Summary:

- TSMC is an undervalued giant with a deep moat.

- As a market leader with 62% share, it has the most advanced technological process leadership.

- Its constant innovation and process leadership is a virtuous circle with all its fabless design partners.

- TSMC is vital for Nvidia’s GPU production and the AI revolution.

- There are uncertainties due to geopolitical concerns, but it is a risk worth taking.

SweetBunFactory

I’ve owned Taiwan Semiconductor Manufacturing Company (NYSE:TSM) (OTC:TSMWF) for several years and am surprised that I never wrote about it. My last purchase was in April 2024, around $128. The dip caused by sector rotation, the political rhetoric before the November elections, and the Japanese carry trade crisis is an opportunity I don’t want to pass up. To be sure, the usual China bashing, and tariff posturing will continue through November and beyond – it’s the one thing both American parties have in common. Besides, we still haven’t seen the end of volatility from the Japanese market crash. I’m prepared for further volatility or a stock that just stays sideways.

As for the chances of war, or invasion of Taiwan by its larger neighbor, I don’t have a crystal ball, and should it happen, believe me, we’ll have bigger, existential problems to worry about.

The monopoly

That said, let’s look at what makes this wonderful company so special and why this quasi-monopoly can continue for a while. The Wall Street Journal had an interesting story about Morris Chang, TSMC’s founder, who started the company at the ripe old age of 55, giving up a cushy well-paid career for an extremely challenging life. It was the 30+ years of Chang’s experience that made it so successful instead of the dorm room starry-eyed aspirations of other typical founders like Sergey Brin, Larry Page, Steve Jobs, or even the slightly older Jensen Huang and Jeff Bezos.

The core principles of starting the company were:

Intense laser-like focus – It had to be a manufacturing giant making chips designed by others – it would never compete with its clients. They in turn wouldn’t bother or need to struggle with the intricacies of running a massive scaled-up operation and never compete with him.

Leverage your expertise as a 55-year-old with decades of experience to constantly improve your production and processes and wring out every efficiency possible. Chang likely knew more about semiconductor manufacturing than any semiconductor executive in the US at that time.

Create the company in your image of relentless hard work and passion, and make calls on your honeymoon if you have to!

Understand your company’s and Taiwanese strengths and weaknesses, leverage the strengths to the fullest, and stem the weaknesses. Morris knew then that manufacturing was the best possible route with the massive backing of Taiwan’s Industrial Technology Research Institute. He understood that manufacturing was best used in Taiwan not just for the labor arbitrage of a weaker currency – he saw right away that efficiency was significantly higher.

“TSMC was a business-model innovation,” Chang says.

Chang says the idea behind TSMC was also the result of the personal philosophy that he’d developed over the course of his long career. “To be a partner to our customers,” he says. That founding principle from 1987 is the bedrock of the foundry business to this day, as TSMC says the key to its success has always been enabling the success of its customers.

Today it operates at a scale that is almost incomprehensible. The first Intel microprocessor had about 2,000 transistors, but the latest Nvidia chip is packed with more than 200 billion transistors. Churning out identical copies of a single chip for an iPhone requires one TSMC fab to produce more than a quintillion transistors—that is, one million trillions—every few months. In a year, the entire semiconductor industry produces “more transistors than the combined quantity of all goods produced by all other companies, in all other industries, in all human history,” Miller writes.

Replicating TSMC is extremely difficult if not impossible – I wish Intel (INTC) and other foundries who’re getting funding from the Chips Act well, but it is too little too late and TSMC’s troubles in starting its $40Bn plant in Arizona with labor shortages and other delays suggest that this monopoly is very, very unlikely to be threatened.

Market Leadership

Here’s a look at the giant and the dwarfs. All the rest total 38% to TSMC’s 62%. And it’s not revenues, it’s the inability to move up the value chain – can you imagine Apple (AAPL) and NVIDIA (NVDA) going to a smaller competitor for their newest products on the 3Nm and the 2Nm nodes? Perhaps Samsung, but as of now, even foundry competitor Intel is using TSMC for its advanced nodes.

Global Semiconductor Market Share (Counterpoint)

TSMC and ASML

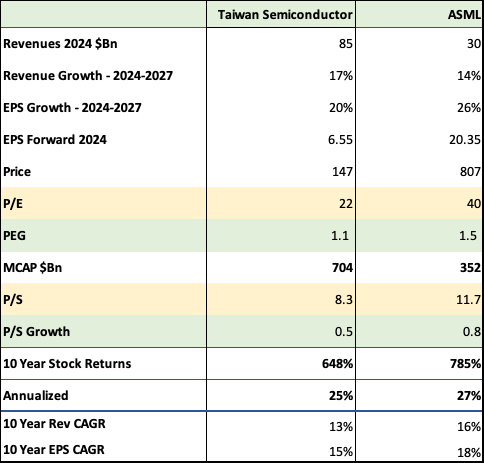

Samsung’s foundry business is perhaps the only real competitor to TSMC, even at just 21% of its size, but it is part of a conglomerate, and the entire company is not a good comparison. That’s why I used ASML (ASML) as the most advanced equipment maker with its monopolistic EUV machines to compare it to.

I believe the multiple and valuation for TSMC should be close to ASML’s multiple. We assign all these high multiples to ASML, Nvidia, ARM, and so on – if TSMC falls, its contagion effect will doom all of the rest or at least derail them for several years.

TSMC and ASML (Seeking Alpha, Fountainhead)

TSMC stacks up fairly well with ASML. Based on consensus analyst estimates, TSMC should grow revenue at 17% compared to ASML’s 14% from 2024-2027. Its EPS growth of 20% is considerably lower than ASML’s 26% a) as a manufacturer, and b) exposure to cyclical and mature notes, which often go through slowdowns, and c) competitors will cut prices often – foundries tend to be cutthroat price leaders, and it is only been in the past few years that newer more technologically advanced nodes have stemmed price action simply because others are finding it impossible to catch up. Even though TSMC’s EPS growth is lower, we’re paying just a little over half of what we pay for ASML – at a P/E of 22 compared to a P/E of 40 for ASML, and as a result, the PEG ratio is just 1.1 compared to 1.5 for ASML. Similarly, the P/S to growth is lower at 0.5 for TSMC compared to 0.8 for ASML, which is great because TSMC is almost 3x ASML’s size at $85Bn to $30Bn.

Over the past ten years, ASML’s stock has performed better at 27% compared to 25% for TSMC, on the strength of faster revenue growth of 16% to 13% and faster earnings growth of 18% and 15%.

But the differences are minimal, and both are market leaders and quasi-monopolies. Clearly, TSMC is in the same league and, going forward, should be accorded the same valuation.

Capital Expenditure

Capex is one of the biggest reasons to invest in TSMC – TSMC’s capacity to keep spending and improving, and increase scale is a huge, huge moat. I would think it is as valuable as ASML’s technological and innovation lead.

TSMC spent $30.9Bn in Capex in 2023, after generating $40.4Bn in cash. Its depreciation expense alone was $17Bn. After all that, its Fort Knox balance sheet had $55Bn in cash and 30Bn in long-term debt. In this case, the capacity to borrow and carry $30Bn in debt is also a competitive advantage and not a millstone as one would conventionally think. Who’s going to lend TSMC’s competitors $30Bn easily?

Moving up the value chain

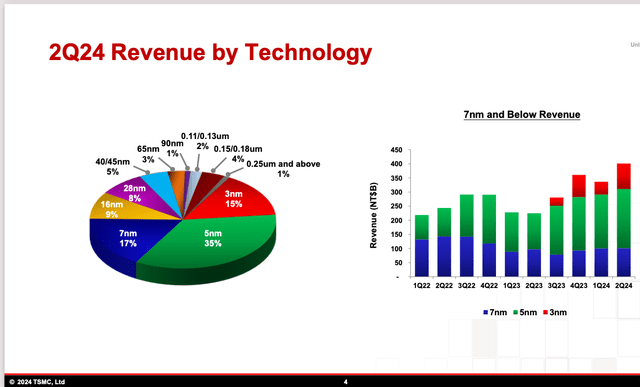

TSMC revenue by technology Q2-24 (TSMC)

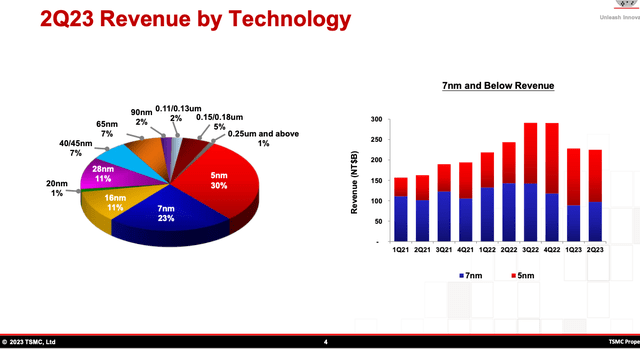

As we can see from the chart above, 3nm has already climbed to 15% of revenue, from 0 last year, and 5nm has moved from 30% to 35% this year. The two most advanced nodes take up 50% of revenue. Similarly, last year, the two most advanced nodes, 5nm and 7nm, took up 53%. TSMC is constantly moving up the value chain, probably in 2025 or 2026 you would see 2nm and 3nm occupying more than 50% and so on…And they keep raising prices as they go along.

TSMC revenue by technology Q2-23 (TSMC) TSMC revenue by platform Q2-24 (TSMC)

TSMC’s biggest strength is capturing the fastest-growing segment in semiconductors; as of Q2-24, HPC (High-Performance Computing) for data centers powered by Nvidia’s GPUs made up 52% of revenues. It also grew the fastest at 28%. This is not a new thing; for years, Apple has used TSMC for its smartphones. The semiconductor industry cannot survive without process innovation and TSMC is constantly and relentlessly ahead of the curve – it has to be as Morris Chang thought so decades ago when he started.

Intel’s implosion is a testament to how critical it is to keep innovating. Its own foundry is not up to the task, and it’s outsourced its Lunar Lake and Arrow Lake platforms to TSMC.

Weaknesses and Challenges

Regardless of its technology leadership, there are no patents for progressing on advanced nodes – competitors can and do progress and slash prices as they go along.

Diversifying geopolitical risk by setting up foundries worldwide is a good strategy but expensive and more unstable as we see from the delays of setting up in Arizona.

Semiconductors are the new gold, and governments worldwide from the US, China, South Korea, and India are supporting other foundries. The Chips Act passed by the US in 2022 also helps competitors like Intel and Samsung.

While the big demand from High-Performance Computing (HPC) is now center stage with 52% in Q2-24, TSMC still got 33% of its revenues from smartphones, a market, which is saturated and cyclical. Customers don’t make upgrades unless there are special features, and we’ve seen Apple’s revenues barely grow.

Similarly, after the initial gold rush for Nvidia’s GPUs from Meta and Microsoft, there could be a slowdown in growth for GPUs, especially if AI doesn’t deliver as promised.

Valuation and investment case

TSMC Forecast (TSMC, Seeking Alpha, Fountainhead)

Based on consensus analysts’ estimates, TSMC should grow revenues at a brisk CAGR of 17% and earnings at an even faster clip of 20%. This is higher than the 10-year average of 13% and 15% respectively, most of it based on GPU acceleration for data centers.

I believe that for a 20% earnings grower, a P/E of 22 and a PEG ratio of 0.8 are low – despite the geopolitical risks of a Chinese takeover of Taiwan associated with TSMC. I’m not implying that TSMC could suddenly circumvent that risk, I’m positing that a) the risk applies equally to all the stalwarts in the semiconductor industry such as ASML, and b) If such an event happened, we have far bigger problems to worry about.

TSMC is absolutely unique in its position as a market leader with a deep moat of these competitive advantages:

- Economies of scale and premium pricing as a result of technological leadership.

- The most advanced processing nodes, which further consolidate its leadership position – This is a virtuous circle.

- Impossible for fabless customers to make inroads into foundries.

- Humongous capital needs are a huge barrier to entry.

- Strong partnerships with chip designers such as Nvidia, AMD, and Apple.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, ASML, NVDA, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.