Summary:

- Leading offshore driller Transocean reported underwhelming Q1/2024 results with contract drilling revenues coming in below expectations and bottom line outperformance mostly the result of a large non-cash tax benefit.

- The company attributed the underperformance to delayed contract commencements, adverse weather conditions and operational issues.

- On the conference call, management issued Q2/2024 guidance below consensus expectations and reduced full-year projections for the second time within just two months.

- However, not all is bad as leading drillship rates have reached new recovery highs above $500,000 per day. With more rigs about to commence new high-margin contracts, the company’s financial performance should improve materially going forward.

- While I still expect 2025 to be the year of earnings inflection for Transocean and the industry as a whole, the company’s premium valuation is keeping me sidelined even after Tuesday’s 10% selloff. Reiterating “Hold” while reducing my price target to $5.50.

pabst_ell

Note:

I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Monday’s regular session, leading offshore driller Transocean Ltd. or “Transocean” reported underwhelming Q1/2024 results with contract drilling revenues coming in below expectations and bottom line outperformance mostly the result of a large non-cash tax benefit.

Regulatory Filings / Company Press Releases

On the conference call, management attributed the underperformance to a number of issues:

- delayed contract commencements for the Transocean Endurance, Deepwater Orion and Dhirubhai Deepwater KG2 due to “longer-than-anticipated mobilizations, extensive customer acceptance processes and operational start-up issues, as well as extended contract preparation“

- adverse weather conditions offshore Norway with the Transocean Encourage losing its position in a storm and drifting for miles in the North Sea

- unexpected downtime on the 8th generation drillship Deepwater Titan as the rig experienced issues during the initial deployment of its second 20k PSI blowout preventer (“BOP”).

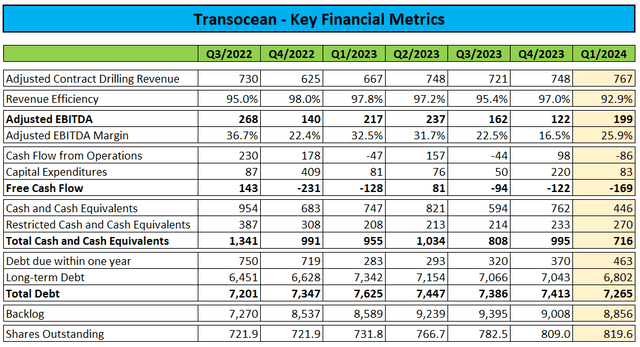

The Deepwater Titan’s BOP problems in combination with some “operational start-up issues” on other rigs resulted in revenue efficiency deteriorating to 92.9%, a new multi-year low for the Transocean stock.

In addition, the company experienced negative free cash flow of $169 million and finished the quarter with $716 million in cash, cash equivalents and restricted cash as well as $7.265 billion in debt.

Transocean expects to end the year with liquidity of approximately $1.4 billion. Please note that this number includes expected availability under the company’s undrawn revolving credit facility ($575 million) and restricted cash ($395 million).

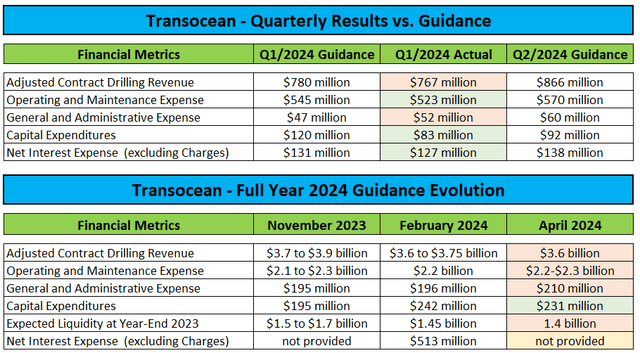

Adding insult to injury, management issued Q2/2024 guidance below consensus expectations and reduced full-year projections for the second time within just two months:

Press Releases / Conference Call Transcripts

Transocean’s weak results and disappointing outlook alienated market participants, thus causing the stock price to crater more than 10% in Tuesday’s regular session.

However, not everything was bad as the company secured follow-on work for the 8th generation drillship Deepwater Atlas at a market leading dayrate:

Also in the U.S. Gulf of Mexico, we just signed a contract for an additional four wells of 15K work on the Deepwater Atlas at a dayrate of $505,000 (…) in direct continuation of its current program expected to last between 240 and 360 days.

In addition, Transocean disclosed a letter of intent for the harsh environment semi-submersible rig Transocean Spitsbergen:

As an example of customers looking further into the future, we just signed a letter of intent, subject to final partner approval for the extension of the Transocean Spitsbergen by three wells estimated at 150 days plus 6 priced option wells in direct continuation, which is currently anticipated to be July 2025. We will disclose full details once the extension becomes a fully binding contract.

Subsequent to quarter-end, the company raised an aggregate $1.8 billion in senior guaranteed notes at very reasonable terms, as also outlined in the company’s quarterly report on form 10-Q:

In April 2024, we issued $900 million aggregate principal amount of 8.25% senior guaranteed notes due May 2029 (the “8.25% Senior Notes”) and $900 million aggregate principal amount of 8.50% senior guaranteed notes due May 2031 (the “8.50% Senior Notes”), and we received $1.77 billion aggregate cash proceeds, net of issue costs. The 8.25% Senior Notes and the 8.50% Senior Notes are fully and unconditionally guaranteed on a senior unsecured basis by Transocean Ltd. and certain of our wholly owned subsidiaries. On or prior to May 15, 2026 and 2027, respectively, we may redeem all or a portion of the 8.25% Senior Notes and the 8.50% Senior Notes, respectively, at a price equal to 100 percent of the aggregate principal amount plus a make whole premium, and subsequently, at specified redemption prices.

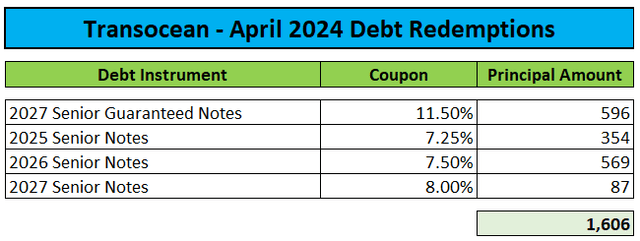

The majority of the proceeds were used to retire an aggregate $1.6 billion in near- and medium-term debt obligations:

The company also managed to extend its secured revolving credit facility by three years to June 2028 at less restrictive terms. However, commitments under the facility were reduced slightly from $600 million to $575 million, with another step down to $510 million in June 2025.

Despite the underwhelming performance and reduced 2024 outlook, management remained optimistic on industry prospects going forward (emphasis added by author):

(…) Additionally, and to emphasize the confidence that our customers have in the duration of this upside, we are actively engaged in conversations for rigs that are not scheduled to roll off contract for one to three years. In fact, all indications continue to suggest heightened demand for at least the next several years.

In its independent assessment, but an assessment that is fully supportive of our view, Rystad anticipates deepwater greenfield CapEx in 2025 will be the highest in 12 years. And that by 2027, total deepwater investment will reach nearly $130 billion, an increase of approximately 40% from 2023.

Additionally, there are many important deepwater projects expected to reach final investment decision this year, including BP’s Atlantis 4 and 20K Kaskida fields in the US Gulf of Mexico, Shell Bonga North in Nigeria, TotalEnergy’s Kaminho discovery in Angola and Venus Discovery in Namibia and ExxonMobil’s Whiptail in Guyana, which was approved earlier this month. These predications reinforce our confidence there will be sustained market tightness for the foreseeable future.

Please note also that two additional drillships (Deepwater Aquila and Dhirubhai Deepwater KG2) are expected to commence multi-year contracts with Petrobras (PBR) offshore Brazil next month, thus adding approximately $80 million to quarterly revenues.

However, with implied 2024 Adjusted EBITDA guidance lowered by another 10%, free cash flow for the year will likely come in around $250 million, approximately 50% below the number implied by management’s original 2024 guidance in November.

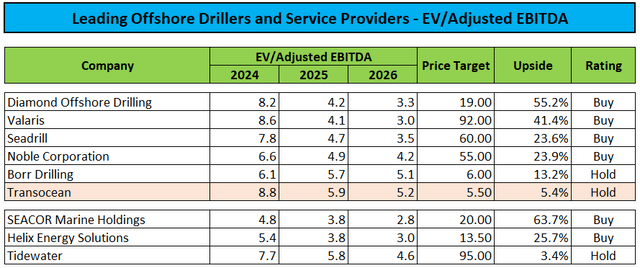

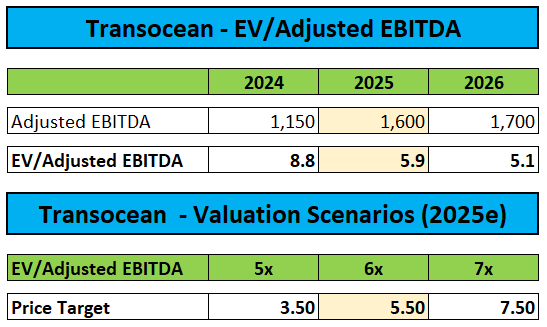

While I am leaving my recently increased 2025 Adjusted EBITDA expectations intact, higher-than-previously modeled net debt levels going into next year are resulting in the share price target being reduced from $6.00 to $5.50 based on an unchanged EV/Adjusted EBITDA multiple of 6x my 2025 Adjusted EBITDA estimate:

Implied Company Guidance / Author’s Estimates

Consequently, I am reiterating my “Hold” rating on the stock.

Investors looking for exposure to the industry, should rather consider peers like Seadrill Limited (SDRL), Noble Corporation (NE), Valaris (VAL) and Diamond Offshore Drilling (DO) which are all trading at substantially lower forward valuations while commanding vastly superior balance sheets.

Bottom Line

Market participants are clearly starting to lose patience with Transocean following another set of underwhelming quarterly results and lowered forward guidance.

While I still expect 2025 to be the year of earnings inflection for Transocean and the industry as a whole, the company’s premium valuation is keeping me sidelined even after Tuesday’s 10% selloff.

Peers in the floater space like Seadrill, Noble Corporation, Valaris and Diamond Offshore Drilling are offering substantially higher upside amid lower risk levels in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.