Summary:

- Chip companies have experienced significant selling pressure in the last couple of days.

- Nonetheless, TSMC reported strong financial results for Q2’24, driven by AI demand, especially in the HPC segment.

- TSMC also submitted a strong outlook for Q3’24, in terms of both revenues and gross margins, indicating that the demand situation for semiconductors is very robust.

- Investors have a unique buying opportunity in chip stocks. TSMC has the lowest forward P/E ratio in the industry group.

solarseven

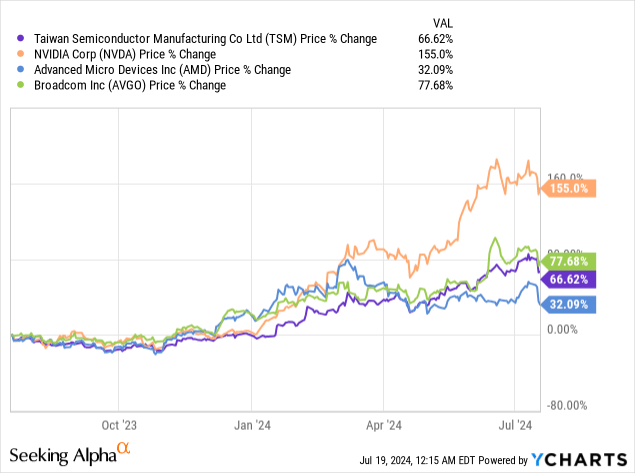

Chip companies have seen massive selling pressure in the last several days with names like Nvidia (NVDA), AMD (AMD), Broadcom (AVGO) and Taiwan Semiconductor Manufacturing (NYSE:TSM). However, TSMC reported strong financial results for its last quarter on Thursday which were overshadowed by the ensuing sell-off in the chip sector. TSMC benefited from ramping AI demand, with its revenues soaring 32.8% Y/Y and the company reporting gross margins that came in ahead of guidance. Given the recent sell-off in chip stocks, I believe investors have a unique opportunity to be greedy here and scoop up shares in a company that benefits immensely from the AI-driven spending boom in the semiconductor industry!

Previous coverage and rating

I rated TSMC a strong buy in June — 3 Reasons To Buy This Semiconductor Play — as the chip manufacturer obviously was set for a strong earnings release for the second fiscal quarter. While TSMC beat estimates and reported near-33% year over year top line growth amid chip companies splurging on manufacturing capacity, Taiwan Semiconductor Manufacturing’s strong Q2 did not get the recognition it deserved. I believe the drop is a unique buying opportunity for investors that want to capitalize on irrational fear in the market.

TSMC beats estimates

Taiwan Semiconductor Manufacturing continued to benefit enormously from AI in Q2’24 and the chip manufacturer easily sailed past Wall Street’s average predictions: TSMC earned $1.48 in adjusted profits in the second-quarter, beating the consensus estimate by $0.06 per-share. The top line also came in ahead of the average estimate: TSMC reported revenue of $20.8B, which was $730M better than expected.

AI spending boom continues, TSMC reports record results for Q2’24

Chip stocks started to sell off this week after former president Trump made comments about Taiwan and said that the Asian country should pay for its own defense. The comments triggered a sell-off in the chip market, with companies like Nvidia, AMD and TSMC slumping hard. Unfortunately, this noise overshadowed TSMC’s strong second-quarter earnings release, which was defined by a continual spending boom related to AI chips.

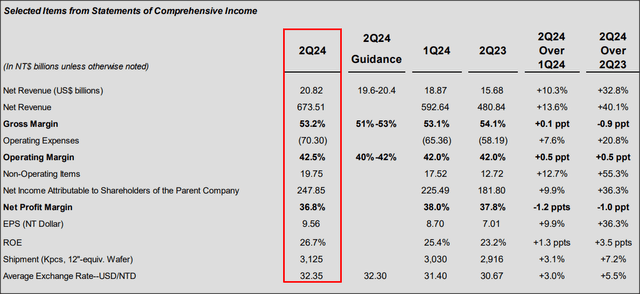

In the second fiscal quarter, TSMC generated net revenue of $20.8B, showing year-over-year growth of 32.8%. Besides robust top-line growth, what stood out positively from Taiwan Semiconductor Manufacturing’s earnings scorecard was that the company achieved a gross margin of 53.2%… which came in above TSMC’s guidance for Q2’24.

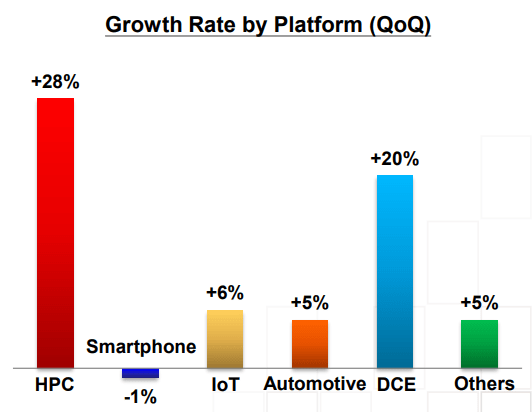

TSMC’s results were driven by HPC, the company’s high-performance computing segment, which is not only seeing the strongest growth (+28% Y/Y), but which contributes also the majority of revenues for TSMC. In the second-quarter, HPC represented a revenue share of 52% (+6 PP Q/Q), by far the highest. The second-largest segment were smartphones with a 33% share, but smartphones did disappoint with a negative 1% growth rate in Q2’24. HPC benefits from the ramp in spending on Data Center infrastructure, which is the single biggest driver of TSMC’s business right now.

TSMC

Outlook implies margin upside

The most important take-away from TSMC’s earnings release, in my opinion, was the outlook for Q3’24 as it gives us some insight into how the chip manufacturer sees its demand situation as well as margin trajectory.

TSMC expects to generate between $22.4B and $23.2B in revenues in Q3’24, implying a year-over-year growth rate, at the mid-point, of 31.9%, so TSMC is not expecting to see any kind of significant top line growth deceleration in the next quarter… which bodes well for multiplier expansion. Additionally, TSMC’s guidance for Q3’24 implies a gross profit margin between 53.5% and 55.5%. In other words, TSMC expects to continue to benefit from red-hot demand for semiconductors in Q3’24, resulting in a 1.3 PP increase in its gross margin Q/Q, at the mid-point.

TSMC is now trading at a bargain 21X P/E…

In June I said that TSMC represented a strong deal due to its unique position in the semiconductor supply chain and accelerating demand for AI chips. The same argument, broadly speaking, also applied to chip equipment manufacturer ASML (ASML) whose shares were also brutalized this week.

The chip sell-off that we have seen in the last couple of days, in my opinion, is a solid engagement opportunity since nothing fundamentally has changed about the supply-demand situation in the semiconductor market (suppliers can’t deliver product fast enough). TSMC’s Q2’24 earnings scorecard further showed that the chipmaker benefits from sizzling demand for its chips, a view that has been confirmed by the company’s outlook for Q3 as well.

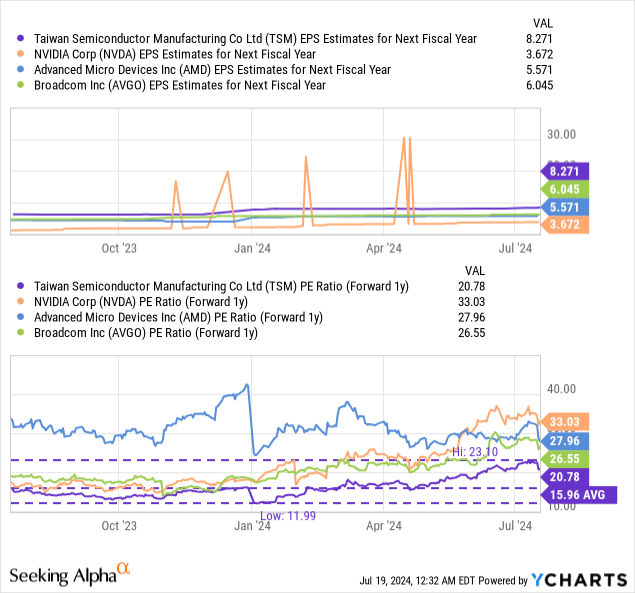

TSMC is currently trading at a P/E ratio of 20.8X, which has contracted from 22.6X in June. Nvidia, AMD and Broadcom have also seen their multipliers contracts, in-line with TSMC, due to comments about Taiwan’s defense made by the former president. TSMC is also by far the lowest valued chip stock in the industry group — consisting of Nvidia, AMD and AVGO.

In my last work on TSMC I said that I see a fair value P/E of at least 26X for the semiconductor company’s shares given the strength of demand for semiconductors, the company’s robust free cash flow (margins) and positive gross margin momentum. In my opinion, after TSMC’s Q2’24 earnings, the value proposition has gotten even better as it reduced uncertainty about the company’s top line and gross margin growth.

A 26.0X P/E ratio implies a fair value of $215 which reflects 25% upside revaluation potential. This is a dynamic number, and it may increase/decrease in-line with TSMC’s revenue and gross margin momentum.

Risks with TSMC

There is clearly a risk about a potential invasion of Taiwan by China. Semiconductor manufacturing capacity is concentrated in Taiwan, although the U.S. is making efforts to reduce the dependency of its supply chain on Taiwan by incentivizing investments in domestic chip production through the Chip and Science Act… which earmarks $39B for investments in semiconductor production on U.S. soil. Besides the risk of an invasion, which would throw the global semiconductor supply chain into turmoil, the biggest operational risk is likely a slowdown in spending on the company’s HPC products, which represent more than half of the company’s revenue.

Final thoughts

There was no rational reason for investors in either Nvidia, AMD, Broadcom or TSMC to sell their shares in the last several days and investors likely overreacted to comments made by the former president. Unfortunately, the ensuing sell-off in the chip sector overshadowed TSMC’s earnings release for the second-quarter… which was as solid as it could be. TSMC is seeing sustained revenue momentum and expanding gross margins, and the outlook for Q3’24 is favorable. With TSMC’s shares selling undeservedly at a lower price-to-earnings ratio, I believe investors should consider buying the fear in the chip market!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA, AMD, ASML, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.