Summary:

- TSMC reached a new 1-year high on optimism for consistent top line growth.

- Market share gains and record Q1 results drive revenue growth.

- The firm’s free cash flows are growing significantly faster than revenues, which in turn translates to significant potential for EPS estimate upside revisions.

- Shares are attractively valued and have a fair value north of $207 per share. The risk profile in the context of accelerating FCF growth is also favorable.

MF3d

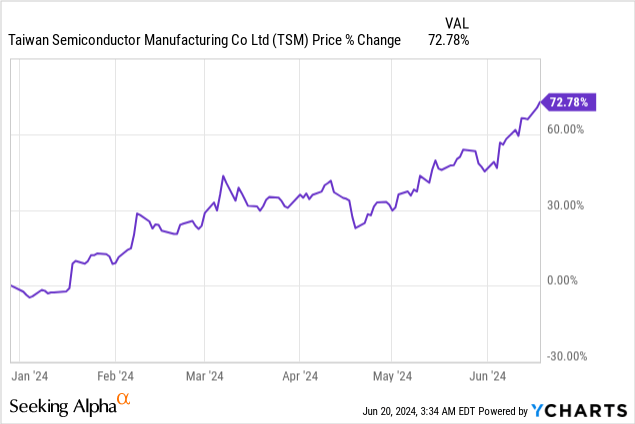

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) just reached a new 1-year high on optimism that the chip company can back up its valuation with consistent top line growth. Taiwan Semiconductor Manufacturing’s first fiscal quarter results also showed considerable promise in this regard. The chipmaker also achieved sequential market share growth in its core business and is seeing its free cash flows growing much faster than its revenues. As a result, TSMC is on a free cash flow upswing and set to FCF margin expansion. Due to rising demand and adoption of customized AI chips, I believe Taiwan Semiconductor continues to have considerable revaluation potential, despite a 73% year-to-date gain!

Previous rating

I made TSMC a large portfolio holding (5%) back in March, chiefly because of the company’s strong focus on the fast-growing high performance computing market and because Taiwan Semiconductor Manufacturing was the leading foundry with the highest market share in the world. In Q1’24, TSMC increased its lead on the competition as the chipmaker further improved its dominant position in the foundry business. This bodes well for the company’s revenue and especially free cash flow growth. Although TSMC has seen a sharp increase in valuation since my last coverage, I believe the risk profile it still skewed to the upside.

Market share gains imply sustained potential for revenue growth

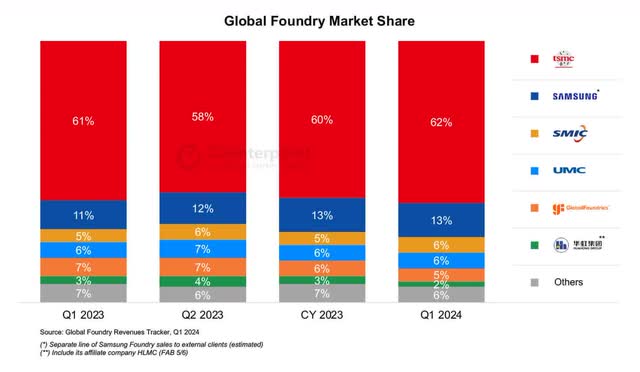

Taiwan Semiconductor Manufacturing has been the leading global foundry for years, which underlines why the company is benefiting significantly from the current upswing in demand for computer chips. TSMC had a market share in the global foundry market of 60% (as of FY 2023) which expanded in the first-quarter to 62%. Demand for AI chips is so high that the company’s Arizona subsidiary even received $6.6B in grants from the U.S. government in April in a bid to ramp up domestic production and alleviate a serious AI chip shortage.

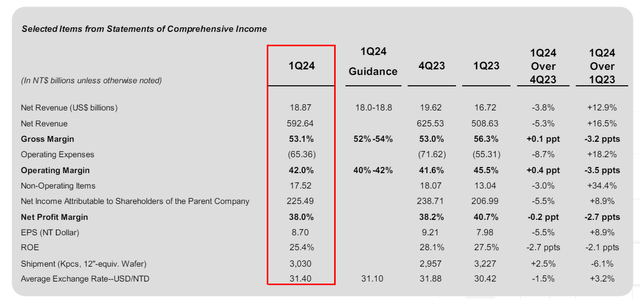

Not surprisingly, TSMC reported very strong results for its first fiscal quarter that included a 13% increase in net revenue to $18.9B, which beat the company’s own guidance of $18.0-18.8B in revenues. This demand is driven, as I indicated, by the growing demand for computer chips that support artificial intelligence applications. This sector is booming chiefly because of the broad-scale adoption of large language models that require a lot of processing power for purposes of LLM training. Since TSMC sits at the very nexus of this exploding demand and increased its lead on the competition in Q1’24, Taiwan Semiconductor Manufacturing has very attractively potential for free cash flow growth, especially.

Free cash flows have started to grow much faster than revenues

What caught my eye in Taiwan Semiconductor Manufacturing’s most recent financials was that the chip firm’s free cash flows are ramping up significantly faster than revenues, which, I feel, is an underappreciated element of the investment case for TSMC.

In Q1’24, the company’s total revenues increased 17% year over year (in local currency terms), but its free cash flows soared more than 200%. Or explained differently, TSMC’s free cash flows are growing (as of Q1’24) 12.6X faster than the firm’s top line… which I would say gets most investors’ attention. This growth in free cash flow, not surprisingly, translated to a significant improvement in the company’s FCF margins, which skyrocketed to 43% in the last quarter.

|

NT$ billions |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Y/Y Growth |

|

Revenue |

508.63 |

480.84 |

546.73 |

625.53 |

592.64 |

16.5% |

|

Operating Cash Flow |

385.24 |

167.25 |

294.65 |

394.83 |

436.31 |

13.3% |

|

CapEx |

-302.50 |

-250.53 |

-226.62 |

-170.16 |

-181.30 |

-40.1% |

|

Free Cash Flow |

82.74 |

-83.28 |

68.03 |

224.67 |

255.01 |

208.2% |

|

FCF Margin |

16.3% |

-17.3% |

12.4% |

35.9% |

43.0% |

164.5% |

(Source: Author)

3 catalysts for TSMC (and reasons to buy the shares)

I see three catalysts for Taiwan Semiconductor Manufacturing in the next twelve months:

- TSMC’s free cash flow growth, as demonstrated above, will likely continue to accelerate as demand for chips remains red-hot, and the market is currently undersupplied

- As the highest capacity producer in the foundry market, TSMC seems set to also capture a lion share of the escalating demand for AI-supportive computer chips, which could imply a multi-year run-way in accelerating top line growth

- As the company’s free cash flows ramp up, I would not be surprised to see management focus more on capital returns going forward in order to return excess FCF to shareholders via buybacks. Given the company’s market share gains in Q1’24, I believe TSMC has a strong chance to trigger EPS estimate upside revisions in FY 2024 as well.

TSMC valuation

Shares of Taiwan Semiconductor Manufacturing have revalued sharply higher since my work on the foundry was published in March… which I see with regret, mainly because I like to load up on shares when they are cheap, and before they catch the eye of the public. This year alone, shares of Taiwan Semiconductor Manufacturing have seen a near-73% rise in valuation… but they are still relatively cheap based off of earnings, in my opinion.

Taiwan Semiconductor Manufacturing chiefly benefits from enterprise clients that have escalating demand for more computing power and need more chips. This growth is still not adequately reflected in the company’s valuation, in my opinion.

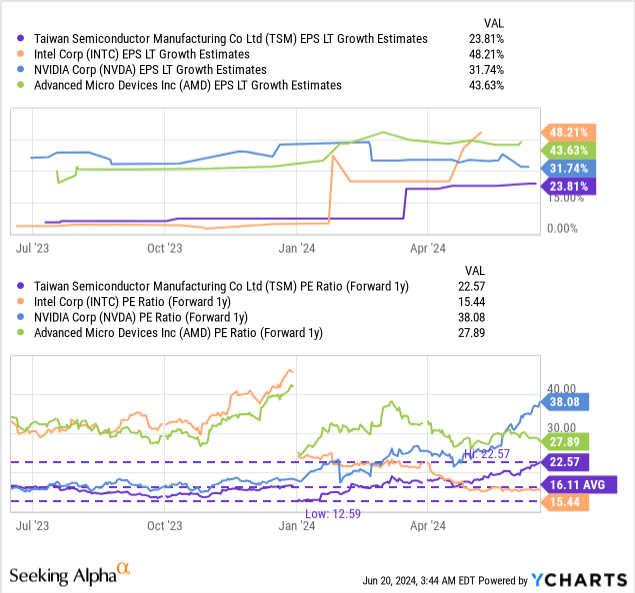

Taiwan Semiconductor Manufacturing is expected to grow its EPS by 24% annually in the long term which I consider to be a conservative estimate given its massive upswing in free cash flow. Intel (INTC) has the largest EPS potential, but also the lowest P/E valuation, chiefly because the company is caught in a messy restructuring. I recently wrote that the market is too bearish about Intel, in large because the company is making an aggressive push with its AI accelerator Gaudi 3.

From a valuation point of view, TSMC has revaluation potential and is not too expensive, in my opinion, especially considering that the foundry guided for 28% growth in revenues this year at the mid-point (range: $19.6-20.4B), and that the firm is crushing it in terms of free cash flow growth. Shares of TSMC are valued at 22.6X forward (FY 2025) earnings which is 13% below the industry group average P/E of 26.0X.

Since Intel has such a low valuation due to its continual restructuring, Intel is an outlier to the down-side and could be excluded from the industry group. In this case, the industry group average ex-Intel is 29.5X. If TSMC could revalue to a P/E ratio between 26.0-29.5X, the foundry would have considerable revaluation potential: its fair value would fall somewhere into a range of $207 and $235. With shares currently trading at $180, TSMC remains fundamentally undervalued, in my opinion.

Risks with TSMC

Companies like Intel are aggressively investing into their chip-making abilities which also has the support of the U.S. government through the 2022 CHIPS and Science Act which is meant to stimulate manufacturing of domestically-produced semiconductors. Intel is a big beneficiary here and received billions in grants and loans earlier this year to boost chip manufacturing. In the long term, these government subsidies could eat into TSMC’s market share and negatively affect the company’s valuation factor. What would change my mind about TSMC if the company saw a serious deceleration of its free cash flow (especially in relation to top line growth).

Final thoughts

Although shares of TSMC have had a very solid run so far in 2024, I believe the foundry is still in the early stages of a multi-year cycle of strong growth, driven by demand for AI-capable chips. The fact that Taiwan Semiconductor Manufacturing was able to further improve its market position in Q1’24 by increasing its market share to 62% highlights how desperate the market really is for TSMC chip-making capabilities.

Additionally, it is worth noting that while investors are overly impressed with TSMC’s revenue growth, the real story is the ramp in free cash flow which is growing by an order of magnitude. A free cash flow margin of 43% also highlights increasing potential for capital returns, in the form of stock buybacks.

I believe that the rate of TSMC’s free cash flow growth is underrated by the market as the company is still seeing a relatively low P/E ratio… at least when compared to other high-flying AI chip plays. The risk profile remains therefore broadly favorable, even for investors that missed out on this year’s rally in TSMC’s shares, in my opinion!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSMC, NVDA, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.