Summary:

- TSMC’s stock has rallied 12% since last coverage, approaching the target price of $210 with solid growth prospects.

- Q3 2024 revenue reached NT$759.69 billion (~$23.6 billion), surpassing analyst expectations due to AI chip demand.

- TSMC’s 3nm technology accounted for 15% of wafer revenue in Q2 2024, with further growth expected from 2nm chips.

- HPC revenue increased from 42% to 52% of total revenue, driven by AI and advanced technologies.

- TSMC’s CapEx exceeded NT$170 billion per quarter, reflecting necessary investments for maintaining competitive edge in advanced chips.

luza studios

Investment Thesis

TSMC (NYSE:TSM) has rallied 13% since our last coverage, narrowing the gap toward our target price of $210. Following its Q3 2024 earnings, which showed substantial year-over-year (YoY) revenue and profit growth, we believe TSMC’s long-term prospects remain intact. The company’s rapid growth is a testament to its success in fulfilling tech giants’ expanding demands. Advanced technologies like 3-nm and impending 2-nm chips place TSMC in a better position to satisfy this growing demand.

Its strategic focus on AI and high-performance computing (HPC) keeps us bullish on the company growing fast and reaching higher margins than traditional segments. Despite the high CapEx being a concern, it’s necessary to equip TSMC as the leading supplier of advanced chips. Innovation and a dominant market share have been the pillars of TSMC’s success, ensuring steady future revenue and profitable growth.

TSMC Delivers Strong Q3 2024: Powered by AI and HPC Demand, Revenues Surge 39% YoY

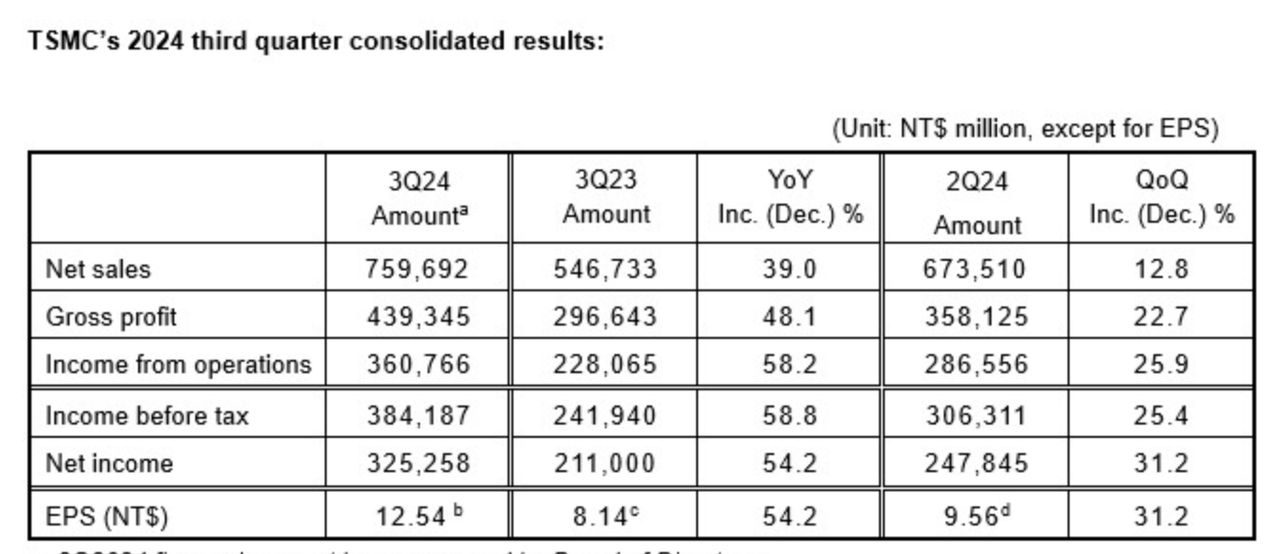

TSMC had a strong Q3 of 2024, posting revenues of NT$759.69 billion, approximately $23.5 billion, up 39% YoY and 12.8% quarter-over-quarter (QoQ) compared to Q2/2024. The company reported Q3 GAAP EPS of $1.94, beating estimates by $0.15, with revenue of $23.5 billion exceeding expectations by $210 million. Net incomes during the same period were up 54.2% YoY at NT$325.26 billion, reflecting the company’s ability to capitalize on highly advanced chips in AI and HPC applications.

Not surprisingly, Q3 revenue has exceeded the analyst consensus forecast of ~NT$748 billion (~$23.21 billion), signaling that TSMC’s revenue generation capacity exceeds the street standards based on its AI-technology-related chips. Against Q2 2024 (NT$673.51 billion), the sequential quarterly growth of 12.8% marks the robustness of AI-driven demand in propelling the company’s top-line growth.

Moreover, the key driver for TSMC’s substantial profitability growth is a net income increase of 31.2% QoQ and an underlined operational efficiency to scale up production to meet increasing demand. Strategic focus on high-margin sectors like AI, HPC, and 5G continues to drive demand for advanced chips and help TSMC achieve more substantial margins and revenue growth.

Remarkably, September 2024’s YoY revenue increased by 39.6%, directly corresponding with the increasing demand for AI chips. Driven by the need for HPC, TSMC is considered a lead supplier of critical technology to tech giants like Apple (AAPL), Nvidia (NVDA), and AMD (AMD) under AI adoption and may continue to support its top-line growth.

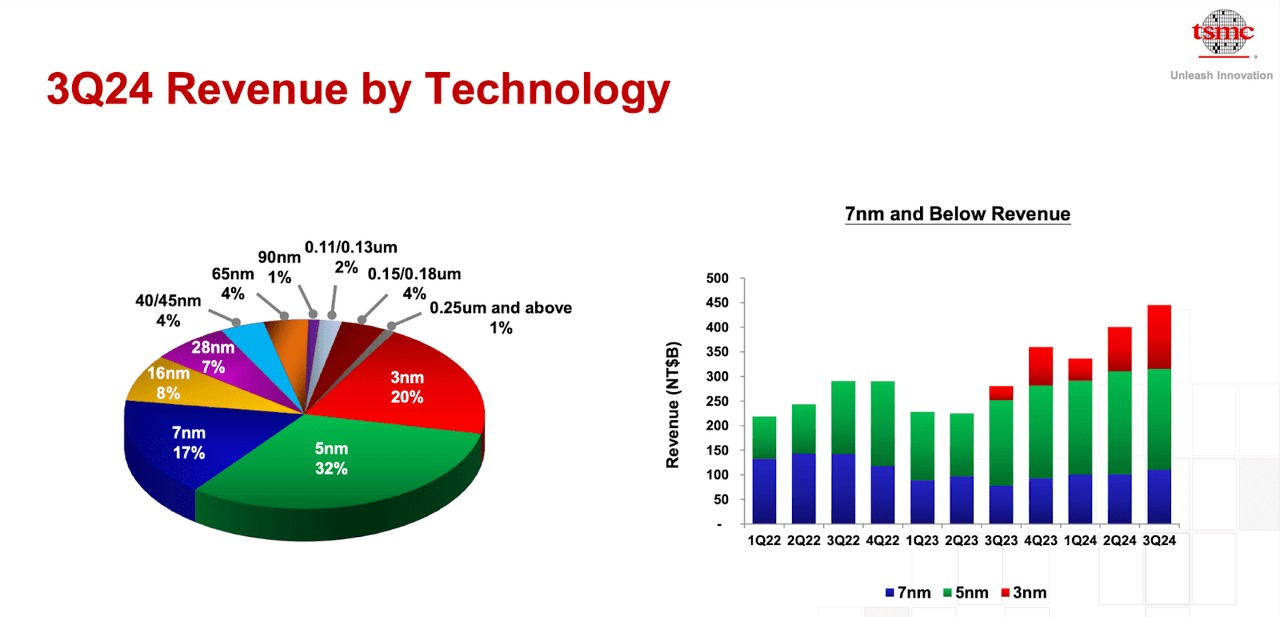

Most importantly, though, the strong position of TSMC in leading-edge processes, the 3nm process in particular, is a very real and tangible bridging point between these revenues at the very top and ongoing advancements in tech. For Q2 2024, the 3nm technology accounted for 15% of wafer revenue from 6% in Q3 2023. This growth reflects the market’s increasing reliance on smaller, more efficient chips for AI, smartphones, and HPC applications. For instance, 59% of the company’s total Q3 2023 revenue stemmed from advanced technologies (7nm and below). Now, this share expanded to 67% by Q2 2024.

In Q3 2024, the 3nm, 5nm, and 7nm technologies together accounted for 69% of the total wafer revenue, compared to 67% in Q2 2024. This means that TSMC still leads the process race in semiconductor manufacturing, while expanding its share in the rapidly growing AI and HPC markets.

Besides, the move to value chains of advanced technologies underpins TSMC’s ability to maintain its robust margins, with the gross margin reaching 57.8% in Q3 2024. Continuing revenue growth and a steady cadence of adoptions at advanced nodes testify to the company’s leadership position in the semiconductor space and ability to meet future demand for a high-performance chip as markets evolve.

TSMC also claims that production of its 2nm process technology is targeted to begin in full-volume production in 2025. The N2 can provide a 10-15% speed improvement at the same power or a 25-30% power improvement at the same speed. With that, there is a 15% chip density increase over its 3nm predecessor.

The new tape-outs for 2nm in the first two years may outpace both the 3nm and 5nm technologies in their early production phases. This aggressive ramp-up of N2 technology mirrors the strong demand already seen in N3. Rapid adoption rates are fundamental to a secure pipeline of clients (like Nvidia and AMD) eager to adopt these energy-efficient solutions. However, these factors may not be integrated into the company’s consensus revenue growth estimates for 2025 and 2026.

Furthermore, the company’s extension of N2 technology with N2P provides an additional 5% performance or 5% to 10% power efficiency gains. N2P is slated for production in H2 2026. These simultaneous enhancements provide TSMC with a solid competitive advantage in performance and efficiency.

Moreover, the N2P technology supports both smartphone and HPC applications that may serve the dual demands of consumer electronics and enterprise computing. For instance, HPC contributed 42% of total revenues in Q3 2023. By Q2, 2024, this share had risen significantly to 52% as more industries increasingly require advanced computing capabilities (particularly in AI, data analytics, and machine learning).

In contrast, smartphone revenue, traditionally one of TSMC’s core segments, has declined from 39% in Q3 2023 to 33% in Q2 2024. While this decline may appear concerning, it points to a strategic pivot towards HPC and AI. Here, margins are typically higher, and long-term growth potential is greater. Hence, this strategic shift justifies the focus on developing 2nm and 3nm chips.

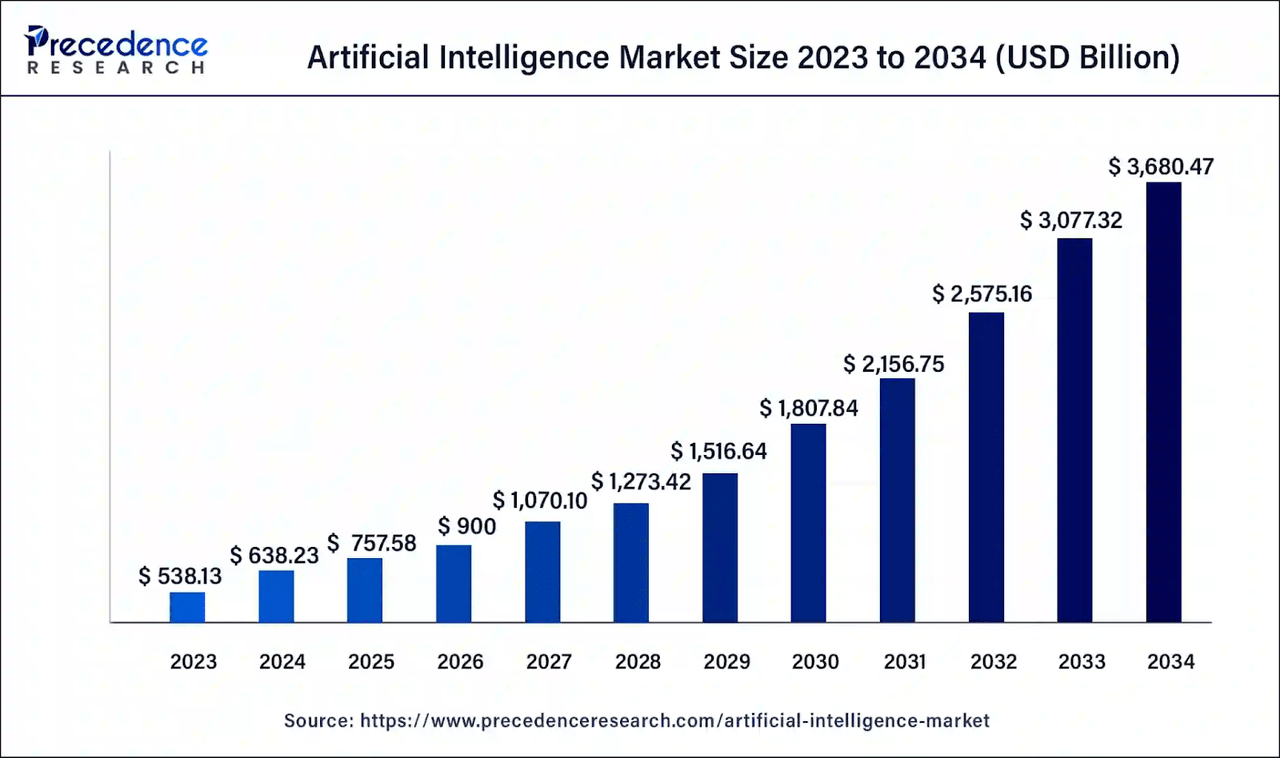

In other words, the global AI market will be over $638 billion in 2024 and may reach ~3.7 trillion by 2034 at a CAGR of 19.1% (2024-2034). On the other hand, revenues across the US AI market stood at 123.07 billion in 2023 and may surpass ~851 billion by 2034, growing at an annual rate of 19.3% (2024-2034).

Finally, TSMC’s top line protects against regional economic issues. For instance, North America remains TSMC’s largest market and consistently contributes a major portion of revenue. The region accounted for 69% of the revenue in Q3 2023 and 65% in Q2 2024. Similarly, China’s revenue share increased from 9% in Q1 2024 to 16% in Q2, reflecting the expanding demand for semiconductors in this region despite US-China tensions.

Massive CapEx and Cash Flow Strain

A structural weakness in TSMC’s growth potential derives from its massive CapEx that considerably strains its cash flow and financials. Considering the quarterly trends from Q3 2023 through Q3 2024, CapEx constantly exceeded NT$170 billion per quarter. In Q3 2023, CapEx was NT$226.62 billion, dropping to NT$170.16 billion in Q4 2023. Then, it rose to NT$181.3 billion, NT$205.68 billion, and NT$207.08 in Q1, Q2, and Q3 2024, respectively.

These are massive capital outlays to maintain TSMC’s competitive edge as it invests in advanced node manufacturing processes (3nm and 2nm). However, such heavy investments can hinder short-term profitability and pressure cash flow. This may hurt stock valuation based on turns in the street sentiment if returns on these investments do not materialize as quickly as anticipated.

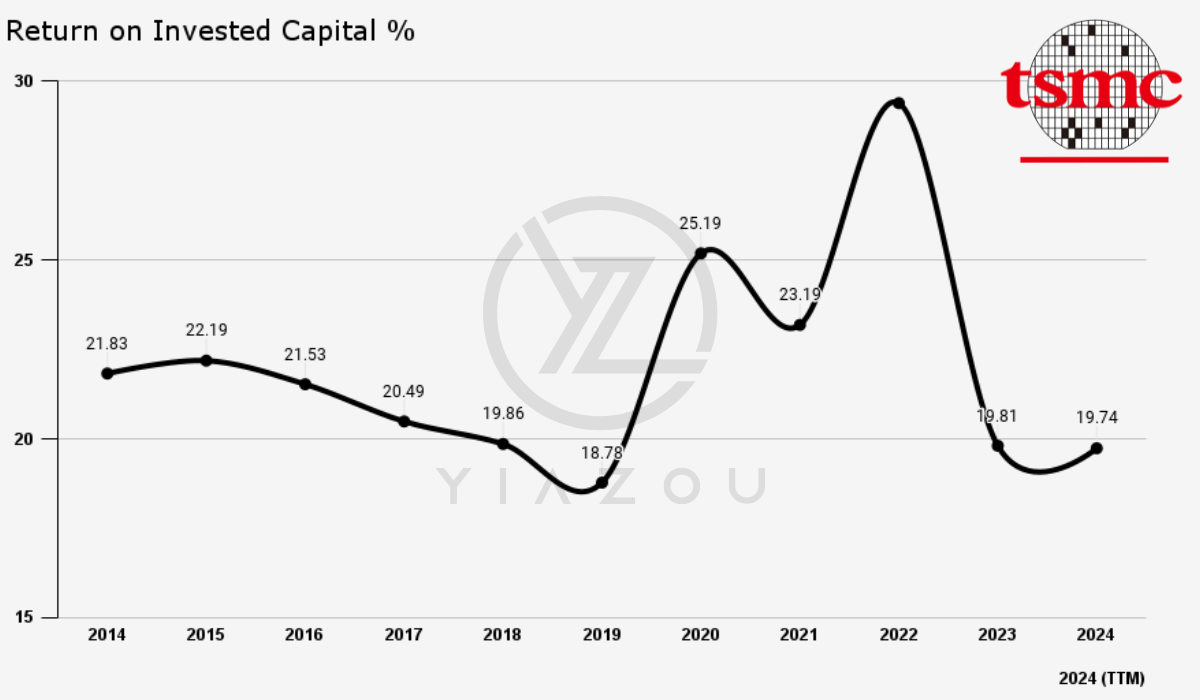

For instance, TSMC has experienced a gradual erosion in its ROIC that signals inefficiencies in capital deployment and challenges in maintaining return trends as its scale and CapEx requirements grow. TSMC’s ROIC in 2014 was 21.83%, and for a couple of years, it ranged evenly around ~21%; then, it slowly drifted downward and hit 19.86% by 2018, continually falling to 18.78% in 2019.

Although the company saw a resumption in its ROIC in 2020 (reaching 25.19%), this upward trend was temporary. By 2023, TSMC’s ROIC had dropped to 19.81%; in 2024, TTM’s ROIC was flat at 19.74%. The decline in ROIC suggests that the company is generating less profit from its capital investments than in previous years. This is attributed to the increasing complexity and cost of advanced semiconductors that may not yield proportionally high returns. This eroding profitability from capital investment directly impacts the stock valuations, as ongoing projects may struggle to justify the enormous capital outlays based on current ROIC trends.

TSM’s ROIC (Yiazou)

Takeaway

TSMC’s strong revenue momentum, driven by AI and high-performance computing, supports the corporation’s long-term growth prospects. Demand from major clients and new chip technology developments place TSMC in an excellent position to maintain its competitive advantage in this market. Despite high capital expenditures, its strategic focus on AI and HPC ensures continued revenue and profit expansion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.