Summary:

- Transocean is reportedly considering a bid for industry peer Seadrill, which, we believe, would further extend its leading scale and position it well into the second half of the decade.

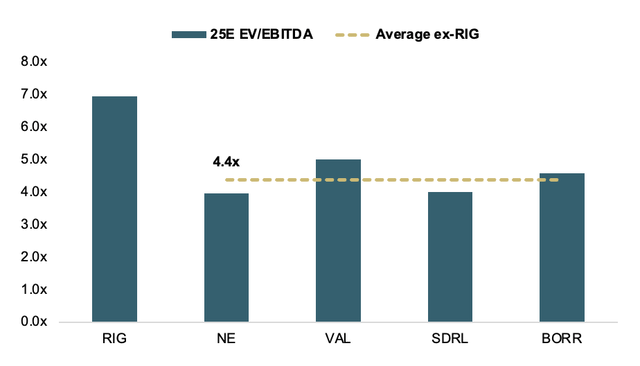

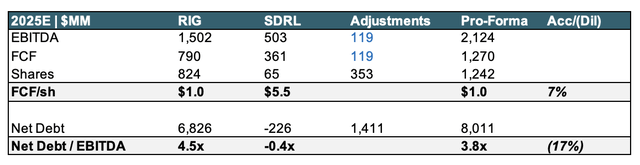

- We estimate a deal could be worth around $2.6B (5x Seadrill’s fwd EBITDA vs. sector average at ~4.4x) with Transocean likely issuing a significant amount of new shares.

- At our benchmark assumptions, we calculate a ~7% uplift on 2025E FCF/sh, potentially rising above 20% depending on funding structure and takeout multiple.

- We also expect the deal to be beneficial to Transocean’s debt metrics, lowering net debt/EBITDA to 3.8x and alleviating some investor concerns around its sector-high leverage.

arild lilleboe

On October 23, Bloomberg reported that Transocean (NYSE:RIG), the largest oil & gas offshore driller was considering a bid for Seadrill (SDRL), the currently fourth-largest industry player. While the report noted that any interest was highly preliminary and no concrete offers had been made so far, we believe a deal would make a lot of sense on both an operational and financial scale.

Acquiring Seadrill would extend Transocean’s leading scale while still remaining a 100% floater pure-play which, we believe, should benefit overproportionally as deep and ultra-deepwater grows in importance. While dayrates have been largely stagnant YTD, we also believe adding Seadrill’s high-spec and relatively uncontracted assets could position the combined company in a prime spot to capitalize on a renewed uptick in dayrates as contracting activity picks up again later next year and into 2026.

Based on current industry multiples, any deal would be likely to yield a valuation around $2.6B in our view ($2.8B in equity value). At our benchmark assumptions of a 50/50 cash/stock consideration split, this would result in the issuance of around 353MM additional shares, giving Seadrill shareholders a 43% stake in the combined company. Further assuming synergy potential at comparable levels to the recent Noble/Diamond merger, we estimate a potential deal to be ~7% accretive to 2025 FCF/sh while lowering pro forma leverage from 4.5x to 3.8x.

While Transocean’s high leverage remains a risk vs lower-levered or debt-free peers, we believe acquiring Seadrill during a period of relatively discounted industry valuations could prove a strong strategic move in the midterm, expanding the company’s scale and leverage to an emerging offshore supercycle. While we refrain from issuing a definitive price target due to the industry’s high volatility, we are confident in Transocean’s midterm prospects, especially should they be able to acquire Seadrill.

Key risks come from both industry-wide and deal-specific issues. Weaker oil prices could materially hinder offshore exploration efforts, resulting in lower dayrates going forward. Additionally, any deal will likely come both in the focus of peers and regulators. While we do not see any major antitrust issues given the industry’s global nature and spread of rigs, we would not rule out a potential counterbid from industry peers given Seadrill’s relative attractiveness. Should a counterbid and especially a bidding war between Transocean and a third party emerge, we believe Transocean might struggle due to its relatively lower financial flexibility.

[Note: Peers are Noble Corp (NE), Valaris (VAL) and Borr (BORR). All financials in US$; Transocean company projections taken from the January 2024 investor day and its most recent roadshow deck.]

Key Investment Thesis

With US shale growth peaking, offshore is set for a renaissance, with (ultra-)deepwater offering the highest growth. James West, equity analyst at US investment bank Evercore recently noted that “offshore and deepwater are currently undergoing a remarkable renaissance, driven by the imperatives of energy security, regionalization, and a maturing and disciplined North American shale supply”. While offshore simply refers to any oil production that does not take place on land, deepwater [DW] is typically defined as a water depth greater than 1,000ft with ultra-deepwater [UDW] referring to depths above 5,000ft.

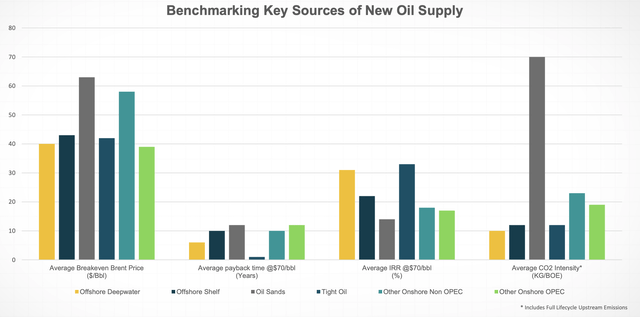

According to energy consultancy Rystad Energy, additional DW and UDW production is set to contribute around 9Mboed or 16% of total new production brought online through the end of the decade. Currently representing ~9.5% of global supply, this implies a more than 40% production growth with DW/UDW share of total production growing to 12% by 2030. While plateauing growth in the US shale patch is a key driver of the return to offshore, we also believe offshore, and especially deepwater, provides some of the most cost- and emission-efficient ways of oil and gas production.

As opposed to shale wells, deepwater projects have a much longer lifecycle, requiring significantly less incremental capex once brought online which leads to a faster payback and, ceteris paribus, better cash margins. According to Rystad, deepwater projects have an average breakeven price of just around $40/bbl Brent while generating a >30% IRR at $70/bbl while drilling on the continental shelf has slightly weaker economics. Specifically compared to the average US shale well, offshore wells also tend to have a more favorable (that is higher) liquids mix with most crudes produced offshore being also slightly heavier which bodes well for refining. With US shale becoming increasingly gassy, we believe this should further contribute to offshore’s relative attractiveness.

Rystad Energy via Transocean IR

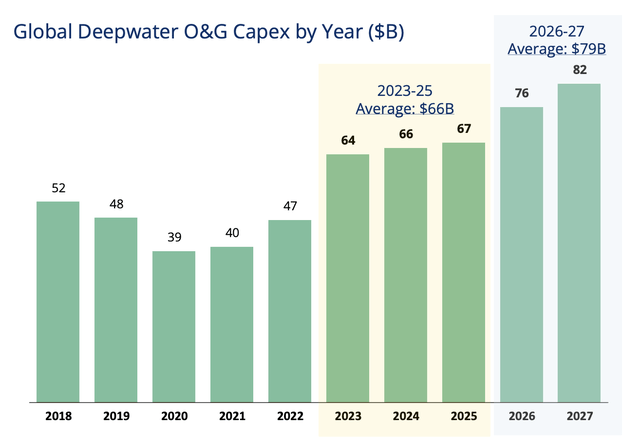

With several key projects coming online in the second half of the decade and significant exploration efforts in key offshore regions, Rystad expects global deepwater capex to grow to over $80B by 2027, up more than 100% from its 2020 lows and around 25% above current levels.

While the Gulf of Mexico is expected to remain relatively flat given the ongoing consolidation in US oil & gas, Evercore notes that specifically South America is likely to continue being a key growth driver. Currently operating 40 deepwater rigs across Brazil, Guyana and Colombia, the firm expects the figure to rise to 45 by 2026. While Brazil will remain the major driver of the region we also anticipate growth in the Guyana Basin with currently only five rigs, notably none of which offshore Suriname. With TotalEnergies (TTE) and APA (APA) having FID’ed their first FPSO earlier this month, we expect further exploration efforts in Block 58 and adjacent areas to add some rigs while Guyana also continues to grow with three further FPSOs sanctioned/planned by the Exxon-led consortium.

In the midterm, we also see sizeable incremental demand along Africa’s west coast with Exxon announcing a $10B investment offshore Nigeria and Namibia’s Orange Basin emerging as a key frontier oil region. We believe the latter to be well-supported Shell’s (SHEL) and Total’s finds in the area with Galp’s (OTCPK:GLPEF) recent 10Bboe Mopane discovery also having drawn the attention of most global oil majors including Exxon and Petrobras (PBR).

Acquiring Seadrill would expand RIG’s scale advantage in deepwater and add $2.5B of high-quality backlog. With a more favorable outlook for deepwater vs shelf production in our view, we believe there is great economic sense for the deal. In the offshore drilling industry, there typically exist two types of rigs: 1) floaters, which are fully oceangoing vessels such as drillships and semi-submersible platforms and 2) jack-ups: platforms that are mounted to the seafloor. With jack-up deployment limited to lower water depths as found on continental shelves in i.e. the North Sea and the Persian Gulf, we believe floater demand should overproportionally profit from the growth in offshore production and floater pure-plays (such as RIG and SDRL) look better positioned vs mixed operators.

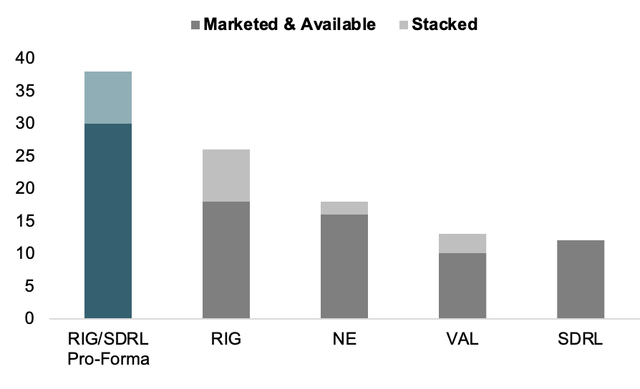

Through acquiring Seadrill, Transocean’s fleet of currently marketed and available 6th and 7th generation drillships would grow 70% from 17 to 29. This would make the combined fleet around double the size of next-largest peer Noble (16) and almost three times as large as Valaris (10). Including stacked rigs, combined drillship fleet size increases to 37, more than Noble and Valaris combined. With Transocean estimating a cost of ~$75-150MM to bring those ships online, we believe this spare capacity could become crucial later into the decade. As comparable newbuilds cost upwards of $1B and would likely take several years to construct given limited shipyard availability, this potential quick and cheap extension of marketable rigs should provide Transocean for additional growth upside once demand materializes.

UWD/DW Drillships Fleet (Company Filings)

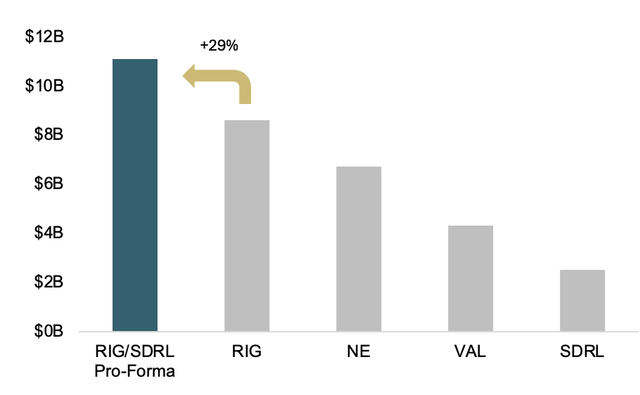

Based on latest available figures, acquiring Seadrill would also increase backlog by around 30% with absolute value rising from $8.6B to more than $11B. This would put the pro-forma entity around a similar backlog size to Noble and Valaris combined (~$11B).

Backlog as of Q2 24 (Company Filings)

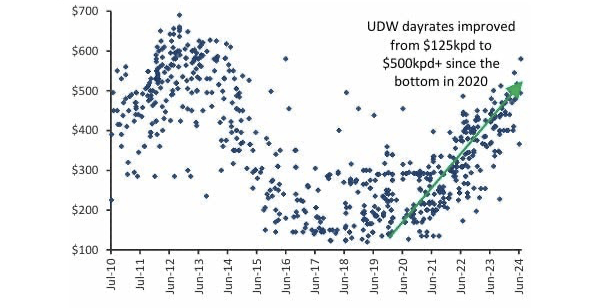

Regarding backlog, we note that compared to most peers, Seadrill has a relatively lower share of rigs pre-contracted (that is backlog), making revenues for the next years more exposed to fluctuations in dayrates. And while dayrates have been relatively stagnant during 2024 as the US oil & gas industry continued its active consolidation and simultaneously prioritized shareholder returns overinvestments, contracting activity is expected to reaccelerate in 2025. With the current FID pipeline translating into new demand, rig supply is estimated to tighten meaningfully going into the latter half of 2025 and 2026, which should help push up dayrates further.

We note that despite having climbed more than 3x from the cycle lows of 2017-2020, dayrates for ultra-deepwater drillships remain significantly below previous cycle highs, indicating room for further expansion as additional offshore capex comes online in the latter half of the decade.

UDW Rig Dayrates (Evercore ISI)

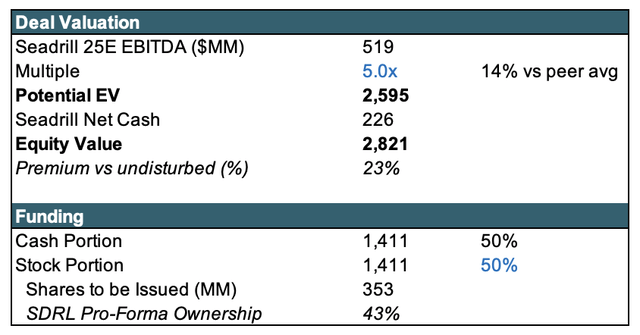

On our benchmark assumptions we see a potential deal as ~7% accretive to FCF/sh while lowering leverage. With the sector ex-RIG trading at ~4.4x on a forward EBITDA basis currently, we believe any takeout multiple for Seadrill would likely have to be above that, reflecting both the company’s streamlined business and best-in-class balance sheet.

Assuming consensus figures for 2025E EBITDA and a benchmark multiple of 5x (~14% above sector average), a potential transaction could be valued at around $2.6B in our view, with an equity value slightly above that at $2.8B. This would imply a premium of ~23% vs Seadrill’s last undisturbed market cap before the rumor was reported by Bloomberg.

Given Transocean’s high leverage of currently ~4.5x net debt to forward EBITDA, we expect any deal to have a significant amount of equity funding. At a benchmark 50/50 split between cash and RIG stock, we calculate current Seadrill shareholders could receive a stake of around 43% in the combined company, making this seem somewhat more like a merger of equals than an acquisition.

Company Filings, WSR Estimates

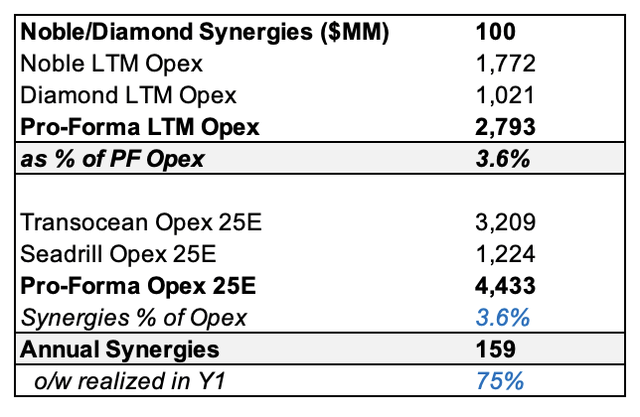

We also estimate any deal to likely result in meaningful synergies from opex redundancies and shared best practices. We note Noble’s recent acquisition of Diamond Offshore is expected to yield around $100MM in run-rate annual synergies, which represents around 3.6% of LTM combined operating expenses (LTM as of deal announcement in early June). Applying a similar ratio to RIG and Seadrill’s combined costs, we see synergy potential of around $159MM annually.

Company Filings, WSR Estimates

Assuming a deal close in early 2025 and ~75% synergy achievement within that year as well as additional share issuance in line with our benchmark scenario, we calculate a ~7% potential accretion on FCF/sh. On the other hand, and driven by the acquisition of Seadrill’s net cash balance sheet, we see RIG’s leverage falling from currently 4.5x to a pro forma level of 3.8x, even considering a 50% cash/debt funding structure.

Company Filings, WSR Estimates

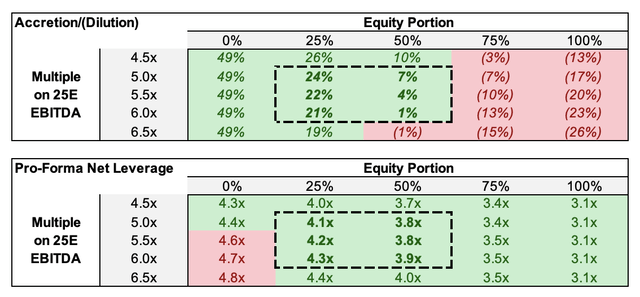

Flexing our assumptions on equity funding percentage and takeout multiple, we believe any potential acquisition would likely sit in a multiple range of 5-6x with an equity component of around 25-50%. Any deal within those boundaries is likely to provide both 1) an uplift to FCF/sh and 2) a positive effect on group leverage.

Company Filings, WSR Estimates

With Transocean being somewhat hamstrung by its high leverage, however, we note that we see a considerable potential of a rival bidder emerging. While Noble seems a relatively unlikely bidder given that they are still very much in the process of integrating Diamond, Valaris could become a potential interloper with its low leverage likely granting it more financial flexibility. Borr could also be a suitor for Seadrill’s assets, yet given their status as a jack-up pureplay vs Seadrill a floater pure-play we view this as relatively unlikely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.