Summary:

- Taiwan Semiconductor Manufacturing Company Limited’s blockbuster Q3 outperformance continues to support a robust AI demand environment, complemented by better-than-expected internal management of its cost structure.

- Despite the increasing mix shift to margin-dilutive 3 nm volumes, TSMC exceeded the upper range of its previous gross profit guidance for Q3 and is positioned for further expansion exiting 2024.

- This accordingly mitigates the anticipated impact of impending cost challenges facing TSMC, including new facility ramp-up costs and rising electricity prices heading into 2025.

- The latest results also set a strong foundation for impending uptake rates and margin accretion from TSMC’s next-generation N2 node next year, which should underpin a further upward valuation re-rate.

BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) delivered a blockbuster quarter that met high expectations following the release of preliminary sales data earlier this month, which outperformed expectations. The company’s third quarter results and forward outlook continue to highlight robust AI demand, putting earlier investors’ concerns about AI fatigue back to rest. TSMC’s Q3 results have also overshadowed risks of a diminishing smartphone sales mix amid softer-than-expected demand for its largest customer, Apple Inc.’s (AAPL), newest AI-enabled iPhone 16s. And despite an increasing mix shift towards more advanced nodes to support AI deployments, particularly the 3nm (“N3”) process which remains margin dilutive, TSMC also outperformed its earlier gross margin guidance by more than two points to 57.8%.

TSMC’s latest streak of growth and earnings outperformance reinforces our view that its upcoming start of volume productions on the 2nm process node represents an impending catalyst for the stock. Specifically, the next-generation process node delivers better unit economics and is expected to drive further margin accretion for TSMC. Demand is also underpinned by ongoing power efficiency requirements to support increasingly complex and compute-intensive AI workloads, which can be addressed by the next-generation node. Taken together, TSMC’s upcoming entry into 2nm, combined with its proprietary advanced CoWoS packaging technology’s mission-critical role in AI developments, underscores an impending upward re-rate for the stock from current levels.

An Accelerating AI Opportunity

TSMC’s moat continues to come from its advanced chip manufacturing and packaging capabilities at scale, especially amid heightened demand for complex, compute-intensive AI hardware. In the latest earnings update, management has reiterated their optimism for a 10% y/y expansion in the overall semiconductor market, ex-memory. Investors are also reminded of TSMC’s redefined “Foundry 2.0” roadmap, which will expand from chip manufacturing to include “packaging, testing, mask making, and others and all IDM, excluding memory manufacturing.” This continues to reflect TSMC’s expanding TAM and revenue opportunity, which management has quantified during both the 2Q and 3Q earnings call:

Under this new definition [of Foundry 2.0], the size of the foundry industry was close to $250 billion in 2023, as compared to $115 billion under the previous definition…TSMC’s share of the foundry industry, under our new definition, was 28% in 2023, supported by our strong technology leadership and broader customer base, we expect this one to further increase in 2024.

Source: TSMC 2Q24 Earnings Call Transcript.

Let me assure you that the last time we proposed a new version of the Foundry 2.0, which including the wafer manufacturing and packaging and testing, mass making, and all others. All these kinds of things become more growing importance, like packaging, testing, mass making….And so I think Foundry 2.0 is a better reflect TSMC’s traceable market. And our share is probably around 30%, so not a dominant yet.

Source: TSMC 3Q24 Earnings Call Transcript.

The robust demand environment is further corroborated by key customer Advanced Micro Devices, Inc. (AMD) latest commentary during its “Advancing AI” innovative keynote. Specifically, AMD predicts the AI processor marketing alone to advance at a 60% CAGR between 2023 and 2028 to represent a $500 billion opportunity. This continues to underpin TSMC’s tremendous growth prospects, given that “almost all AI innovators” are collaborating with the company on next-generation processors.

Meanwhile, earlier worries about AI spending fatigue have also been debunked amid resilient end-market demand for both accelerators and data center CPUs, which are highly dependent on TSMC’s advanced technologies. Hyperscalers have earmarked more than $160 billion in capex towards AI initiatives this year, with further headroom for longer-term growth given the accelerating pace of global data center expansion. And TSMC continues to be a key beneficiary given its technology moat, as evidenced in the increasing mix shift towards HPC sales amid an accelerating growth trajectory.

Recent endorsement by key chipmakers, NVIDIA Corporation (NVDA) and AMD, also reinforces TSMC’s unmatched advantage against emerging fabrication rivals like Intel Corporation (INTC) by wide margins:

We’re fabbing at a TSMC because it’s the world’s best and it’s the world’s best not by a small margin, it’s the world’s best by an incredible margin…And so we use them because they’re great, but if necessary, of course, we can always bring up others.

Source: NVIDIA CEO Jensen Huang, Goldman Sachs Communacopia + Technology Conference Transcript.

TSMC is a fantastic partner. I mean they have been an excellent partner to us across all of the various aspects of technology and manufacturing…We’re happy that TSMC is building Arizona. We’re taping out products and ramping that. And we’ll continue to look at how to derisk the supply chain with the notion of this is an industry-wide problem and all of us are looking at how do we create just more geographic diversity.

Source: AMD CEO Lisa Su, Goldman Sachs Communacopia + Technology Conference Transcript.

Admittedly, geopolitical risks remain a significant immediate overhang on the stock, given its saturated manufacturing footprint in Taiwan. However, continued diversification of its overseas operations, with the Arizona and Kumamoto plants coming online next year, is expected to mitigate said risks partially.

In the latest development, AMD has qualified chip production at TSMC’s upcoming Arizona facility. Although details remain limited, the industry is reporting that AMD’s upcoming Instinct MI325X AI accelerators might be produced in Arizona, which supports the 4nm process node. If true, this will provide substantial validation to TSMC’s advanced manufacturing capabilities overseas, and effectively reduce the risk premium currently attributable to its elevated exposure to China-Taiwan tensions.

2nm is an Impending Catalyst for TSMC

Recall that the 3nm node has largely been margin dilutive for TSMC since its debut, despite robust adoption in the midst of relentless AI hardware requirements. This was largely due to the underpricing of the advanced node during the early stages of its tape-out and customer contracting, which did not account for subsequent implications of inflationary pressures recently.

Yet, TSMC’s margins have been expanding at a rapid pace, despite the increasing mix shift towards the 3nm process node alongside rising electricity costs in Taiwan. The company delivered a substantial Q3 earnings beat, with gross margins exceeding the upper range of previous guidance by more than two percentage points at 57.8%. Paired with additional cost savings realized through improved utilization and increased productivity gains, TSMC’s latest results set a strong foundation for additional margin accretion from upcoming volumes on 2nm (or “N2”).

As a result, we believe TSMC’s upcoming start of volume production on the 2nm process node will be a key catalyst for the stock. The next-generation process node is expected to deliver superior unit economics when compared to its predecessors, 3nm and 5nm, and will be complemented by a faster ramp schedule. It also benefits from a strong demand outlook, given N2’s substantial lead in power efficiencies compared to its predecessors. This effectively addresses a critical consideration in the development of next-generation compute-intensive AI hardware.

N2 Unit Economics

Unlike its predecessor, the N2 process node will be better priced to its value according to management. Although management has yet to provide details on N2 pricing, the industry expects it to “exceed $30,000 per wafer.” This represents a marked increase from the N3’s ~$20,000 per wafer and almost double from the 4nm and 5nm process nodes.

In addition to pricing, N2 will also benefit from higher tape-outs, which underscores a stronger growth outlook. Specifically, management expects new tape-outs – or design wins proceeding to manufacturing – in the first two years of N2 production to be higher than volumes observed from the 3nm and 5nm processes over the same timeframe. The emerging technology’s performance and yield are also already ahead of plan, preserving TSMC’s competitive moat against up-and-coming rivals in advanced nodes, such as Intel’s 18A.

Taken together, the N2 is expected to be a key impending margin accretive factor for TSMC. Compared to the 5nm and 3nm process nodes, which took about 10 to 12 quarters to become margin accretive for TSMC, the N2’s better pricing and yield are expected to deliver a substantially better profitability profile at a much faster pace. This is supportive of an upward re-rate to TSMC’s fundamental trajectory, which remains underappreciated at the stock’s current levels.

N2 Demand Outlook

The materialization of N2’s favorable unit economics is further reinforced by a strong demand outlook for the technology. Specifically, the ongoing AI transformation has unleashed an “insatiable need for energy-efficient computing.” This is corroborated by Nvidia CEO Jensen Huang’s latest remarks, which state that computing costs will have to come down substantially to make next-generation AI developments, such as “reasoning,” feasible. The leader of AI processors expects to “boost its chip performance every year by two to three times,” while maintaining minimal changes to cost and energy consumption levels.

And TSMC’s next-generation advanced node can address these requirements. Specifically, TSMC’s N2 node will incorporate a “nanosheet transistors structure”, which unlocks industry-leading density and energy efficiency. The N2 will deliver “10 to 15 speed improvement at the same power, or 25% to 30% power improvement at the same speed, and more than 15% chip density increase as compared with the N3E”.

This performance and power advantage will be furthered by the N2P extension coming 2H26 – similar to the current N3’s ramp profile, with extensions N3X, N3P and N3E – which incorporates “backside power delivery“. The N2P will deliver an incremental 10% power benefit on top of the N2 node.

The N2 family’s leading performance capabilities and power efficiency will be succeeded by further advancements in the A16 node, which starts volume production in 2H26 as well. The A16 node will be the first to feature TSMC’s proprietary “Super Power Rail” (“SPR”) backside power delivery technology. The composition will unlock up to 10% power improvement at the same speed as N2P, which represents power improvement of up to 20%. It is also 7% to 10% denser, which enables greater performance while maintaining lower power consumption.

To better address robust demand for its advanced nodes, driven by the ongoing AI transformation’s requirements for power-efficient computing, TSMC has also invested accordingly in capacity expansion. The company’s second Arizona fab will be fitted with 2nm manufacturing technologies, and start volume production by 2028 to complement output from its Taiwan facilities. This will be complemented by additional capacity for more advanced technologies at its third fab in the U.S., which is expected to come online by the end of the decade.

Fundamental Considerations

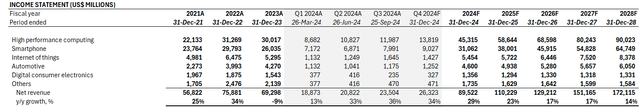

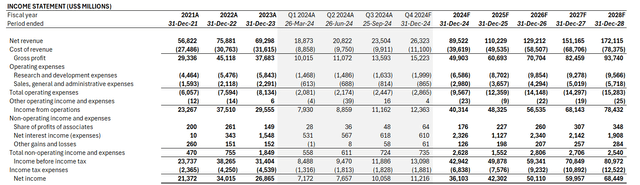

Adjusting our previous forecast for TSMC’s actual Q3 performance and forward outlook, we expect its full-year 2024 revenue to expand 29% y/y to $89.5 billion. We expect a continued mix shift towards HPC, given TSMC’s industry-leading role in the production of AI processors, to facilitate the ongoing upgrade cycle in data center builds.

Despite the increasing mix shift towards 3nm, we expect continued moderation in relevant margin dilution due to expanding scale, complemented by ongoing manufacturing cost optimization efforts. This is consistent with TSMC’s blockbuster earnings outperformance observed in Q3, and management’s guidance to further margin expansion heading into the end of the year. Paired with expectations for further margin accretion given better unit economics from next-generation process nodes, we expect TSMC to outperform its long-term gross margin target of more than 53%.

Valuation Considerations

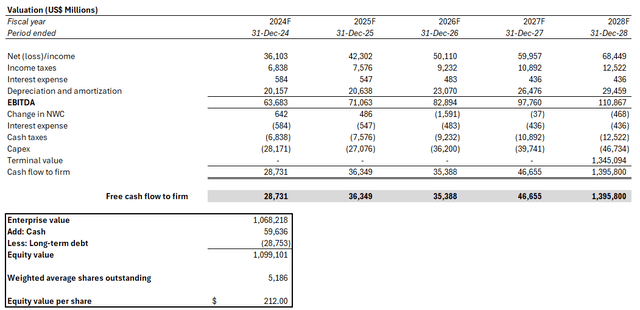

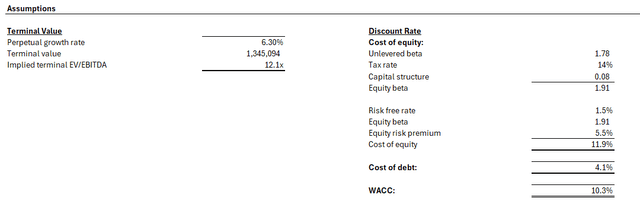

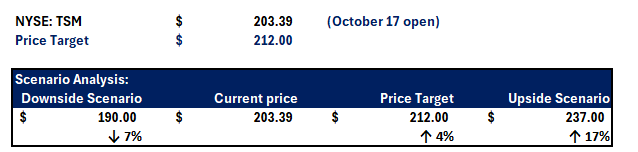

We expect the upcoming start of volume productions of N2 to be an impending catalyst for the TSMC stock, especially given the company’s streak of substantial earnings outperformance since introducing N3. The new N2 volumes are expected to drive further margin accretion, benefitting cash flows that underpin TSMC’s valuation outlook. As a result, we are increasing our price target for the stock to $212 (previously $180).

Author

The price is derived using the discounted cash flow analysis, which considers projections taken from the foregoing fundamental discussion. A WACC of 10.3% in line with TSMC’s capital structure and risk profile is applied. The analysis also considers an implied perpetual growth rate of 1.5% on 2033E EBITDA (or 6.3% on 2028E EBITDA) to determine TSMC’s terminal value at steady-state. We believe the valuation assumption applied, which gears towards the lower range of the anticipated rate of long-term economic expansion across its core operating regions, appropriately accounts for TSMC’s incremental geopolitical risk premium. The analysis also anticipates a capex spend of $28 billion in 2024, or 31% of the current year’s revenue estimate, to support the company’s long-term growth expectations.

Conclusion

Given TSMC’s growth outlook, we believe the stock continues to trade discounted on a relative basis to its chip-making peers with similar fundamental profiles. There is substantial upside for TSMC from current levels, especially given its competitive advantage in leading-edge manufacturing and advanced packaging technologies. All AI chipmakers are currently working with TSMC, as it remains the preferred chip fab despite inherent geopolitical risks. This continues to underscore that the industry has yet to find a close replacement to TSMC’s technological capabilities and scale.

Although geopolitical risks remain TSMC’s most significant overhang, the impending start of volume production at its Arizona and Kumamoto fabs should provide some alleviation. At Arizona, specifically, TSMC is expected to start producing on the 4nm process node, with volumes already accounted for by Apple and AMD. Further expansion in the region will add diversification to its supply of advanced node manufacturing, such as 2nm, which is critical for addressing next-generation accelerated computing builds.

Taken together with better unit economics from its next-generation process nodes, TSMC is well-positioned for further margin accretion. This is expected to unlock an incremental upward re-rate to TSMC’s long-term fundamental trajectory, which remains underappreciated at the stock’s current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.