Summary:

- TMSC is a key player in the AI semiconductor space and has seen its market fortunes improve significantly.

- The company’s robust revenue and earnings growth and its focus on AI chips contribute to its positive outlook.

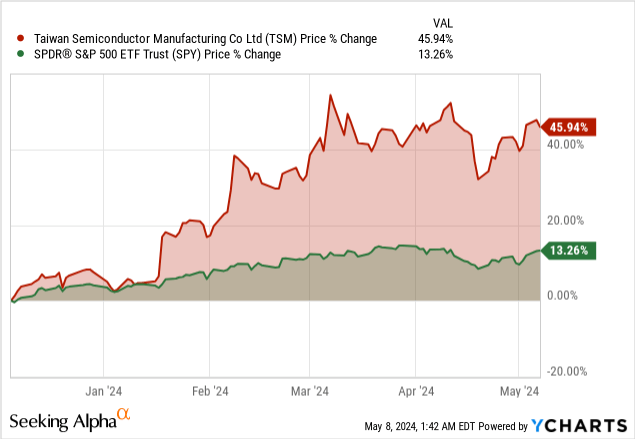

- TSM has nearly doubled, hitting a 52-week high, buoyed by its role as one of the largest semiconductor manufacturers and the elevated demand for Nvidia’s AI chips.

- TSMC has exceeded expectations, surpassing ambitious targets and projecting further growth to potentially reach $185 in 2024, underscored by solid price momentum and market demand.

luza studios

Investment Thesis

Taiwan Semiconductor Manufacturing Company, or TSMC (NYSE:TSM), dominates the rapidly expanding semiconductor industry. It spearheads the development of cutting-edge chips essential for powering AI technologies. As a pivotal supplier for major AI-driven applications, TSMC’s strategic positioning has notably enhanced its market standing and financial success.

Likewise, it is unsurprising that the stock nearly doubled to a 52-week high in April despite a high turnover in traded shares. The impressive market run comes from TSMC’s being one of the world’s largest manufacturers of semiconductor chips, some of which are used by chip giants, including Nvidia (NVDA).

Finally, our investment thesis has proven successful as TSMC has yielded substantial gains, surpassing our ambitious target of $145 from $96 five months ago. Thus, in addition to the strong fundamentals, TSM is projected to potentially reach $185 in an optimistic scenario and stabilize around $150 by the end of 2024.

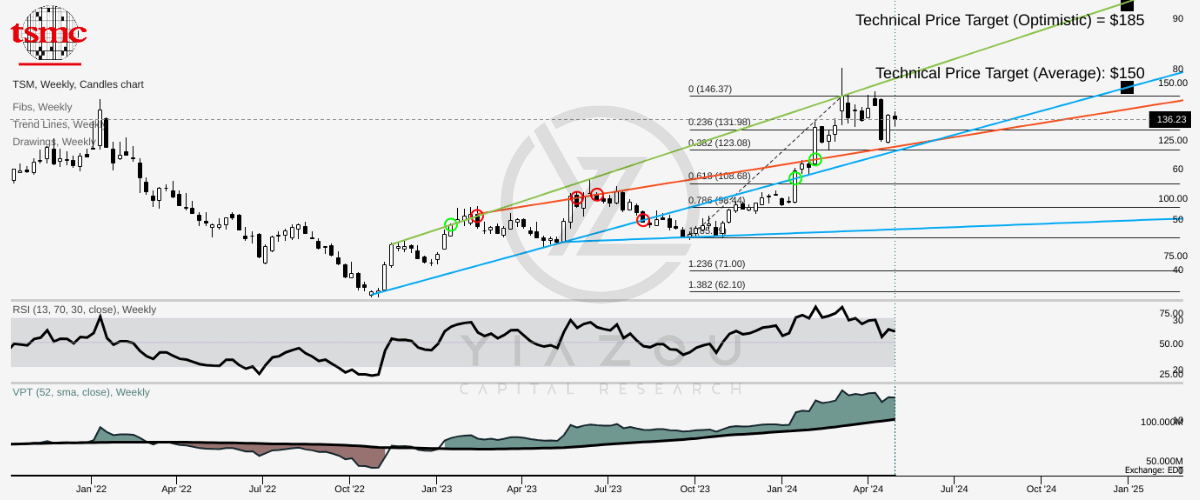

Targets $185 by 2024

The stock price of TSMC may hit $185 and $150 on average by the end of 2024. The optimistic price target is based on the higher-high momentum of the stock price, whereas the average price target is based on the momentum prevailing at higher lows. The momentum reflected by these trend lines is of a short-term nature. Fibonacci retracement suggests critical support of $123 at the 0.382 level. On the downside, $109 is critical mid-term support (at 0.618). Reaching that level is less likely, considering the current price momentum.

Looking at the Relative Strength Index (RSI), at 59, recovered from 54, the stock price reflects a neutral state. Considering the recent highs, there is a double top formation (on an open-close basis) indicator, suggesting there are possibilities for further downside price movement. However, a lack of bearish divergence in RSI at the top suggests further upside due to the absence of historical resistance at the all-time high.

Lastly, the volume price trend (VPT) is aggressively bullish. There is no clear indication of any major reversal (downside trend) in the stock price 2024.

trendspider.com

Surges with Strong Q1 Results, Beats Expectations

Taiwan Semiconductor’s solid financial results have reaffirmed the continuous growth in the core business amidst several headwinds. For instance, it posted revenues of $18.87 billion in the first quarter of 2024, a 12.9% year-over-year growth. However, the figure was lower by 3.8% compared to the last quarter of the previous year.

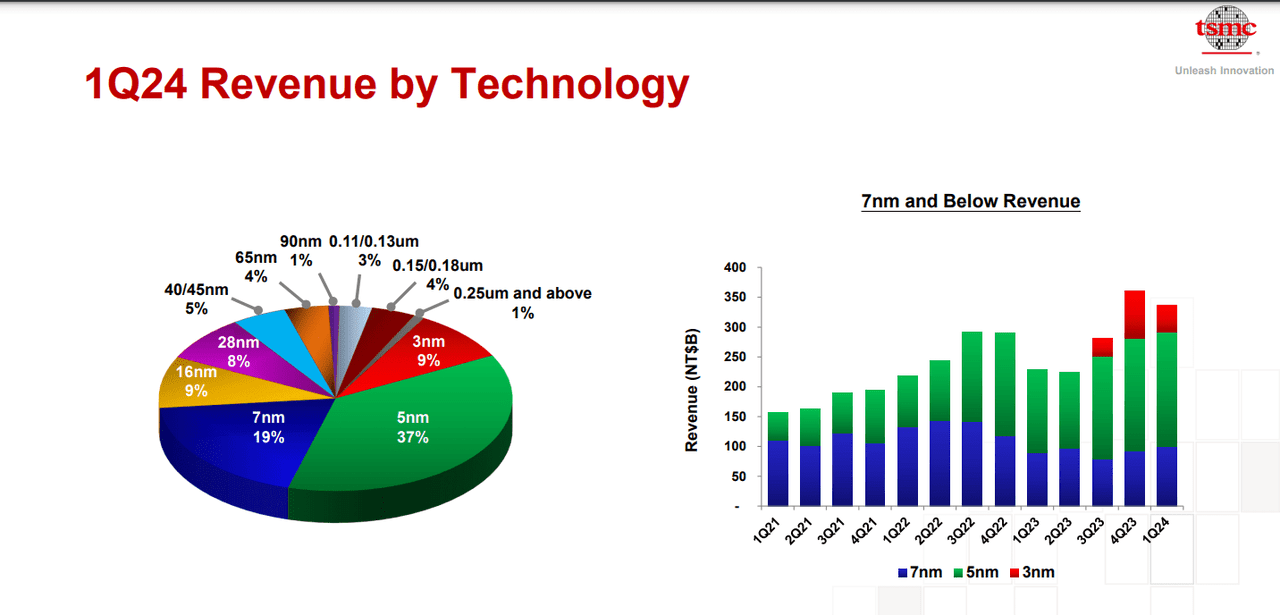

The robust revenue growth came as the world’s largest chipmaker experienced surging demand for advanced chips amid the enthusiasm for AI. This revenue growth is interpreted as solid performances, with shipments of 3 nanometers accounting for 9% of the total wafer revenue, 5-nanometer chips accounting for 37%, and 7 nanometers accounting for 19%.

The robust top-line growth has led to $1.38 a share earnings, surpassing the $1.30 a share that most analysts had anticipated. This achievement not only outperforms the $1.30 a share delivered in the same quarter last year but also instills confidence in its ability to exceed expectations consistently. Net profit also saw a significant rise of 8.9%, marking the end of a three-quarter run of declines.

With first-quarter results, Taiwan Semiconductor is officially back on the sales and earnings growth ramp following four straight quarters of year-over-year revenue and earnings decline. With the company guiding to solid demand for its best-in-class 3—and 5-nanometer technology, it should continue this rising revenue and earnings growth trend. However, its performance could be hit by continued seasonality around smartphones.

TSMC Eyes Robust Growth with AI Chip Demand Despite Economic Challenges

The CEO has warned of deteriorating macroeconomic and geopolitical conditions that can impact consumer sentiment. The warning came when the chipmaking sector faced industry-wide inventories post-pandemic in 2023.

Looking ahead, AI chips present a promising opportunity for Taiwan Semiconductor. They are expected to be a key driver of growth in 2024, with the company projecting strong demand for chips in its high-performance computing segment. This segment, which includes chips for artificial intelligence, holds immense potential for future growth and success.

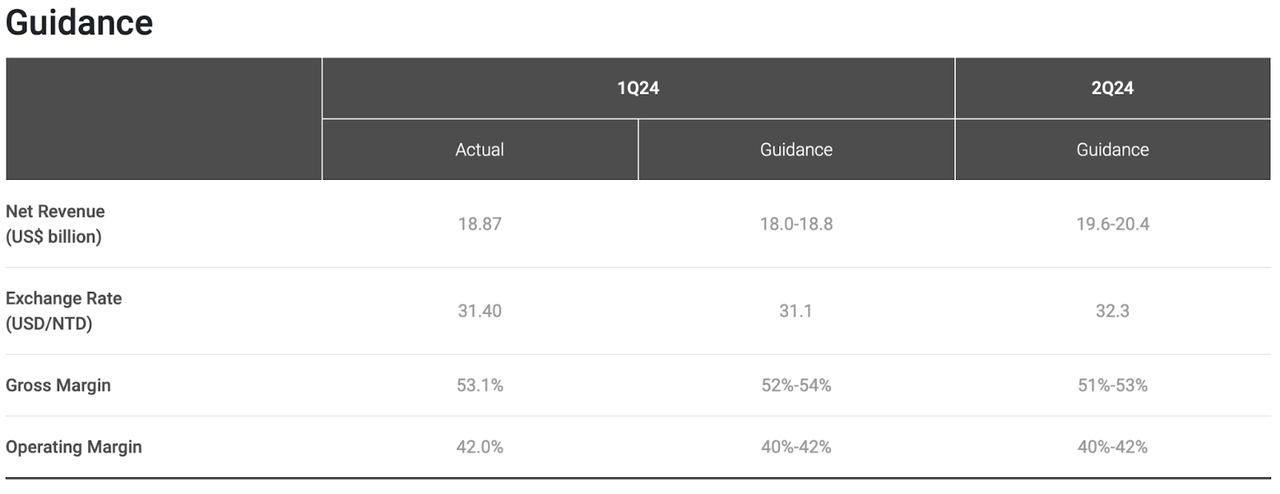

Consequently, Taiwan Semiconductor is projecting revenue growth of low to mid-20% for the current quarter, which should range between $19.6 billion and $20.4 billion. The strong growth will be attributed to a robust demand for chips supporting various AI-related innovations. The chip giant expects its gross profit margin to be between 51% and 53%, with an operating profit margin of 40%- 42%.

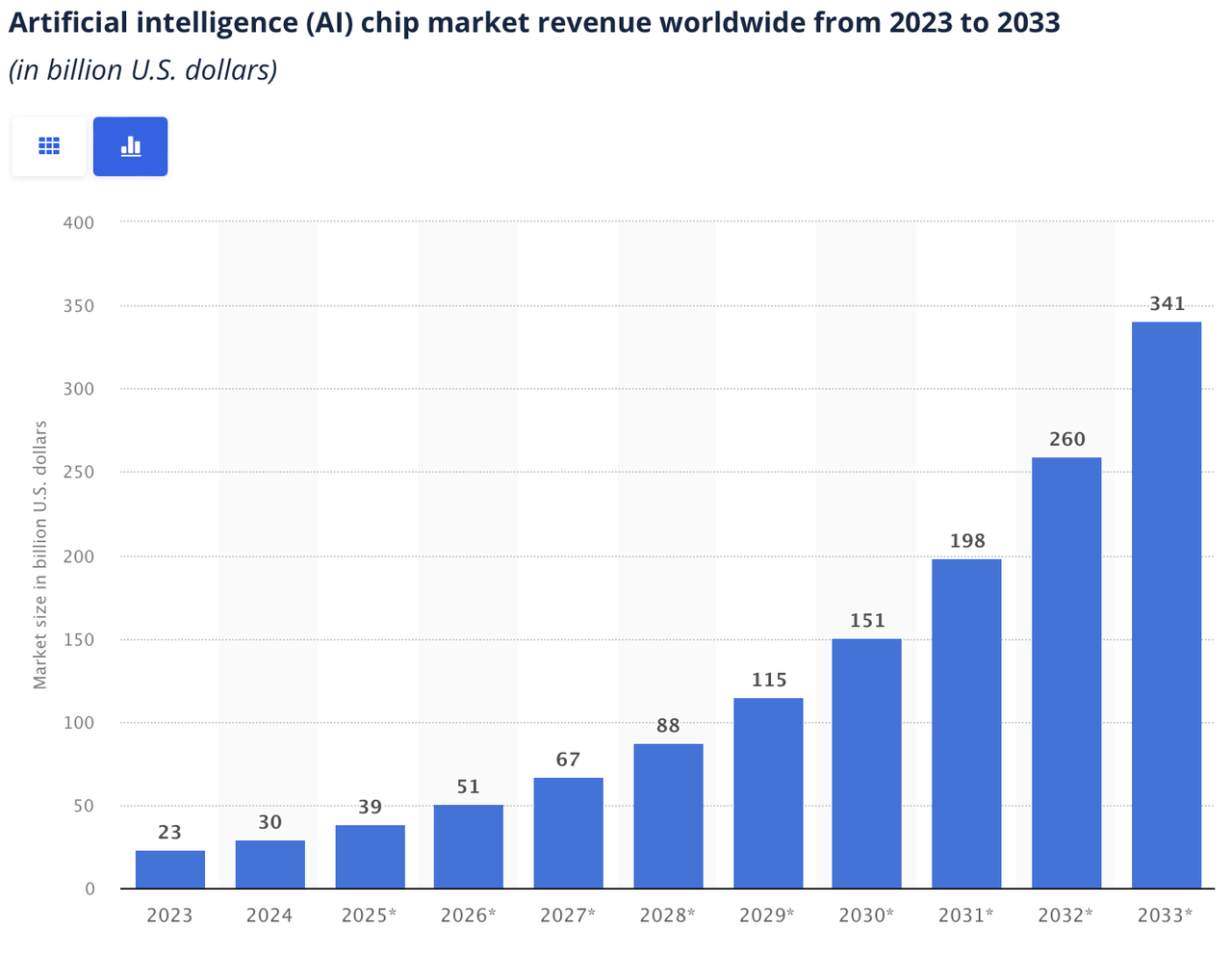

In 2023, the AI market reached highs of $23 billion, attributed to strong demand from various quarters. Going by the ever-growing demand for chips to power the AI revolution, the market size is expected to more than quadruple to record highs of $151 billion by the end of the decade.

The AI chip market reached a record $23 billion in 2023 on solid demand from varied sectors. Strong demand is witnessed due to the growing adoption of AI technologies in applications ranging from data centers to consumer electronics, requiring increasingly sophisticated processing power.

Since industries continue to embed AI into their operations, the need for specialized chips to perform the task efficiently should explode. Finally, the AI market is estimated to grow exponentially in the years ahead, reaching around $151 billion by 2030. This underlines how important it is for companies making semiconductors, such as TSMC, to stay at the vanguard of development and manufacturing for this AI revolution.

TSMC Secures Record $6.6 Billion US Investment to Expand Chip Manufacturing

Taiwan Semiconductor has already secured $6.6 billion in federal funding, representing US history’s most significant direct investment in foreign companies. While the investment will enhance the development of semiconductor fabrication in Arizona, it presents a massive opportunity for the company to bolster its chip manufacturing in the US, one of its US markets.

The investment comes as Taiwan Semiconductor operates massive factories in Taiwan that churn out the vast majority of small components that supply processing power to computers, phones, and other devices.

In addition to the $6.6 billion grant, TSMC is also entitled to $5 billion in loans from the federal government as it claims federal tax credits of up to 25% of the cost of building and outfitting factories. With the grant, TSMC has already confirmed plans to increase its total investments in the US to more than US$65 billion, up from $40 billion.

TSMC Expands Amid Geopolitical Risks and Market Uncertainty

Taiwan Semiconductor has always been among the best-performing companies in innovation, profitability, and revenue growth. However, its stock price does not reflect its capability due to the unending geopolitical concerns. China’s mounting pressure on the island over its growing ties with the US has always forced some investors to stay clear of the chip giant.

Because most of the company’s operations are in Taiwan, it is always at significant risk should tensions between the US and China escalate. Given that most of the company’s plants are on Taiwan’s west coast, it is heavily exposed should there be a Chinese invasion. For investors like Warren Buffett, the escalating tension between the two superpowers appears to outweigh the enthusiasm for a company’s potential to dominate the sector.

On the other hand, TSMC is acting to avoid the same geopolitical risks by making its operations less exposed to that jurisdiction. For example, it is building fabrication plants in the US after the $6.6 billion grant. Lastly, the company has also opened its first chip fabrication plant in Japan as it diversifies its operations.

Bottom Line

Recent weakness for Taiwan Semiconductor can be pinned on broader concerns for the semiconductor market, which has slashed its foundry market outlook. Even a closer look at the company’s results will show that it is firing from all angles, judging from the revenue and earnings growth.

The company also has bullish hopes for the future as the AI market grows, a trend that should offset weakness in PC and smartphone markets. Given that the chief executive is said to be adamant that a surge in AI-related demand has the company in good stead, the recent pullback arguably presents a unique buying opportunity for long-term investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.