Summary:

- Amazon will release much-anticipated Q3 earnings on October 31.

- Cash flow and earnings are at all-time highs, with tailwinds for AWS and advertising.

- The stock is surprisingly undervalued and an excellent long-term buy. Here’s why.

eli_asenova/E+ via Getty Images

Earnings On Deck

Amazon (NASDAQ:AMZN) is set to release Q3 2024 earnings on October 31 after the closing bell. If you would like to listen to management’s comments on the earnings call, you can do that here. Seeking Alpha will also post the transcript shortly after here. Earnings calls are illuminating as long as we keep them in perspective. Management will always put a positive spin on results, but also offer interesting insights and clues to future results.

Here’s why I recently added to my already significant position.

Is there any value out there?

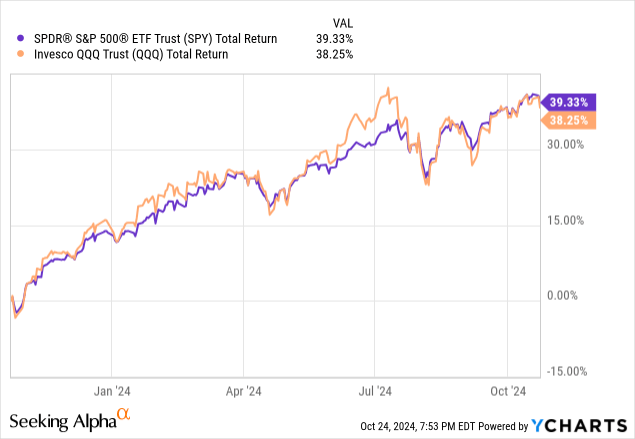

Stocks are on fire this year. The S&P 500 (SPY) and Nasdaq (QQQ) are up nearly 40% over the last twelve months, as shown below:

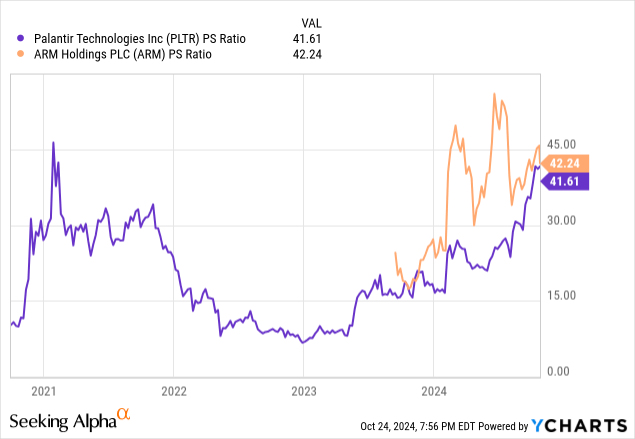

They continue to make new highs as the bull market rolls on. However, this is a double-edged sword. It’s great for existing investments, but it’s difficult to find undervalued stocks to put in new dollars. Popular stocks like Arm Holdings (ARM) and Palantir (PLTR) trade at incredible valuations, as shown below.

Both are terrific companies, and Arm is a favorite of mine. But more than 40 times sales reminds me too much of 2021 to consider buying here. As Buffett said, “The stock market is a mechanism for transferring wealth from the impatient to the patient.” I’m patiently waiting for a much more attractive entry point.

Despite the advancement of the market, Amazon is surprisingly undervalued. Its financial results are terrific, profits and cash flow are impressive, and it has artificial intelligence tailwinds.

Will services continue to shine?

Many people, especially those outside of the investing world, see Amazon as a product company that makes its money selling goods online. However, Amazon’s services revenue overtook product revenue in Q1 2022, and the company hasn’t looked back. I covered this several times, including this buy recommendation when the stock was trading for less than $100 per share.

This trend is bullish for investors because services tend to have much higher margins than selling discount products. Online product sales require tremendous investments in logistics, returns eat into profits, and competition (Walmart (WMT), Target (TGT), etc.) is fierce. The revenue stream is still important because it feeds Amazon’s ecosystem, but services have profits and cash flow skyrocketing.

Advertising

Digital advertising has been a terrific boon, supplementing Amazon’s income. In 2020, advertising revenue spiked 57% to $20 billion. It kept growing at a breakneck pace and reached $51 billion over the last twelve months. Advertising sales grew 20% year over year last quarter, and another high-teens to low-20% increase would be impressive heading into the all-important holiday season.

Amazon Web Services (AWS)

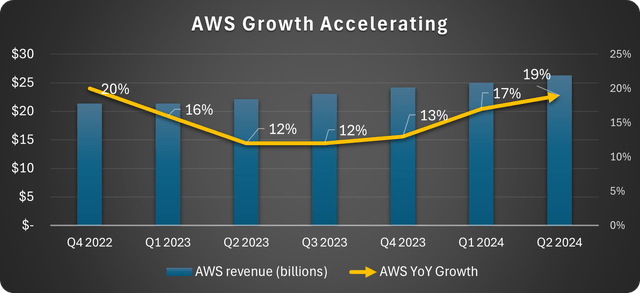

AWS stole the show recently as growth reaccelerated as predicted. Data budgets increased as fears of an imminent recession subsided, and artificial intelligence applications are a major tailwind.

As depicted below, the segment came out of a challenging 2023 and reached 19% growth last quarter.

Data source: Amazon. Chart by the author.

I fully expect the company to achieve over 20% year-over-year growth this quarter. This will solidify that the tailwinds are real and brisk. It should also give the stock a shot in the arm on Wall Street.

Cash flow

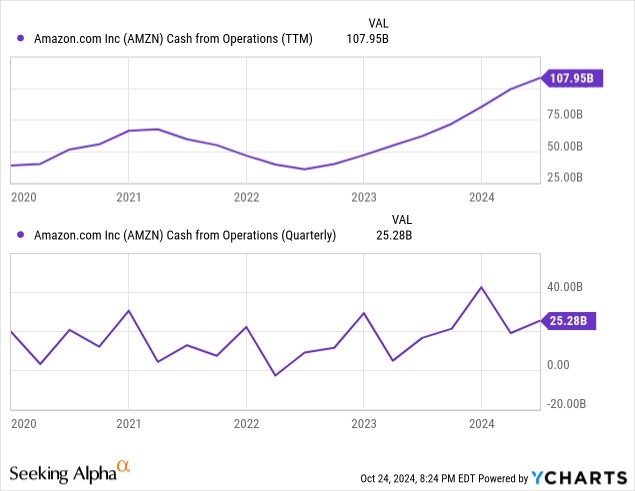

Finally, I will be watching for another increase in operating cash flow. Amazon has steadily righted the ship after the challenges of 2022 and 2023, and hit a record $108 billion over the past twelve months, as you can see below.

Operating cash flow has easily exceeded the stimulus era records of 2021 and increased 53% year-over-year last quarter, going from $16.5 billion to $25.3 billion. This pace will be difficult to match; however, a modest quarterly increase will be impressive. Keep an eye out for that.

Surprisingly undervalued

I’ve been racking my brain lately looking for undervalued growth and tech stocks to buy. There are some, but not too many. I always come back to Amazon. There are many ways to value stocks, but if we look at earnings, cash flow, and sales, that covers each base. Amazon is historically undervalued on every one of these metrics. Let’s take them in order.

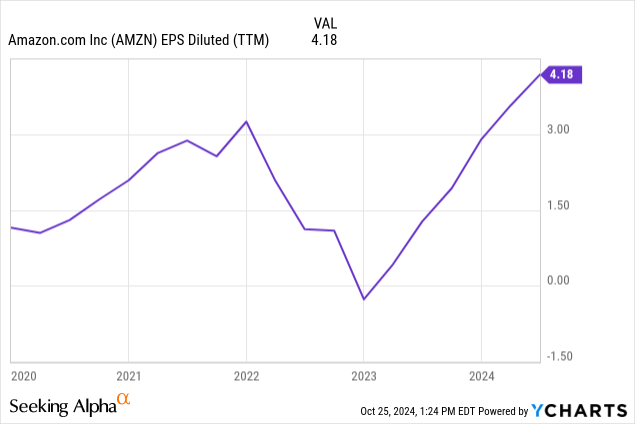

Amazon has never been a high earnings-per-share (EPS) company, but this is beginning to change. The company set a new record over the past twelve months, as shown below.

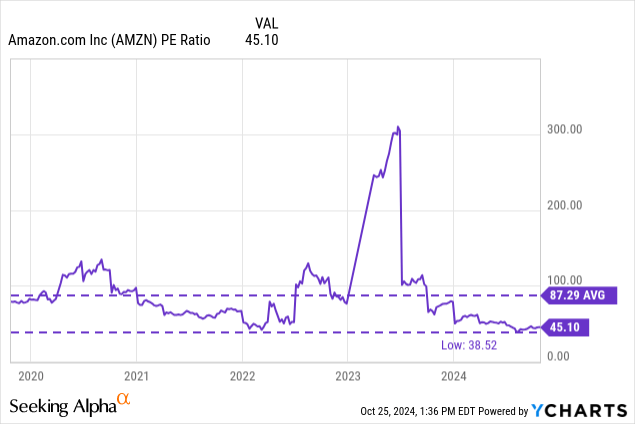

The price-to-earnings ratio is now near a record low:

This drops to 40 on a forward basis and could be lower if Amazon beats Wall Street estimates.

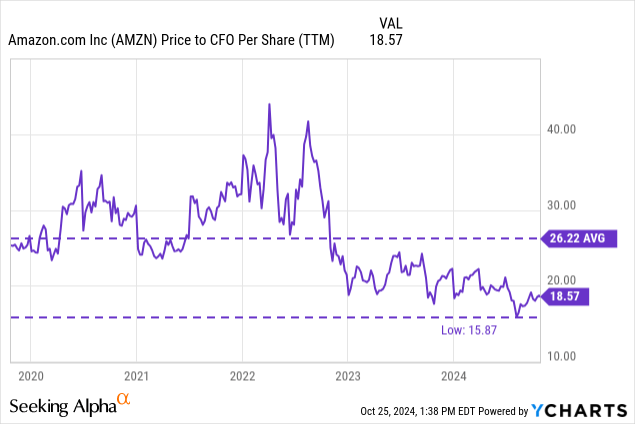

The cash flow valuation is also historically low, as depicted below.

This is the most telling metric, especially if Amazon posts a strong Q3, setting up another operating cash flow record in the all-important holiday season Q4.

Finally, Amazon trades for a tad over 3 times sales, which is right around its 5-year and 10-year average. But today’s sales are more valuable than past sales since they produce more cash flow and income.

What could go wrong?

The biggest risk to Amazon is macroeconomic. The economy is slowing by design to fight inflation. The Federal Reserve is attempting a “soft landing”, and so far the economy and consumer spending are still strong. However, a recession would negatively affect online sales, which would slow advertising growth. Companies could also cut data budgets like they did in 2023, hurting AWS growth and margins.

Is Amazon stock a buy?

The market can react strangely to earnings releases, so there is no guarantee the stock will rise; however, there is plenty of reason for optimism heading into the earnings release. Several segments have momentum, cash flow is setting records, and earnings are rising. The stock price is reasonable, and there are significant tailwinds for AWS, making Amazon a long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.