Summary:

- A Chinese invasion of Taiwan would likely trigger a global economic depression, devastating TSMC and tech supply chains, causing massive equity sell-offs and GDP drops worse than COVID-19 and the 2008 crisis.

- China could face severe economic fallout: sanctions, loss of foreign capital and technology, GDP reduction up to 35%, RMB depreciation, capital flight, and diplomatic isolation from key economies.

- Given these geopolitical risks affecting TSMC, investing is unwise; a prudent portfolio should focus on low-risk bonds and gold, minimizing equity exposure until tensions ease.

Tanaonte

This is a prescient analysis of the effects on Taiwan Semiconductor Manufacturing Company (NYSE:TSM), also known as TSMC, if China decides to proceed with a military invasion of Taiwan. As a macroeconomic investment analyst, I consider this to be the most important point of analysis for TSMC investors. In fact, it is likely the most important point of analysis for portfolio management at this point in time in general.

Since my last TSMC Hold rating, the investment is up 85%. Returns could continue to compound for a few years. With strong U.S.-China diplomatic relations, TSMC returns could compound indefinitely (with normal cyclical dynamics).

Geopolitics & Economics

The immediate effects:

- A Chinese military invasion of Taiwan would likely cause a sell-off in global equities. Technology stocks, in particular, would likely be severely affected. If supply chains are disrupted for extended periods, initial market reactions anticipating a sustained global depression would likely ensue quickly.

- Taiwan’s stock market would likely suffer the most immediate and severe impacts—there would likely be a potential spillover into other Asian markets, such as Japan and South Korea. Trade routes would be particularly affected in the South China Sea.

- A prolonged conflict could lead to a significant contraction in GDP. Estimates suggest that a full-scale war could reduce global GDP by about 10%, surpassing the impacts of the COVID-19 pandemic and the 2007 to 2009 financial crisis.

In my opinion, the immediate understanding of this means that it’s currently wise for investment portfolios to be heavily risk-mitigated, focusing on investment-grade bonds, gold, and low-risk dividend-oriented equities until current tensions ease and the U.S. is more firmly established in global economic leadership.

The effects on China:

- An invasion could lead to China being deprived of foreign capital and critical technology. Many countries would likely impose economic sanctions similar to those seen on Russia with the invasion of Ukraine. China’s access to international markets and its economic status would be severely damaged. A major decoupling between the United States and China would be likely.

- China would likely experience a contraction in trade activities due to a disruption of major shipping lanes, particularly in the South China Sea. In addition, China would face disruption to its supply of semiconductors from TSMC.

- The onset of conflict would likely cause a depreciation of the renminbi (‘RMB’) and a loss of business confidence. This would likely result in capital flight and increased economic instability within China.

- Estimates suggest that a prolonged conflict could result in a 25-35% reduction in China’s GDP, highlighting the substantial economic costs associated with military action.

- Beyond economic sanctions, I see it likely that China would face diplomatic isolation from key advanced economies. This would likely hinder its long-term economic growth prospects and diminish its influence on the global stage.

The effects on the U.S.:

- The U.S. economy could suffer a significant decline if it becomes embroiled in a conflict over Taiwan. Estimates suggest a potential 6.7% decline in U.S. GDP in the first year if the U.S. is directly involved in a conflict surrounding Taiwan and a 3.3% blow to U.S. GDP in the case of a yearlong blockade of Taiwan by mainland China.

- The heavy constraints placed on TSMC’s operations would severely impact almost all U.S. companies but particularly affect the technology, automotive, and defense sectors. Operations from consumer electronics to military systems could be severely disrupted.

(U.S. ‘3’) An analysis from global financial firm GTS has estimated a short-term stock market plummet of up to 34% after an invasion [of Taiwan by China], as uncertainty about the U.S. response may lead institutional investors and retail investors to quickly exit their equity positions while market makers struggle to accurately price stocks in this volatile environment. The long-term effects would be much greater. Bloomberg speculates that a military engagement over Taiwan would cost roughly $10 trillion and reduce global GDP by 10%. This drop would be almost twice what was observed in the aftermath of the global financial crisis and Covid pandemic, events which triggered peak to trough declines of 57% and 35% in the S&P 500. — United States Congressman Blaine Luetkemeyer April 2024 Bulletin

This action, if performed by China, would be mutually assured economic depression. If China controlled Taiwan, it could potentially leverage this to gain economic advantages over other countries, particularly in technology sectors where semiconductors are crucial. Successfully annexing Taiwan would also be seen as a major geopolitical victory for China, increasing its influence in the Asia-Pacific. I italicize ‘successfully’ because I find a successful invasion highly improbable. The goal here for China may be to increase its global power position, but I believe an invasion of Taiwan would be a fatal blow to China’s international prosperity. In addition, I believe that Chinese citizens would likely express significant dissent within China due to the economic disruption they experience.

Due to the self-destructive nature of such an act, it may be reasonable to consider it unlikely. However, that’s not entirely accurate. Deterrence is important for the West right now, not only to protect Taiwan but also to protect the total U.S. economy. The Department of Government Efficiency will be playing a critical role in strengthening the U.S. economy. The next U.S. president after Trump must have a strong diplomatic ability to deal successfully with Xi Jinping and Putin. Moreover, we must strengthen our Western, U.S., and NATO total defense, including developing world-leading AI defense capabilities, to show our continued economic leadership.

- As of 2024, the U.S. has the largest economy globally, with a GDP of just under $29 trillion. This represents about 26.3% of the global economy.

- China holds the position as the second-largest economy, with a GDP of approximately $18.5 trillion, accounting for about 16.9% of the global economy.

China must not forget that the U.S. is still the financial world leader. Despite China’s prosperity and desired bipolarity with the U.S., it is unlikely to be the financial leader in the world, based on current reforms underway in the U.S. with the impending Trump presidency. Instead, China can consolidate itself as a regional leader, manufacturing world leader, and, I believe, a peaceful ally of the West (if we have reformed U.S. government leadership and reinvigorated U.S. economic strength as a result). It goes without saying that navigating peaceful diplomatic relations with China is fundamental to successfully allocating capital to TSMC over the long term.

Valuation

Due to the potential volatility surrounding an investment in TSMC, given the geopolitical risks, I will be using a valuation model using just three years. This also aligns with the indications of when China would be militarily prepared for an invasion of Taiwan, in 2027. All calculations are based on my own independent estimates.

|

TTM Revenue |

$83.44 billion |

|

December 2027 Revenue Estimate |

$140 billion |

|

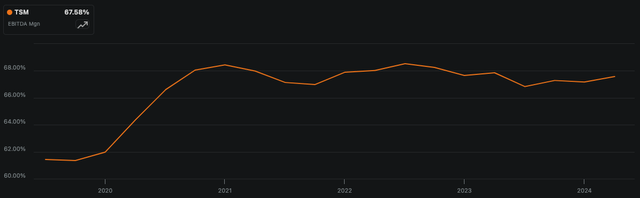

December 2027 EBITDA Margin Estimate |

68% |

|

December 2027 EBITDA Estimate |

$95.2 billion |

|

EV-to-EBITDA Terminal Multiple |

12 |

|

December 2027 Enterprise Value Estimate |

$1.142 trillion |

|

Current Enterprise Value |

$765.66 billion |

|

Three-Year Enterprise Value CAGR |

14.26% |

|

Weighted Average Cost of Capital |

12.35% |

|

Discounted Implied Current Intrinsic Enterprise Value |

$805.28 billion |

|

Margin of Safety |

4.92% |

- TSMC’s weighted average cost of capital is 12.35%, with an equity weight of 97.45% and a debt weight of 2.55%, where equity costs 12.64% and debt costs 1.17% after tax.

TSMC EBITDA Margin TTM, 5Y (Author, Using Seeking Alpha) TSMC EV-to-EBITDA TTM, 5Y (Author, Using Seeking Alpha)

The obvious risk with my valuation model is that it ends at the end of 2027. An invasion of Taiwan before this is somewhat speculative, but it could happen. However, it’s also worth considering that there could be a broader slowdown in economic growth, including a coinciding reduction in capital expenditures by Big Tech companies in AI infrastructure. Therefore, we could see TSMC’s valuation rerated much lower in early to mid-2027, independent of China’s stance on Taiwan. At an EV-to-EBITDA terminal multiple of 10, the company’s December 2027 enterprise value would be approximately $952 billion.

Conclusion: Hold

Given the significant geopolitical risks, investing in TSMC appears unwise at this time. This is further reinforced by the fact that even without accounting for a potential invasion in my valuation model, the three-year enterprise value CAGR is likely to be slightly under 15%. I maintain a 15% annual return threshold for investment and strongly believe in protecting my portfolio from macroeconomic risks. We need a strong succession plan for the Republican Party following Trump, substantial results achieved by the Department of Government Efficiency, the war in Ukraine to end, and better diplomatic relations with China. Until then, a portfolio model consisting of 50% in short-term treasury bills and investment-grade, low-risk bonds, 10-15% in gold, and 35-40% in low-risk equities seems prudent to me. A smaller portfolio can be managed to take on more risk, with proceeds siphoned off into the larger, lower-risk portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.