Summary:

- Transocean’s backlog increased for the second consecutive quarter.

- To be sure, Transocean’s debt load is high and higher interest rates are a threat.

- But if the oil prices stay high enough, the company will do extremely well.

- Transocean’s stock is not overvalued as far as its backlog is concerned.

- RIG is a great stock for value investors.

CloudVisual

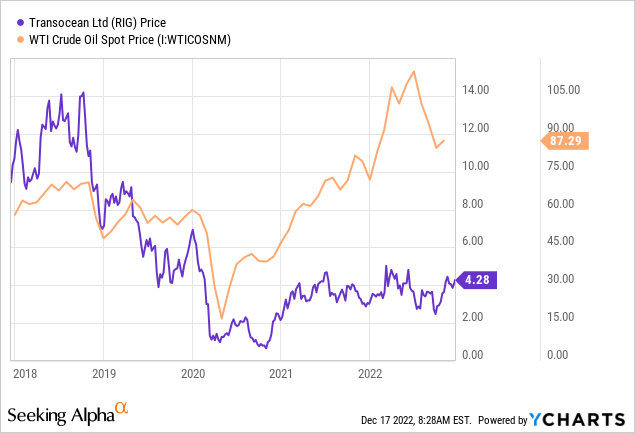

Transocean (NYSE:RIG) reported two new contract additions that are worth $1 billion altogether. This is really good news for the shareholders. It proves once again that offshore drilling is recovering, in spite of the fact the oil prices have been off their spring 2022 highs. Oil majors plan for the long term, and I believe the long term is really good for the company. Let me explain.

Contract awards, RIG’s competitors, and valuations

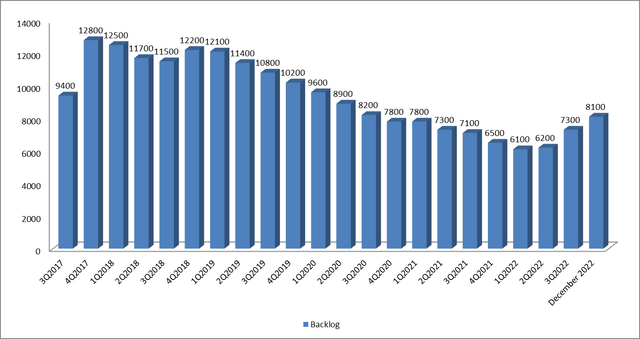

A very good article was written by my fellow Seeking Alpha contributor Fun Trading regarding Transocean’s recently announced contracts. It was the second consecutive quarter when the company’s backlog increased. This is significant because the pandemic made many investors doubt Transocean’s ability to receive new contract awards. Many analysts also pointed out that RIG consumed its backlog at a very fast pace during Covid-19 lockdowns. You can easily see this from the diagram below.

Transocean’s backlog (in $million)

Source: Prepared by the author based on Transocean’s data

And yet, everything seems to be changing right now. Right now, the backlog is near the levels seen in 3Q2020. One of the worst problems with Transocean was its falling backlog, which does not seem to be the case right now.

As I have mentioned before, the company’s backlog started increasing in 2Q2022. At the same time, oil prices have been rising since the second half of 2020. The stock price, meanwhile, has been staying almost constant between 2021 and 2022.

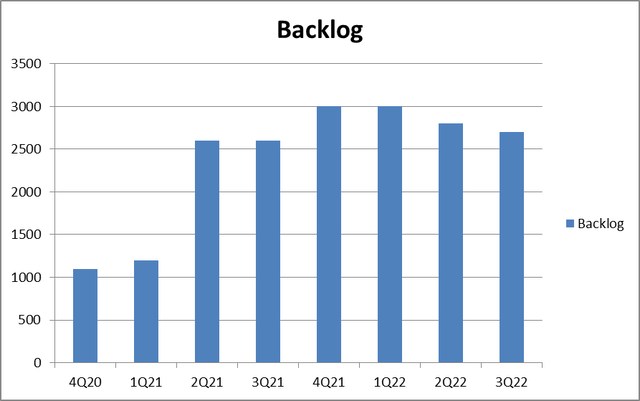

This makes me draw the following conclusions: RIG is more undervalued right now than it was at the end of 2021 – in the very beginning of 2022 as far as its backlog is concerned. Another very obvious fact is that offshore drilling requires long-term investing and exploration. That means a surge in oil prices does not make oil majors invest in new offshore contracts straight away. Yet, if large oil companies see that the price of the base commodity is high and very likely to stay so, they invest in offshore drilling. But I will discuss this problem later on. Very interesting would also be to compare Transocean’s backlog and its stock price to that of its closest competitor Valaris (VAL). Just a short reminder, Valaris emerged from bankruptcy in the spring of 2021.

Valaris backlog (in $million) – history

| Quarter | Backlog |

| 4Q20 | 1100 |

| 1Q21 | 1200 |

| 2Q21 | 2600 |

| 3Q21 | 2600 |

| 4Q21 | 3000 |

| 1Q22 | 3000 |

| 2Q22 | 2800 |

| 3Q22 | 2700 |

Source: Prepared by the author based on VAL’s data

Source: Prepared by the author based on the VAL’s data

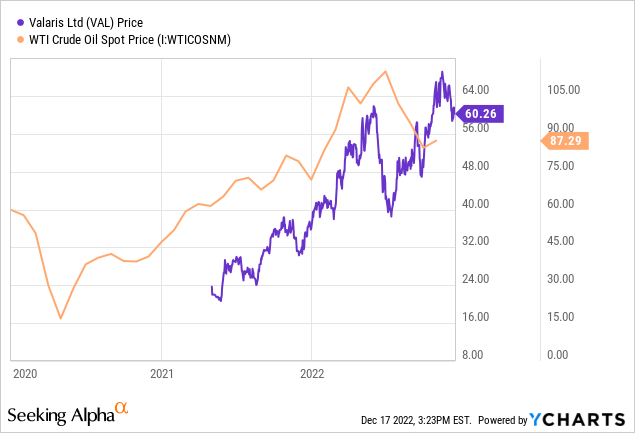

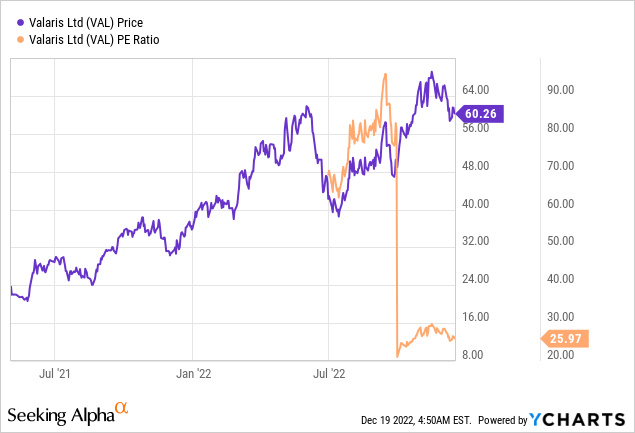

Immediately after VAL emerged from bankruptcy, its backlog surged from $1.2 billion to $2.6 billion in 2Q21. It has not increased much since then. VAL’s stock, however, has been doing extremely well after 2Q21. As you can see from the diagram below, its stock moved in correlation with the oil price in spite of the fact that its backlog showed no signs of an upward trend.

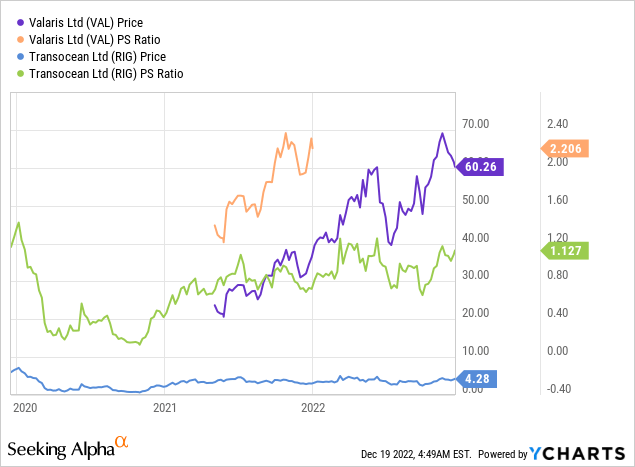

This makes me personally question if VAL is overvalued as far as its backlog is concerned. I also used the price-to-sales (P/S) indicator to question if VAL is more overvalued than Transocean. RIG is not profitable right now. So, I decided to use the P/S indicator to compare the two companies.

VAL’s P/S is two times higher than that of Transocean, which is explainable, given the fact Transocean has been recording net losses for a while. Both of the companies’ P/S ratios look quite moderate.

But let me also pick a little bit on VAL’s price-to-diluted earnings (P/E) ratio. Although it used to be much higher, over 90, right now it does not suggest undervaluation either. So, in that respect, VAL’s stock is not undervalued.

Certainly, VAL is recording profits right now. It also emerged from bankruptcy. This means that it has very little debt. But it does not look like its fundamentals are improving simultaneously with its stock price. It looks like Transocean is probably a better pick as far as its valuations are concerned.

Offshore drilling and oil prices

As I have mentioned before, offshore drilling requires heavy long-term investing. That is because offshore oil production cannot easily be stopped, commenced, or increased as opposed to onshore oil extraction, especially non-shale. So, oil prices should rise and stay at a high enough level for a while for oil majors to invest cash in offshore. That is happening now. The recent decrease in oil prices did not stop Transocean’s backlog from rising because it looked like a temporary correction.

Although the oil prices are down somewhat, there are plenty of things to be very positive about for oil investors. The G7 leaders and the EU decided on the $60 per barrel oil price cap for Russia. This would make the Russian government sell the country’s oil to other countries, most importantly, China and India. Meanwhile, the OPEC+ countries seem to be reluctant to raise their oil output since there is too much uncertainty in the oil markets. I discussed these problems in some more detail in my article on XLE. This means G7 countries and the EU in particular would face substantial oil supply shortages. Europe is also struggling to move away from Russian natural gas. This will not be easy. According to IEA’s estimates, if the supply from Russia to the EU totals zero and the LNG demand reaches 2021 levels, Europe’s supply-demand gap could total 27 billion cubic meters in 2023. If that happens, it would be a catastrophe. This winter would highly likely be a stress test for Europe.

The point I am making is that this winter it will likely become totally clear the energy crisis is not over. So, in order to solve it and also to record higher revenues, oil majors would have to invest more in exploration and offshore oil. Transocean, obviously, will be here to gain.

Risks

Transocean is a highly indebted company. And yet, as my fellow Seeking Alpha contributors have recently pointed out, RIG has enough cash to operate for at least a year without its shares going through dilution. The company’s backlog is going up, its revenues will highly likely also rise, which will be a positive for its income statement and its cash flows. I was impressed with RIG’s management, which organized a debt exchange in 2020. It is possible they would do a similar thing sometime soon to make RIG’s financial position even better.

Regarding the recent decrease in oil prices, I would say there are a few fundamental factors on the market that keep the commodity’s price at the current levels. First of all, the traders are worried that the rate hikes would provoke a deep recession very soon. This is the only valid reason I see to keep the oil prices suppressed somewhat. However, the Fed, the ECB, and other central banks would, hopefully, start reacting if the macroeconomic fundamentals deteriorate. In other words, monetary tightening will not last forever. Earlier on, oil investors were also worried about Covid-19 lockdowns in China. But it seems the problem is of lesser importance since many restrictions are over right now. Then, there is also a technical reason. As the year 2022 is nearing its end, traders also tend to close their market positions. But provided nothing extraordinary happens, this should change in January next year.

Conclusion

Transocean is an indebted company that is not recording net profits. There is a recession risk for the global economy. And yet, we have witnessed a turnaround time for RIG. Oil majors would highly likely increase their capital expenditures further in order to meet the demand for oil, as the global energy crisis is not over yet. The market does not fully realize this, it seems, given the fact the company’s price has not reacted too much to RIG’s backlog additions. If you are not a very risk-averse investor, and you believe in oil and offshore drilling, there is plenty of value to be found in RIG.

Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.