Summary:

- Taiwan Semiconductor Manufacturing Company Limited aka TSMC is positioned as the “enabler” of the AI industry, fabricating AI chips for companies like Nvidia, AMD, Broadcom, and Marvell.

- TSMC expects over 20% YoY revenue growth in 2024, driven by AI-related revenue and the scaling of its N3 process node.

- The sustainability of the AI growth inflection could lead to further upside potential for TSMC’s valuation.

- I explain why the market isn’t foolish, as it lifted TSMC’s valuation since bottoming out in 2023.

- With AI FOMO driving significant recent gains in TSMC, it’s time to play the defensive until we get a steeper pullback.

BING-JHEN HONG

TSMC Is The AI “Enabler”

I urged Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) aka TSMC investors to ignore the pessimism in TSM’s pre-earnings pullback in mid-January 2024 as the market prepared for TSMC’s fourth-quarter earnings release back then. I assessed robust buying sentiments heading into TSMC’s pivotal earnings scorecard and forward guidance as the market contemplated TSMC’s AI growth inflection.

The leading pure-play foundry didn’t disappoint, as TSMC focused its earnings conference on being the key “enabler” for the semiconductor industry’s AI hype. It shouldn’t surprise investors that TSMC is a critical player in the value chain in fabricating the AI chips that Nvidia (NVDA) customers demand. Furthermore, even arch-rival Intel (INTC) outsources its foundry requirements, given its current lack of process leadership. With Advanced Micro Devices (AMD), Broadcom (AVGO), and Marvell (MRVL) leveraging TSMC as its key foundry partner, TSMC investors can be assured that the Taiwan-headquartered company will continue to play a vital role in the AI future.

Accordingly, TSMC expects to deliver more than 20% YoY growth in revenue for 2024, driven by the surge in AI-related revenue. In addition, it also expects its N3 process node to continue scaling, with revenue “expected to triple in 2024 and account for a mid-teens percentage of total wafer revenue.” Notably, TSMC is on track to achieve volume production of its N2 node in 2025, heaping more pressure on Intel to catch up. Based on the latest announcement by the Biden Administration on grants and loans provided to TSMC, the foundry is expected to build a third domestic fab for the N2 node “before the end of the decade.” While N2 is scheduled to go into volume production in 2025, I don’t expect it to be the bleeding edge node when TSMC’s third Arizona fab is ready for volume production. Therefore, I believe the most advanced manufacturing technologies will remain in Taiwan, securing its silicon shield while mitigating geopolitical risks with its ex-Taiwan production (including in Japan and Germany).

Furthermore, the sustainability in the AI growth inflection could persist over the next few years, spurring further potential upside that might not have been baked into its valuation.

TSM Valuation Remains Reasonable

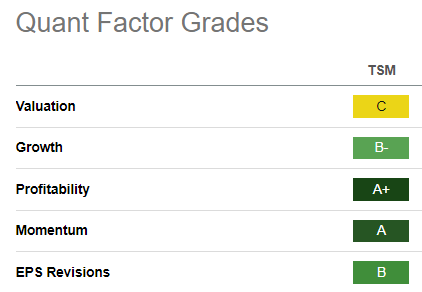

TSM Quant Grades (Seeking Alpha)

As seen above, Seeking Alpha Quant assigns TSM a “C” valuation grade, suggesting it’s still reasonable. Buying momentum on TSM is also highly robust, with an “A” momentum grade. Therefore, the market has lifted TSM’s bullish thesis, seeing the foundry as a vital cog in fulfilling the AI ambitions of its fabless AI chips designers.

Can TSM continue to drive a further valuation re-rating? Why not? Valued at a forward adjusted P/E of just over 22x, it’s well above its 10Y average of 18x. Therefore, investors must consider why the market could lift its valuation much higher than its long-term average. The 20+% growth recovery in its top line momentum corroborates TSM’s bullish thesis that the leading-edge foundry will underpin the industry’s push toward accelerated computing.

Is TSM Stock A Buy, Sell, Or Hold?

Moreover, with Intel not expected to supplant TSMC as the world’s largest foundry through 2030, it suggests Intel might face more intense challenges to grab market share against TSMC. The significant losses undertaken by Intel Foundry in the near term behoove robust financial execution as Intel attempts to defend against market share losses against AMD and Nvidia. As a result, I gleaned that TSMC has a less complicated roadmap, bolstered by its solid execution as it continues to ramp toward N2 volume production next year.

Geopolitical headwinds that hampered TSMC’s valuation in 2023 are expected to taper as it diversifies its production base away from Taiwan. Investors will likely be increasingly confident in affording TSM a higher valuation multiple, consistent with its exposure and position as a key “enabler” of the AI growth cycle.

As a result, I view steep pullbacks in Taiwan Semiconductor Manufacturing Company Limited’s price action as solid opportunities to add exposure. However, I also assessed that the surge from TSM’s 2023 lows has been likely priced in significant near-term optimism as it struggled to overcome the $150 resistance level. With selling pressure expected to intensify as earlier investors take profit to lock in gains, I move back to the sidelines as I await another, more attractive opportunity to buy more shares. Notwithstanding my caution, I remain confident about TSM’s long-term thesis and will consider buying aggressively if we get a solid retracement to dissipate the recent optimism.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!