Summary:

- I reiterate a “Buy” rating for Taiwan Semiconductor Manufacturing Company Limited with a one-year target price of US$240 per share, driven by strong AI demand and advanced processes.

- TSMC’s 2nm and A16 processes are key growth drivers, with mass production starting in 2025 and significant adoption expected by Apple for iPhone 18.

- Q3 FY24 results showed 39% revenue growth, driven by 3nm and 5nm technologies, with AI server processors projected to triple in revenue contribution.

- Potential risks include US export restrictions on AI chips to China and geopolitical pressures to shift production to Intel’s foundry capabilities.

JHVEPhoto

I assigned a “Buy” rating to Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) in September 2024, emphasizing their 2nm and A16 roadmap. During the Q3 FY24 earnings call, the management indicated very strong demand for server AI processors, which they anticipate will account for 15% of total revenue in FY24. I reiterate a “Buy” rating with a one-year target price of US$240 per share.

TSMC’s 2nm Fabrication Process for iPhone 18

As reported by the media, Apple Inc. (AAPL) is poised to make a significant change with the iPhone 18 in 2026, leveraging TSMC’s 2nm fabrication process for their A20 chip. TSMC’s management indicated that the mass production of their 2nm process will begin in 2025. In addition, it was reported that TSMC demonstrated its initial 2nm chips to Apple back in December 2023. Given this timeline, I think it is quite possible for Apple to adopt TSMC’s cutting-edge 2nm fabrication process for the 2026 iPhone.

Apple’s A20 chipset is also expected to change its packaging process from an Integrated Fan-Out to a Wafer-Level Multi-Chip Module, enabling the integration of different chips in the same package process. The design change could significantly enhance the iPhone’s communication speed, delivering substantial improvement for end-users. I think it is a very positive catalyst for TSMC, showcasing their technology leadership in their 2nm process. As discussed in my previous article, the 2nm and A16 are critical components of TSMC’s product roadmap, enabling the company to maintain their leadership position in the future.

Q3 and Outlook

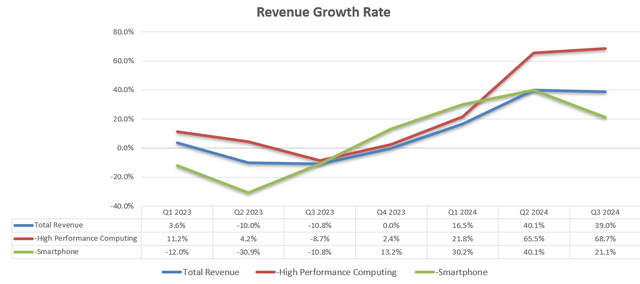

TSMC released their Q3 result on October 17th, reporting 39% revenue growth, driven by strong performance in the high-performance computing segment, as shown in the chart below.

The strong performance was primarily driven by their 3nm and 5nm technologies, which together accounted for more than 52% of total wafer revenue during the quarter. My biggest takeaway from the quarter is the management’s confidence in AI growth. As indicated over the earnings call, TSMC’s management anticipates revenue from server AI processors will triple this year, reaching mid-teens as a percentage of total revenue for FY24. The strong growth in the AI processor business reflects robust demand across GPUs, AI training and inference workloads as well as other related segments such as AI servers, HBMs and custom silicon chips. Due to the strong performance, TSMC is guiding for around 33.5% revenue growth in FY24.

Valuation

Considering the strong growth YTD, I don’t anticipate any earnings surprises for FY24. As such, I raised my FY24 revenue growth rate forecast to 33.5%, aligned with their guidance. For growth from FY25 onwards, I am considering the following factors:

- I continue to anticipate the overall foundry market will grow by mid-single-digit through the cycle, primarily driven by AI chips, automotive semiconductors as well as industrial automations.

- TSMC’s 2nm and A16 will likely begin driving their revenue business from FY25. I project these new advanced processes will contribute an additional 2% growth to the overall topline. During the earnings call, the management noted that A16 is very attractive for AI server chips, with strong demand expected for both the 2nm and A16 processes.

- TSMC has been gaining market share from Intel Corporation (INTC) and other small players. I forecast a 1% growth contribution from their market share gains.

As such, I model 8% organic revenue growth from FY25 onwards. I also revised my margin expansion to 30bps, driven by 15bps from gross profit improvement due to revenue mix towards a more advanced process, 10bps from SG&A operating leverage and 5bps from utilization improvement. As indicated in the earning call, TSMC has benefited from capacity utilization improvement in FY24. In addition, their 2nm and A16 are expected to carry a much higher gross margin once they enter the mass production phase.

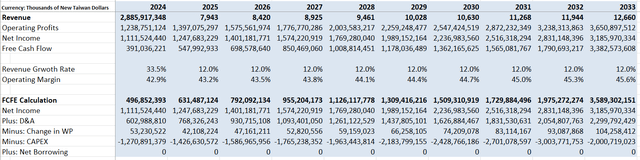

The cost of equity is calculated to be 11% assuming: a risk-free rate of 3.6%; a beta of 1.16; and an equity risk premium of 6.5%. The free cash flow from equity (FCFE) is calculated as follows. Please note, the currency in the table below is New Taiwan Dollars in thousands.

Discounting all the future FCFE, the one-year target price is calculated to be US$240 per share, as per my estimates. The FX used in the model is 1 USD = 32 Taiwan Dollar.

Key Risk

On October 14th, Bloomberg reported that the US government has discussed capping sales of advanced AI chips from NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) to some countries such as China. As both Nvidia and AMD are TSMC’s key customers, any potential export restrictions would pose some near-term challenges for TSMC’s growth.

As discussed in my initiation report, the US government is pushing Nvidia and Apple to utilize Intel Corporation’s (INTC) foundry capabilities. Currently, it is difficult to quantify the impact of these geopolitical risks on TSMC.

End Note

I am confident that TSMC’s 2nm and A16 will become a significant growth driver for the company in the near future. TSMC is leading the competition in the global foundry market. I reiterate a “Buy” rating with a one-year target price of US$240 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.