Summary:

- TSMC’s Q3 earnings surpassed expectations, with a 39% Y/Y revenue surge and 54% Y/Y earnings growth, driven by high-performance computing demand.

- TSMC’s AI-driven growth is profitable, with the company managing to translate AI spending into significant earnings and free cash flow growth.

- The company forecasts $26.1B to $26.9B in Q4 revenue, implying 35% Y/Y growth and potential gross margin expansion.

- TSMC, with a 60% market share in its core market, is crucial in AI chip manufacturing, offering a compelling investment at a forward P/E ratio of 23.8X.

da-kuk

Taiwan Semiconductor Manufacturing (NYSE:TSM) reported better-than-expected earnings for its third fiscal quarter on Thursday, lifting not only TSMC but the entire chip sector up. The strong earnings report, which showed quite significant earnings and free cash flow explosion at the chip manufacturer, came just days after Netherlands-based chip manufacturer ASML Holding (ASML) crashed on a decline in net bookings for its lithography machines. I have since explained why I bought the crash. I believe TSMC is and will remain a top bet for investors seeking exposure to the AI industry, and the company is facing a very attractive demand picture in the near future.

Previous Rating

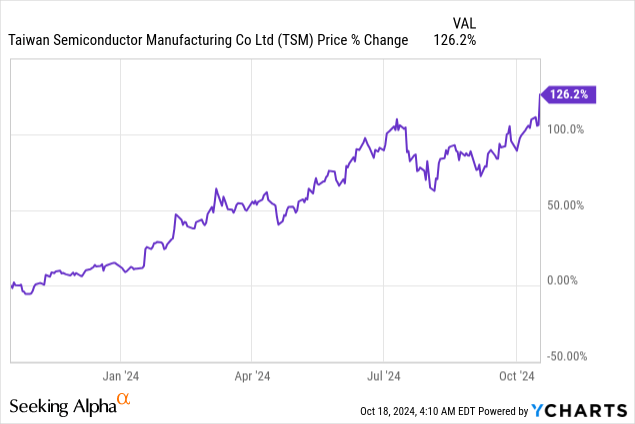

I recommended Taiwan Semiconductor Manufacturing consistently throughout the last year as the chipmaker benefited from accelerating demand for AI chips. I also aggressively recommended TSMC ahead of the very strong earnings release: Why Taiwan Semiconductor Is A Strong Buy Ahead Of Q3 Earnings. TSMC’s order books are filled, which is why the company submitted a strong revenue outlook for Q4 as well. I believe TSMC is set for long-term earnings growth and the high-performance computing segment is going to be a catalyst for a continual upside revaluation.

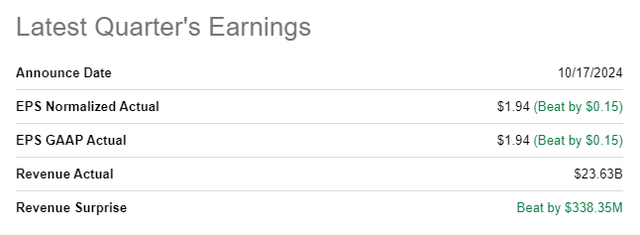

TSMC Beats Estimates

It was an earnings release that couldn’t have been better if you invented it: TSMC beat expectations on both the top and bottom line, revenues surged 39% year-over-year in Q3’24 while earnings soared 54% year-over-year.

The earnings beat was significant as well: TSMC reported adjusted earnings per share of $1.94 which beat the consensus estimate by $0.15 per share. The top line came in at $23.63B, which also beat the average prediction by $338.4M.

TSMC benefited once again from accelerating demand from the high-performance computing sector, which was responsible for 51% of the company’s revenues in the third fiscal quarter. HPC-related revenues surged 11% year-over-year due to strong demand for AI-optimized chips that help customers stem demand for artificial intelligence workloads.

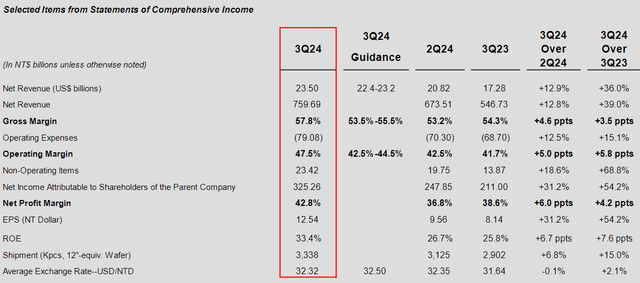

TSMC generated NT$759.7B in revenue – which calculates to $23.5B – showing a year-over-year growth rate of 39%. Most importantly, TSMC’s AI-driven growth is very profitable, both in terms of earnings and free cash flow. This is an important realization as many investors have been both worried about the durability of AI-related spending as well as the degree to which AI spending is profitable.

In the case of TSMC, the semiconductor company has been able to translate AI-driven spending tailwinds into real earnings growth. In the third quarter, TSMC reported NT$12.5 in earnings per share, which showed 54.2% earnings growth year-over-year. TSMC’s free cash flows are looking even better, with the chip company reporting NT$184.9B, showing 171.8% growth.

Importantly, TSMC managed to deliver a significant gross margin beat in the third quarter as well: The chipmaker reported a gross margin of 57.8%, showing a significant 4.6 PP margin expansion compared to the previous quarter, Q2’24. The company also beat the top-end of its gross margin guidance by 2.3 PP, indicating strong pricing power for TSMC.

Outlook for Q4’24

TSMC guided for $26.1B to $26.9B in revenue for the fourth quarter, which implies a revenue growth rate of 35% year-over-year. Meaning, the company expects its revenue momentum to continue. In terms of gross margins, TSMC sees a range of 57-59% in Q4’24 which implies that the semiconductor maker sees gross margin expansion potential of up to 1.2 PP quarter-over-quarter.

TSMC’s Valuation

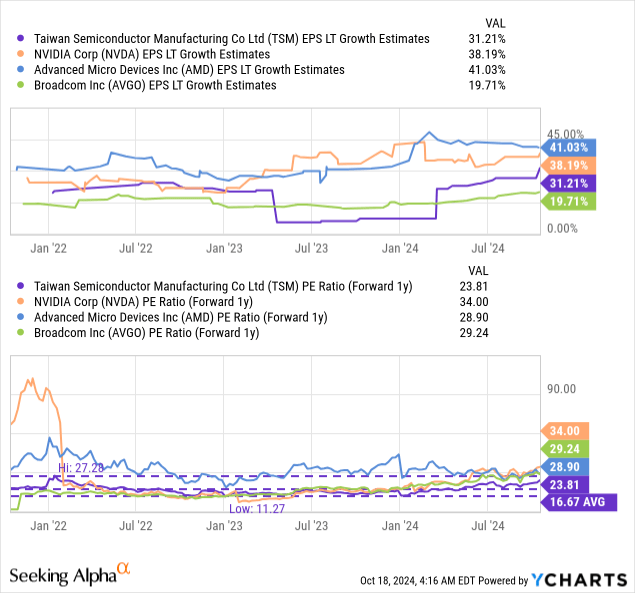

The reason why I like Taiwan Semiconductor Manufacturing, even more so than ship design companies such as AMD (AMD) or Nvidia (NVDA), is that TSMC is strategically located at the very heart of the chip manufacturing industry and therefore is set to benefit from increasing AI-related chip spending. Taiwan Semiconductor Manufacturing also owns more than 60% of the chip manufacturing market, making it all but impossible for companies to circumvent TSMC.

This market position creates a moat (a market entry barrier) and strong pricing power, which has been reflected in a growing gross margin trend. Still, shares of TSMC are not especially expensive, allowing room for valuation growth.

TSMC is currently valued at a forward P/E ratio of 23.8X, based off of FY 2025 earnings, which represents an 18% discount to the industry group average P/E ratio of 29X. The industry group includes Nvidia, AMD, and Broadcom (AVGO)… which are AI plays for investors as well that benefit from growing CapEx in the market for AI-optimized GPUs.

In my last work on the chipmaker, I argued that TSMC could have a fair value in the neighborhood of $218, based off of a fair value P/E ratio of 26.0X. TSMC is also expected to see 30%+ annual EPS growth going forward, in large part because companies are desperate for new AI chips. This setup should benefit TSMC, especially because I believe, as I said before, that AI spending seems to be secular, not cyclical. Companies are investing heavily in long-term AI-capable hardware, and Nvidia and AMD both are moving to 1-year product release cycles in order to capture more of this surging demand. Since TSMC is positioned right at the heart of the AI revolution, the company is also the ultimate AI weather vane that will show investors the general underlying business trends in the industry.

If TSMC revalues to the industry group average P/E ratio of 29X, shares could have a fair value of $250 per share, implying a 22% upside revaluation potential. Given that TSMC just presented a strong revenue and gross margin outlook, I believe this could be a realistic longer-term stock price target for the chipmaker.

Risks with TSMC

Waning demand for AI chips, chiefly in the Data Center market, would be a red flag and potentially indicate demand weakness. This demand weakness would likely imply a weaker gross margin profile as well as slowing earnings growth rates. What would therefore change my mind on the chipmaker is if TSMC were to see a weakening gross margin trajectory and a slowdown in its top line. In the long term, however, I believe TSMC’s strong market position will serve the company very well, and I see a risk profile that is skewed to the upside.

Final Thoughts

The third fiscal quarter was a very solid quarter for Taiwan Semiconductor Manufacturing and a number of data points indicated a very healthy business: 1) TSMC continues to benefit from red-hot demand for AI chip manufacturing which is led to a 39% Y/Y surge in revenues, 2) TSMC translated this demand to 172% Y/Y free cash flow growth in Q3’24, and 3) The revenue outlook for the fourth quarter, which implies a sequential gross margin expansion, indicates that there is, in fact, no slowdown in demand for AI chips. This should calm investors’ nerves after ASML’s third-quarter earnings report indicated some cautiousness on the part of chip customers. Investors who seek a long-term play in the semiconductor market and who want to benefit from TSMC’s exceptionally strong and dominant market position may want to consider an investment in Taiwan Semiconductor Manufacturing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.