Summary:

- Taiwan Semiconductor Manufacturing Company Limited reported Q3 results and outlook Thursday morning, reversing ASML Holding’s negative outlook and confirming our positive thesis on the stock.

- We expect the outperformance to be supported once again by AI, as well as smartphones, on the specific thesis that both moving to smaller nanometer nodes will work in TSMC’s favor.

- Management expects capex for the current quarter to double to approximately $11.5B due to healthy demand, with CEO Wei noting “the demand is real.”

- As the AI penetration rate expands, we expect AI tailwinds for TSMC to expand alongside it.

PM Images

Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) is among our top three picks in our semi-coverage universe, and Thursday morning’s Q3 earnings results and outlook confirm our positive thesis is well-placed for next year. TSMC reported a 54% Y/Y and 31.2% Q/Q surge in net profit for Q3, with net income hitting 325.3B Taiwanese dollars (about $10.1B) for the July-September quarter, comfortably surpassing the consensus of $300.2B Taiwanese dollars ($9.35B). The results pushed the stock over 12% higher Thursday so far. Net revenue increased 36% Y/Y and 12.9% Q/Q to $23.50B on a gross margin of 57.8%, up 4.6% Q/Q and 39% Y/Y from 54.3% in a year ago quarter and 53.2% last quarter.

TSMC stock is up +112% since our buy-rating, a little over a year ago, in October of last year, versus the S&P 500, up 33% during the same period, supported by our investment thesis stating:

“We think the weakness is priced in and see end demand recovery in +44% of TSMC’s end market exposure happening in 2024, and longer-term growth tailwinds from A.I.”

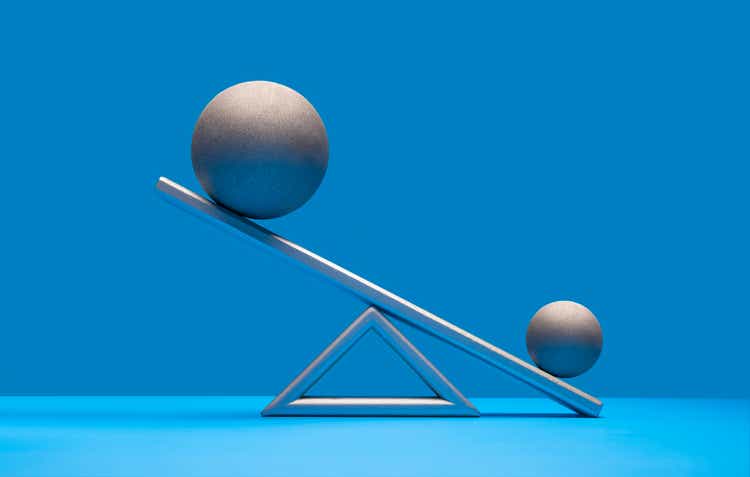

TSMC’s outperformance in FY24 has been largely supported by AI tailwinds as end demand outside of AI remains lacking; ASML confirmed this chip weakness earlier this week with their bookings miss and reduced guidance range for FY25 bookings. TSMC management notes in the Q3 revenue analysis that outperformance was driven by “strong smartphone and AI-related demand for industry-leading 3nm and 5nm technologies,” with 3nm process tech making up 20% of total wafer revenue for the quarter while 5nm and 7nm represented 32% and 17%, respectively.

The industry is moving to smaller nanometer process tech for AI to keep up with Moore’s Law, which should benefit TSMC, in our opinion, as TSMC dominates the global foundry market with a 62% share as of 2QCY24. TSMC’s top customers, Apple, Nvidia, Qualcomm, and AMD, are showing strong demand “nearly fully booking TSMC’s 3nm capacity.” Now, we expect TSMC’s next leg of outperformance to be supported once again by AI, as well as smartphones, on the specific thesis that both moving to smaller nanometer nodes will work in TSMC’s favor. We emphasize to investors that while some positives have been priced in after Thursday’s report, we still see more room for upside surprise next year.

Nanometer Size Matters

The semiconductor industry can never remain static; there is a constant strive to achieve Moore’s Law from Intel co-founder Gordon Moore, which states “the number of transistors on an integrated circuit will double every two years with minimal rise in cost.” That’s what customers are chasing when moving to smaller nanometer that’ll allow more transistors to “be squeezed into the same area.”

AI is currently at 4 nm with Nvidia Blackwell GPUs using TSMC’s 4nm process, but quickly, AI will have to move to 3nm and then 2nm processes, which will be through TSMC as the industry-go-to with Nvidia and Apple as its two largest customers. TrendForce report about the strong momentum in 3nm demand noted, “Following the widespread adoption of TSMC’s 3nm process, the 3nm supply chain has attracted significant market attention, with expectations for operational boosts in the coming year.” We expect AI moving to small nanometers will result in a higher 3nm revenue by technology, as 3nm and 2nm come with a higher price tag. Analyst Tom O’Malley noted that 2nm will likely get a “bigger initial revenue contribution than N3 [3nm].” We expect top-line growth supported by this industry transition from AI to smaller nodes, as well as the smartphone transition. Apple’s iPhone 16 uses TSMC’s 3nm, and we should also see a transition to 2nm there down the line.

The following charts showcase TSMC’s revenue by technology for 3Q24.

TSMC 3Q24

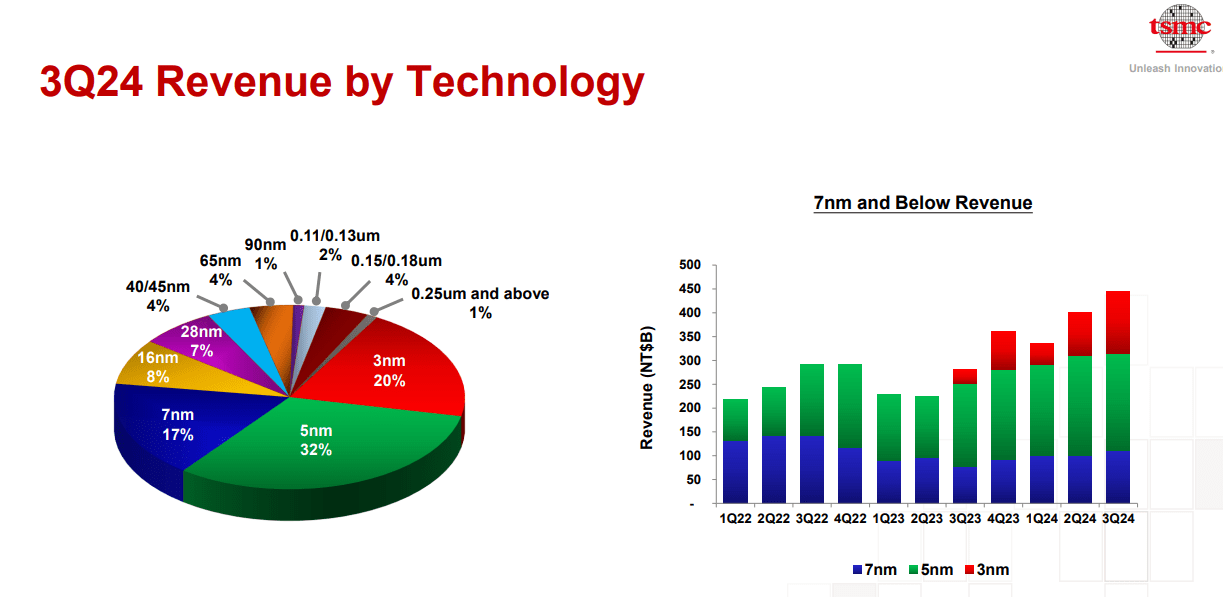

We’re also more positive about TSMC’s position to lead the industry transition to smaller nanometer nodes. The expectations are for capex this year to pick up to over $30B, with this quarter’s capex higher at $6.4B versus an average of $6.36B for the first three-quarters of FY24. Management expects capital spend for the current quarter will double to approximately $11.5B due to healthy demand, with CEO C.C. Wei noting on the earnings call that “the demand is real.” TSMC is also keeping up with the U.S. interest to move chip making to U.S. soil, investing $65B in three plants in Arizona, with the first fab estimated to see volume production in 2025. The graph below outlines TSMC’s capital expenditure since 1Q22.

TSMC

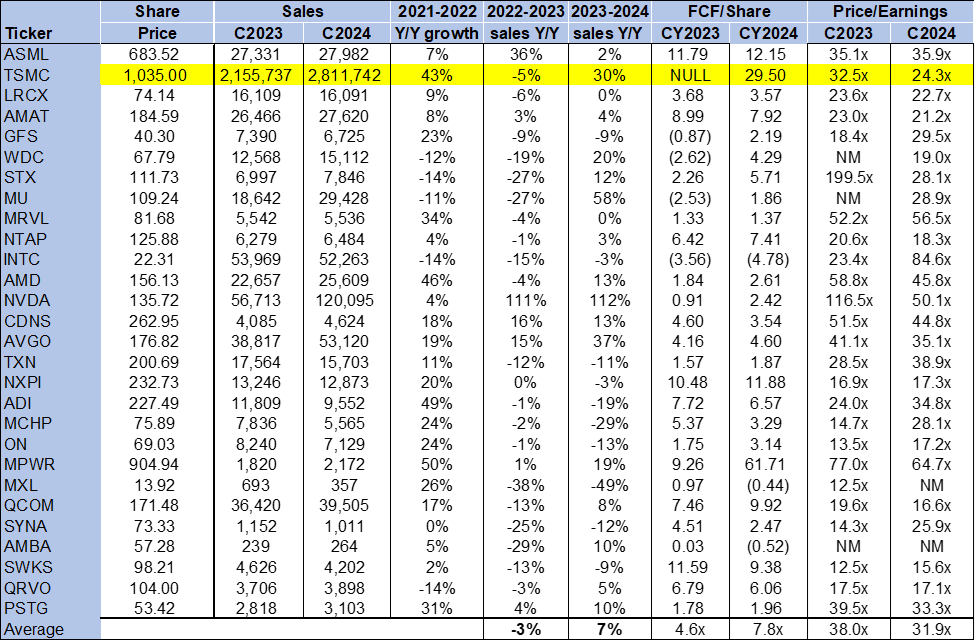

Valuation & Word on Wall Street

TSMC remains cheap relative to its semi-peer group; the stock is even somewhat undervalued, considering its unique position with Nvidia (NVDA) and Apple (AAPL). On a P/E basis, the stock is trading at 24.3x C2024, slightly higher than its ratio in late August at 23.1x but still comfortably lower than the peer group average of 31.9x. Solely considering real AI top-line growth exposure, it would actually make more sense for TSMC to be pricier than, for example, Advanced Micro Devices (AMD), which hasn’t achieved the same AI-related sales but trades at a P/E ratio of 45.8x. We think TSMC will continue to provide a favorable risk-reward profile in FY25.

TechStockPros

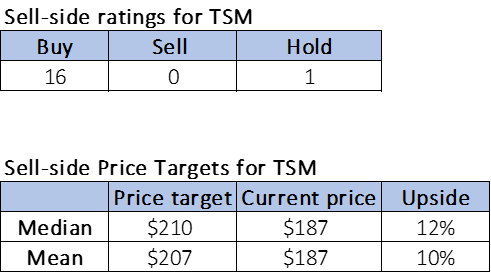

Wall Street recognizes TSMC’s special position. Of the 17 analysts covering the stock, 16 are buy-rated, and the remaining one is hold-rated, which is similar to the sentiment we had when we wrote about the stock in late August. The stock is currently priced at $187 per share, with a median price target of $210 and a mean price target of $207 for a potential 10-12% upside. It’s our belief that TSMC is positioned to outpace current median and mean sell-side price targets on its industry-go-to status and heightened demand for advanced nodes; the company has grown at a CAGR of 14% since 1998, reflecting just how much leverage TSMC has in the semi supply chain. The following charts outline TSMC’s sell-side ratings and price targets.

TechStockPros

What to do With the Stock?

Management is guiding Q4 sales between $26.1B and $26.9B, representing a 13% Q/Q and 35% Y/Y growth at the midpoint, and we expect TSMC to report within the upper range of that guidance. While the stock is up over 12% in Thursday trading so far, we see more upside in 4Q24 and FY25. The back end of the year tends to be more of a “peak season” for TSMC, as hyper scalers and other tech companies’ stock up ahead of the end-of-year holidays. AI penetration remains low at mid-single-digit percentage, which most investors don’t understand yet. So, as the AI penetration rate expands, we expect AI tailwinds for TSMC to expand alongside it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.