a reduction of the company’s earnings power.

- Given the purchase price, it is very likely that the units will continue to compete in the offshore drilling market.

Let’s take a look into these issues in more detail:

1. Massive Impairment Charge

While it should be no secret that the book value of the company’s assets is well above the current market value of Transocean’s fleet, market participants have likely been caught flat-footed by the sheer amount of the impairment charge.

The charge will reduce the company’s equity by 6%, but with sales proceeds being earmarked for debt repayments, Transocean’s important debt-to-capitalization ratio will remain at 0.41, well below the 0.60 covenant governing the company’s undrawn revolving credit facility.

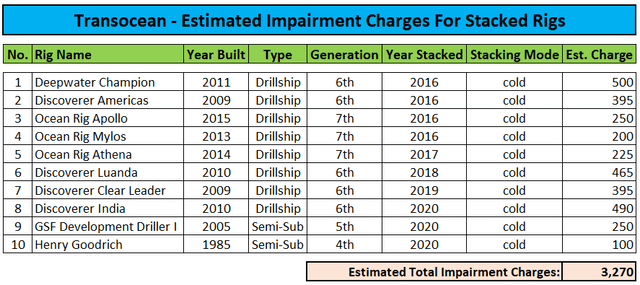

Even if we assume zero sales proceeds and an aggregate $3.3 billion in impairment charges for Transocean’s remaining idle units, the company’s debt-to-capitalization ratio is not likely to eclipse 0.50.

Regulatory Filings / Author’s Estimates

Please note that this is a highly unlikely worst-case scenario as the company’s cold-stacked fleet includes three high-specification 7th generation drillships which might still make it back into the market.

Regarding the company’s active fleet, it is critical to note that individual asset values are often boosted by attached long-term contracts. As long as these rigs remain in Transocean’s fleet, the company should manage to avoid impairment charges.

In sum, while the headline number looks plain ugly, the impairment charge is mostly an accounting exercise with no implications for the company’s debt covenants.

2. Non-Strategic Assets

Quite frankly, with the table above containing five drillships and one semi-submersible rig with similar or even lower specifications, investors are rightfully asking why Transocean hasn’t disposed of these assets long ago already? Instead, they are selling two warm-stacked units, which won’t require a large amount of investment to compete in the marketplace again.

The most likely answer is that Transocean has been trying to avoid outsized impairment charges without prospects for material sales proceeds.

Remember that management estimates reactivation costs of up to $125 million for the company’s cold-stacked rigs, a number that I consider too low given the fact, that several units have been stacked for almost a decade now.

In the case of Deepwater Inspiration and Development Driller III, very manageable reactivation costs likely attracted the buyer to the rigs. With almost $350 million in sales proceeds, management was apparently willing to take the resulting impairment charge.

3. Conflicting Management Statements

During the questions-and-answers session of the Q2 conference call, CEO, Jeremy Thigpen, stated that the company was just waiting for the “right opportunities” for these rigs:

I think, as we said before, we’re basically going to only put them on the right opportunities, but we’re not going to try and compete with them for the short-term market. So we’re basically keeping them dry for longer opportunities.

Given the surprise sale of the rigs, it is fair to assume that management no longer expects these “right opportunities” to arise anytime soon. Essentially, the sale can be viewed as an admission to less-than-stellar market conditions for lower-specification units, as already stated many times by various competitors.

4. Reduction Of Earnings Power

While the sale is not likely to impact analyst estimates for the remainder of the year, I would expect that at least some models include renewed contributions from these rigs starting in 2025. As a result, I would expect several analysts to reduce their forward estimates for the company.

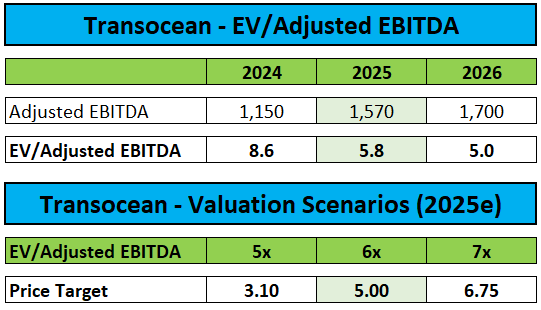

For my part, I assumed only minor EBITDA contributions for next year, thus resulting in my estimates and price target remaining largely unchanged:

Author’s Estimates

5. Sale To Competition

Given the substantial purchase price, I would expect the rigs to continue competing in the marketplace rather than being repurposed. With Transocean’s remaining 6th generation floaters all employed on long-term contracts with Petrobras (PBR), the sale of the Deepwater Inspiration and Development Driller III will not result in immediate direct competition for Transocean. However, the more units leaving the fleet, the better the overall industry supply picture.

Management has already demonstrated its willingness to sell non-core assets to competitors, as evidenced by the recent sale of two 5th generation semi-submersible rigs to Dolphin Drilling.

Bottom Line

While market participants have likely been caught flat-footed by the massive impairment charge and are rightfully scrutinizing the company’s motivation behind the surprise disposal of two warmed-stacked 6th generation floaters, I don’t consider the sale a major issue. Given the current lack of demand for lower-specification floaters, these units would have likely been sitting idle for years to come. In fact, I was positively surprised about the fact that a buyer was willing to shell out almost $350 million for these assets.

With net debt coming down by more than 5% and only minor estimate revisions, I consider the selloff as overdone. With almost 20% upside to my unchanged price target of $5, I am upgrading Transocean’s shares from “Hold” to “Buy.”

Please note also that even with the industry currently undergoing a period of lower contracting activity, 2025 should be a much better year in terms of profitability and cash generation for Transocean and the industry as a whole.

However, investors looking for exposure to the ultra-deepwater market should rather consider peers like Noble Corporation (NE), Valaris (VAL) and Seadrill (SDRL), which all trade at substantially lower valuations while at the same time commanding vastly superior balance sheets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SDRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.