Summary:

- Recently Taiwan Semiconductor Manufacturing officials said that they were considering raising prices charged to NVIDIA.

- With a 60% market share in chip manufacturing, TSMC is the only company with enough manufacturing capacity to fill NVIDIA’s massive orders.

- Although NVIDIA works with Samsung as well as TSMC for manufacturing, it’s not clear that it could cut out the latter due to higher prices in the near term.

- TSMC will make money off of Apple’s new AI with on-device processing, NVIDIA might not.

- In this article I make the case that Taiwan Semiconductor Manufacturing is fundamentally stronger than NVIDIA.

View of the Taiwan Semiconductor Manufacturing Company (TSMC) plant. BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), also known as ‘TSMC,’ is NVIDIA Corporation’s (NVDA) contract manufacturer. With a 60% share of the global semiconductor market and a 90% share in high-end chips, it is a very powerful company. So powerful, in fact, that it may even be in a position to hike the prices it charges to NVIDIA itself. In a recent interview following TSMC’s shareholder meeting, Chairman C.C. Wei said that he was considering raising the prices his firm charges NVIDIA. Given the demand for NVDA’s new AI chips, and the fact that TSMC’s competitors have nowhere near as much capacity as it does, TSMC will likely be able to get the contemplated price hikes accepted.

The fact that TSMC is even able to talk about raising NVIDIA’s prices shows the extreme amount of market power the company enjoys. NVIDIA is one of the most powerful companies in the world right now, being the sole supplier of the AI accelerator chips the software industry depends on for high intensity workloads. Other companies make AI chips of different types (for example QUALCOMM Incorporated (QCOM) makes chips for on-device processing), but only NVIDIA’s products can handle the demanding workloads of services like ChatGPT.

NVIDIA’s power in the software industry can’t be understated. With virtually all of the big tech “Magnificent Seven” stocks dependent on it, NVDA is nearly unassailable. However, Taiwan Semiconductor Manufacturing might be even stronger. Big tech companies essentially have to take the prices NVIDIA charges without asking questions, while TSMC can raise the prices it charges to NVIDIA (or thinks it can). Its self-perception here is likely to hold true in the near term, as Samsung Electronics Co., Ltd. (OTCPK:SSNLF), NVIDIA’s #2 supplier, has far fewer manufacturing sites than TSMC has (I count five fabs on Samsung’s website and 20 on TSMC‘s).

None of this is to say that Taiwan Semiconductor and NVIDIA are competitors. They have a working relationship, not a competitive one. However, it is worth comparing them, as investors in semi stocks may be interested in picking one of these stocks over the other, or giving one of them a higher portfolio weighting. Active stock picking usually entails making such choices, and I consider TSM a better choice than NVDA today.

When I last covered Taiwan Semiconductor Manufacturing, I rated the stock a strong buy on the grounds that it had a very strong competitive position and was cheap. I’m even more enthusiastic about the company itself than I was then; however, the stock’s price appreciation and outperformance of the S&P 500 since that time, do demand a re-rate. I consider TSM a ‘buy’ today, mainly because it has gotten pricier than it was when I last covered it.

It wouldn’t be saying much to claim that TSMC is stronger than any of its semiconductor manufacturing competitors. I think that’s already the consensus on Seeking Alpha and elsewhere. To say that TSMC is stronger than NVIDIA, however, is a bold claim. NVIDIA is one of the three most valuable companies in the world. At times, it has been THE most valuable company in the world. No other semi name comes close in terms of size and scale. In terms of importance to the global economy, however, Taiwan Semiconductor Manufacturing is arguably even more important. In this article, I will make the case that TSMC is, indeed, a stronger company than NVIDIA, and still very much worth buying at today’s prices.

TSMC Has More Paths to Growth than NVIDIA Does

In addition to being (in this author’s personal opinion) more indispensable to NVIDIA than NVIDIA is to it, Taiwan Semiconductor also has more paths to growth than the former company does. While NVIDIA’s big money maker right now is a data center, TSMC can make plenty of money off of on-demand AI processing as well. So, TSMC has more optionality and more different avenues to growth than NVIDIA does.

Consider Apple Inc.’s (AAPL) new Apple Intelligence suite of products. The suite triggered a 13.8% rally in Apple shares when it was announced last week. As I wrote in my recent Apple article, the rally was deserved. Apple is the first of the ‘Magnificent Seven’ companies to attempt a unique and fully integrated AI ecosystem, as opposed to the generic ChatBot approach that had been the norm until now. Additionally, Apple may generate revenue directly from AI by driving ChatGPT paid plan signups.

What was missed in all the hype about Apple Intelligence was the fact that NVIDIA will likely not be joining the party. Apple Intelligence is primarily processed on-device. That means that the processing will be handled by Apple’s own proprietary A-series chips, not NVIDIA chips in a remote data center. Some high-intensity user requests that go beyond what Apple can handle on-device will be sent to ChatGPT, which uses NVIDIA on the backend. But the majority of day-to-day tasks people will be doing with Apple Intelligence will likely not require any NVIDIA chips

Taiwan Semiconductor is much better positioned here. As NVIDIA AND Apple’s contract manufacturer, it makes money from AI data centers as well as on-device AI services like Apple Intelligence. TSMC is Apple’s exclusive contract manufacturer. It manufactures all of the advanced chips that Apple relies on to power its on-device AI, which includes the A16 bionic chip used in all iPhone 15s. In order to use Apple Intelligence, users will have to have an iPhone 15 or a higher-end model. Given the extremely high level of interest the Apple Intelligence announcement generated-the WWDC got a whopping 10 million views on YouTube alone-it appears likely that people who haven’t upgraded to the iPhone 15 yet will upgrade just to experience Apple Intelligence. The announcement that brought Apple Intelligence to the world was both widely watched and well-reviewed. So, Apple could see an iPhone 15 sales surge driven by Apple Intelligence, which would lead to more orders for TSMC.

What this means is that Taiwan Semiconductor Manufacturing stands to benefit from Apple’s ventures in generative AI. That’s probably not the case with NVIDIA, whose entire AI revenue stream comes from data centers (“servers”) that host services like ChatGPT. Should Apple’s on-device AI vision gain prominence, then NVIDIA will miss out on that segment of the AI industry. TSMC, as Apple’s chip manufacturer, will gain a piece of it.

How Generative AI Impacts Taiwan Semiconductor’s Valuation

The latest shifts in generative AI have a bearing on TSMC’s valuation.

TSM is well known for being one of the cheapest AI stocks out there, trading at “moderate” multiples despite having high growth. As the table below shows, the combination of value and growth is very compelling.

|

TSMC’s multiple |

Corresponding 5-year CAGR growth rate |

|

GAAP P/E: 33 Adjusted P/E: 27.5 10.5 times sales 6.5 times book value |

20.7% EPS growth 20.7% EPS growth 17.5% revenue growth 16% growth in book value |

As you can see, Taiwan Semiconductor Manufacturing has roughly “average” multiples for a big tech company, while having very high five-year compounded growth. The trailing 12-month growth rates are not so good; however, TSM’s recent revenue reports show revenue growth rates well in excess of the five-year average. So, there is reason to hope that the company’s upcoming earnings release will show high growth and considerable acceleration.

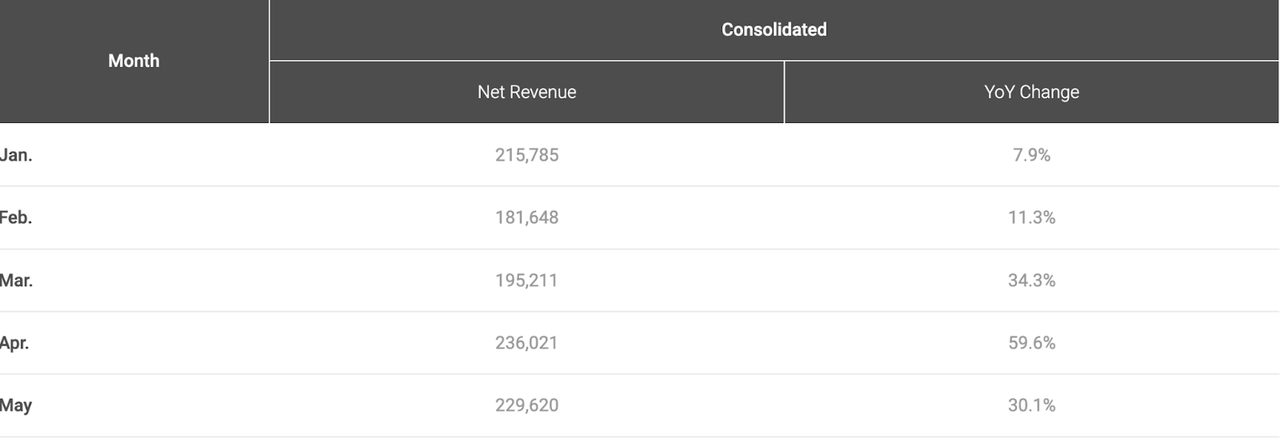

It goes without saying that TSMC is far cheaper than NVIDIA at today’s prices. What is less commented on is the fact that its growth is quickly ramping up. Although NVDA has grown much faster than TSMC historically, the latter’s last few revenue reports showed a major acceleration in growth (see image below). If this trend continues then we may see TSMC growing faster than NVIDIA in the year ahead. If that occurs then stock price appreciation will likely follow.

A Risk to Bear in Mind

Although my overall take on TSMC is extremely bullish, I do note some risks that investors ought to be aware of.

The biggest of these by far is geopolitical risk. Taiwan is right next door to the People’s Republic of China, a country that appears to consider Taiwan its own territory. Historically, China has more or less acknowledged Taiwan’s status as a semi-independent country, but lately, it has been ramping up rhetoric about “reunifying” the island with the mainland. This rhetoric has been accompanied by military action. For example, China has been conducting military drills off the coast of Taiwan, the most recent of these having used live ammunition. Described as “punishment drills,” these exercises were intended to dissuade the island from “separatist activities,” which China perceived as having increased in likelihood after the Island elected an anti-Beijing leader.

Although most experts do not see a Taiwan invasion occurring in the near future, some think that one could occur eventually. For example, U.S. leaders think that China is making preparations to take Taiwan in 2027 or afterward. If that forecast turns out to be correct, then it’s possible that TSMC facilities could be affected. Depending on the severity of the fighting, facilities could be destroyed. So, the possibility of a U.S.-Taiwan war is a risk for investors to bear in mind.

Nevertheless, Taiwan Semiconductor Manufacturing is, on the whole, an attractive opportunity. It has a dominant market position, a large piece of the generative AI action, plenty of optionality, and a rapidly accelerating growth rate. It’s one of the most intriguing AI opportunities in the market today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.