Summary:

- Transocean’s fleet status report exceeded analysts’ expectations, with a backlog totaling $9.2 billion, largely due to new contract announcements.

- Despite the positive report, Transocean’s stock price has not significantly reacted.

- Some analysts argue it is trading too high compared to its peers.

- The company’s backlog is nearing pre-pandemic levels, with strong demand for drillships and potential for more contract awards at high dayrates.

grandriver

Transocean’s (NYSE:RIG) fleet status report beat many analysts’ expectations. The backlog totaled $9.2 billion, over and above the result reported for the previous quarter. This is due to the new contract announcements. At the moment, the company is getting more backlog additions than it is consuming. But the stock price still does not match the recent news. Indeed, Transocean’s shares appreciated after the last contract announcement but did not react to the fleet status report. Some analysts argue the company’s stock is trading far too high relative to its peers. This is not entirely so in my view, especially if we compare RIG to Valaris (VAL). I will explain this later on in this article.

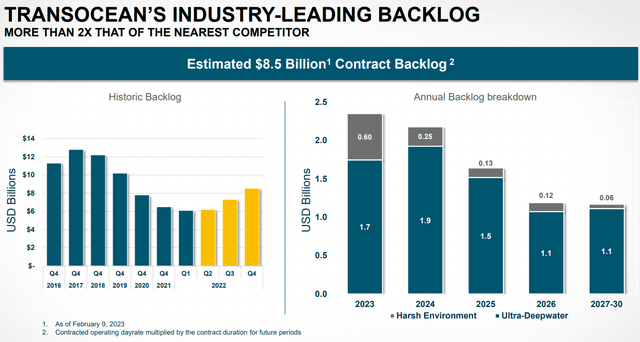

Fleet-status report

Transocean was awarded a $518M ultra-deepwater drillship contract in the Gulf of Mexico. Note that it is not a semi-submersible but a drillship. This and the other contract awards I wrote about in the previous article contributed to its backlog rise. The total backlog in RIG’s previous fleet status report, covering the period up to 18 April 2023, was around $8.6 billion. Meanwhile, RIG’s 4Q 2022 backlog totaled $8.5 billion.

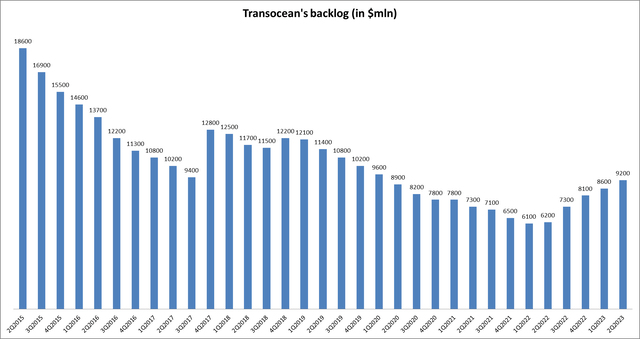

The company’s backlog of $9.2 billion is close to the levels seen in 2019, that is before the pandemic. If everything goes according to the plan, the trend will continue. I do not quite agree with my fellow Seeking Alpha analyst Henrik Alex who is concerned about low demand for offshore drillers in the Gulf of Mexico. The recent contract announcement also showed the demand for drillships is quite strong, especially given the current dayrate of $480,000 per day. Transocean is well in the $500,000s for its ultra-deepwater equipment. Let us not forget the fact the demand for offshore drilling in the Gulf of Mexico is not quite as strong as that in other regions. There are other countries where the demand for deepwater offshore drillers is strong and rising. Brazil, Guyana and Angola are just some of them. So, more announcements may follow soon at even higher dayrates.

Transocean’s management named three possible candidates for the recent contract award.

- Seventh Generation Ultra-Deepwater Drillship (Deepwater Invictus, Deepwater Thalassa, or Deepwater Proteus) – Awarded a 1,080-day contract in Mexico at a rate of $480,000.

Only one of these will be engaged, whilst two other drillships will not. That means they will be available for other contract awards at high dayrates. So, more backlog additions and revenue increases are likely ahead.

Transocean’s competitors and valuations

Indeed, few analysts would argue the offshore drilling sector is not recovering well. However, many of them consider Transocean’s competitors to be much better investment options. The first reason for that is the fact many of them re-emerged from bankruptcy with clean balance sheets. In my view, this is the only valid reason why RIG’s competitors might have an advantage over it. However, I believe RIG’s indebtedness is paradoxically a stimulus for further stock price gains. That is because Transocean has been deleveraging for a while. By this, I mean it has been retiring its debt for a long time. So, once the company completely gets rid of its liabilities, its stock could soar to decade-highs in my view.

But I disagree that Transocean’s stock is highly overvalued. Let me explain.

Below I have prepared a diagram that presents RIG’s backlog history. It might seem that the recently reported backlog figure is not as high as the results reported in 2017 or 2015. Yes. It is so. Unfortunately, I was unable to generate a graph presenting the backlog figures before the 2014-2015 decline in the offshore drilling sector because the company’s fleet status reports did not include any total backlog numbers.

Yet, we can see a clear upward trend here.

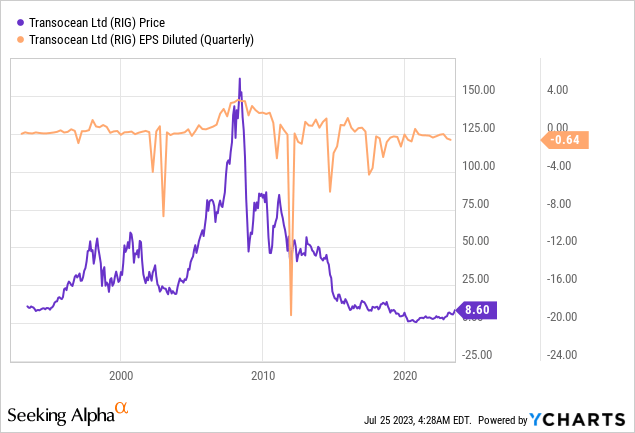

But let us look at Transocean’s earnings per share and stock price histories.

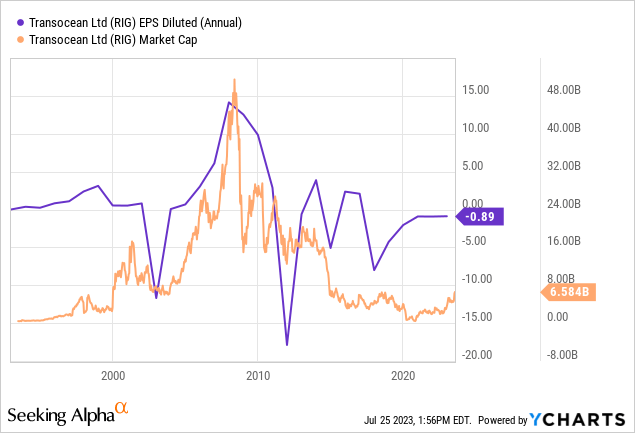

Very often even before the 2014-2015 decline in the offshore drilling sector the company’s EPS were below $0. You might say that quarterly figures tend to fluctuate.

But the same is true of the company’s annual EPS. However, Transocean’s market capitalization was substantially above the levels seen today. So, in that respect, I argue Transocean’s stock is not overvalued.

Some analysts, however, might argue that RIG is far too expensive based on its estimated 2024 P/E ratio.

|

Company |

2024E P/E |

|

Diamond Offshore Drilling/DO |

8.7 |

|

Noble/NE |

6.9 |

|

Seadrill/SDRL |

8.6 |

|

Transocean/RIG |

14.7 |

|

Valaris/VAL |

8.4 |

Source: Barron’s

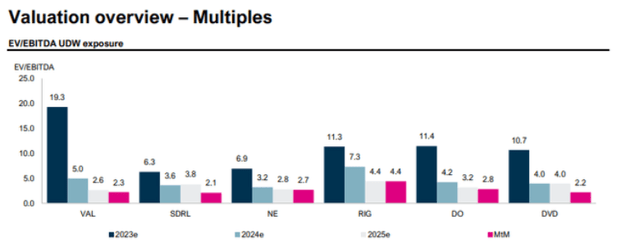

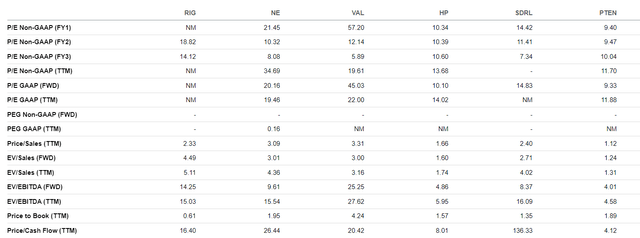

But not everything is so obvious. If you have a look at the companies’ EV/EBITDA ratios, Transocean is not the most expensive one. Valaris and Diamond Offshore (DO) are more expensive.

According to Seeking Alpha’s table below, a number of valuation indicators suggest that Transocean is not as expensive as many other drillers, most notably Valaris. The Price-to-Sales (P/S), EV-to-EBITDA, Price-to-Book (P/B) and Price/Cash Flow (P/CF) are the indicators that show RIG’s reasonable and even quite low valuations in comparison to some of its peers.

So, RIG is not overvalued, it seems.

Risks

The risks are very clear. Transocean’s debt is quite high. At the same time, most of the interest RIG has to pay is fixed and won’t rise. Moreover, the deleveraging story is bullish for its stock.

Competition might also be the issue. But so far Transocean has the largest fleet and also the highest backlog from all the offshore drillers I have mentioned above. The only visible advantage of RIG’s peers is their low indebtedness.

The final risk is that of a global recession. Indeed, the offshore drilling sector will most likely stop recovering if there is a prolonged economic downturn. However, offshore drilling contracts are signed for the long term. So, a short recession won’t be a big problem for Transocean, in my opinion.

Conclusion

In my opinion, the contract awards are not over for Transocean. The company is recovering at a fast enough pace. The company’s stock is still not overvalued relative to peers. Meanwhile, we shall hear many more details regarding Transocean’s news and its growth potential very soon because the company will present and comment on its earnings on 31 July. I am particularly interested in rig reactivations and potential contract announcements. I believe Transocean’s stock is still a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.