Summary:

- TSM is undervalued despite nearing all-time highs, driven by strong AI demand that has helped maintain its 30%+ YoY revenue growth trajectory, significantly exceeding the guided 5-year CAGR.

- The management sees growing demand for lower nanometer ramps, as 3nm accounts of 20% of revenue mix in 3Q, up from 9% in 1Q FY2024.

- The company continues to significantly expand its margins, providing a higher sequential margin outlook for 4Q, driven by high utilization rates, but warned some pressure in FY2025.

- The increased capex outlook for FY2024 confirms strong underlying AI demand, with even higher capex expected in FY2025 to prepare for 2nm and A16 ramps.

- Despite the rally, its valuation multiples have not expanded significantly, with the stock trading at 28x fwd non-GAAP P/E and non-GAAP PEG fwd of 1.07x, indicating “growth at a reasonable price”.

JHVEPhoto

What Happened

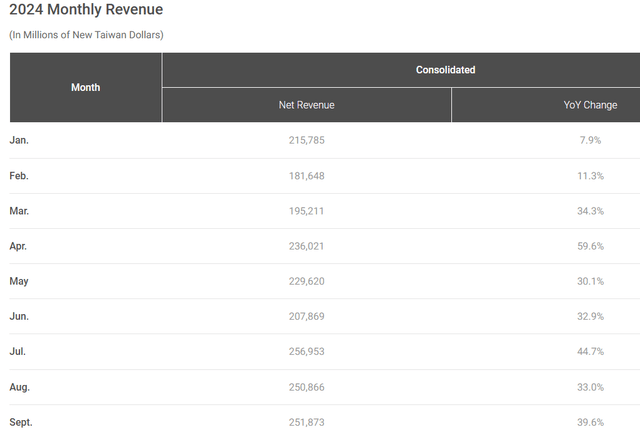

Despite Taiwan Semiconductor (NYSE:TSM) reaching an all-time high after reporting strong 3Q FY2024 earnings, the stock remains undervalued. Last week, the company reported its September revenue, which grew 39.6% YoY to NT$252 billion, accelerating from 33% YoY in the previous month. TSM topped both revenue and GAAP EPS in 3Q, highlighting the continued robust demand for N2 and N3 chips, which is expected to persist into FY2025. This strong demand also contributed to a significant beat in gross margin, surpassing the company’s high-end guidance by 2%. In my previous analysis on July 22nd, I maintained a buy rating on the stock as higher utilization rates and the shift to lower nodes will drive further growth acceleration and margin expansion over time, making the stock even more attractive given its relative cheap valuation. Since then, the stock delivered a total return of 25%, outperforming 18% to the iShares Semiconductor ETF (SOXX). Given the sustained demand for AI chips, I reiterate my buy rating on TSM, as the company’s 4Q guidance points to continued margin expansion and revenue growth that exceeds my previous expectations.

AI Demand Remains Robust

TSMC website

TSM once again delivered impressive 3Q earnings, as reflected in its July-September revenue reports. As shown in the table, TSM’s monthly revenue growth momentum has been strong. However, I believe the more than 10% post-earnings rally was largely driven by its upbeat forward guidance. The recent significant drop in bookings reported by ASML (ASML) in its 3Q earnings raised doubts about the sustainability of AI demand heading into FY2025.

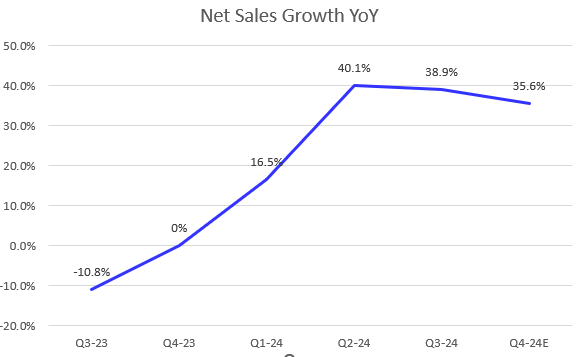

The company model

TSM’s 4Q FY2024 outlook beat the market consensus, indicating a 35.6% YoY revenue growth. Previously, I expected revenue growth in the “mid-20%” range for 4Q, as the management had guided revenue growth in FY2024 to be slightly above mid-20 percent during the 2Q FY2024 earning call. The current revenue growth momentum has exceeded the company’s 15% to 20% CAGR guidance for 2021 to 2026, which justifies a higher valuation multiple for the stock.

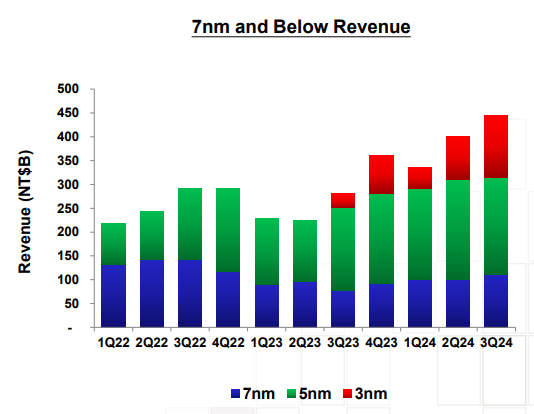

3Q FY2024 Presentation

I previously mentioned that the company’s key growth driver is its shift towards lower nanometer technologies. In 3Q FY2024, the company highlighted that its 3-nanometer accounted for 20% of total revenue, up from only 9% in 1Q FY2024. During 3Q FY2024 earnings call, the management signaled “strong structural AI-related demand continues”, supported by resilient capex in the FY2024 outlook. Therefore, I see no signs of a potential growth slowdown based on this earnings report.

Margin Expansion Driven by Higher Utilization Rate

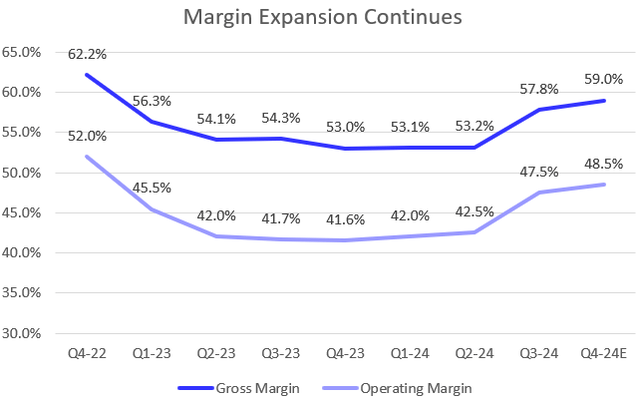

The company model

TSM exceeded my expectations not only for revenue growth but also for gross margin. The company significantly expanded its 3Q gross margin to 57.8%, beating the high end of its guidance by over 2%, breaking the previous flat trend. During the call, management attributed the strong gross margin to “higher-than-expected overall capacity utilization rates,” which offset continued dilution from N3 production and higher electricity costs. Additionally, the company raised its 4Q gross margin guidance to a range of 57% to 59%. I believe TSM will easily surpass the high end of this guidance, achieving a 59% gross margin in 4Q, which is 4.5% above my previous estimate of 54.5%.

However, I believe the company’s gross margin may face pressure heading into FY2025 for two reasons. First, the expansion of overseas fabs will initially result in a 2%-3% gross margin dilution, though I expect gradual improvement as these facilities ramp up. Second, management noted that higher electricity prices and other inflationary costs are projected to impact gross margin by at least 1% next year.

Raising Capex Outlook For 2nm and A16 Ramps

The company raised its capex outlook for FY2024 to slightly over $30 billion, in-line with FY2023, with 70% to 80% of that allocation directed toward advanced process technologies. Management noted that “a higher level of capital expenditures is always correlated with greater growth opportunities in the following years.” As a result, we can expect the company to prioritize 2nm and A16 ramps in the coming year, as they prepare more capacity to meet the growing demand for lower nanometer ramps. While the management will not provide FY2025 capex guidance until 4Q FY2024, I do not see a significant slowdown in AI chips demand in the near term, as they also added the capex next year will be higher than FY2024.

Valuation Is Still Attractive

Seeking Alpha

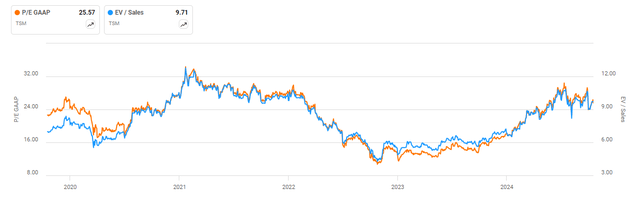

Despite the recent bull run, the stock is still trading at a reasonable valuation. the stock is currently trading at 28x non-GAAP P/E fwd and 9.3x EV/sales fwd. While these multiples are above its 5-year averages, they are justified by the company’s above-trend growth of over 30% YoY and strong margin expansions over the past quarters, far exceeding the guided high-teens CAGR from 2021 to 2026. Additionally, its P/E fwd remains below the Nasdaq 100 index’s 30.4x. According to Seeking Alpha’s valuation section, its non-GAAP PEG fwd of 1.07x is nearly 42% below the sector average, highlighting its “growth at a reasonable price”. In comparison, its earnings growth, reflected in the P/E, is even cheaper than NVIDIA (NVDA)’s 1.3x non-GAAP PEG fwd. While there are concerns about a shift in AI demand outlook for FY2025, I believe TSM has limited downside risk due to its relative attractive valuation.

Conclusion

TSM’s robust 3Q FY2024 earnings justified the post-earnings rally, driven by over 30% YoY revenue growth and expanding gross margins, supported by higher utilization rates. Despite concerns about the sustainability of AI demand into FY2025, the company’s forward outlook remains positive, with increased capex for FY2024 and strong demand for 2nm and A16 ramps. While potential margin pressures from overseas fab expansions and inflationary costs may arise in FY2025, TSM’s valuation remains compelling, with a non-GAAP forward PEG of 1.07x, well below the sector average. However, it’s important to note that the recent rally had entered overbought territory, contributing to some selling pressure this Friday. I view this as a buying opportunity after the stock consolidates, as the combination of strong growth, margin expansion, and attractive valuation continues to support a buy rating on TSM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.