Summary:

- Tesla, Inc. revenue for Q2 2023 reached an impressive $24.93 billion, marking a YoY growth of 47.2%.

- The company’s profit margins and ROE have been on an uptrend, indicating operational efficiency and profitability.

- Analyst sentiment is mixed, with several bullish on Tesla’s future prospects.

- Concerns arise from the stock’s high valuation, significant short interest, volatility, and debt levels.

- The escalating competition in the EV market, underscored by narrowing sales gaps and global expansion ambitions of contenders like BYD, encapsulates a vibrant and challenging landscape for Tesla, necessitating strategic agility to sustain its market leadership.

- Investors should approach Tesla stock with a balanced perspective, weighing both its strengths and potential risks.

Tesla Debuts Its New Crossover SUV Model, Tesla X – Elon Musk standing in front of Tesla automobile while giving a speech Justin Sullivan

Introduction

Tesla, Inc. (NASDAQ:TSLA) has always been a company that has piqued my interest. Its innovative approach to electric vehicles (EVs), combined with ventures into energy storage and solar products, positions it as a standout player in both the tech and automotive sectors. The rapid growth, pioneering products, and the undeniable influence of its CEO, Elon Musk, have further deepened my intrigue.

However, like any high-profile stock, I’ve observed that opinions on TSLA’s future prospects can be quite polarized. In this analysis, I’ll share my insights into both the bullish and bearish cases for TSLA, supported by recent data.

The Bullish Case for TSLA

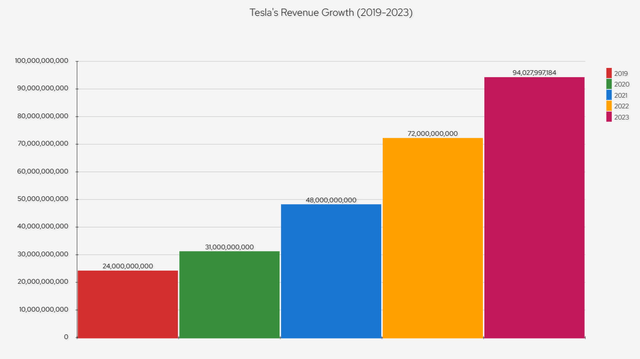

Strong Revenue Growth: One of the standout metrics for Tesla is its financial trajectory. The company’s total revenue for Q2 2023 reached an impressive $24.93 billion, marking a YoY growth of 47.2%. This growth is visually represented in the chart below, showcasing Tesla’s expanding market presence over the years.

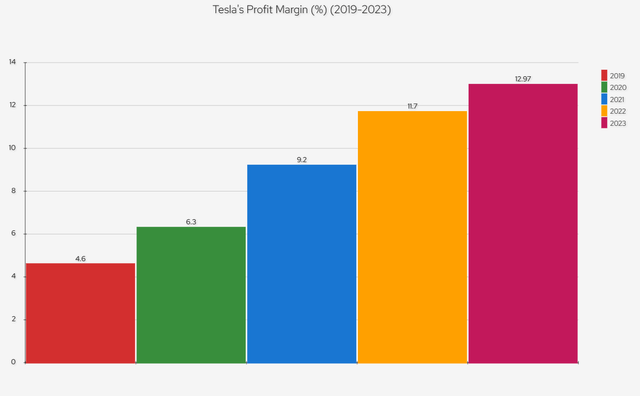

Impressive Profit Margins: Profit margins are a testament to a company’s operational efficiency. Tesla’s profit margins have been on an uptrend, as depicted in the chart below. This trend underscores Tesla’s ability to manage costs effectively while scaling its operations.

Earnings Surprises: Financial analysts’ opinions are something I always consider. Tesla has a commendable history of surpassing these earnings estimates. In the last quarter, the company reported an EPS of $0.91, outperforming the estimate of $0.82 by a notable 10.98%.

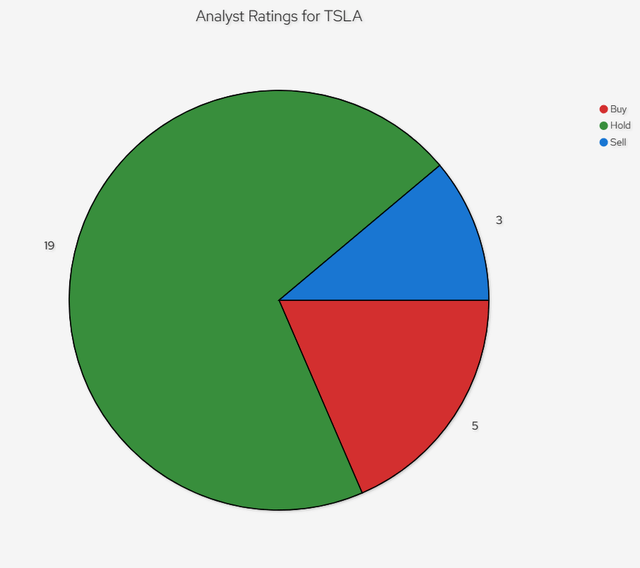

Analyst Upgrades: The broader financial community’s sentiment is also worth noting. Several analysts have turned bullish on TSLA, as depicted in the pie chart below, which gives a visual representation of the current analyst ratings for the stock.

Healthy Operating Margin: An operating margin indicates how much profit a company makes from its core business operations. Tesla’s operating margin for the trailing twelve months stands at 13.46%, showcasing its ability to efficiently convert sales into profit. Considering the automotive industry’s average operating margin typically ranges between 5% to 10%, Tesla is doing relatively well.

Robust Return on Equity: ROE is a measure of a company’s profitability concerning shareholders’ equity. With an ROE of 27.14% for the trailing twelve months, compared to the average ROE for the automotive industry, which usually hovers around 10% to 15%, Tesla has demonstrated its prowess in generating profits and providing value to its shareholders.

The Bearish Case for TSLA

High Valuation: While I’m impressed with Tesla’s achievements, its current P/E ratio of 70.87 does raise eyebrows. This ratio is significantly higher than the industry average, suggesting potential overvaluation. Incidentally, the industry average P/E ratio for the automotive sector as a whole typically ranges between 15 to 20.

Short Interest: Market sentiment is crucial. The latest data reveals a substantial 84.72 million shares of TSLA sold short. This significant short interest indicates that a portion of the market is betting against the stock. Bill Gates I’m looking at you, sir!

Volatility: Day traders tend to love trading this stock, because TSLA’s stock price can swing quite dramatically. With a beta of 2.0892, it’s quite evident that TSLA is more volatile than the broader market.

Debt Concerns: Financial leverage is always a concern. While Tesla has a commendable cash reserve, its debt levels can’t be ignored. The company’s short and long-term debt stands at $2.18 billion, which could impact its future flexibility.

The Link Between Oil and the S&P 500: How It May Impact Tesla

While my main expertise lies in algorithmic trading software engineering, I also wear the hat of a licensed Commodity Trading Advisor. I believe that each sector within the S&P 500 (SP500), to different extents, reflects the commodity market. This encompasses everything from energy commodities like oil to precious metals, agricultural products, and even soft commodities. Their price movements can cast a ripple effect on the broader market landscape.

With respect to oil (CL1:COM), its price fluctuations can have a noticeable impact on the S&P 500 index for several reasons:

1. Economic Pulse: Crude oil is a good gauge of global economic vitality. Elevated oil prices often hint at robust global demand and economic expansion, whereas depressed prices suggest the contrary. Given that the S&P 500 encapsulates the performance of U.S. large-cap stocks, shifts in global economic sentiments hinted by oil prices can sway the index.

2. Inflationary Impacts: Oil prices are pivotal in shaping inflation trends. A surge in oil prices escalates the cost of energy, transit, and commodities, which subsequently drives up inflation. Rising inflation might influence interest rates. This, in turn, can modify the discount rate used for valuing stocks, possibly dragging down stock valuations and subsequently, the S&P 500 index.

3. Consumer Expenditure: Fluctuations in crude oil prices determine gas prices at the pump. When oil prices climb, gasoline becomes pricier, which might suppress discretionary spending on other products and services. Given that consumer expenditure is a cornerstone of the US economy, any pullback could dent the performance of firms listed in the S&P 500.

4. Investor Sentiment: Price volatility in the oil sector can seed doubts among investors. Dramatic price shifts can spur market volatility, potentially shaking investor confidence and by extension, the S&P 500 index.

Now, zooming in on Tesla, a key player in the S&P 500, any movement in the index influenced by oil or other factors could have implications for Tesla’s stock price. Especially given Tesla’s positioning in the electric vehicle sector, shifts in oil prices and the subsequent effects on traditional automotive companies in the S&P 500 might lead investors to make comparative judgments about Tesla’s future prospects in relation to oil trends. I will expand on this below.

How Fluctuation of Oil Prices Impacts Tesla Sales

Increased Interest in EVs: High oil prices can drive interest towards electric vehicles as they are seen as a more economical alternative when gasoline prices rise. The oil price shock of 2022, for instance, led to increased interest in EVs according to a report by CleanTechnica. With a market cap of over $800 billion, Tesla is the largest EV manufacturer in the world.

Cost Comparison: The economic appeal of Tesla vehicles compared to gasoline-powered vehicles can be influenced by oil prices. For instance, when oil prices were high around 2011, owning a Tesla was not only ecologically sensible but also economically sensible in regions like Belgium due to lower electricity costs. However, when oil prices dropped significantly by 2016, the cost of charging an electric vehicle in Europe approached the cost of filling a gasoline tank, which might affect the sales appeal of EVs.

Tesla’s Stock and Sales Momentum: The stock price of Tesla can be affected by oil price changes. For example, Tesla shares plummeted 13.6% on Monday, March 9, 2020 when it shed nearly $100 to close at $608 per share, dropping 6 percentage points more than the S&P 500 did for the day, demonstrating significant relevant weakness to the market, when oil prices had plummeted over 20%.

Surge in Orders: Conversely, high gasoline prices, driven by high oil prices, have led to a surge in Tesla orders in the U.S. as more people look towards electric vehicles as a more cost-effective alternative. In fact, it was almost exactly two years since that near $100 drop in Tesla price when on March 10th, 2022, Electrek ran an article with this headline “Tesla (TSLA) order rate is surging in the US as gas prices are turning people toward electric cars.”

Potential for Future Stock Surges: Analysts have also projected that higher oil prices could potentially lead to a surge in Tesla’s stock, as higher oil prices might drive higher sales of electric vehicles, including Tesla’s. The violent geopolitical environment in the world today will continue to have a significant impact on the exorbitant price of oil.

Full Self-Driving (FSD) Technology:

Tesla is continually improving its FSD technology. The latest versions, 11.4.4 and 11.4.7.2, are still in Beta and mainly available in North America. The rest of the world must wait until regulatory challenges and global public sentiment are addressed.

Tesla had announced at their Tesla AI Day on September 30th, 2022 an aspiration to make FSD available worldwide by the end of 2022. However, achieving this goal by the end of 2023 or even 2024 appears increasingly unlikely. The pinnacle achievement would be reaching Level 5 autonomy, where the car is truly fully autonomous. This milestone would lead to cost savings for Tesla and could make the car more affordable for consumers. At this stage, vehicles wouldn’t require steering wheels, pedals, gear shifts, or side/rearview mirrors. Yet, Level 5 autonomy remains a distant goal.

Competition:

The EV market is witnessing heightened competition, with traditional automakers and new entrants striving to gain market share. Particularly noteworthy is the rivalry between Tesla and BYD Company Limited (OTCPK:BYDDF). While Tesla has been leading in the EV space, especially in North America, the scenario is shifting, with BYD emerging as a formidable competitor, especially in China.

Recent sales data from Q3 2023 showed that Tesla delivered 435,059 pure electric cars, with BYD closely trailing at 431,603 sales, marking a narrow sales gap of 3,456 units. This trend might see BYD surpassing Tesla in the near future, especially given BYD’s impressive year-on-year sales growth of 66.9% compared to Tesla’s quarter-to-quarter dip of 6.7%.

Both companies have global ambitions, illustrated by their investments in worldwide facilities. While Tesla is eyeing a new factory in Mexico, BYD is also expanding its footprint globally with facilities in China and substantial investments in countries like Uzbekistan, Thailand, and Brazil, and is making an aggressive entry into the Mexican market. BYD’s diverse offerings like the recently unveiled DOLPHIN, and its broader technological background spanning various sectors, underline its competitive edge.

This competition symbolizes a larger momentum in the global shift towards sustainable transportation, and suggests that the EV market crown is indeed up for grabs, making the landscape more dynamic and less monopolistic.

The competitive landscape extends to other players like Lucid Group (LCID), Rivian (RIVN), Ford’s (F) Mustang Mach-E, and the Volkswagen (OTCPK:VWAGY) ID.4, each bringing unique offerings and innovations to the table, further intensifying the competition Tesla faces in maintaining its market dominance.

Moreover, key players in OPEC, realizing the imminent threat posed by EVs to their market share, have also begun to venture into the electric vehicle domain. Following the ethos of “if you can’t beat them, join them,” Saudi Arabia, for instance, is developing its own brand of electric vehicles, Ceer, and has set an ambitious target to install 50,000 domestic EV charging stations by 2025. Adding to this, Saudi Arabia’s Ministry of Investment has inked a $5.6 billion deal with Human Horizons, a Chinese electric vehicle manufacturer. On a similar note, the UAE has acquired a 7% stake in NIO (NIO), a well-established electric car company based in Shanghai, indicating a strategic shift towards embracing EV technology.

The Dual-Edged Nature of Competition in the EV Industry

The impact of competition within the electric vehicle industry is largely contingent upon the prevailing circumstances. If we zoom out, a broader perspective on the EV market reveals a sector in a state of flux. According to the International Energy Agency (IEA), data from 2022 reveals a stark disparity with 95% of global automotive vehicles still reliant on gasoline, juxtaposed against a mere 5% harnessing electric power, encompassing both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The IEA holds an optimistic outlook on the proliferation of electric vehicles, projecting a substantial uptick to 30% by 2030, further escalating to 50% by 2040. This trajectory delineates a substantial market share awaiting capture, highlighting the potential for an influx of contenders to flourish within this burgeoning sector. For Tesla to capture even a third of the market share would be huge.

However, the competitive dynamics could take a bearish turn under certain scenarios. For instance, should a contender in the mold of Tesla, like BYD, attain a technological advantage enabling cost leadership and economies of scale, the subsequent accelerated production scale and lower price points for their EVs—maintained without any compromise on quality—could pose a significant threat to Tesla’s market standing. Moreover, geopolitical factors could further intensify the competition; if, say, the Chinese government extends a helping hand to BYD in navigating regulatory mazes, while Tesla finds no such favor in North America, the repercussions could be swift and severe for Tesla. This hypothetical scenario showcases how competition, while fostering innovation and consumer choice, can also precipitate market realignments that may be unfavorable for Tesla.

Expectations for the October 18, 2023 Earnings Report

Earnings Growth: Analysts forecast that Tesla’s earnings will grow by approximately 40.82% in the coming year, increasing from $2.94 to $4.14 per share. However, there are differing opinions on Tesla’s full-year earnings, with estimates ranging from $2.72 to $3.29 per share.

Wall Street Sentiment: There’s a notable decline in Wall Street’s sentiment towards Tesla, mainly due to its recent Q3 deliveries falling short of Q2, which was down by 7%. The stock has been fairly volatile over the past month, and despite some growth in early September, it has been trending downward. Analysts from JPMorgan and Goldman Sachs have issued bearish takes on Tesla, with Ryan Brickman of JPMorgan reiterating a “sell” rating and a price target of $135, while Goldman Sachs’ Mark Delaney lowered his price target to $252 and rated the stock as a “hold.”

Concerns Over Margins and Price Cuts: Toni Sacconaghi of Bernstein expressed concerns over Tesla’s auto gross margins, expecting potential downside due to lower volumes and significant discounts on cars sold from inventory. There’s a prediction that Tesla would need to cut prices further next year to drive volumes, which would impact margins.

Price Targets and Ratings: Several analysts have lowered their price targets for Tesla stock. For instance, William Stein of Truist Financial lowered his TSLA stock price target to $243, maintaining a “hold” rating. Despite these concerns, Tesla stock maintains its status as a “moderate buy” consensus on TipRanks, with 12 Wall Street analysts rating it as a buy, and 12 rating it as a hold, while four analysts maintain sell ratings.

Uncertainty Ahead of Earnings Report: Due to the missed forecasts on Q3 deliveries, analysts have less reason to be optimistic about Tesla stock, contributing to uncertainty as investors wait to learn how Tesla performed in Q3.

Getting Down to Brass Tacks: Where’s Price Headed by Earnings?

To gauge the potential future price range of Tesla’s stock, it’s insightful to delve into key metrics, market indicators, and tools that can aid in monitoring and analyzing price movements. Below are the relevant data points, derived expectations, and some recommendations for monitoring critical price levels:

Implied Volatility:

-

Current Value: 52.7%

-

Trend: Ascending

-

Implication: Higher implied volatility suggests a wider expected price range, indicating potential for significant price movement.

-

Current Stock Price: Approximately $260 (as of the date of this analysis)

-

Time Frame: 13 days (from October 5th to October 18th)

-

Options Market Price Range Expectation: $234.25 to $285.75.

Moving Average:

- 50-Day MA: $250.45

- 100-Day MA: $245.75

- 200-Day MA: $207.78

Round Number Alerts:

- Key Levels: $225, $250, $275, $300

- Tool Recommendation: Utilize the alerts feature on Seeking Alpha to monitor these key levels, rounding as necessary.

Alert Strategies:

- Bullish Investors: Set up alerts for lower range numbers, seeking possible long entry points.

- Bearish Swing Traders: Set up alerts for higher range numbers, eyeing possible short entry opportunities.

- Note: Monitor price action and volume to potentially confirm directional bias, emphasizing risk management alongside any entry strategy.

Round Number Trading Systems:

- Background: I occasionally receive requests from futures traders that would like for me to build a system for them primarily based on round numbers or what some people call psychological numbers.

- Insights from Backtesting: I have conducted extensive backtesting of these strategies across multiple instruments. I’ve discovered that the success of a round number strategy notably improves when it is melded with an analysis of the overall price structure. Additionally, comparing the current price to the closing price of the previous trading day, along with an examination of the trading volume, has elevated the level of success of these strategies from low to moderate, to a more favorable standing.

The effectiveness and suitability of the above-analyzed strategies and indicators largely depend on individual investment goals and timeframes.

Conclusion

In my view, Tesla’s journey is filled with both opportunities and challenges. Its growth metrics and market leadership are indeed commendable. Furthermore, Elon’s impact as a CEO is unparalleled in contemporary times. Yet, concerns such as high valuation and significant short interest remain pressing. The looming question also persists: What would Tesla’s trajectory be if Elon were to step away one day?

I believe that anyone looking at Tesla, Inc. should approach it with a balanced perspective, weighing both its strengths and potential risks. As always, thorough research and understanding one’s risk tolerance are crucial before making any investment decisions. Happy trading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm a licensed Commodity Trading Advisor. The information I provided is to be deemed as opinion, and is for educational purposes only. The information I provided is not a recommendation to buy or sell any instrument. As a way of a regulatory disclaimer, futures, foreign currency, and commodity trading involves substantial risk of loss and is not suitable for all investors. Past results are not necessarily indicative of future results.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.