Summary:

- The 2nm wafer technology ramp-up can potentially accelerate revenues and gross margins even more than what was seen in the 3nm ramp-up.

- TSMC is capacity-constrained. Capex investments to alleviate these constraints are positive for long-term growth that is likely to maintain and extend technological and market share leadership.

- Valuations are at a deserved premium??vs.??historical levels and peers. TSMC has better revenue and earnings growth prospects than before and is increasing its edge as a market leader.

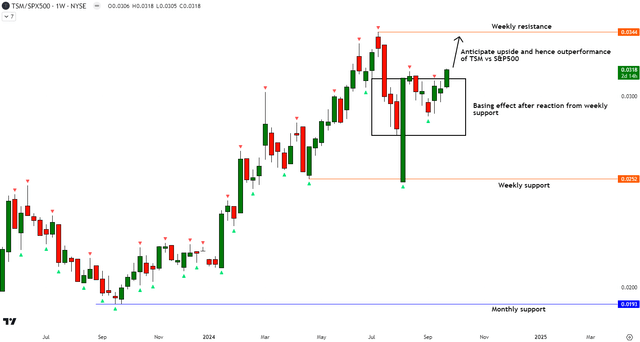

- Relative technicals??vs.??the S&P500 are bullish as a sharp reaction off weekly support followed by a basing pattern is a recipe for further upside and outperformance.

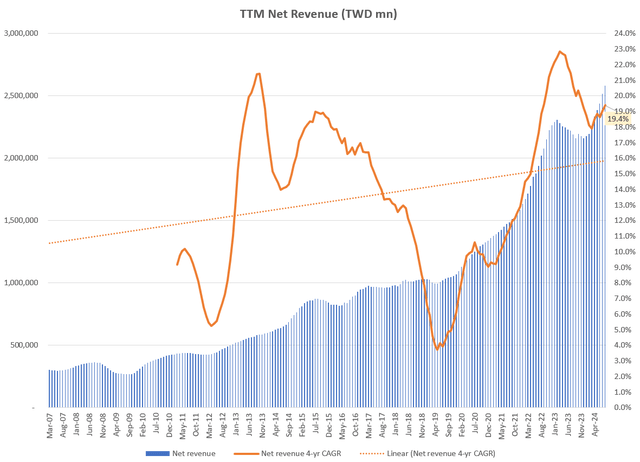

- Despite the bullish drivers, let’s not forget that the semiconductor market is still cyclical. Currently, TSMC’s growth is at the upper end of longer-term cyclical growth averages. But the bottom-up drivers are constructive.

asbe

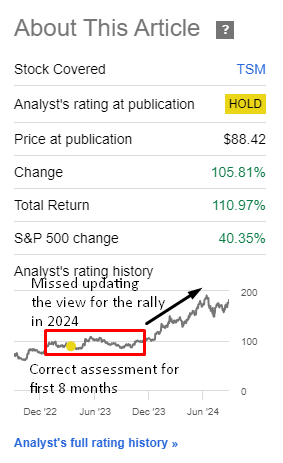

Performance Assessment

In my last article on Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) (OTC:TSMWF) (often abbreviated as TSMC), I rated the stock a ‘Neutral/Hold’. This view was correct for the first 8 months. However, I didn’t update my view after that, as my focus was unfortunately on other stocks. I’ve missed a potential >60% active return upside opportunity in TSMC in 2024:

Performance since Author’s Last Article on TSMC (Seeking Alpha, Author’s Last Article on TSMC)

I believe I have a better organization system now to track key companies on my watch list. So going forward, I hope such errors of omission and delayed publication updates will be less frequent.

Thesis

Since my last update, TSM’s demand outlook has improved. It has seen great success in its sale of 3nm technology wafers and I believe it is set to benefit from a similar boost in newer technologies coming in the next few quarters. I am now bullish on Taiwan Semiconductor Manufacturing Company Limited (TSM) (TSMWF). Here’s my thesis:

- 2nm technology ramp-up’s impacts on revenues and gross margins may be accelerated.

- Capex investments to alleviate capacity constraints are a positive for long-term growth.

- Valuations are at a premium, but I think deservedly so.

- Relative technicals are bullish.

- The upper end of semiconductor cyclicality is a risk monitorable.

2nm technology ramp-up’s impacts on revenues and gross margins may be accelerated

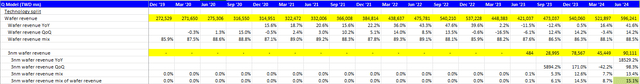

Wafer revenue and 3nm contribution (Company Filings, Author’s Analysis)

TSMC started to monetize its 3nm wafers in Q2 FY23. The ramp-up has been impressive as within the space of a year, 3nm wafers grew from zilch to make up 13.4% of overall revenues. The last quarter in particular has seen a step jump as sequential growth has almost doubled. This has led to a meaningful growth acceleration in overall wafer revenues (which make up almost 89% of overall revenues) from sub-20% YoY in Q1 FY24 to 42% in Q2 FY24.

The next generation is TSMC’s 2nm (N2) wafers. Management expects a ramp profile similar to that of the 3nm (N3) process node:

N2 is on track for volume production in 2025 with a ramp profile similar to N3.

– CEO C.C. Wei in the Q2 FY24 earnings call.

Customers’ interest in TSMC’s 2nm wafers is already high. For example, Apple Inc. (AAPL) is set to use 2nm chips for the iPhone 17 series. An analyst in TSMC’s latest earnings call also highlighted that virtually every client is engaged with TSMC to get their hands on the 2nm wafers, thus forming expectations of a faster ramp on revenues, as well as faster gross margin improvements (as new process nodes typically start out at a lower yield and utilization before ramping up as production increases with continuous efficiency improvements):

I remember C. C., you mentioned earlier that every client is now engaged with you on the 2-nanometer’s migration. So I’m just wondering that when we enter in maybe 2026, the third — the second year, can we expect that the revenue contribution initially will be larger than what we had comparing to N3? And also wondering that since the performance is much better. So can we expect the dilution period will also be shorter than N3?

– Chia Yi Yen Citigroup Analyst’s question in the Q2 FY24 earnings call.

TSMC’s CFO confirmed this hypothesis in her reply:

The revenue, yes, it’s going to be bigger, okay? Gross margin dilution, it will be faster to reach corporate average.

– CFO Jen-Chau Huang’s response in the Q2 FY24 earnings call.

Thus, I am bullish on an accelerated revenue and gross margin ramp of TSMC’s 2nm technology wafers, which are expected to begin high-volume production in H2 FY25.

Capex investments to alleviate capacity constraints are a positive for long-term growth

Similar to NVIDIA Corporation (NVDA), TSMC is facing red-hot demand and is supply-constrained (probably to an even higher extent than NVIDIA). As the CEO himself noted:

All the people want to move into kind of a power-efficient mode. And so they are looking for the more advanced technology so that they can save power consumption. And so a lot of my customers want to move into N2, N2P, A16 quickly. We are working very hard to build the capacity to support them. Today, it’s a little bit tight, not a little bit, actually, today is very tight. I hope in next year or the next 2 years, we can build enough capacity to support this kind of demand.

– CEO C. C. Wei in Q2 FY24 earnings call, Author’s bolded highlights.

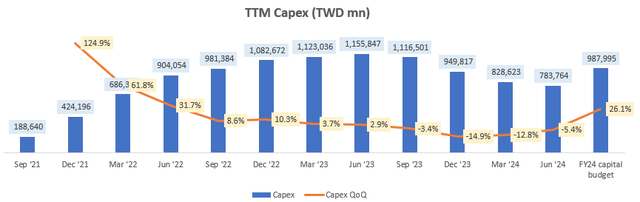

For this reason, TSMC is ramping up capex investments. Its FY24 capex budget is USD 30-32 billion, which corresponds to almost TWD 989 billion at the midpoint based on current USD/TWD FX rates. This corresponds to a sharp sequential increase of 26.1% in annual capex spending:

Capex (TWD mn) (Company Filings, Author’s Analysis)

Management also assured investors that higher capex for TSMC correlated with higher growth in subsequent years:

Between 70% and 80% of the capital budget will be allocated for advanced process technologies. About 10% to 20% will be spent for specialty technologies, and about 10% will be spent for advanced packaging, testing, mass-making and others. At TSMC, a higher level of capital expenditures is always correlated with the higher growth opportunities in the following years.

– CFO Jen-Chau Huang in the Q2 FY24 earnings call

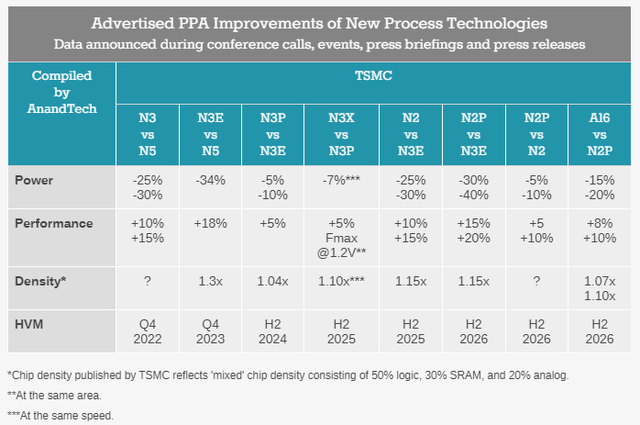

Based on the success of the recent N3 process node’s commercial success and the bullish outlook on the N2 process node, I have no doubts in believing management’s commentary about the growth ROI on capex in future years. I see a long runway of growth catalysts ahead even beyond the N2 nodes as the A16 technology (1.6nm) is due for high-volume production in H2 FY24:

PPA refers to power, performance, and area; these are the 3 key optimization variables in semiconductor designs

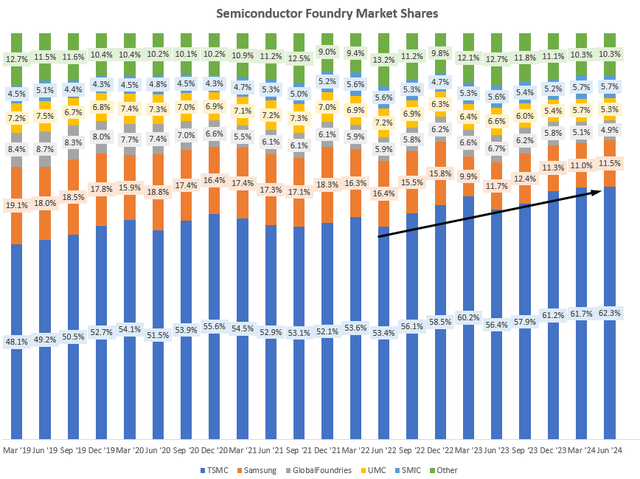

Overall, I anticipate these investments to continue maintaining and extending TSMC’s technology and market share leadership:

Semiconductor Foundry Market Share (Statista, TrendForce)

Valuations are at a premium, but I think deservedly so

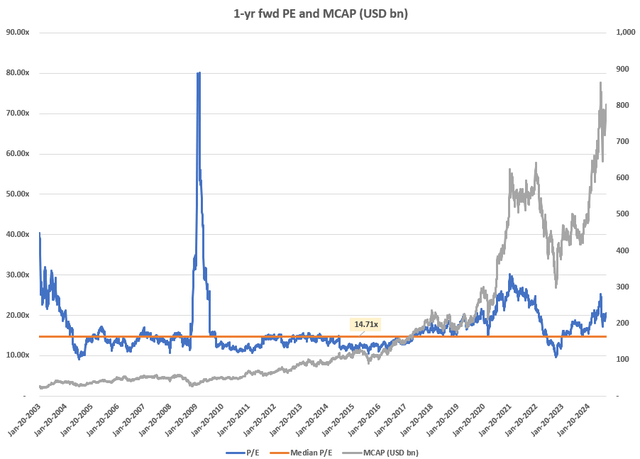

At 20.61x, TSM stock is trading at a 40.1% premium to its longer-term 1-yr fwd PE of 14.71x:

1-yr fwd PE and MCAP (Capital IQ, Author’s Analysis)

Although this seems high, it must be viewed in the context of the growth expectations ahead. Currently, the forward FY25 revenue expectations hover around a mid-20s% YoY currently and EPS growth expectations are in the mid-high 20s% YoY. This is higher than the sub-20% YoY revenue and earnings growth seen in 2021, when the multiples were higher in the mid-high 20x ranges.

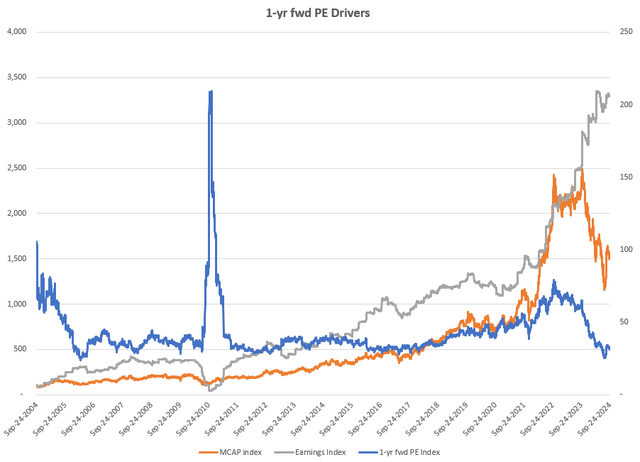

Looking at the drivers of the 1-yr fwd P/E, it is good to see that the recent correction in the market capitalization and hence stock price is driven mostly by valuation de-ratings. The earnings growth index (which is a more sustainable driver of long-term stock performance), has shown no signs of deterioration:

1-yr fwd PE Drivers (Capital IQ, Author’s Analysis)

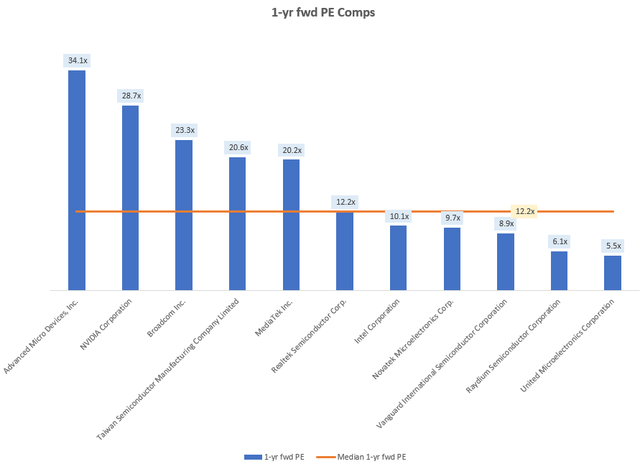

Relative to its peers, TSMC trades at a 69% premium to other major semiconductor companies, who have an average 1-yr fwd P/E of 12.2x:

1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Given TSMC’s technology leadership, dominant market position, and strong growth outlook ahead, I deem this premium to be acceptable and deserved.

Relative technicals are bullish

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of TSM vs. SPX500

TSM vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P500 (SPY) (SPX), TSM is rebounding off a weekly support after forming a basing pattern. My technical read says this increases the chances of further upside ahead to the weekly resistance and potentially beyond, leading to the outperformance of TSM vs. the broader market.

Upper-end of semiconductor cyclicality is a risk monitorable

The semiconductor industry has done remarkably well since 2020. However, it is very easy to get caught up in the bullish drivers and ignore the fact that the industry, and TSMC, do have cyclicality. Since 2000, the typical semiconductor cycle has lasted 3.7 years. So I’ve plotted TSMC’s revenues and overlaid it with a 4-yr cycle period CAGR average here:

TTM Net Revenue (TWD mn) (Company Filings, Author’s Analysis)

Currently, the growth trends are on the upper end of the cycle, which makes a cyclical downturn a key risk monitorable. For now, I still lean bullish since the bottom-up drivers indicate that instead of an oversupply problem (which is often the trigger for cyclical downturns), TSMC is currently facing the opposite scenario of strong demand and capacity (supply) constraints.

Takeaway & Positioning

After looking at how TSMC’s 3nm wafer technology ramped up production to accelerate revenue growth, I am very bullish on the upcoming 2nm high volume production due in H2 FY25 because there are already signs of strong demand, which is leading to expectations of an even faster ramp up in revenues and gross margins than what was seen for the 3nm process nodes.

Currently, TSMC is facing red-hot demand but is capacity-constrained. Hence, it is ramping up capex investments aggressively to reinvest in continued technological leadership and scale production for the next 2 generations of wafer technologies. I believe management is making the right moves here to maintain and grow its technological and market share leadership among semiconductor foundry players.

From a valuation perspective, TSMC trades at a premium vs. both its historical 1-yr fwd multiples and vs. other semiconductor companies. However, I believe this is acceptable and deserved since the company’s revenue and earnings outlook is stronger than prior levels when the valuation multiples were even higher. And the company has a dominant position in its sector with an outlook that builds on its technological edge.

Relative to the S&P500, TSM stock has reacted sharply off a weekly support and formed a base. I expect this setup to lead to an upside and hence outperformance in the stock.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis.

Neutral/hold: Expect the company to perform in line with the S&P500 on a total shareholder return basis.

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis.

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence.

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSM, TSMWF, TSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.