Summary:

- I calculated an upside of about 70% for TMC, supporting my buy recommendation.

- Key partnerships with AI leaders like NVIDIA, AMD, and Apple ensure a steady revenue stream and highlight its critical role in AI innovation.

- Robust financial performance, including consistent revenue growth and strong profit margins, underscores its operational efficiency and ability to invest in future technologies.

BING-JHEN HONG

Investment Thesis

I rate Taiwan Semiconductor Manufacturing Company (NYSE:TSM) as a buy due to its cutting-edge technological advancement, a solid market position supported by profitable strategic partnerships, and a dynamic client portfolio. TSM has led global semiconductor manufacturing, which explains its impressive solid fundamentals and good financials. It is the world’s largest semiconductor foundry and has consistently developed new chip technology. The rise of generative artificial intelligence (GenAI) is the recent most lucrative demand for semiconductors. This attractive background raises the company’s value, which is why I rate it as a buy.

A Leader in Chip Technology

1. Cutting-edge

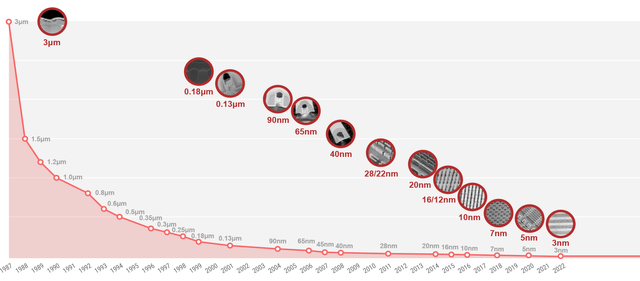

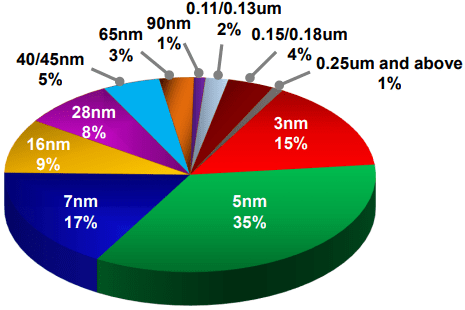

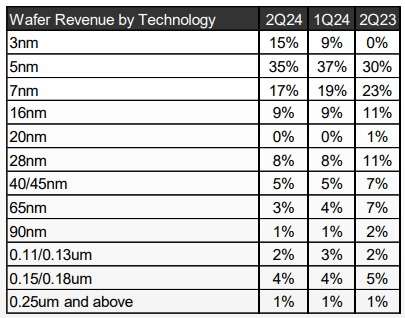

TSM has a hack on technology, which is evident in the manufacturing of advanced process technologies used by the most advanced chip designers, such as AMD and NVIDIA. The company is currently producing 5nm and 3nm processes at a scale gaining popularity among AI high-performance computing (HPC). The 3nm and 5nm are advanced nodes with high utility for AI applications that demand speedy performance and power efficiency. Delivering cutting-edge technology consistently has given it a competitive advantage in the AI sector.

For instance, the 3nm process has a 1.6x logical density and around 30-35% power reduction, one of the critical features supporting its industry leadership. This explains why giant tech designers like NVIDIA, Apple, AMD, and Qualcomm have nearly booked 3nm capacity chips until 2025.

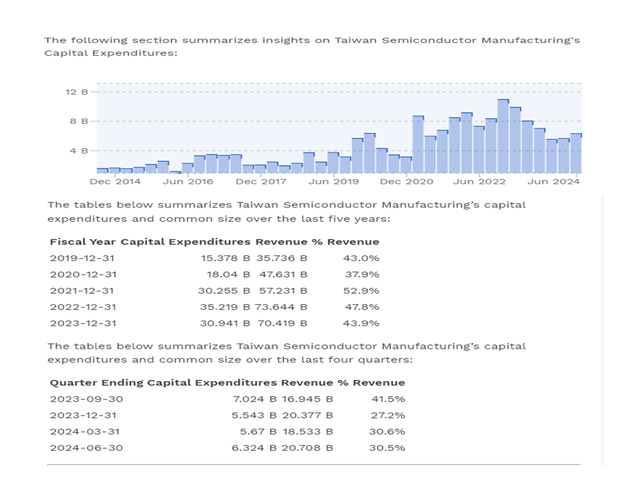

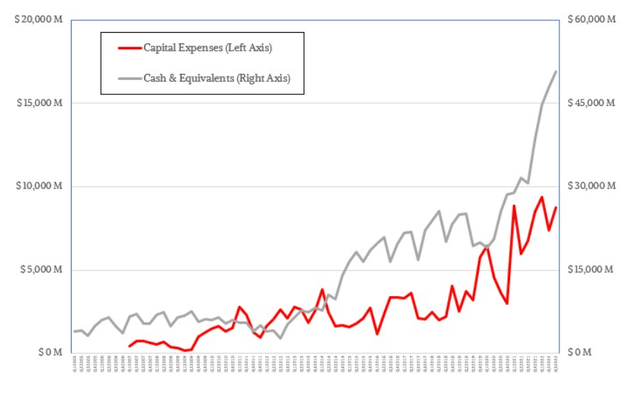

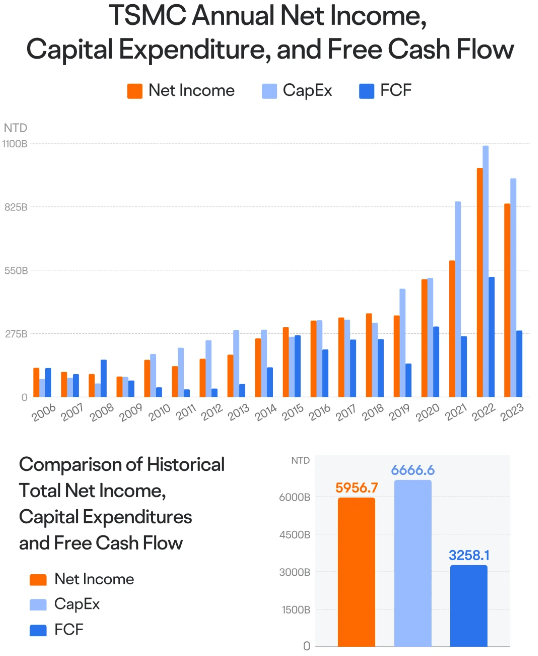

The world is already digitalized, and AI enhances that. Advanced chips by TSM fill this AI enhancement by already attaining technological dominance in its high capital expenditure. By 2024, the company forecasts to spend $30 to $32 billion in CAPEX, which is $5 billion ahead of its close competitor.

TSMC intertwines CAPEX expenditure with the increasing demand to produce scale 3nm and 5nm chips. I attribute this expenditure to positive Q2 24 financials as the company generated high revenues broken down as follows.

TSMC Q2 2024

2. Achieved Next-Generation Packaging Solutions

Besides process technology, TSM has achieved manufacturing advanced packaging solutions such as Chip-on-Wafer-on-Substrate (CoWoS), System-on-Wafer (SoW), and Integrated Fan-Out (InFO). Next-generation packaging enables high-performance computing and better energy efficiency, saving and reducing AI workloads. Achieving these solutions places TSMC in a position that meets the stringent requirements of AI chip designers.

NVIDIA, Guanghuida, and AMD are among some of the giant designers who have fully booked TSM’s advanced packaging capacity for the next 2 years. The high demand comes from its capability to produce high-performance computing and advanced cutting-edge packaging. TSM meets Both NVIDIA and AMD’s demand for CoWoS and SolC advanced packaging.

For example, its 4nm process is used along with NVIDIA’s H100 chip and utilizes CoWos packaging. On the other hand, AMD’s MI300 series is produced with TMSC’s 5nm and 6nm process capability to leverage SolC for GPU and CPU integration before using CoWoS which has a High Bandwidth Memory (HBM).

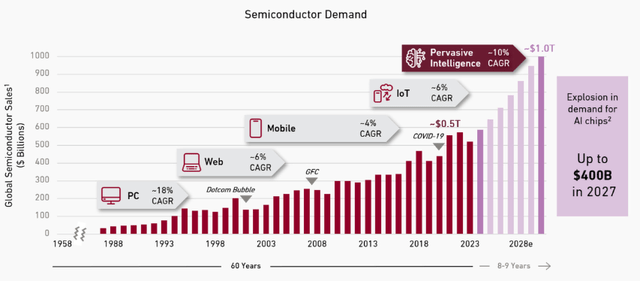

The financial outlook here is very bright, which lends credence to my initial assertion that the company’s future revenue generation is stable and visible. TSM expects a huge increase in income from AI processors, with estimates showing that revenues will double this year alone. Over the subsequent five years, the CAGR for AI chips is estimated to reach 50%, with AI processors accounting for more than 20% of TSMC’s sales by 2028.

Customer Base Driving TSMC Product Demand

1. Key Partnerships With AI Leaders

TSMC’s customer base includes some of the biggest names in AI, such as NVIDIA, AMD, and Apple. These companies use TSM’s advanced manufacturing capabilities to produce their cutting-edge AI chips. The partnerships with these industry leaders provide TSMC with a steady revenue stream and position it as a key enabler of AI innovation. For instance, in 2023, TSM generated 25% of its revenues from Apple, NVIDIA accounts for 11%, and 7% from AMD annual revenues. This accounts for more than 40% of its total revenue, which is a significant portion.

As a leader in small outline integrated circuits (SolC) 3D chip stacking, TSMC has partnered with AMD to supply SolC to be paired with CoWoS for AMD’s MI300. AMD forecasts to earn $6 billion from the sales of MI300 paired CoWoS by the end of 2024. This assures TSMC confidence in its products gaining massive commercialization. These key partnerships have placed TSMC at a competitive point as its advanced packaging plant is at full capacity.

2. Diversified Customer Portfolio

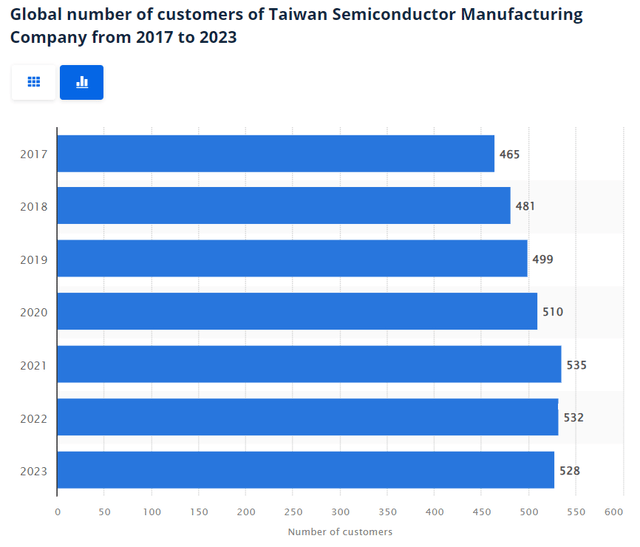

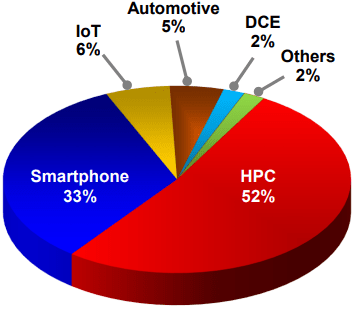

Beyond the AI giants, the company serves 528 customers across various industries, including automotive, telecommunications, and consumer electronics. This diversification reduces its reliance on one customer or market segment, providing stability and resilience in its business operations.

For example, TSMC is already supplying automotive applications chips as the race toward electric and hybrid vehicles soars. Carmakers offer an Advanced Driver Assistance System (ADAS) to reduce casualties and accidents, which can only be achieved with chips. The N7A chip for automotive applications is currently used for varied applications, including ADAS and non-volatile memory (NVM) technologies, among others.

Financial Performance

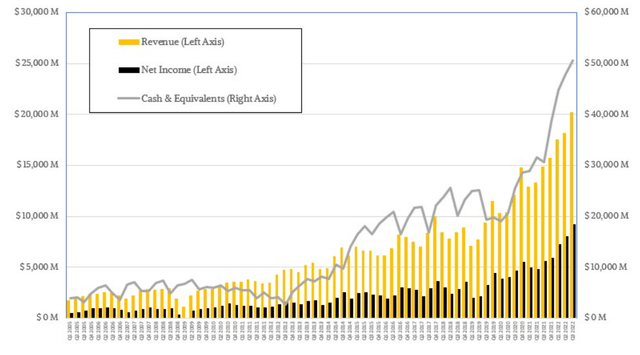

1. Consistent Revenue Growth: Ahead of Its Peers Revenue Generation

TSMC has demonstrated consistent revenue growth over the years, driven by strong demand for its advanced semiconductor solutions. The company’s financial performance reflects its ability to capitalize on emerging trends, such as AI, 5G, and the Internet of Things (IoT). This consistent growth gives it the financial resources to invest in research and development, ensuring its continued technological leadership.

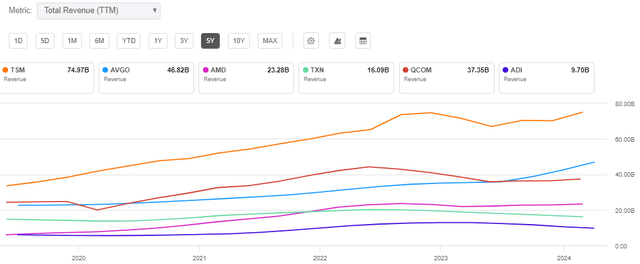

For more than 5years, its total revenues[TTM] have been ahead of its peers.

The numbers are not closer to TSM, alluding to its market dominance and unmatched competitiveness. Over time, the company garnered a reputation as a major driver for its advanced process nodes, charging a higher price than its competitors. The revenues are thus set to soar.

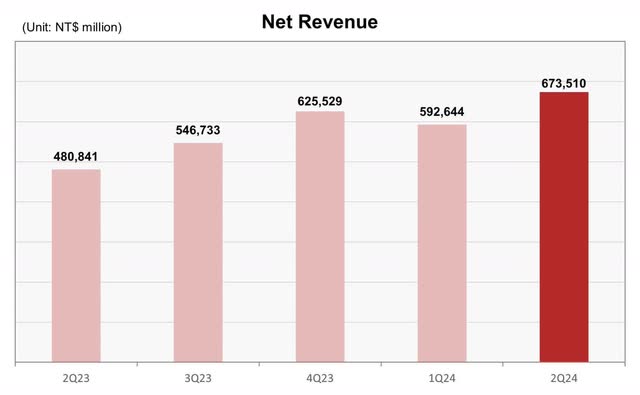

Its Chairman and CEO C.C. Wei states that the second quarter of 2024 was greatly supported by the rising demand for its most advanced 3 – nm and 5 – nm technologies, reporting a consistent increase in net revenue.

In the second quarter of 2024, it recorded a revenue of $20.58 billion, a 33.3% growth YoY beating the estimates by $491.6 million. This indicates that its solid revenue trajectory is resilient and stable.

Profit Margins

Its profit margins testify to its operational efficiency and pricing power. The company’s ability to maintain healthy margins while investing heavily in cutting-edge technology and capacity expansion underscores its scalable and reliable business model. This financial strength allows them to weather economic fluctuations and continue investing aggressively in future technologies.

The company’s second-quarter 2024 high-performance computing (HPC) revenues exceeded 52% year over year, reflecting its preparation to offer advanced chips for AI in HPC and personal computer (PC) market.

TSMC Q2’24

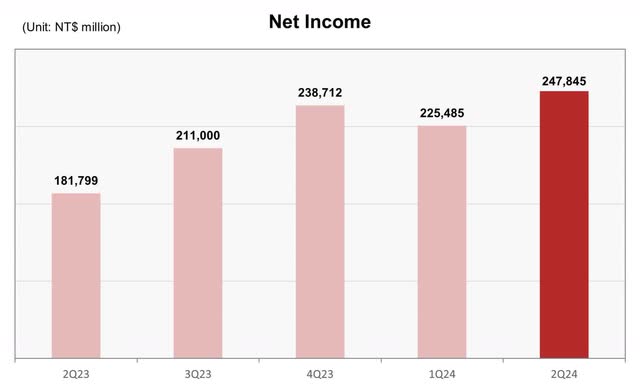

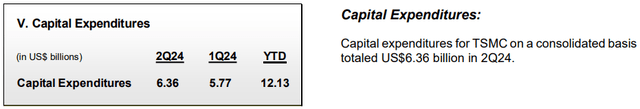

Q2’24 net income was $7.66 billion, translating to a gross margin of 53.2%. This is a decent lower gross margin of 60.4% (Q3’22), which is justifiable when the company is still at high capital expenditure to ramp up its N3 (3nm-class) fab lines. The company recorded Q2’24 CAPEX of $20.708 billion, which is 30.5% of the revenue.

Positioning The Company To Meet AI Demand

1. Expanding capacity

To meet the growing demand for advanced semiconductors, TSM has been making significant investments in expanding its manufacturing capacity.

The company has announced plans to build 2 new fabs and upgrade existing ones, ensuring it can keep up with the increasing needs of AI and other high-growth markets. By meeting customer demand for advanced chips at a scale, these strategic investments will enable TSM to maintain its leadership position and capture a larger share of the AI market.

For example, TSMC’s announcement of proposed 2nm technology and more advanced chips has received direct support of $6.6 billion from the Biden-Harris administration. The strategic investment of TSM Arizona, a subsidiary of TSMC April, signed a non-binding preliminary memorandum for direct funding of $6.6 billion. This unprecedented investment funding under the CHIPS and Science Act is an edge for TSM foundry services to continue manufacturing advanced chips in the United States.

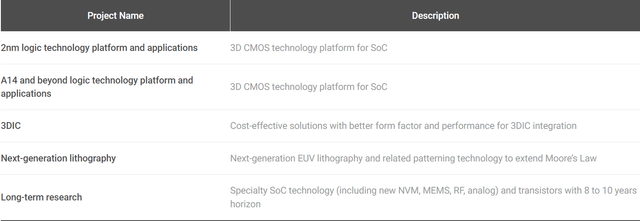

Research and development

TSM’s commitment to research and development (R&D) is a key driver of its technological leadership. The company consistently allocates significant revenue, specifically above 30% of its revenue to R&D. The focus is developing next-generation lithography process technologies and innovative packaging solutions. This relentless pursuit of innovation should help ensure that it remains at the top of semiconductor technology and is well-positioned to support the evolving needs of AI applications.

R&D has consistently increased and is directly reflected in the net income. Certainly, the company’s fundamentals are primarily based on its high R&D funding, which has maintained its focus on its 3D and RF intelligent sensors for 5G and smart IoT applications.

Moomoo Tec Inc

As a global manufacturer of chips, it still maintains the record of the comprehensive and most advanced portfolio in foundry process technologies, which, in my view, is its MOAT.

The CAPEX in the second quarter increased from $5.77 in Q1’24 to$6.36.

With more revenues generated from recently invented 3nm semiconductors, particularly from HPC, the 2nm advanced invention is expected to gain massive demand. The aggressive R&D has continuously facilitated the exponential growth of its revenues over the years.

TSMC

Let’s Model This: Valuation

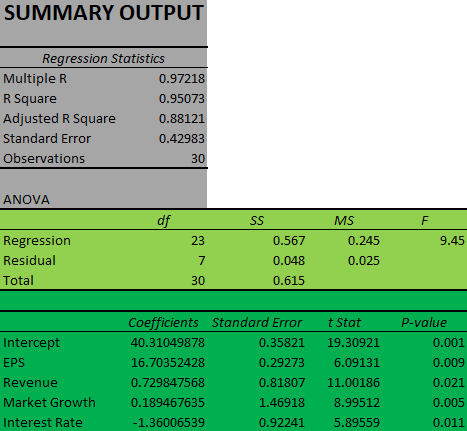

In the above sections, I have discussed several aspects that, I believe, make this company an attractive investment opportunity. In this section, I will put the above aspects in a multiple regression model and estimate my price target for this company in the next two years (by 2026). Looking at the discussions above, I can classify the information into two broad categories, which will form my variables in the model. The first category is the micro factors or rather the company-specific aspects that influence the stock’s performance and the second category is the macro factors that influence the stock performance.

In general, my model is grounded in a fundamental framework, and my inputs, specifically, independent variables(X-variables), consist of a combination of macroeconomic factors (interest rates and market growth) and company-specific elements (revenue and EPS). This in my view makes my model comprehensive in scope and hence its reliability in estimating my price target.

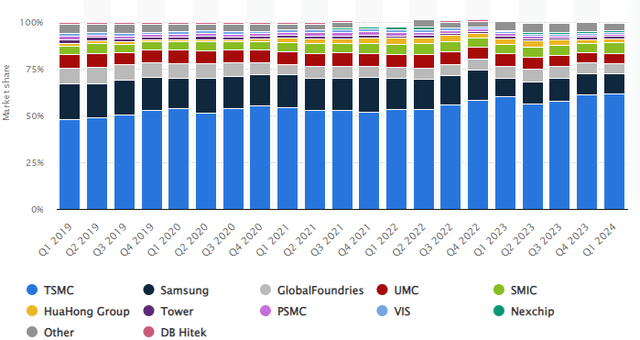

My adoption of revenue and EPS is based on the fact that a company’s financial standing has a significant impact on how well its stock performs, which was a major theme of my article. I decided to include the market growth variable since it is a reliable predictor of the company’s prospective earnings in the future. I derived this variable from my analysis of the company’s innovative products and solid customer base. These attributes of the company will enable them to leverage the projected market growth and maintain its double-digit market share, as it has been since at least 2019. This explains why it is a key variable in my model.

Lastly, I included interest rates (fed rates) as a risk component in the model. This is due to the fact that interest rates have a greater effect on the macroenvironment by increasing borrowing costs or even operating expenses, which reduce margins and ultimately result in poor stock performance and vice versa.

In this analysis, I will take data from the last five years to estimate the overall model, which will be used to forecast the stock price by 2026. For revenue and EPS, I will take data from Seeking Alpha, and for interest rates, I will use Fed rates. Finally, I will adopt data from Statista on market growth.

My assumptions are that the stock price(Y-variable) and the independent variables have a linear relationship, and that the Y variable’s response to changes in any X variable is always independent of the model’s other variables. In light of the above background, below is the model output which I ran at a 95% confidence interval.

Author

With an adjusted R square of 0.8812, the model explains approximately 88.1% of the variability in the dependent variable, making it a suitable fit for this analysis. This is because a higher R square indicates that the model explains a greater proportion of the variation. Furthermore, all t-stat values are greater than 2 and p-values are less than 0.05, indicating that all variables have statistical significance and so are reliable predictors of the dependent variable.

The output further shows that market growth, EPS, and revenue have a positive beta coefficient, which means that an increase of one unit in any of these variables would have a positive effect on the stock price equal to the beta value of that variable. Conversely, the interest rate has a negative beta coefficient, which means that the stock price is negatively impacted by every unit increase in this variable. This leads me to the overall model equation;

Y=Bo+B1X1+B2X2+B3X3-B4X4+e, defined as follows;

B0-Y Intercept

B1-EPS coefficient

X1-EPS

B2- Revenue coefficient

X2-Revenue

B3- Market growth coefficient

X3-Market growth

B4- interest rate coefficient

X4-Interest rate

e-the standard error.

Using the equation, I can estimate the price target of 2026 by inserting the estimated values of the independent variables in the equation. For revenue and EPS, the figures are $127.82 billion and $9.33 respectively according to Seeking Alpha. The projected fed rate for Q4 2026 is 3.1%. Finally, I assume that the company will maintain its current market share of 60% in the projected market growth. Inserting these figures in the model equation, I arrived at a target price of $295.19 which translates to an upside potential of about 70% in the next two years.

It should be noted that my price target is reliant on the estimated future values of the independent variables, and therefore any significant changes in the estimated values would lead to a revised price target accordingly.

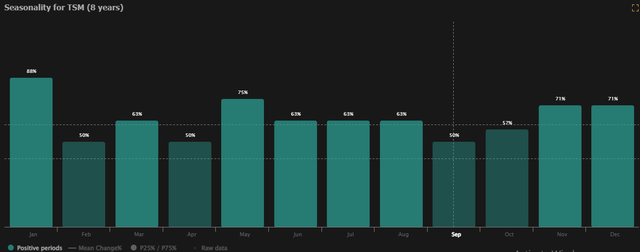

Technical View

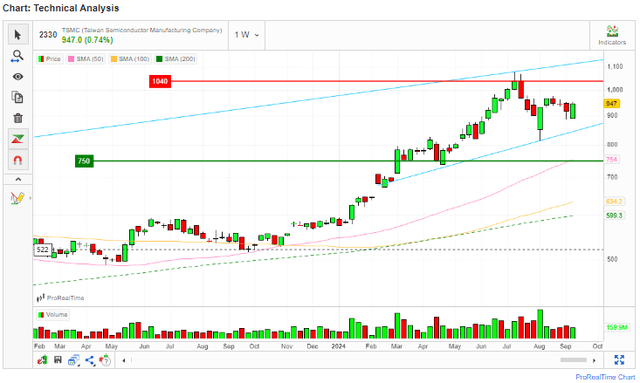

Looking at the price chart, the stock has dipped slightly. Data for the last 8 years show that September is one of the three worst-performing months for this stock, therefore the current dip aligns with this trend and hence it offers a buying opportunity to potential investors.

Despite the recent slight price decline, the overall outlook of this stock is bullish as shown by the moving averages. The price is above the MAs which are trending upwards, indicating that the dominant trend is bullish. Notably, the 50-day MA crossed above the 100-day MA forming the golden cross, which is a confirmation signal for a sustainable uptrend in the long run.

Additionally, although the OBV had slowed down slightly, it is currently recovering, an indication that the stock’s incremental trading volume is gaining traction and this should result in a sustainable uptrend. Above all, the RSI is shy above the 50 mark, implying that the bull run has ample space before hitting the overbought region of 70 where a trend reversal is likely.

Risks: NVIDIA Considering Intel For Foundry Supplies

Although I am optimistic about this stock, potential investors should be mindful of the risks associated with a potential partnership between NVIDIA (one of its key customers) and Intel (one of its main competitors). If INTC enters NVDA’s supply chain, it will stiffen competition, which could result in long-term market share erosion and revenue decline for TSM. Investors should keep a close eye on how events evolve and how TSM responds to this potential risk.

Conclusion

In conclusion, I reiterate my buy rating for this company owing to its strong double-digit upside backed by solid fundamentals.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.