Summary:

- Dayrates for Transocean Ltd. rigs are increasing faster than we expected.

- Nevertheless, Transocean stock has declined over recent months along with the energy sector.

- We bring forward the timing of our $12 price target for Transocean Ltd. stock.

think4photop/iStock via Getty Images

Our Transocean Ltd. (NYSE:RIG) investment thesis is simple. It has two main premises: first, increasing demand for Transocean’s drilling rigs amid constrained supply will push dayrates higher; and second, management doesn’t significantly dilute shareholders.

The faster dayrates improve, the lower the risk of dilution. Fortunately, for Transocean shareholders, the outlook for dayrates continues to strengthen.

Dayrate Trends are Improving

Our Transocean thesis is progressing more positively and more quickly with regard to dayrates than we expected when we first presented our investment thesis on March 31.

On May 10, the company announced a 300-day contract for one of its harsh environment semi-submersible rigs at an attractive rate of $456,667 per day, well above the fleet average and trending toward the $500,000 dayrate that we believed would be the norm by 2025 or 2026. But if the current improving trend holds, a $500,000 dayrate could be the norm by mid-2024. This would accelerate the timing of our investment thesis.

In 2022, the average dayrate for Transocean’s entire fleet was approximately $360,000. On June 12, Wood Mackenzie reported on that dayrates for ultra-deepwater rigs were currently averaging $420,000. With 90% of these rigs currently contracted, increased offshore drilling capex is likely to result in even higher dayrates. As Transocean’s older contracts roll off and are replaced with higher-priced new contracts, the average dayrate of its total fleet should increase.

Wood Mackenzie also noted that dayrates for ultra-deepwater rigs could hit $500,000 by the end of this year. Meanwhile, Transocean’s management expects the utilization of its rigs to increase over the balance of 2023.

These trends bode particularly well for Transocean’s free cash flow generation in the 2024-to-2026 timeframe. At an average dayrate of $500,000, we estimate the company can generate $2 billion of EBITDA. Assuming no debt reduction and a 6-to-7 times EV/EBITDA multiple, Transocean’s stock would trade in the $10 to $12 range, nearly double today’s price of $6.20.

Assuming the company spends $750 million on capex annually, $2 billion EBITDA would translate to $1.25 billion of free cash flow that could be used to reduce the company’s $7.6 billion debt load. Lower debt would increase equity value further.

We believe Transocean will have a long runway to grow its free cash flow. Until newly-built rigs enter the picture, the current deepwater offshore drilling cycle is likely to be extended as U.S. shale reaches the limits of its growth and E&Ps increase capex toward offshore projects. If dayrates are sustained at high levels, Transocean will have several years over which it can generate more than $1 billion of free cash flow that can be used to reduce debt.

Risks for Shareholders are Receding

The trend of increasing dayrates affirms the first premise of our Transocean investment thesis. The second premise-that management refrains from significant shareholder dilution-remains to be seen. As such, dilution remains the greatest risk for shareholders. Dilution could come from regular share issuance from the company’s at-the-market (ATM) share offering program, by which it has regularly dribbled out additional shares over the past few years. Or it could come from a convertible bond offering made to deleverage the company while reducing its cost of debt.

The risk of new share issuance will remain high as long as Transocean operates at a cash flow deficit that has to be funded through newly-issued shares, additional debt, and/or cash on hand.

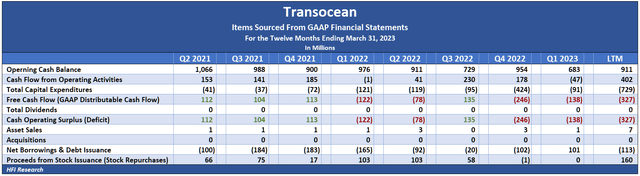

In 2022, the company generated a $311 million cash flow deficit. That year, its only quarterly surplus came in the second quarter, which benefitted from a working capital draw and relatively low capex. The company funded the cash flow deficit by issuing $263 million of new stock.

Then in the first quarter of 2023, Transocean generated a cash flow deficit of $138 million. However, despite the large cash-flow deficit generated in the first quarter, the company did not sell new stock. In fact, it generated a $384 million cash flow deficit over the past two quarters and didn’t sell any new shares from its ATM program. Transocean’s quarterly cash flows for the past eight quarters are detailed below.

Going forward, we expect the company’s cash flow deficit to transition to a sustained cash flow surplus. The surplus will eliminate the need for additional share issuance. The cash flow surplus will arise as higher dayrates boost operating cash flow. But at the same time, capex is set to fall significantly.

Transocean’s high level of capex in 2022 was attributable to its investment in building two new rigs, the Deepwater Atlas and Deepwater Titan. These rigs have been contracted to Beacon Offshore Energy and Chevron (CVX), respectively, and have commenced their contractual service. They are the only rigs in the world with a lifting capacity of 3 million pounds. Higher lifting capacity ultimately translates into lower-cost deepwater wells. With payments toward the new rigs nearly complete, capex over the next few quarters will decrease. Management has guided for 2023 capex of $285 million, well below the $759 million spent in 2022.

In the first quarter, the company has already spent $91 million of its $285 million capex budget for full-year 2023. If management stays within budget, Transocean will spend a total of $194 million on capex over the next three quarters, for a quarterly average of $65 million. This represents a dramatic reduction from the last six quarters, when capex averaged $145 million per quarter.

The combination of higher operating cash flow combined with lower capex will result in increased free cash flow and minimal dilution risk. We expect management to allocate all free cash flow in a shareholder-friendly manner toward deleveraging.

Conclusion

Transocean’s stock price has suffered over recent weeks, along with the entire energy sector. However, its fundamental outlook has actually improved, making its stock even more attractive for long-term holding.

The improvement brings forward our expectation for the stock to hit our $12 per share price target. In our initial Transocean investment thesis, we expected the shares to reach our $12 target over a 3-to-5-year timeframe. Improving fundamentals bring the timeframe forward to 3 years as free cash flow grows, risk to shareholders declines, and investors better appreciate that the company’s fortunes are turning for the better.

Importantly, we believe robust offshore contracting activity and increasing dayrates are likely to persist through an economic downturn. E&Ps that pursue offshore projects typically have a multi-year time horizon. Since rig utilization will remain at high levels while there is almost no prospect for a large increase in new rig supply for at least several years, only an unusually severe recession that keeps oil prices below $70 per barrel for several quarters would derail the longer-term trend of higher day rates. On the other hand, higher oil prices and stepped-up capex for offshore projects would accelerate the trend.

Clearly, Transocean is well-positioned to generate attractive returns for its shareholders over the next few years. Investors who can stomach the inevitable share price volatility should buy Transocean Ltd. stock now for the prospect of a 100% return.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperform!

At HFIR Energy Income, we strive to outperform with every pick recommendation. Since inception in 2021, the HFIR Energy Income Portfolio has returned 65.7% with a return of 26.1% YTD.