Summary:

- TSMC is the leading AI foundry in the semiconductor industry.

- It dominates AI semiconductor manufacturing with over 90% market share in the leading process nodes.

- TSMC’s capacity utilization is expected to remain tight through 2026, bolstering its operating performance.

- TSMC anticipates to become a more significant player in advanced packaging, broadening its growth prospects.

- I argue why I’ve been too cautious on TSM previously, as it’s well-positioned to rally further. Read on.

BING-JHEN HONG

TSMC’s Leadership Is Undisputed

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is the world’s foremost foundry for advanced semiconductor manufacturing. As a result, the Taiwan-based foundry dominates manufacturing for the leading process nodes with a market share of more than 90%. It directly competes against Intel (INTC) and Samsung (OTCPK:SSNLF), although TSMC’s foundry leadership is undisputed.

I last updated TSMC investors in April 2024. I downgraded the stock to a Hold, urging caution against going FOMO into the AI surge. However, I should have maintained my bullish thesis, as the CapEx growth momentum driven by Gen AI has been much more robust than I had anticipated.

The AI gold rush has benefited TSMC and bolstered its dominance. TSMC’s Q2 earnings release underscores the company’s vital role in the semiconductor value chain. Nvidia (NVDA) is the primary resource for merchant AI chips, and Broadcom (AVGO) is the go-to leader for AI networking chips. TSMC underpins these companies’ leadership as the primary foundry for manufacturing their chips.

TSMC Benefits From The AI Gold Rush

As a result, Taiwan Semiconductor’s capacity utilization has been bolstered markedly, reflecting the surge in demand for the foundry. In TSMC’s Q2 earnings conference, management telegraphed that demand/supply dynamics will remain tight through 2026. In addition, the pure-play foundry indicated that yields for its most advanced nodes are expected to improve further. Therefore, secular AI growth opportunities in high-performance computing and AI smartphones are expected to entrench TSMC’s dominance against its peers. Accordingly, the foundry’s “capacity of the 3nm process is expected to more than double in 2024.”

In addition, the foundry’s N2 (2nm process node) is expected to begin volume production in the second half of 2025. The company is expected to benefit from improved pricing power linked to TSMC’s strategic value and solid demand. As a result, its N2 node is “expected to be priced at least 15% higher than the N3 process.”

Consequently, I assess the improved clarity in the semiconductor value chain as bolstering the company’s confidence in narrowing its CapEx guidance for FY2024. Accordingly, TSMC adjusted its CapEx to between $30B and $32B, relative to its previous forecasted range of $28B to $32B. Notably, the foundry expects to dedicate about 70% to 80% of its CapEx to advanced process nodes, highlighting its leadership in these technologies.

Investors new to investing in TSMC must understand that adjusting CapEx is a significant endeavor. It suggests that the foundry anticipates a sustainable improvement in underlying demand and pricing dynamics. As a result, the foundry leader can invest more aggressively, even though there could be near-term dilution in margins attributed to node transition.

Despite that, TSMC’s ability to drive higher capacity utilization should alleviate the impact. In addition, management also highlighted a potentially accelerated adoption of its N2 node. TSMC expects a “higher number of new tape-outs anticipated in the first two years” than its 3nm and 5nm processes. Therefore, I assess that it gives investors more confidence in TSMC’s operating performance and confidence in maintaining its market-leading gross margin target of 53% or above.

In addition, the foundry highlighted that 10% of its revised CapEx guidance will be dedicated to advanced packaging. The advances in AI chips require a significant acceleration in capacity for TSMC’s advanced packaging technologies. As a result, I assess it could bolster the company’s leadership across the foundry value chain, solidifying its dominance.

Accordingly, management highlighted a revised Foundry 2.0 definition that includes advanced packaging. The company specified that the updated definition “better reflects TSMC’s broader addressable market opportunities.” Under the revised definition, the foundry’s market share is only 28% (based on 2023 metrics), suggesting substantial potential for gains. Furthermore, management indicates that profitability for advanced packaging has been trending up, “now approaching or meeting the corporate average.” Therefore, I assess that it justifies TSMC’s ability to broaden its growth opportunities into advanced packaging, aligning it with its traditional foundry manufacturing capabilities.

Is TSM Stock A Buy, Sell, Or Hold?

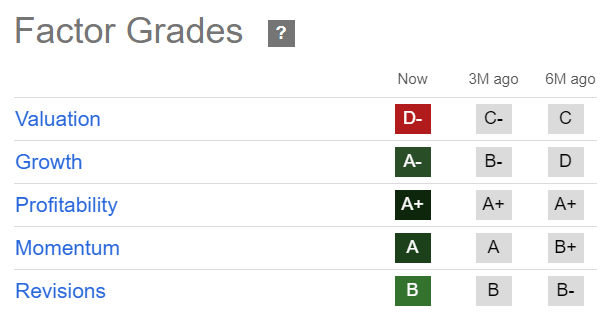

TSM Quant Grades (Seeking Alpha)

TSM stock notched a 1Y total return of almost 65%. Consequently, it is no longer assessed to be cheap. TSM’s adjusted EBITDA multiple of 12.7x is way above its 10Y average of 8.6x (according to S&P Cap IQ data). Therefore, investors are likely buying at a premium even though it remains almost 15% below its tech sector median.

Investors considering investing in TSM must anticipate potentially higher volatility swings, given its business model as a foundry. Therefore, fixed cost leverage must be carefully assessed as it could impact its underlying profitability. The cyclicality linked to the semiconductor business cycle could also worsen the impact. As a result, I don’t expect TSM to be valued as high as its fabless peers, given potentially higher execution risks.

In addition, TSM could suffer from geopolitical headwinds linked to a second Trump administration. Tighter chips restrictions against China could also lead to increased market volatility affecting TSM and its peers. Furthermore, President Biden’s withdrawal from the November presidential election has also injected more uncertainties into the democratic candidate’s nomination. Therefore, I assess the geopolitical headwinds affecting the company as unlikely to be resolved in the near term, undermining a more robust valuation re-rating possibility.

Notwithstanding my caution, I’ve not assessed red flags in TSM’s price action. Therefore, the recent pullback in the stock has likely presented a solid long-term buying opportunity for investors who missed adding exposure previously. The company’s solid fundamentals and market leadership position the company well to benefit from the AI gold rush. While TSM’s valuation is no longer cheap, it’s also not excessive.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.