Summary:

- TSMC’s leadership in advanced node processors (N2/A16) and advanced packaging technologies (CoWoS) positions it as a near-monopoly in leading-edge process technology.

- The global semiconductor market is expanding rapidly, creating a substantial addressable market for TSMC as fabless chip designers outsource manufacturing.

- TSMC’s robust AI-related growth, driven by data centers and AI accelerators, supports high revenue growth and premium valuation multiples.

- Despite geopolitical risks and Intel’s foundry ambitions, TSMC’s global footprint and leadership in advanced nodes ensure long-term growth prospects.

BING-JHEN HONG

TSMC (NYSE:TSM) (OTC:TSMWF) is one of the world’s leading semiconductor foundries. It manufactures integrated circuit manufacturing services, including process technology, special process technology, mask technology, 3DFabric advanced packaging, and silicon stacking (Chip-on-wafer-on-substrate) (CoWoS) technologies.

It has completed the development and mass-volume production of 7/5/3nm technology (N7/5/3 Nodes). It is engaged in researching and developing 2/1.6nm (N2/A16) process technology, which is expected to enter volume production in 2H25/26, respectively.

Overall, I remain bullish on TSMC’s long-term quality growth story since I believe that TSMC will likely continue to emerge as the near-monopoly manufacturer for leading-edge process technology in the N2/A16 and beyond the era, which should support higher P/E multiples over the long term. In the near term, CoWoS Capacity expansions and pricing power for wafers/advanced packaging, alongside strong AI ramp from hyperscalers, continue to provide a supportive backdrop for double-digit top-line/EPS/margin expansion from 2025-26. Thus, I reiterate an overweight rating on TSMC.

Industry Overview of TSMC

Expanding Semiconductor Industry

According to the Semiconductor Industry Association, the global semiconductor market currently sits at $570 billion. McKinsey predicts the global semiconductor market will exceed $1 trillion by 2030, growing at a CAGR of 8-9%, driven by the fast-growing demand for disruptive technological applications – from Generative AI to cloud computing from hyperscalers, autonomous driving vehicles, and AI Smartphone/PC to 6G, which requires to be powered by advanced chip processes including CPU, GPU, TPUs, ASICs etc. As most fabless chip designers outsource most of their manufacturing capabilities to TSMC, this creates a substantial addressable market for TSMC as a chip manufacturer.

Dominant Market Share in Global Foundry Industry:

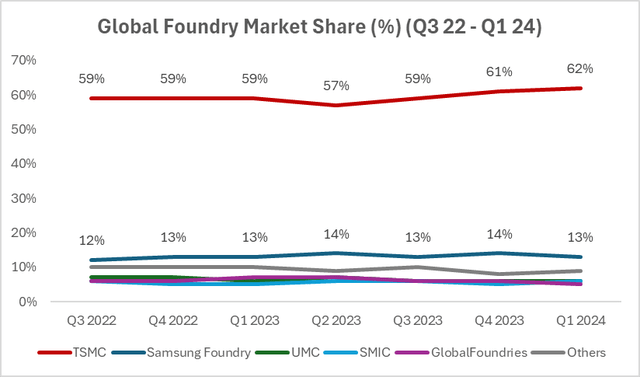

TSMC Market Share (KL Research, Statista)

In my opinion, TSMC possesses a wide economic moat among competitors. As of 1Q24, TSMC accounts for 62% of the global foundry market share, significantly surpassing its closest competitors Samsung Foundry (13%) and SMIC (6%). Over the past 5–6 quarters, TSMC has seen marginal share gains, slightly growing from 59% to 62% from 3Q22 to 1Q24. The relatively stable market share suggests that the foundry industry has high entry barriers (Capital Intensity). TSMC is less susceptible to threats of new entrants, making it an ideal long-term investment.

Foundry 2.0 Strategy expands TSMC TAM

In 2Q24 earnings call, TSMC introduced the concept of “Foundry 2.0,” redefining the foundry industry to include further sectors like packaging, testing, mask making, and other IDM. TSMC has reclassified its Total Addressable Market (TAM), which consists of the original foundry TAM of US $115bn and the new advanced packaging TAM of US$132.5bn. This gives the new TAM of around US$247.5bn in 2023 and is expected to grow 10% in 2024. TSMC’s share of this new TAM was 28% in 2023 but is expected to grow further.

Wafer Price Hikes Drive Q3 Gross Margin Improvements

TSMC has faced margin dilutions due to research expenses for 2nm/A16 processes, higher electricity costs in Taiwan, and delays in overseas fabs. Nevertheless, I expect TSMC’s margins to gradually improve starting from 2025, primarily supported by TSMC wafer price hikes for 2025, including both N2 and N5 should at least see 5-10% price hikes on AI customers (Up to $30,000/wafer for N2 and $18,500/wafer for N3) and advanced packaging CoWoS could see up to 10-15% price increases in 2025.

I believe the price hike will allow TSMC to pass on its costs to customers, resulting in higher gross margins in Q3 next year (above management guidance of 54.5-55.5%) and showcasing its pricing power.

Better CoWoS/Foundries Capacity Utilization

TSMC faces supply constraints in its advanced packaging chip (CoWoS Capacity) in meeting customer demands. As a result, TSMC is now subcontracting their packaging capacity to OSAT (Outsourced Semiconductor Assembly and Test) Partners like Amkor in Arizona to fill the gap. TSMC’s 2024 CoWoS capacity is around 34k wfpm, and is expected to double to 60-70wfpm in 2025 and around 110-120wfpm in 2026.

TSMC’s CoWoS capacity has mainly been at AP6 in Zhunan, Taiwan. The expansion in short-term CoWoS capacity in 2024 will be primarily driven by acquiring Innolux’s 5.5G LCD fab in Tainan back in August, and expansion at AP5 in Taichung in 4Q24. Construction at AP7 in Chiayi is expected to be completed in 2026, doubling its advanced packaging capacity by at least 30-40wfpm.

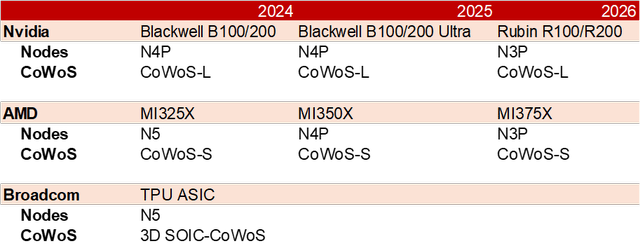

With greater capacity, this will enable TSMC to satisfy the robust demand from AI accelerators, including Nvidia’s Blackwell B100/B200 or Hopper H100/H200 demand for CoWoS-L by 2025/26, AMD’s MI350/MI400 GPUs (CoWoS-S), Intel Gaudi 3, and ASIC Broadcom/Google TPUs. Nevertheless, TSMC continues to expect demand for AI accelerators to outpace supply into 2025 or 1H2026, which has already filled its 2025/26 order backlog.

Robust demand from AI data centres:

Growing demand for AI infrastructure, including data centres/servers for AI Large Language Models training and inferencing, creates strong demand for AI Processors like GPUs/NPUs and ASICs. For instance, the current Nvidia Blackwell B100/200 and Hopper H100/200, as well as AMD’s MI300/325 and Broadcom TPU ASIC, are produced under the TSMC 5nm technology (N5/N4P nodes)

Starting from 2026, Nvidia’s Rubin AI R100/200 GPUs, AMD’s MI375/400X GPUs, and Broadcom/Google’s TPU (System on Integrated Chip) will be based on TSMC’s 3nm (N3P/X nodes) technologies.

Personally, I believe that strong demand and interest from AI/HPC customers to adopt leading-edge processing N2/A16 nodes should support a faster ramp for leading nodes and a high-20% robust revenue growth for TSMC from 2024-26.

Cyclical Recovery From The AI PC/Smartphone Market Could Benefit TSMC

TSMC’s smartphone and PC businesses have been in a slump throughout 2023, which caused a cyclical drag in top-line and margins last year.

Nevertheless, in 2Q24, TSMC’s smartphone business rose by 32.8% YoY to $6.87 billion, suggesting a cyclical recovery driven mainly by increased iPhone 15/16 sales. Currently, the iPhone 16 is powered by an ARM-based M4/A18 system on chips, which is part of TSMC’s 3nm family. To meet customer demand for Apple Intelligence, Apple is expected to produce up to 100 million A18 chips and 90 million iPhone 16 units, up 10% YoY.

Smartphones are expected to see larger NPUs dedicated to AI inference in the next several years, and greater demand for AI PCs with CPUs from AMD Ryzen and Intel Lunar Lake series for Microsoft copilot AI adoption. This will benefit TSMC, given its role as the primary supplier of AI PC and smartphone processors.

TSMC Is A Long-Term Buy Given Its Leadership In Advanced Production Nodes Technology

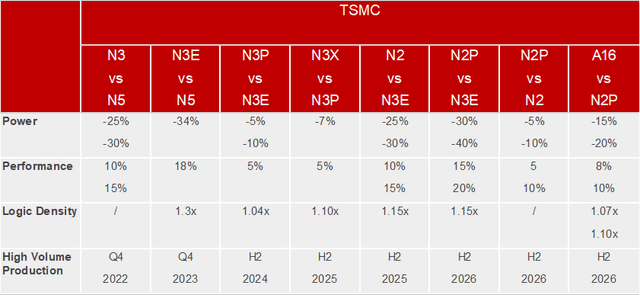

TSMC Nodes Roadmap (Anandtech, KL Research)

I rate TSMC as a long-term buy, given TSMC’s leadership in advanced production nodes technology. The N2 process is on track with performance and has better than expected wafer yields than N3, with fewer wafer yield penalties and volume production starting from 2H 2025. It will yield 10-15% better performance for the same number of transistors than N3 processors or 25 – 30% lower power consumption at the same speed as N3E. There is an N2P variant that will be used with HPC and smartphone chips, offering a 5% performance enhancement or a 5-10% lower power than N2 process.

The A16 process (1.6nm process) will incorporate Superpower Rail, or SPR, a backside chip power delivery system to improve the logic and transistor density. A16 will offer 8-10% higher speeds than N2P, or 15-20% lower power consumption and 1.07-1.1x chip density. Volume production will start in the 2H 2026.

With Intel 18A/14A facing production delays and Samsung’s 3nm production nodes facing a high wafer penalty (10-20% wafer yield), I remain optimistic about TSMC’s long-term growth prospects and its ability to maintain its competitive moat in advanced semiconductor manufacturing.

Financial Analysis – TSMC Likely Beat 3Q Revenue Guidance

TSMC’s revenue for August 2024 was approximately NT$250.87 billion (~US$7.80 billion), a decrease of 2.4% MoM but up 33.0% YoY. Meanwhile, revenue for July 2024 was approximately NT$256.95 billion, (US $7.9 billion) an increase of 23.6% MoM and a rise of 44.7% YoY.

Assuming that TSMC maintains a revenue of around NT $250 billion (~US$7.80 billion), same as August. TSMC should comfortably beat its 3Q Revenue guidance (US $22.4 – 23.2 billion).

Furthermore, I expect TSMC to beat its high-end gross profit margin guidance (53.5-55.5%), primarily supported by better wafer yields (less yield penalty), price hikes for N3 nodes, better capacity utilization rate for foundries and robust demand for N3 processors (A18 chips for iPhone 16) and N4/5 (AI Accelerators), reasons that I have mentioned above.

Valuation Analysis

I believe TSMC deserves to be traded at a premium multiple compared to the historical average due to its more robust AI-related growth from data centres. This is enabled TSMC’s critical role in enabling AI processing at the data centre and the edge.

For analysis & modelling purposes, I have decided to standardize the currency into TWD.

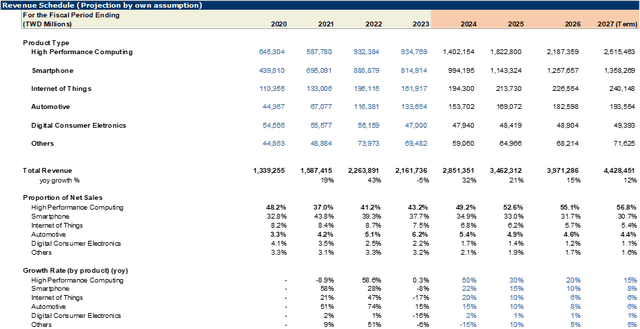

TSMC DCF Revenue Forecast (KL Research)

First, I forecast TSMC’s FY24/25/26 revenue to reach NT$2.8Tn/$3.46Tn/$3.97Tn, respectively, translating into a 32%/21%/15% revenue growth. This is mainly due to the robust increase in TSMC’s High-Performance Computer revenue driven by AI data centre usage from GPUs/NPUs/ASICs. I estimate TSMC’s HPC revenue segment will grow by 50%/30%/20% from FY24-26, resulting in an estimated HPC revenue of NT $1.4Tn/1.8Tn/2.2Tn, respectively. I also expect TSMC’s HPC revenue to account for >50% of TSMC’s total revenue starting from 2024.

I also expect TSMC to benefit from a cyclical Smartphone/PC Market recovery due to Apple Intelligence and Microsoft Copilot adoption for SOCs/CPUs. I thereby estimate the smartphone segment to grow by 22%/15%/10% for smartphones to around NT $0.99Tn/1.14Tn/1.26Tn from FY24/25/26, respectively.

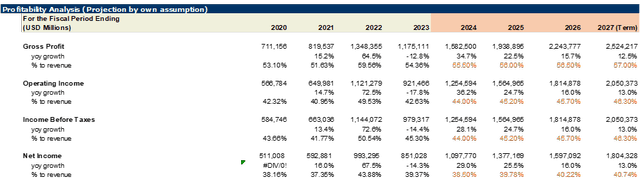

TSMC Profitability Forecast (KL Research) TSMC Fair Value (KL Research)

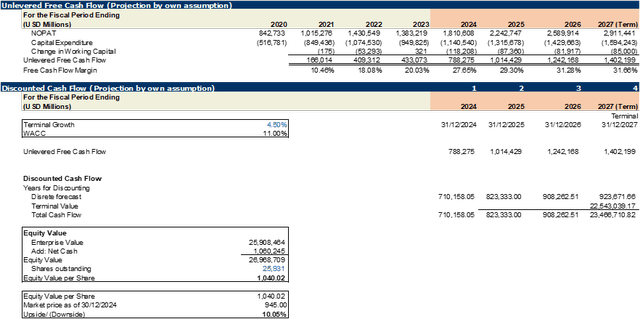

I expect TSMC’s Operating Margins to reach above 44%-46% (FY23: 42.6%) from FY24-27, given better capacity utilization and increased wafer prices and wafer yields. My CapEx estimates of NT $1.1Tn/1.3Tn/1.4Tn (FY23: $0.95Tn) reflect TSMC’s continued investments in Arizona, Germany, and Japan.

This gives TSMC an estimated FCF of $788Bn/1014Bn/1242Bn/1402Bn from FY24-27 (FCF margin of 27.7%-31.7%), which derives my estimated target price of NT $1000 and EV of NT $25Tn, which implies that TSMC is now fairly valued, with an upside of 10% using an 11% WACC and 4.5% conservative terminal growth rate.

TSMC’s current forward P/E ratio of 26x remains well below its fabless counterpart, including AMD (48.8x), Broadcom (35.6x), ARM (91.8x), and Nvidia (42.8x), which could indicate further valuation re-rating potential by the market.

Risks

1. Geopolitical Tensions

TSMC remains at the epicenter of geopolitical tensions. For instance, TSMC shares dropped by 7% after Trump’s comment in Taiwan and Biden’s export control on advanced CPUs/GPUs to Mainland China. China’s hostility toward Taiwan also poses a threat to TSMC.

Nonetheless, I believe TSMC is well-prepared to handle its geopolitical risks, given its 1) Overseas diversification of foundries. TSMC’s Japan Kumamoto Fab has already entered volume production in 1H 2024 for 12/16nm nodes. Meanwhile, the US Arizona Fab is targeted for mass volume production starting from 2H 2025 for 5/4nm nodes, with productivity on par with Taiwan fabs. A further expansion phase in Arizona/Germany is planned for 3/2nm node production in 2026. I believe that TSMC’s global footprint will alleviate the geopolitical risks facing TSMC.

2. Intel in-house foundry business development

One of the most significant risks TSMC faces stems from the in-sourcing of Intel’s foundry manufacturing capabilities. Intel aims to in-source most of its production for its NPUs Panther Lake for AI PCs in 2026, once its Intel 18A process technology is mature and foundry capacity is fully ramped, depending on timing.

Nevertheless, I believe that such risks should be minimal for TSMC, given:

1) Intel’s next-gen PC NPUs Lunar Lake and Arrow Lake will be outsourced to TSMC from 2024-25. Given production delays in Intel Foundry, Intel’s next-generation AI PC NPUs Lunar Lake, with better performance (40+ TOPS), will be outsourced to TSMC in 2024. For 2025, Arrow Lake will equally likely be outsourced to TSMC. I doubt Intel’s foundry’s ability to manufacture NPUs on time in 2026, given its cancellation of the production of 20A nodes.

TSMC Customer Breakdown (LinkedIn)

Next, 2) Intel’s revenue contribution to TSMC remains minimal. In 2023, Intel’s contribution to TSMC was around 3%, far less than Apple (25%), Nvidia (11%), AMD (7%), and Broadcom (5%). The reduction in Intel’s revenue will be good news for other customers like Nvidia, AMD, Apple, and Broadcom, given that demand for TSMC nodes has far outstripped supply.

3) Intel’s foundry business is still experiencing massive losses. It is only expected to achieve profitability breakeven by 2030 (I highly doubt it). Last quarter (2Q) alone, Intel lost $7 billion of operating income from its foundry business (-65.5% Operating Margin). To put things in perspective, for every $10,000 wafer sold, Intel loses $6550, while TSMC profits around $4,350.

Intel management affirms its commitment to achieving 60% Gross Margin and 40% non-GAAP operating Margin by 2030. However, given Intel’s management’s poor execution capabilities, I highly doubt that bold claim.

Bottom Line

Overall, I’m bullish on TSMC’s long-term growth prospect, given its leadership in advanced node processors (A16/N2) and its advanced packaging technologies (CoWoS). TSMC will likely benefit from the continued development of AI accelerators and the cyclical recovery of smartphones over the next few years.

I maintain TSMC as a long-hold position in my personal portfolio, and I don’t plan to sell my position for at least the next 3-5 years. As Warren Buffett says, he prefers buying a wonderful business at a fair price rather than a fair business at a wonderful price. I rate TSMC as a long-term buy for investors that are planning to start a long-term position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.